Max Resource’s district-scale CESAR project offers significant exposure to critical metals

2021.03.05

Nearly a year since the start of a remarkable rally, industrial metal prices are now approaching unchartered territories; to call this a “commodity rally” would simply be an understatement.

The consensus amongst Wall Street analysts is that we’re on the cusp of another “commodity super-cycle” last seen in the 2000s.

Look no further than what copper has been doing over the past several months. Nicknamed Dr. Copper for its purported ability to predict turning points in the global economy, the base metal has nearly doubled since March 2020 with the economy slowly recovering from the pandemic and is now within reach of an all-time high.

Other metals such as nickel, zinc and tin have all gone on a similar upward trajectory, even outshining copper at various points in time.

New Commodity Boom

But unlike the super-cycles of the past, this new commodity boom is predicated on a worldwide shift towards a green industrial revolution, which requires more base materials than ever to build the necessary infrastructure.

Of all the metals used in power generation and energy storage, copper, due to its excellent conductivity, remains the common denominator and backbone of any industrial revolution. The red metal is commonly used in electrical wiring and machinery but will see its usage rise further in electric vehicles.

It is estimated that copper demand will rise as much as 5% annually, resulting in 28% more or 38 million tonnes of the metal needed by 2030, according to UK consultancy Roskill. Analysts at Canaccord have already raised their copper price forecast by 17% this year considering higher demand associated with a global economic recovery.

Outlook for other industrial metals including nickel, aluminum and zinc is also auspicious, with commodities research firm CPM Group pegging double-digit gains in 2021 for many of the base metals listed.

The so-called super-cycle does not apply to just base metals; precious metals, too, are experiencing a structural change in demand. While gold grabbed headlines by setting a record last August, it is silver that captured the spotlight in 2021 by soaring to its highest in eight years.

But silver’s bull run has just begun. The London Bull Market Association says silver is “undoubtedly the star of the show” in 2021, anticipating double-digit gains by year-end. Industrial demand for the metal used to make electronics and solar panels will rise 9% this year, according to the Silver Institute, and is expected to remain healthy as the global economy continues to recover.

Depleting Supply

What is also fueling the commodity super-cycle thesis is the shortage of mined supply to keep pace with demand.

Again, take copper for example. Bloomberg has highlighted that “the global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.”

As a result, this 24 million tonne per year market is set to face a period of chronic undersupply as nations worldwide continue to rebuild their economies, while copper-intensive sectors such as renewable energy and electric vehicles rise to dominance.

Aside from the impact coronavirus has had on the overall global supply chain, two aspects that are hindering copper supply are the lower grade and deeper deposits, according to analysts at Stifel Financial. Market appetite and availability of projects are also areas of concern for miners.

Meanwhile, some of the world’s largest copper mines are seeing their reserves dwindle, with production dramatically slowing down as capital-intensive operations move from open pit to underground.

Low production and high costs have mostly rendered many copper projects unworthwhile to pursue. In fact, analysts are already predicting a supply deficit beginning this year. Without major mines (i.e. 200,000 + tonnes) coming through the pipeline anymore, this supply deficit could rise to as high as 15 million tonnes by 2035.

“Based in part on capital costs, operating costs and a minimum acceptable return on investment, we estimate that current major projects require a minimum price in excess of $3.20/lb. ($7,055/mt) Cu globally,” Stifel said. However, copper prices have broken well past that threshold since November, turning copper mines into cash cows for miners and incentivizing the development of new projects.

More Copper Projects

The industry has reached an important juncture where exploration spending and project acquisitions are poised to pick up as soon as lingering uncertainties from the pandemic dissipate.

Back in 2016, former BHP boss Andrew Mackenzie conceded that the world’s miners didn’t see the 2000s super-cycle coming. But they will not make the same mistake this time around.

Activity within the copper mining space has certainly picked up pace.

Freeport-McMoRan recently greenlighted several mine expansions to capitalize on the market conditions, hoping to add 250 billion lb. to the US annual copper output. Exploration spending in Australia, which has the second-largest copper resources, surged during the December quarter to its highest since 2014.

It will not be long before the big industry players direct their focus towards projects held by juniors that could turn into the next major mines.

CESAR: High-Grade Cu-Ag Discovery

One such project that has attracted the attention of global miners, even before all the rallies in metals prices, is the CESAR discovery made by Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2).

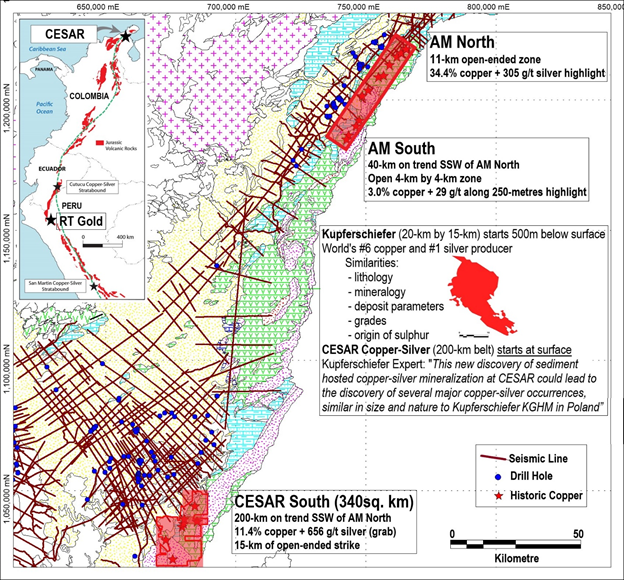

The CESAR property is in northeast Colombia along the world’s largest copper belt in the Andean, where silver is also abundant. It lies on a massive sedimentary system covering a cumulative 200+ km strike of highly prospective Cu-Ag mineralization.

The region enjoys major infrastructure because of oil & gas and mining operations, including Cerrejon, Latin America’s largest coal mine, jointly owned by BHP Billiton, XStrata and Anglo American.

Max is the first company to explore the entire copper-rich areas covered by the CESAR property. The company already has multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Exploration thus far by Max has identified multiple copper-silver target zones (CESAR North, CESAR South and CESAR West) hosting significant discoveries with potential to expand further.

The North zone, which is open in all directions, has SEDEX stratabound mineralization spanning over 45 km2 with grades up to 34.4% Cu and 305 g/t Ag. At the South Zone, discovered late last year 150 km south of CESAR North, grab samples returned values up to 11.4% Cu and 656 g/t Ag.

Due to newly discovered copper showings, the company recently expanded the CESAR West area by adding 500 km2 to the northern boundary, effectively expanding the CESAR project to a district-scale size of over 2,500 km2.

What is more compelling about the CESAR project is that it bears a striking resemblance in terms of grade, scale and mineralogy (see diagram below) to the world-class Kupferschiefer deposits found in Poland, which are the largest source of copper in Europe.

Together, the Kupferschiefer deposits have produced the sixth-highest amount of copper in the world. Not only that; these are also the world’s #1 silver producer, with yields almost twice the production of the next largest silver mine.

The main difference between the deposits is that the Kupferschiefer orebody starts at 500 meters below surface, while CESAR copper-silver mineralization starts at surface, giving the latter an advantage.

According to Kupferschiefer experts at the University of Science and Technology of Krakow, Poland: “This new discovery of sediment-hosted copper-silver mineralization at CESAR could lead to the discovery of several major copper-silver occurrences, similar in size and nature to Kupferschiefer.”

As such, given the outstanding regional scale prospectively of the CESAR project, Max has applied the same exploration model used on the Kupferschiefer, and is in the process of a multiple faceted exploration program that includes advanced analysis and modelling of historical drill cores.

New CONEJO Discovery

This week, while exploring for high-priority targets across multiple areas of the CESAR property, the Max field team made another discovery at CESAR North. This new discovery, known as CONEJO, is a new type of copper mineralization hosted in igneous rock.

The CONEJO zone spans 1.6 km by 0.6 km, is open in all directions and lies along the CESAR North Kupferschiefer-type (SEDEX) copper-silver mineralization.

This new mineralization is considered to be related to the sediment copper-silver system but hosted in an igneous (volcanic) unit. It is associated with fracture-controlled primary chalcocite mineralization that becomes more continuous as fracture density increases (refer to Figure 1 and 4).

“This discovery of a new type of copper mineralization hosted in igneous host rock, significantly enhances the company’s steadfast belief of CESAR as district scale with several pulses of mineralization,” Max CEO Brett Matich commented in a news release.

Over 200 samples have been collected at the new discovery, with assay results expected in April.

Conclusion

The exploration success accumulated by Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) over the past year has not gone unrecognized.

Recently, the company was named one of the top 10 performing mining stocks in the 2021 TSX Venture 50, having seen its value increase more than three-fold over the past year. The TSX Venture 50 ranks the top 50 stocks from over 1,600 companies listed on the TSX Venture Exchange.

Video: https://www.youtube.com/watch?v=EDJJWSmcEIY

Last year’s winners included well-recognized names such as K92 Mining Inc., Great Bear Resources Ltd. and Discovery Metals Corp. Some of these have gone on to become billion-dollar market cap companies.

The 2021 list contains a more diverse set of mining companies, leaning more towards clean energy metals. These include American Lithium Corp. and Nouveau Monde Graphite Inc., both of which had grabbed headlines earlier this year and have become household names in the battery metals industry.

As copper and silver metals will always be intertwined with sustainable energy generation, the sheer district-scale potential of the CESAR project and its similarity to existing world-class deposits possibly offer an upside unmatched by any other junior.

In the words of Max CEO Brett Matich: “CESAR provides Max significant exposure to copper and silver, both critical energy metals necessary for the world’s transition to clean green energy.”

Max Resource Corp.

TSXV:MXR, OTC:MXROF, Frankfurt:M1D1

Cdn$0.285, 2021.01.27

Shares Outstanding 87.6m

Market cap Cdn$24.9m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard owns shares of Max Resources (TSX.V:MXR, OTC:MXROF, Frankfurt:M1D1). Max is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.