Mercado closes CAD$5.598 million private placement; Vizsla Silver becomes strategic shareholder

2025.12.04

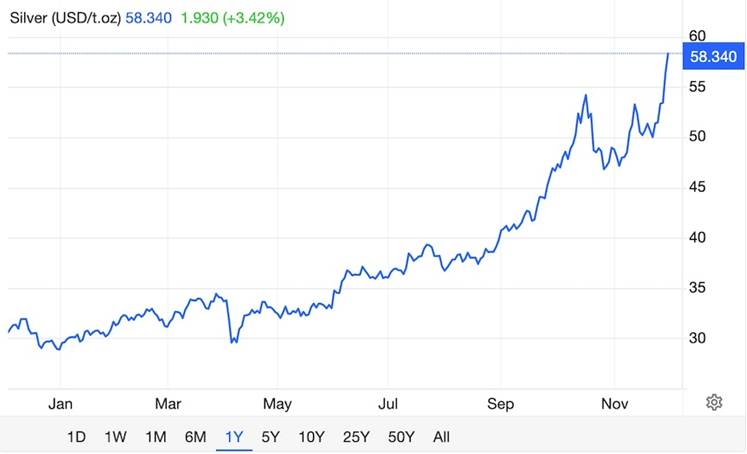

Until fairly recently, it’s been difficult for junior resource companies to raise funds for exploration. That has changed with the incredible run-up in precious metals prices this year, with silver doubling year to date, bettering gold’s +60% YTD performance, and on Monday hitting a fresh record-high $59 an ounce.

Money is again flowing into the sector, and a great example is Mercado Minerals’ (CSE:MERC) oversubscribed private placement.

Mercado Minerals: Not just another silver play — Richard Mills

The Vancouver-based company announced on Dec. 1 it closed a non-brokered private placement, issuing 27,990,000 units at CAD$0.20 per unit, for gross proceeds of $5,598,000.

The offering included participation and a strategic investment from Vizsla Silver Corp (TSX:VZLA) in Mercado.

“We received overwhelming support in this financing, and I am excited to start advancing Copalito and Zamora as we strive to become a premier explorer focused on the under explored western margin of the Sierra Madre. I would like to welcome Vizsla as a shareholder and I am looking forward to their support as we grow,” Mercado’s CEO Daniel Rodriguez stated in the news release.

Each unit consists of one MERC common share and half a warrant, with warrants exercisable at $0.35 until Nov. 28, 2028.

According to Mercado, proceeds from the offering will be allocated towards several initiatives, including exploration of the recently acquired properties Copalito and Zamora.

Having Vizsla Silver participate in the financing and come on as a strategic shareholder is a major coup for Mercado Minerals.

Viszla’s story is one of consolidating Panuco, a large, historically productive district and aggressively exploring it to unlock a world-class resource through a dual strategy of advancing the Copala Mine and continuing to discover new high-grade deposits elsewhere in the district. Vizsla is positioned as a leading silver company with strong project economics, aiming for production through a combination of aggressive drilling, a test mine for de-risking, and a completed preliminary economic assessment.

“This is one of the most exciting silver districts globally. With high-grade resources, existing infrastructure, and strong exploration potential, Panuco has the scale and quality to become a billion-ounce district,” said Vizsla Silver’s CEO Michael Konnert.

Though the Panuco District has a rich history of silver production, it remains underexplored. Vizsla Silver managed to consolidate the district — a complex task involving several landowners — and build a silver resource topping 200 million silver-equivalent ounces.

On Oct. 21, Mercado announced the appointment of John Mirko and Jose Vizcarra to its advisory board.

A prospector and 40-year mining industry veteran, Mirko is the individual who consolidated and sold the Panuco Project to Vizsla Silver.

He was the founder and president of Canam Alpine Ventures before selling Canam to Vizsla Silver, then known as Vizsla Resources, in September 2019.

When the transaction closed two months later, Vizsla had acquired an option over the consolidated mineral rights, infrastructure and processing facilities comprising the large-scale Panuco precious metals camp in Sinaloa, Mexico.

Mercado’s other appointee, Jose Vizcarra, is an exploration geologist based in Sinaloa. He has over 40 years of experience in the Mexican mining industry, specifically in the exploration of epithermal deposits in the Sierra Madre Occidental. Most recently, Vizcarra was instrumental in the discovery of the Napolean Vein on the Panuco Project currently owned by Vizsla Silver.

Since acquiring Panuco from Canam and John Mirko, Vizsla has acquired more land, made discoveries, and become a stock market darling, catapulting from a $5 million market cap to a peak of $2.5 billion. Now sitting healthily at $2.4 billion with a royalty spin-out (Vizsla Royalties Corp), Vizsla Silver currently trades at CAD$7.16/sh.

Mirko is no longer involved with Vizsla Silver, though he remains a major shareholder.

Mercado’s properties, Copalito and Zamora, are located within the Western Mexico Silver Belt in Sinaloa state, Mexico. The properties are near power, roads, infrastructure and local workforces in a mining-friendly jurisdiction. This emerging belt of the prolific Sierra Madre Occidental mountain range, which hosts existing mines and recent discoveries, includes:

- Vizsla Silver’s Panuco District

- First Majestic Silver’s (TSX:AG) San Dimas

- Pan American Silver’s (TSX:PAAS) Alamo Dorado

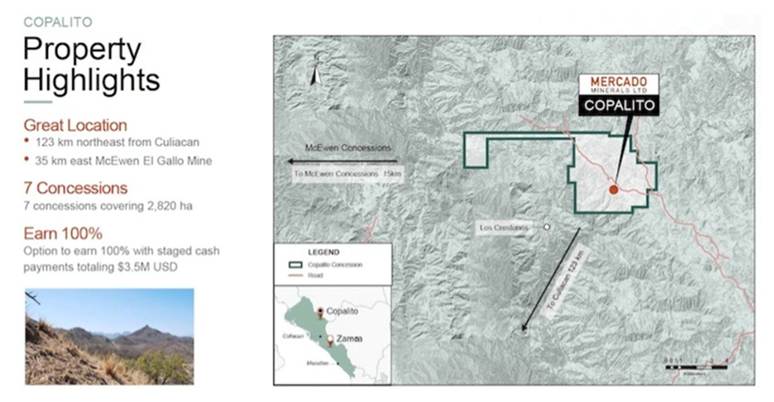

Copalito Project

According to Mercado, their flagship Copalito Project presents a district-scale opportunity with known and drilled silver — gold low sulfidation vein mineralization that is open for expansion. Historical third-party high-grade silver and significant gold and base metal drill intercepts include 347 g/t silver, 0.22 g/t gold, 0.18% lead and 0.38% zinc over 13.10 meters in hole BDH-20-004, and 125 g/t silver, 2.00 g/t gold, 0.34% lead and 0.58% zinc over 23.00m in hole BDH-21-055.

Mercado has acquired an option to purchase seven concessions covering 2,820 ha. The option is to earn 100% over five years, with staged cash payments totaling $3.5 million. Six known veins on the project have a cumulative strike length of 8 km.

The Copalito Project is located approximately 123 km northeast of Culiacan, Sinaloa. The property has good access, moderate topography and infrastructure nearby. The neighboring property to Copalito is McEwen Inc’s (NYSE:MUX) El Gallo mine complex, located 35 km to the west. Kootenay Silver (TSXV:KTN) was the most recent operator of the project.

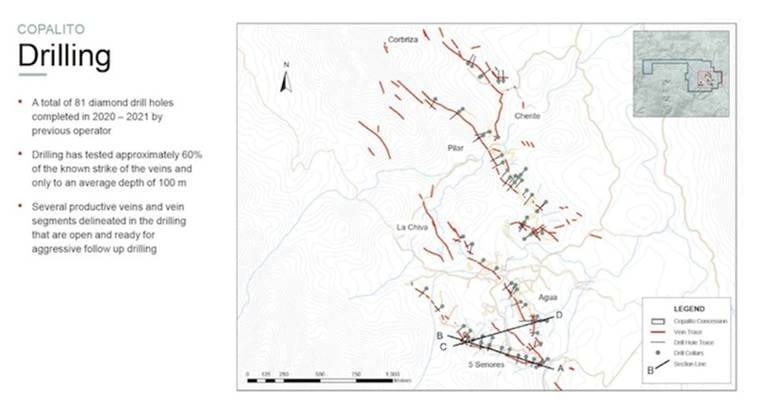

Kootenay drilled 81 holes over six veins. This historical drilling has only tested approximately 60% of the veins’ strike and only to an average depth of 100m. Several productive veins and vein segments delineated in the drilling are ready for follow-up deeper drilling.

Mercado has also acquired the existing drill data, which provides an excellent base for future exploration drill targeting of higher and thicker-grade portions of veins along strike and to depth.

Investors are warned: the data for the Copalito property appears to be of a good standard. However, the Qualified Person (QP) has not conducted sufficient work to independently validate the assay drill core results. Therefore, the company is treating the Copalito results as historical in nature and are not to be relied on. The QP will independently verify results of the historical work during a site visit later this year.

In talking with Rodriguez, he said the technical team, including Senior Technical Advisor Robert Duncan, believes they are at, or near, the top of the mineralizing system as evidenced by vein textures including chalcedonic quartz, geochemical signatures and precious-to-base-metal ratios.

Rodriguez noted the veins pictured in the above image present ample opportunities for expansion. After Kootenay Silver had finished drilling, they uncovered new veins to the northwest of Cinco Senores, north of La Chiva, and also found 300 meters strike length of vein to the southeast.

These areas remain untouched by exploration.

“Not only do we have targets to fill in the gaps on 5 Señores, but we actually also have veins to go prospect and then extensions to go drill,” he said, adding, “We have multiple angles on this property to grow the discovery and make new ones.”

Copalito has four high-priority targets at 5 Señores, El Agua, Pilar and La

Chivas.

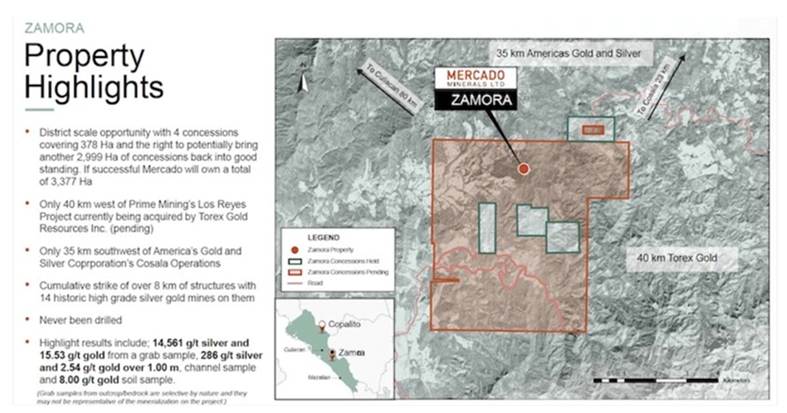

Zamora Project

The Zamora Project and surrounding area presents district-scale potential that, according to historical reports, has never been drilled.

Mercado has acquired four concessions covering 378 ha, which covers small-scale historical underground production at Campanillas, and the right to potentially bring another 2,999 ha of concessions back into good standing with the government, thereby securing title.

If successful, Mercado will own a total of 3,377 ha covering a cumulative strike length of over 8 km of structures with 14 historical high-grade silver gold mines on them.

Historical sampling by the previous operators on concessions currently under LOI and controlled by Concordia includes results from underground workings at Campanillas that returned 14,561 g/t silver and 15.53 g/t gold from a grab sample. Additional sampling at El Triunfo returned 286 g/t silver and 2.54 g/t gold over 1.00m, while a soil sample near the Periguete workings is reported to have returned 8.00 g/t gold.

Like at Copalito, the data for the Zamora property appears to be of a good standard. However, the QP has not conducted sufficient work to independently validate the assay rock sample results from Zamora. Therefore, the company is treating the Zamora results as historical in nature and are not to be relied on. The QP will independently verify results of the historical work during a site visit later this year.

Mercado Minerals Closes Subsequent Private Placement and Increases Institutional Ownership

Silver market

Silver’s combination of monetary and industrial demand, along with tight supply conditions, is driving the metal to fresh heights. As mentioned at the top, silver scaled $59 on Monday for the first time ever, extending Friday’s record $56.

Investopedia says silver is being boosted by limited supply and rising investor demand, especially in light of expectations of more interest rate cuts. Precious metals, which offer neither a dividend yield nor interest, tend to do well as rates fall.

The investor education website says the cost to lease silver, which industrial users often do, rose to its highest since 2002 this year, indicating an extraordinary shortage.

Stockpiles at the Shanghai Gold Exchange have fallen to their lowest level in a decade.

Investors are finally waking up to how scarce silver has become.

Industrial demand tied to the accelerating electrification of the global economy has produced significant supply deficits for five straight years. Above-ground stocks have been depleted, and the metal that is available tends to be in the wrong form or the wrong place. That mismatch has fueled a string of supply shocks in 2025.

We saw the first big wave at the start of the year when massive volumes of silver poured into the U.S. as traders braced for potential tariffs under President Donald Trump’s global trade agenda. Silver ultimately wasn’t tariffed, but the fear never fully dissipated—especially after Washington officially labeled it a critical metal.

All that extra metal sitting in the U.S. tightened physical inventories elsewhere, especially in London’s over-the-counter market. Strong buying out of India added more strain, driving record lease rates and premiums worldwide.

A slowing world economy has weighed on the precious metal’s industrial demand, but strong investment demand has more than made up for the drop, states the Silver Institute.

Investors are buying silver for the same reason they are buying gold — as a safe-haven asset amid the economic chaos caused by the Trump administration’s tariff policy, de-dollarization, rising US debt, and global hot spots like Gaza, Venezuela and Ukraine.

In its outlook, the institute re-iterated that the silver market will see its fifth annual deficit this year of 95 million ounces. Inflows into silver-backed ETFs had increased by 187Moz as of Nov. 13, said Philip Newman, managing director at Metals Focus, the British research firm behind the annual Silver Survey.

Deutsche Bank expects exchange-traded funds to hold about 1.1 billion troy ounces of silver by the end of 2026, surpassing a record high set in 2021. DB forecasts silver prices will average about $55 an ounce next year, up from around $38 this year.

Kitco notes the gold-silver ratio, found by dividing the price of spot gold by the price of spot silver, was over 100 in April, far from its long-term average of between 50 and 60. This has drastically changed.

The ratio between the two metals… has plunged to 74, breaking through a long-term support line. And some analysts think the momentum could carry it all the way back to 50. If the growing chorus calling for $5,000 gold by 2026 is right, that would imply silver at roughly $100.

Conclusion

It’s a great time to be exploring for silver, with by-products gold, lead and zinc, in the under-explored western margin of the Sierra Madre, Mexico. Mercado’s Copalito Project has four high-priority targets at 5 Señores, El Agua, Pilar and La Chivas.

It presents a district-scale opportunity with known and drilled silver — gold low sulfidation vein mineralization that is open for expansion.

Mercado has acquired an option to purchase seven concessions covering 2,820 ha. The option is to earn 100% over five years, with staged cash payments totaling $3.5 million. Six known veins on the project have a cumulative strike length of 8 km.

The Zamora Project, and surrounding area, presents district-scale potential that, according to historical reports, has never been drilled.

Mercado has acquired four concessions covering 378 ha, which covers small-scale historical underground production at Campanillas, and the right to potentially bring another 2,999 ha of concessions back into good standing with the government, thereby securing title.

If successful, Mercado will own a total of 3,377 ha covering a cumulative strike length of over 8 km of structures with 14 historical high-grade silver gold mines on them.

With about $5.5 million in the treasury from an oversubscribed private placement, and a strong management team including two area experts on its advisory board, Mercado is well-positioned for a discovery.

Mercado Minerals Ltd.

CSE:MERC

2025.12.01 Share Price: Cdn$0.40

Shares Outstanding: 41.9m

Market Cap: Cdn$16.7m

MERC website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Mercado Minerals Ltd. (CSE:MERC). MERC is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of MERC

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.