Max Resource samples high-grade copper-silver from newly discovered AM-7 target – Richard Mills

2023.06.26

In mineral exploration, a promising discovery can often be validated by the sampling/drilling results that follow. This is what Max Resource Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) has done at its newly discovered AM-7 target at its wholly owned CESAR copper-silver project in northeastern Colombia.

AM-7 represents the seventh discovery by Max in the 20-km-long AM District, which forms the northern end of the CESAR property. It encompasses five historic open-cut copper workings extending over 700 meters.

The copper-silver mineralization is hosted in fine-grained sandstone and mudstones with chalcocite as the primary copper-bearing mineral. Exploration crews working the AM-7 Target have already identified multiple horizons of high-grade stratiform mineralization.

On June 22, 2023, nearly a month after the initial discovery, Max reported assay results from channel samples collected across mineralized outcrops at AM-7, with intervals ranging from 0.3 to 3.8m.

Overall, 9 of the samples returned values of 4.0% copper and above; 7 returned values greater than 2.0% copper; 18 returned copper values above 1.0%; and 24 had 10 g/t silver and above.

Multiple channel samples returned high grades, encompassing the five historic copper workings: 1) 18.3% copper and 2 g/t silver over 1.5m; 2) 6.0% copper and 48 g/t silver over 1.0m; 3) 5.9% copper and 56 g/t silver over 1.5m; 4) 5.0% copper and 138 g/t silver over 1.0m; and 5) 4.0% copper and 48 g/t silver over 1.0m.

“The Cesar Basin continues to reward the perseverance of our skilled technical team as demonstrated by the discovery of AM-7 and the impressive assay results,” Max CEO Brett Matich stated in a June 22 press release.

“The high-grade copper-silver mineralization has been identified in multiple, stacked horizons across an impressive strike length of more than 2 km, and remains open in all directions,” he added.

Since the commencement of the 2023 exploration campaign, the Max field team has identified as many as 21 copper-silver targets across three separate districts: AM, Conejo and URU. All three districts are located along a 90-km belt in the CESAR Basin.

Max continues to intensify exploration in the Cesar Basin with the objective of delineating a new world-class copper-silver belt.

Overview of CESAR Project

Max’s CESAR project can be found along the copper-silver-rich Cesar basin of northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by Glencore.

In 2022, Max executed a two-year co-operation agreement with Endeavour Silver Corp. (TSX: EDR, NYSE: EXK), a mid-tier precious miner operating four mines in Mexico, to help the company significantly expand its landholdings at CESAR. In turn, Endeavour will hold an underlying 0.5% NSR.

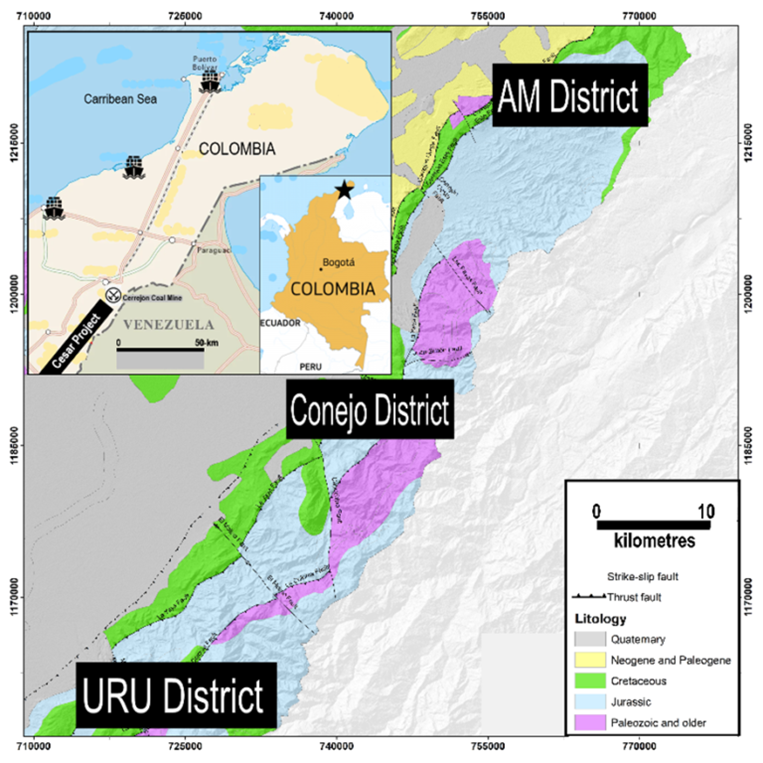

At the moment, Max’s mining concessions collectively span over 188 km², representing the largest area prospective for copper in the prolific Cesar sedimentary basin. The property is divided between three major copper-silver zones (AM, Conejo & URU) individually located along a 90 km long belt (see map below).

The Cesar Basin has a simplified Jurassic-Triassic stratigraphy, characterized by Cu-Mo-Au porphyry and porphyry-related vein systems in the upper levels and sediment-hosted style Cu-Ag deposits lower down.

Starting in the far north of the Jurassic basin, classic stacked red-bed outcrops with extensive lateral continuity have been rock sampled within the 32 km long AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in these sedimentary red-bed sequences.

The Conejo District, midway south, demonstrates mineralization at the contact of intermediate and felsic volcanics which outcrops over 3.7 km. The average of surface samples at a 2.0% cut-off comes in at 4.9% copper.

To the far south, the 2022 inaugural drilling was initiated at two mineralized surface exposures, each located 750 m apart and lie within the URU District’s 20 km long, 2 km wide mineralized target area.

This URU drill program was the first opportunity to test continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks in the sub-basinal environment of the Cesar sedimentary basin.

Multi-Depositional Model

Currently, there are two primary depositional models being used for the massive CESAR project.

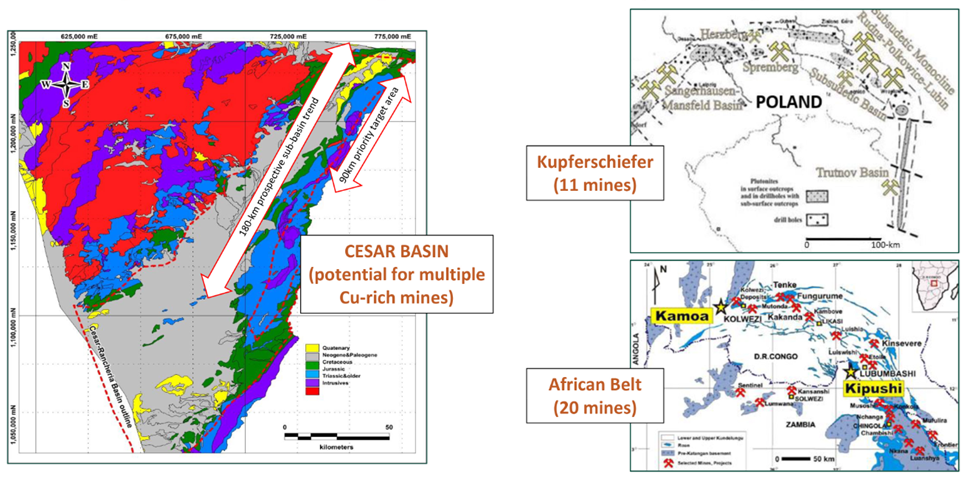

The sediment-hosted stratiform copper-silver mineralization found in the southern end (URU and Conejo zones) of its Cesar project is interpreted to be analogous to the Central African Copper Belt (CACB), while the northern end (AM zone) is compared to the Kupferschiefer deposits in Poland.

It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe Mines’ (TSX: IVN) 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is a mining orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

Based on the hypothesis that the mineralization at the northern end of its property is sediment-hosted and stratiform, similar in style to the Kupfershiefer, Max began the 2023 exploration season on the AM mining concessions.

Geological mapping and historical artisanal mining at the Herradura and Sierra targets, located within the AM District, indicate that mineralization occurs in at least four horizons in the stratigraphic sequence.

To confirm the continuity of mineralization and its hypothesis, Max drilled two scout holes down dip from surface exposures at Herradura this past January. The holes were spaced 250m apart and drilled to a depth of approximately 350m. Both intersected multiple copper-replacement beds containing malachite and chalcocite with copper values ranging from 0.04% to 0.96%.

These results indeed helped to confirm the presence of Kupferschiefer-style mineralization within the northern AM District.

Meanwhile, the first diamond drill program last fall at the 74 km² URU District also demonstrated its proof-of-concept. The program was designed to test the continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks similar to the CACB.

Drilling at the URU-C and URU-CE targets, located 0.75 km apart, confirmed the continuation of copper-silver mineralization at depth. Twelve of the 14 holes intersected mineralized zones, with six intersecting significant copper-silver mineralization.

At URU-C, a 9m of 7.0% Cu + 115 g/t Ag discovery was confirmed at depth by hole URU-12, which intersected 10.6m of 3.4% Cu + 48 g/t Ag. This hole also included 0.8m of 18.5% Cu + 292 g/t Ag. Further drilling is planned to confirm continuation of high-grade mineralization down dip.

At URU-CE the 19m of 1.3% Cu discovery was confirmed by hole URU-9, which intersected a broad zone of copper oxide returning 33m of 0.3% Cu from 4.0m, including 16.5m of 0.5% Cu.

The Max team believes this broad associated alteration zone implies the potential for a bulk tonnage system. Planned drilling will also target surface higher-grade zones, discovered by rock channel sampling along strike 235m to the south.

2023 Exploration Plans

This year, Max is taking a two-pronged approach to ongoing exploration on its CESAR project: 1) To evaluate and prioritize existing targets within the 187 km² of mining concessions for drill testing; and 2) continue the regional sampling and prospecting program to identify additional copper-silver targets along the 90-km long CESAR belt.

“The ultimate goal of our detailed mapping and geophysical surveys is to delineate multiple drill-ready targets along this massive copper system,” Matich commented on the 2023 exploration program.

In the last two years, Max has collected 6,500 surface rock samples over the CESAR belt; Of those, 1,125 samples have returned values greater than 1.0% copper with average grades of 3.5% copper and 36g/t silver.

Max’s geological crew has now started to revisit the clusters of the outcrops with grades >1.0% copper and perform detailed mapping. This has led to the discovery of two new priority targets (Sierra at AM and Potrero Grande at URU).

At present, there are six priority targets being evaluated (Herradura, Sierra, Molino, Potrero Grande, URU South Target 1 and Target 2; see below). At the same time, the regional program is continuing, with the objective of finding additional targets.

As mentioned, drilling has already taken place on the two AM targets. Within the URU District, metallurgical testing of URU-C and URU-CE drill samples remains underway.

In parallel, orientation geophysical surveys have commenced over targets where copper mineralization is outcropping at surface and there is evidence of historical artisanal mining.

The goal of the orientation surveys is to identify which geophysical techniques best identify the copper mineralization based on the two depositional models. Ground geophysical methods including magneto telluric (MT), magnetic, gravity, induced polarization (IP) and electromagnetic (EM) are being tested. In addition, historical seismic data collected over the prospects are being re-processed and interpreted.

Conclusion

The latest sampling from the new AM-7 discovery further confirms what we’ve suspected all along: that there’s a large, potentially world-class copper-silver system straddling along a 90 km belt.

In just over two years exploring Colombia’s mineral-rich Cesar Basin, the Max team has made huge strides in proving that there is at least a Kupfershiefer-style stratiform copper mineralization at the northern end of its property.

There is likely more evidence to come, as the company noted in its latest announcement that further assays are still pending.

Though it’s too early to predict the true extent of mineralization at Max’s CESAR property, the fact the company is already making this many discoveries, at a time when copper supply is increasingly hard to come by, should be bookmarked by investors.

The International Copper Study Group (ICSG) recently said the copper market is facing another year of deficits. The group’s April forecast calls for a supply shortfall of 114,000 tonnes in 2023, compared to a 431,000-tonne deficit in 2022.

Some of the world’s largest mining companies and metal traders, despite their production growth, are anticipating a supply shortfall that could arrive as early as 2025.

Driving the copper supply gap is a relentless demand that, according to S&P Global, could double to 50 million tonnes by 2035. Consulting firm McKinsey expects electrification to create a 6.5-million-ton shortfall at the start of the next decade, highlighting a substantial output gap that the mining industry has to address.

Also needed considering is that the two copper producing nations, Chile and Peru, are each facing their own problems that are dampening hopes of sustained (or, guaranteed) production growth to meet future demand. At some point, other nations must rise to the challenge.

One of those could be Colombia, which shares the geological advantages of the Andes, plus the mineral-rich basins previously explored for petroleum and known for their large coal reserves. To this day, many parts of the country, including the Cesar Basin, remain largely underexplored for key minerals like copper.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.12 2023.06.23

Shares Outstanding 161.9m

Market cap Cdn$19.4m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.