Max Resource discovers Manto-style mineralization at Sierra Azul – Richard Mills

2024.08.24

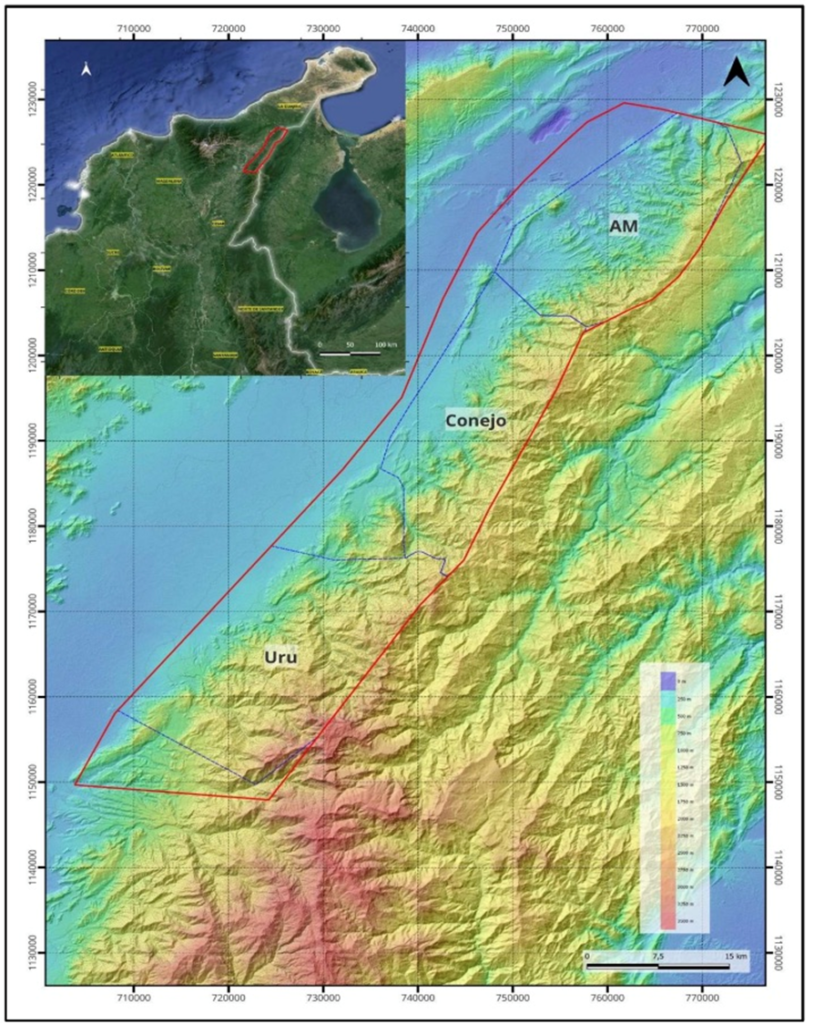

The Sierra Azul project sits along the Colombian portion of the Andean Belt — the world’s largest producing copper belt. It includes the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

Despite the Spanish being there centuries ago, tunneling into the mountains looking for high-grade silver, and the equally-long-known-about massive outcrops exposing high-grade copper and silver mineralization throughout the entire basin, Vancouver-based Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2), led by CEO Brett Matich, was the first to recognize its potential.

The land package now spans more than 1,150 km of geology prospective for sedimentary and volcanic hosted copper/ silver deposits and includes 20 mining concessions covering over 188 square km.

The project was formerly known as CESAR.

Max has already released assay results at Sierra Azul following a recently signed earn-in agreement with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE:FCX).

The results were from 10 continuous channel samples collected at the AM-13 target. AM is one of three districts within Sierra Azul, which means “Blue Mountain” in Spanish. The two others are URU and Conejo. The three contiguous districts stretch over 120 km in a north-northeast, south-southwest direction.

AM District

The AM District starts in the far north of the Jurassic Basin; classic stacked red bed outcrops with extensive lateral continuity have been channel chip-sampled for over 15 km of strike. Highlight values of 34.4% copper and 305 g/t silver have been documented in the sedimentary sequences. The company has confirmed that the stratiform red-bed style mineralization continues at depth with two scout drill holes. Max’s field crews have identified a 15-km mineralized corridor encompassing 14 priority targets (AM-01 to 14).

In addition, Max recently discovered Manto-style targets of significant size in the AM District.

Earn-In-Agreement

On May 13, 2024, Max announced that it had entered into an Earn-In-Agreement (“EIA”) with Freeport, a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE: FCX) relating to Max’s wholly owned Sierra Azul Copper-Silver Project. Under the terms of the EIA , announced on May 13, Freeport can earn an 80% interest in the Sierra Azul Copper-Silver Project in two stages by spending an aggregate amount of CAD$50 million and paying a total of CAD$1.55 million to Max.

AM-13 discovery

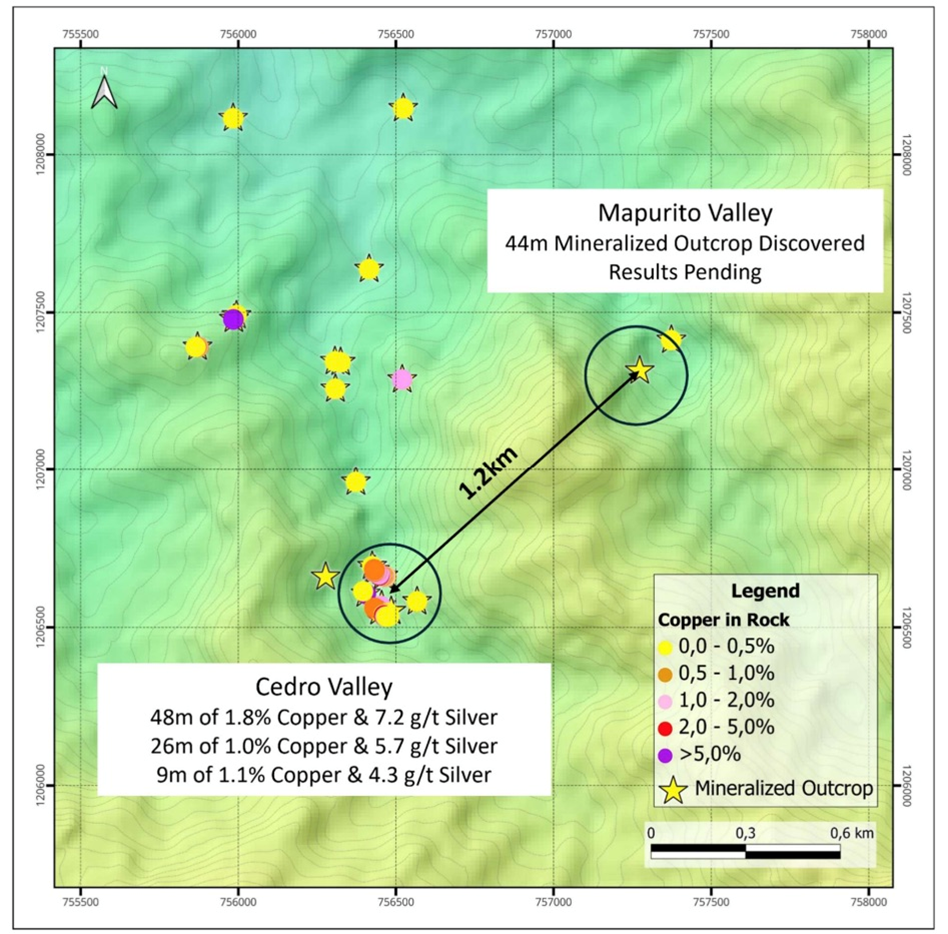

Results from 10 mineralized outcrops from the Cedro Valley include:

- 1.8% copper and 7.2 g/t silver over 48.0m (AM13_CS08, continuous saw-cut channel),

- including 3.4% copper and 14.0 g/t silver over 15.0m

- and 3.5% copper and 15.7 g/t silver over 5.0m

- 1.0% copper and 5.7 g/t silver over 26.0m (AM13_CS01, continuous chip channel)

- 1.1% copper and 4.3 g/t silver over 9.0m (AM13_CS04, continuous chip channel)

According to Max, AM-13 hosts Manto-style mineralization and alteration, similar to deposits in the Tocopilla-Taltal region of northern Chile, a mineralized corridor that extends well over 100 km and hosts several economic deposits including Mantos Blanco (500 million tonnes at 1.18% copper and 12 g/t silver).

A Manto is a geological term for a style of emplaced ore deposit. Meaning blanket in Spanish, manta-type deposits describe flat-lying or pancake-shaped elongated concentrations of minerals. They are not generally layered but rather are continuous bodies of mineralization.

Mantos Blancos is one of a series of eight Manto copper-silver deposits in the Jurassic-age volcanic and volcano-sedimentary rocks of northern Chile.

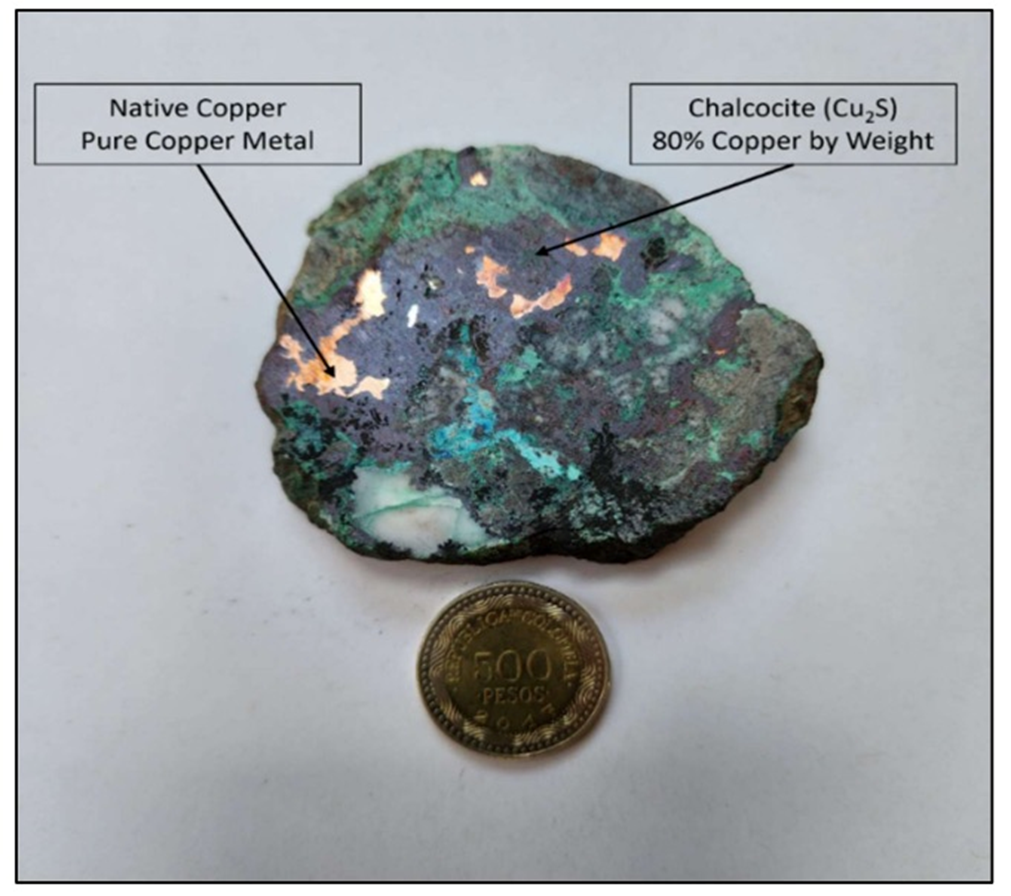

The mineralization at AM-13 is hosted in an andesitic tuff (a type of volcanic rock) that strikes 50⁰, dips 70⁰ northwest and has been structurally faulted.

Native copper and chalcocite are the primary copper-bearing minerals observed in the outcrops. These minerals indicate the depositional environment was sulfur-poor, leading to the precipitation of these high-grade copper minerals.

Trace amounts of bitumen, a type of hydrocarbon, were also observed. Bitumen is believed to be critical to the deposition of copper minerals from fluids that circulated within the Cesar-Rancheria Basin.

Exploration teams prospecting the Mapurito Valley, 1.2 km to the north, also discovered a 44.0m wide outcrop of andesitic tuff with similar mineralization in July 2024, suggesting AM-13 has significant size potential. Rock channel sampling of the Mapurito Valley outcrop is underway. Assays are pending.

“The AM-13 discovery is a significant achievement by the Max team working with Freeport-McMoRan Exploration Corporation (Freeport), which is earning in at the Sierra Azul Copper-Silver Project to unlock Sierra Azul’s potential, which we believe is host to one of the world’s largest underexplored sedimentary and volcanic copper-silver systems,” said Max’s CEO Brett Matich.

“The 48.0m width at 1.8% copper at Cedro Valley is quite remarkable and the discovery of a 44.0m outcrop of similar mineralization in Mapurito valley 1.2 km to the northeast speaks to the target’s potential to be a world-class deposit.”

“The Max property position covers a mineralized belt of rocks similar in length to the Jurassic age belt in northern Chile which hosts no less than five economic deposits. The current exploration program is focused on confirming mineralization continuity between the Cedro and Mapurito valleys to establish the full mineralization footprint and prepare the target for drill-testing,” he concluded.

While AM-13 is the top-priority drill target, the next step is to establish continuity of the mineralization between the Cedro Valley and Mapurito Valley outcrops with detailed mapping, soil sampling and ground geophysical surveys.

Teams will continue to systematically evaluate the entire Sierra Azul project through regional soil sampling (7,500 samples) and stream sediment sampling (up to 1,600 samples). In addition, a regional structural analysis will be conducted, followed by geological mapping and prospecting to identify additional mineralized outcrops.

Results from 109 rock channel samples collected across 10 mineralized outcrops in the Cedro Valley in June 2024 are summarized below. Samples were collected perpendicular to bedding, with each sample representing a one-meter interval. Saw-cut channels had an approximate depth of 2 cm and a thickness of 5 cm.

2024 exploration program and budget

The USD$4.2 million exploration program currently underway has two main objectives:

- Conduct systematic regional exploration over the entire Sierra Azul Project Area (>1,300 sq-km)

- Define priority targets for drilling

Conclusion

Every junior resource company that tries to build a mine suffers the massive dilution that will entail; many fail. Way too many companies get blown-out share structures just getting to a first or second resource estimate, diluting the return to shareholders even before starting the numerous studies and permitting processes.

It’s always a trade-off: let the experienced miners spend the money on exploration by earn-in and manage the diverse country jurisdictions; or try to go it alone, suffering years of risk, market cycles and dilution.

You either dilute the shares or you dilute the property. Arguably, diluting the property can be better.

By partnering with a major, under similar terms to Max Resource there are benefits from enhanced exploration capabilities.

Large mining companies possesses advanced exploration technologies, geoscientific expertise, and a vast network of industry contacts. These resources enable a junior exploration company to conduct more extensive and accurate geological surveys, geophysical studies, and geochemical analyses. As a result, they can identify copper deposits with greater precision, increasing the chances of the deposit becoming a mine.

Also, it’s easier for a major with their vast network of industry and experience with various government jurisdictions, to navigate the operational situation in the home country — which becomes important when it’s time to develop mining operations.

“We are leveraging Freeport’s global exploration team and expertise to unlock Sierra Azul’s potential, which we believe is host to one of the world’s largest underexplored sedimentary and volcanic copper-silver systems,” Max’s CEO Brett Matich said in the July 29 news release.

“The 2024 USD$4.2 million (CDN$5.8m) exploration budget to be implemented in the second half of 2024 is the largest annual exploration budget to date. We look forward to working with Freeport, one of the world’s largest copper producers, to advance our Sierra Azul Copper-Silver Project.”

The two priority districts are AM and Conejo. AM is more advanced and prospective with 14 targets and potential deep-seated surface structures. Conejo is earlier-stage but thought to be at least as prospective as AM. Max is working through the approval-to-drill process.

The regional exploration program has been designed to systematically evaluate the entire Sierra Azul project. Work will include the collection of up to 7,500 soil samples and up to 1,600 stream sediment samples. A regional structural analysis will be conducted, followed by geological mapping and prospecting to identify additional mineralized outcrops.

In February of this year Max completed a 10,000 line-km geophysical survey of the project. Magnetic and radiometric data were collected along tightly spaced lines, providing Max with two detailed data sets packed with geological information.

The 2024 program announced CAD$5.8 million budget covers 2024. The new year, 2025, will bring a new budget, more exploration and planned drilling.

The 2024 program, the largest annual exploration budget to date, has already discovered what they consider Manto-style mineralization at AM-13.

The next step is to establish continuity of the mineralization between the Cedro Valley and Mapurito Valley outcrops with detailed mapping, soil sampling and ground geophysical surveys.

Pretty exciting stuff for an earn-in just three months old.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.07 2024.08.22

Shares Outstanding 176m

Market cap Cdn$12.3m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard owns shares of Max Resource Corp. (TSXV:MAX.) MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

5 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#FreeportMcMoRan $FCX #MaxResource $MAX #Copper #Silver #Manto #TocopillaTaltal #Mantos Blanco

FUN WITH NUMBERS

IF the manto in the Cedro Valley is continious and CONNECTS to the one found in the Mariputo…

What are come speculative copper/ silver numbers in-situ?

The math is quite easy, use what ever number you want for depth. The rest is spelled out in the release.

For length 1,200m, width is average of both discoveries 46m, I’m using 400m depth, specific gravity is 2.8, grade at 1.8% copper is likely a bit of a stretch to say it will be that high grade all the way, it’s a published number but I’m using 1.5% or 33 lbs Cu per ton.

So the formula looks like this: 1,200m x 46m x 400m x 2.8 = metric ton x 33lb Cu per ton = 2B lb Cu. Again use whatever numbers you feel comfortable with, I’ve done the crunching with everything from 46m depth to 400m, grade fron 1.8 down to 1.5%.

All I’m trying to do is get a handle on potential, remember it may not be connected, could be faulted, disappear for a while then pick up. But we are here for potential.

The silver number would be the same formula except the grade is 7g/t / 31 to get ounces.

FUN WITH NUMBERS is 100% speculative and not to be relied on for investment purposes. MAX is a paid advertiser on my site aheadoftheherd.com and I own A LOT of shares and am buying more out of the market.

Gold is seemingly breaking records almost daily. Silver is threatening to bust out. Copper is, despite recent negativity, in a structural supply deficit that is only going to grow. China is threatening more, and tougher, trade restrictions on critical metals.

We live in a finite supply world.

Yet our demand is infinite.

And juniors, the owners of the world’s future mines, cannot get financed, or are doing them at lows we’ve never seen.

I’m going to finance a couple of these Co’s, those with superior, imo, projects. Ones that own their projects 100% and of course have competent management

I’m also looking at (and already own one), juniors that have, very smartly and timely, done recent earn in or JV deasl with a major mining company.

Maybe financing for junior’s will turn around. But those that get financed now, ones w/o already blown out share structures, will have a huge lead in giving their investors what has been historically been the best leverage to rising metal prices – junior’s.

And those junior’s that have a project interesting enough to attract a major’s attention, as an earn in or JV partner, those jr’s whose shareholders will suffer property dilution, not share dilution, will also do well with their senior partners funding exploration & development of any discoveries.

Rick

Yea and all that, how’s about an invite to an Arizona rock hound the tailings must be incredible 💎

It would be be a great trip.

Rick