Max Resource/Max Iron Brazil Florália DSO Iron Ore Project – Richard Mills

2024.12.10

On May 13, 2024, Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) announced that it had entered into an Earn-In-Agreement (“EIA”) with Freeport Exploration Corp, a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE:FCX) relating to Max’s wholly owned Sierra Azul Copper-Silver Project. Under the terms of the EIA, announced on May 13, Freeport can earn an 80% interest in the Sierra Azul Copper-Silver Project in two stages by spending an aggregate CAD$50 million and paying a total CAD$1.55 million to Max.

Max in October closed the transaction to purchase the Florália DSO Iron Ore Project, located 70 km east of Belo Horizonte, Brazil. The transaction closed pursuant to a mineral rights purchase agreement entered into with the company’s Brazilian subsidiary, Max Resource Brazil Ltd. (Max Brazil and, together with the company, the “Max Entities”) Jaguar Mining Inc. (TSX:JAG), and Jaguar’s Brazilian subsidiary, Mineração Serras Do Oeste Limitada (together with Jaguar, the “Jaguar Entities”).

Florália DSO Iron Ore Project

“The Florália DSO Iron Ore open pit reveals sizable, sub-horizonal plunging bands of hematite iron ore which appear to extend in all directions. Upon successful exploration and development, with iron ore buyers situated within 20 km, Florália would have a significant transportation cost advantage, as bulk tonnage haulage to a shipping port would not be required,” said Max’s CEO, Brett Matich, in the Oct. 11 news release.

(High-grade hematite (60% Fe) such as Florália is often referred to as Direct Shipping Ore (DSO) because it is mined and beneficiated using a relatively simple crushing and screening process before being exported for use in steel mills. The appeal of DSO lies not only in its high iron content but also in small environmental footprint, lower greenhouse gas emissions from dry processing, no requirement for water or environmentally sensitive tailings dams.)

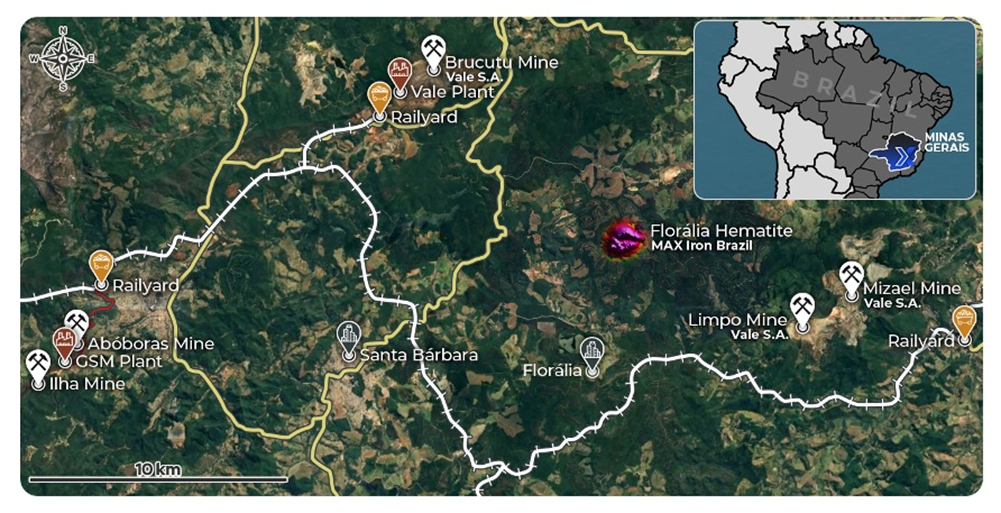

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

As mentioned by Matich, it is also within 20 km of major iron ore mines and steel mills, seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

Brazil is the world’s second-largest producer of iron ore, at 16% of global production. Most of the country’s iron ore mining (53%) takes places in the state of Minas Gerais, home to Florália.

Minas Gerais is Brazil’s second-highest producer of cast products in steel, iron, aluminium, bronze, and tin, with installed capacity of

2 million tons per year.

The state offers a highly skilled workforce, competitive energy prices, and a fast-tracked permitting system that makes it easier for miners to get projects off the ground.

“The government is keen to attract investment into the state, and they’ve made huge strides in streamlining the environmental licensing process,” says Mauro Lopes, international partner with Invest Minas, via Paydirt magazine. “The state is also very competitive in terms of energy costs, offering 100% renewable power at just 4c/kWh — far cheaper than in places like Australia.”

Australia is the largest iron ore producer but the Australian government taxes it at a higher rate than Brazil, taking a 7.5% royalty versus Brazil’s 3.5%. This is another advantage for Max.

Most iron-ore mining is done on surface in open pits. At the dry processing plant, the iron ore is crushed and screened, a classification process, into various size fractions to meet the required specifications.

The iron ore market is forecast to increase by USD$57.5 billion between 2023 and 2028 for a compound annual growth rate (CAGR) of 3.2%.

The World Steel Association forecasts global finished steel consumption to increase by 1.9% in 2024.

Rising demand for high-strength iron and steel, coupled with industrialization across developing nations and a booming construction sector, are driving this explosive growth.

While there has been a slowdown in China affecting iron ore demand, the Asia Pacific region is estimated to contribute 89% to the growth of the global iron ore market from 2023-28.

High-strength steel and green steel are promising new markets for iron ore mining companies.

Deutsche Bank has brushed off signs of oversupply in iron ore markets, suggesting China’s stimulus package could rocket prices of the steelmaking ingredient to $USD130/t next year.

Max announced on Nov. 15 the addition of a wholly-owned Australian entity, Max Iron Brazil Ltd., which will hold the Florália Brazilian assets. The company plans to list on the ASX and to do a pre-listing financing to fund the proposed transaction and to advance drilling. 30 million shares are being offered for AUD0.10 cents (Australian) per share.

A Feasibility Study and environmental study are expected by the end of 2025.

“If you’re a junior iron ore player this project has everything you could hope for,” Matich told Paydirt. “High-grade hematite DSO, strong local demand, minimal infrastructure requirements, and a management team with a proven track record. It’s as simple as that.”

Max Resource Provides Update on its Florália Hematite Iron Ore Project, Mina Gerais State, Brazil

A lot of work has already been accomplished, results from various surveys undertaken are impressive.

Max reports high-resolution drone magnetics at Florália has identified a large anomalous zone of surficial outcropping high-grade mineralization associated with hematite/itabirite type iron formation. The size of the anomalous area has far exceeded the approximate 160m by 160m historic open cut to around 1,500m by 1,000m based on the drone magnetics, field activities and 58 channel samples.

Max’s technical team has reviewed the new drone magnetics and channel sampling data and has significantly expanded the Florália DSO geological target from 8 to 12 million tons at 58% Fe to 50 to 70 million tonnes at 55% to 61% Fe, with an additional itabirite geological target of 130 to 170 million tonnes at 51% to 55% Fe.

The processed geophysical data from the drone survey also indicates a large portion of the magnetic anomaly lies at depth below the surface expressions of high-grade hematite oxide mineralization. Analysis indicates a highly deformed structural geological environment that is fundamental to the increase in iron ore grades and tonnages, a consequence of secondary crystallization of hematite and the development of supergene enrichment.

Additionally, the geophysical survey was also crucial in revealing the potential of a secondary body covered by soil in the northwest portion of the property. This zone was initially regarded as a minor occurrence; however, the magnetic signature and orientation recognizes it as extensions to the initial iron formation target.

The magnetometric geophysical survey utilized drones over the project area located in the Florália region of Santa Bárbara, Minas Gerais, Brazil, within the “Quadrilátero Ferrífero” region. The geophysical survey magnetometric maps were generated with multiples filters along with a 3D inversion that provided a high-resolution block model and isovalue surfaces from the interpreted source of the anomalies.

This data has been fundamental in confirming the principal target area and the true potential of the Florália high-grade hematite (DSO) project.

MAX has also completed characteristic ore tests and commenced environment studies and other components of the Feasibility Study (FS) the company plans to complete before the end of 2025. There is no native title on the property, water permits are not necessary so no tailings dam is necessary, and workers/ contractors will not need accommodation on site.

The channel sampling across road cuts is now complete with assays pending. The next step is auger and diamond drilling.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.045 2024.12.09

Shares Outstanding 179.8m

Market cap Cdn$8.09m

MAX website

Subscribe to AOTH’s free newsletter

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard owns shares of Max Resource Corp. (TSX.V:MAX) MAX is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

13 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

$MAX #IronOre #DSO #Brazil #MinasGerais #GreenIron #MaxIronBrazil

Hi,

interesting the information regarding the seedfunding of MAXBrazil.

How many share will there be altogether? 30 Mil. Seedround, IPO how many shares, how many stay at Max?

When this seedround starts and when the IPO is planed?

When Management expect results from this 4.2 Mio. earn-in invest (drill-programm) from FCX?

Are EDR, Eric Sprott, Merck and Franklin Templeton still 5 % Holder or they sold out?

What´s with RT Peru?

Thank you very much!

JT

.Complicated but trying to absorb. Think i will dip my toe in,What the Heck !! Thx. Mr. G.

The pre-IPO is at AUD0.10, the IPO is priced at 0.20.

Max Columbia receives operator fees for both projects in 2025 and will own shares in Brazil Iron Ore that have doubled and might very well increase over the coming year. And there is Sierra Azul.

Rick

Complicated but trying to grasp. Mat dip my toe in.WHAT THE HECK !! YA. THINK I WILL.THX. GARY

Looking forward to 2025

– Max Resources will receive operator payment fees for both the iron and copper projects in 2025.

– – The pre-IPO for Brazil Iron Ore is at AUD0.10, the IPO is priced at AUD0.20. Max resources will own a large %age of the shares in Brazil Iron Ore. They will have doubled on the IPO and might increase over the coming year.

– — Max Resources will own 20% of Sierra Azul after/if Freeport Exploration spends Cdn$50m on exploration.

—- News flow, from both projects, is going to be extremely strong over 2025.

I own both Max Brazil and Max Resource. Both are paid advertisers on AOTH.

I’m down 90% in Max why do you think this project will finally move the stock higher?

My opinion;

MAX will own almost half of Brazil Iron Ore shares. I believe the ownership of those shares will result in a situation where there will be a huge disconnect between MAX’s share price and Brazil Iron Ore’s share price (half the shares in the pre-IPO are escrowed for a year). If Brazil Iron Ore (BIO) owns 51%, Max 49% of BIO’s shares, than owning MAX (along with the deal with Freeport Exploration) might result in a market correction for MAX’s shares as that might be seen as a viable alternative to owning the higher priced BIO shares.

Rick

I own Brazil Iron Ore shares and Max Resource shares.

MAX is a paid advertiser.

How can you own MaxBrazil shares, as the de-merger prozess didn´t start?

I´m interested in on the pre-IPO Placement.

I called the company and asked if I could get part of the pre-IPO, said yes.

Rick

Are EDR, Eric Sprott, Merck and Franklin Templeton still 5 % Holder or they sold out?

What´s with RT Peru?

Thank you very much!

JT

I did already. Two times.???

https://www.maxresource.com/MAX_Presentation_Web.pdf?9c118