Max Resource secures Mora Gold Project adjacent to Aris Gold’s Marmato gold mine and Collective Mining’s Apollo discovery – Richard Mills

2025.08.23

Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) has just secured a highly prospective gold-silver concession in one of South America’s most prolific mining districts — the Middle Cauca Gold Belt — which stretches across central Colombia and is home to several world-class gold deposits.

Mora Gold-Silver Title

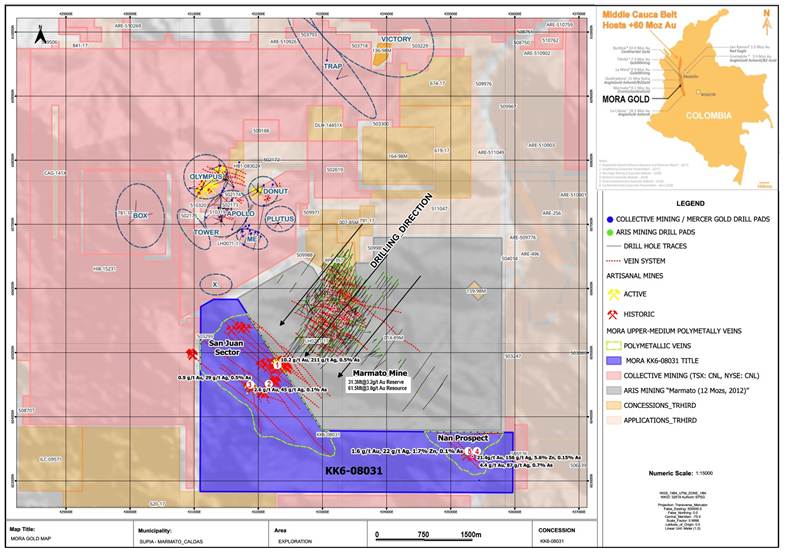

On Aug. 19, Max reported that its subsidiary, Maximum Company Colombia S.A.S., will acquire up to 100% of Inversiones Villamora S.A.S., which holds the 713-hectare Mora title. The concession, located 85 km south of Medellin, sits immediately adjacent to Aris Mining’s Marmato mine and to Collective Mining’s (TSX:CNL) Guayabales project.

(Mora’s eastern boundary lies approximately 600m southeast of the Marmato gold mine.)

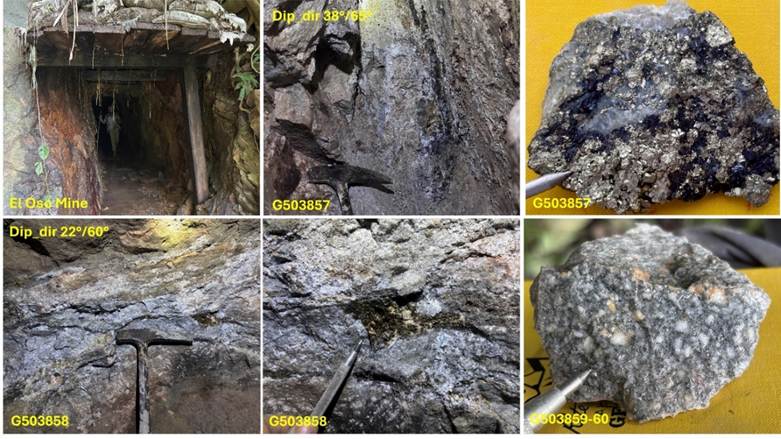

Mora is considered prospective for both high-grade vein-style mineralization and porphyry-related bulk tonnage systems. Though it has never been drill-tested, the property hosts more than 40 historical workings and five active artisanal mines.

Channel samples from previous exploration highlight:

- 45.0 g/t gold and 7,110 g/t silver over 1m; 32.0 g/t gold and 53 g/t silver over 1m;

- 27.0 g/t gold and 732 g/t silver over 1m; 8.9 g/t gold and 75 g/t silver over 1.5m;

- 36.7 g/t gold over 2m; 3.3 g/t gold and 87 g/t silver over 1m.

The geology exposed at Marmato appears similar to Mora and can be considered analogous due to its close proximately and geological similarities, including the same type of host rocks, structural trends, styles of mineralization and types of alteration.

In a 2012 report documenting a field visit for Crown Gold Corp, the author identified numerous high-grade gold and silver sulfide veins exploited by artisanal miners on both Marmato and Mora:

“There is no question that the geology of Marmato continues across the Mora title (KK6-08031) boundary in the region of San Juan. Gran Colombia states that their deposit (Marmato) is open and continues at depth and to the west and south; both areas are within in the Mora title,” the report reads.

The accompanying Crown Gold news release stated:

“During a visit in November, Crown gained access to, and channel sampled, 7 of the 40 adits which it has located to date, on the Mora Property. A total of 7 channels were cut in these 7 adits and all samples returned gold and silver values. The weighted average value of gold was 13.2 g/t over 5.9m sampled, while the weighted average value of silver was 1,647 g/t…

There appears to be a series of mineralized “polymetallic” veins running through the Mora Property, similar mineralization to [previous operator] Gran Colombia’s Marmato gold deposit, which lies adjacent to the east side of the Mora Property.

The polymetallic veins in the San Juan sector extend over 2.5 km of strike, dipping to the southwest across a width of 1.5 km SW to NE.

The Mora property also appears to share characteristics with Collective Mining’s Apollo porphyry system bordering Mora to the north. According to Max, Collective’s recent Apollo porphyry system discovery appears to trend over the northern border of the Mora title:

The extensive “polymetallic” sub-parallel mineralized structures identified within the San Juan Sector are of significance. Collective Mining’s NI 43:101 titled “Guayabales Gold-Silver-Copper Project”, states, “Polymetallic veins occur on all targets” as of the Apollo, Olympus, Donut, Box, Trap and Victory targets.

More specifically, Aris Mining’s Marmato title abuts along Maximum’s 3.4-km eastern boundary, and Collective Mining’s Guayabales project abuts to the north (Apollo porphyry system), west, south, and vertical east boundaries, 4.8 km in length.

“The Mora Gold-Silver Title is of significant size, and provides both a high-grade Marmato-type target, clearly manifested by the numerous small-scale mines and geological proximity and an underlaid Apollo Porphyry type target, again with geological proximity and the series of ”polymetallic” structures, which occur on all the targets for the adjacent Guayabales Gold Project, including the recent Apollo discovery,” says Max’s CEO Brett Matich, adding:

“We are excited with the opportunity of being the first exploration Company to conduct significant exploration on the Mora Title. Our in-country expertise abodes well to acting as the sole operator.”

The acquisition’s payment structure gives Max flexibility to advance exploration while limiting upfront capital costs. Villamora shareholders will receive four milestone payments ranging from $50,000 to $150,000. Full ownership would require $8.3 million in staged payments plus a 3% NSR royalty.

Max’s initial exploration program will involve collection of historical data and a property-wide assessment; identifying and mapping historical workings and active mines; and conducting outcrop, road cut geological mapping and sampling. Later exploration will include geophysical surveys and drilling.

Marmato Gold Mine

Marmato’s mining history goes back to pre-Colonial times, when it was worked by the Quimbaya people. The Spanish colonists assumed control of the Marmato mines in 1527, and they have been in almost continuous production ever since. Local history recounts that Simon Bolivar, the revolutionary leader who liberated much of South America from Spanish rule, used the mines as collateral with British banks to secure funding for a war of independence against Spain.

Aris Mining (TSX:ARIS) acquired the Marmato gold mine as part of a business combination with GCM Mining on Sept. 26, 2022. This transaction involved the merger of GCM and Aris Gold, with the combined entity being renamed Aris Mining Corporation. The Marmato mine became one of Aris’s key operating assets, along with the Segovia gold-silver mine. Both mines are underground.

Marmato hosts proven and probable reserves of 31.3 million tonnes at 3.2 grams per tonne, for 3.2 million ounces of contained gold. The measured and indicated resource stands at 61.5Mt @ 3.0 g/t Au, for a contained 6Moz. By the second half of 2026, Aris is planning to ramp up Marmato’s gold production to 200,000 ounces per year, once the Bulk Mining Zone is in operation.

The historic Narrow Vein Mining Zone (formerly referred to as Upper Mine) uses small-scale, labor-intensive mining methods and is currently producing approximately 20,000 to 25,000 ounces of gold per year.

An expansion project is underway with the construction of the new Bulk Mining Zone (formerly referred to as Lower Mine) to access the porphyry-hosted mesothermal gold deposit below the Narrow Vein Mining Zone. The expansion started in Q3 2023 and includes a new portal and decline, dedicated 5,000 tpd carbon-in-pulp (CIP) processing facility and the use of more efficient, mechanized mining methods.

Between Segovia and Marmato, Aris Mining plans to produce 500,000 ounces by 2026 — more than doubling the +200Moz mined in 2024.

Apollo Gold Discovery

Under the leadership of Ari Sussman, who created billions in value with Continental Gold, Collective Mining is focused on its Guayabales project, located in the Middle of the Cauca Gold-Copper Belt. Continental Gold was sold to Zijin Mining in 2019 for $1.4 billion, mainly for Continental’s large and high-grade Buritica vein gold-silver deposit.

Recent drilling at the Apollo and Trap targets yielded exceptionally high-grade gold and silver intercepts over hundreds of meters. An example from the table above is 497m @ 3.0 g/t gold-equivalent at Apollo. The property has six targets: Apollo, Trap, Olympus, Donus, Box and Victory.

The most significant discovery is the Apollo gold-silver-copper deposit, which is a porphyry stockwork deposit with an intermineral breccia called the Apollo porphyry system, and is overprinted by high-grade gold-silver bearing sheeted carbonate base metal veins. The current dimensions of the Apollo porphyry system, based on limited drilling, are 385m by 350m on surface by 915m vertical, and it is open in all directions. The breccia lies within stockwork mineralization. (NI 43-101 technical report dated April 21, 2023)

On March 17, 2025, Agnico Eagle Mines (TSX:AEM) announced a non-brokered private placement at $11 a share, for an aggregate investment of $52.161 million in Collective Mining.

Apollo, which begins at surface, is strongly mineralized over 1,200 vertical meters, and is open at depth.

High-grade gold, copper, silver and tungsten assay results have been received for four holes from its ongoing shallow drilling program designed to outline and expand the near surface zone of mineralization at the Apollo system with highlighted results as follows:

- 183.70 metres @ 3.01 g/t gold equivalent (0.86 g/t gold, 44 g/t silver, 0.83% copper and 0.14% WO3) from 37.30 meters downhole (APC-134);

- 37.15 meters @ 7.05 g/t gold equivalent (2.19 g/t gold, 89 g/t silver, 0.92% copper, and 0.73% WO3) from 118.10 meters downhole (APC-136)

The company currently has 11 drill rigs operating as part of its fully funded 70,000-meter drill program for 2025, with eight rigs operating at the Guayabales project and three rigs turning at the San Antonio project. Drilling at the Guayabales project is focused on multiple objectives which include defining shallow mineralization, expanding and identifying new high-grade sub-zones, expanding the high-grade Ramp Zone at depth and testing new targets.

Two deep-capacity drill rigs are now at Apollo with the first rig now drilling a mother hole after successfully extending a previous step-out hole which failed to reach its intended depth when targeting the Ramp Zone (assays results pending). A second deep-capacity rig has recently arrived at site and is expected to begin drilling a second mother hole to test the high-grade Ramp Zone discovery within the next two weeks.

Approximately 133,000 meters of diamond drilling has been completed to date at the Guayabales project, including 93,000 meters at Apollo. There are currently 25 drill holes in the lab with assay results for most of these holes expected in the near term.

Florália DSO Iron Ore Project

Circling back to Max Resource, the company continues to work on the Sierra Azul project under the purview of Senior Technical Consultant Bruce Counts. The strength of that discovery led to an earn-in agreement with Freeport Exploration Corp, a wholly owned affiliate of Freeport-McMoRan Inc.

But Max is now laser-focused on the newly acquired Mora concession, and its Florália DSO iron ore project in Brazil.That project appears to have significant potential with a possible pathway to near-term cash flow.

The term “Direct Shipping Ore” aptly captures the simplicity of the DSO mining process and the streamlined pathway this iron ore takes from mine to market. DSO stands out as a premium product, a cut above in a world demanding efficiency and environmental sensitivity.

From a geological standpoint, DSO deposits are relatively rare, often formed through the chemical alteration of banded iron formations (BIFs) under specific environmental conditions. Brazil and Australia are by far the world’s largest producers and exporters of DSO.

DSO is high-grade hematite that can be shipped directly to refineries, circumventing the need for costly processing facilities and large operations, translating to significant cost savings and a smaller carbon footprint.

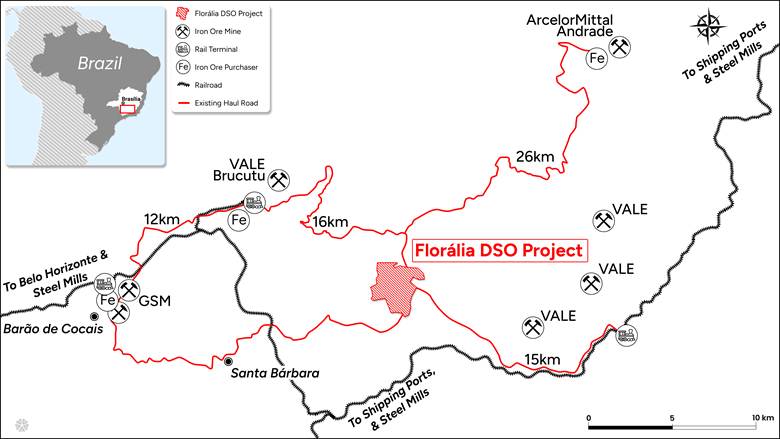

The Florália DSO project is strategically located with an existing 20 km road SE to a railway terminal and there are existing roads to potential DSO buyers Vale (20 km NW) and Arcelor Mittal (30 km E). Local mining infrastructure includes railway networks, haul roads, mining services and personnel.

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

A lot of work has already been accomplished and the results from the various surveys undertaken are impressive.

Max reports high-resolution drone magnetics at Florália has identified a large anomalous zone of surficial outcropping high-grade mineralization associated with hematite/itabirite type iron formation. The size of the anomalous area has far exceeded the approximate 160m by 160m historic open cut to around 1,500m by 1,000m based on the drone magnetics, field activities and 58 channel samples.

Max’s technical team has reviewed the new drone magnetics and channel sampling data and has significantly expanded the Florália DSO geological target from 8 to 12 million tons at 58% Fe to 50 to 70 million tonnes at 55% to 61% Fe.

Analysis indicates a highly deformed structural geological environment that is fundamental to the increase in iron ore grades and tonnages, a consequence of secondary crystallization of hematite and the development of supergene enrichment.

The magnetometric geophysical survey utilized drones over the project area located in the Florália region of Santa Bárbara, Minas Gerais, Brazil, within the “Quadrilátero Ferrífero” region. The geophysical survey maps were generated with multiple filters along with a 3D inversion that provided a high-resolution block model and iso-value surfaces from the interpreted source of the anomalies.

This data has been fundamental in confirming the principal target area and the true potential of the Florália DSO project.

Max has also completed characteristic ore tests and commenced environment studies and other components of the Feasibility Study (FS) the company plans to complete by Q1 2026. There is no native title on the property, water permits are not necessary so no tailings dam is needed, and workers/contractors will not need accommodation on site.

The channel sampling is now complete with high-grade assays reported on March 30. Iron ore and recovery results from dry magnetic test work were reported on April 22.

An environmental study is expected by year-end.

Conclusion

For Max, the Mora concession diversifies its portfolio into gold while retaining exposure to copper and silver through the Freeport partnership, and iron ore through the Florália DSO project.

Take another look at the map above. The Mora property is literally surrounded by Collective Mining and Aris Mining. The Marmato mine is undergoing an expansion and the drilling is in the direction of Mora.

The Middle Cauca Belt hosts over 60 million ounces of gold and there are some major gold projects/ companies there, including Zijin Mining’s Buritica, B2Gold’s Gramalote, and AngloGold Ashanti’s La Colosa.

A key point is that the polymetallic veins on Aris Mining’s Marmato property extend onto Mora. Initial channel samples yielded 45 g/t gold and 7,110 g/t silver over one meter. The weighted average gold value was 13.2 g/t over 5.9m sampled, while the weighted average silver value was 1,647 g/t. These are magnificent grades.

Collective Mining’s Apollo porphyry system borders Mora to the north. According to Max, Collective’s recent Apollo porphyry system discovery appears to trend over the northern border of the Mora title:

The extensive “polymetallic” sub-parallel mineralized structures identified within the San Juan Sector are of significance.

The Mora concession itself hosts more than 40 historical workings, five active artisanal mines, and polymetallic structures spanning 2.5 km x 1 km. It has never been drill-tested, suggesting an exciting upside.

CEO Brett Matich sees both high-grade Marmato-type targets and a potential Apollo porphyry system.

Now enter the Florália DSO project, which offers Max the opportunity to be a unicorn among the junior sector – cash flow.

All of that is a considerable amount of uncounted value in a junior with a market cap of only $13 million.

I see Max as offering outstanding value for shareholders to capitalize on a very exciting gold exploration project, in one of the richest gold-mining belts in the world and you’re going to be hearing a lot more about Max Resource’s Mora Gold Project.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.075 2025.08.21

Shares Outstanding 175.8m

Market cap Cdn$13.4m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.