Max reports CESAR’s silver mineralogy is similar to “Kupfershiefer”

2020.08.25

Mineralogy is the branch of geology that studies the chemistry, crystal structure and physical properties of minerals. When it comes to the potential for mineral deposits to become mines, it is important to know the processes in which the minerals formed, their physical properties, and how they are distributed in the deposit.

Minerals are classified according to their density – often given as specific gravity – hardness, tenacity (how the mineral behaves when it is broken or crushed), and if they are crystalized, how the atoms are structured.

In gold exploration, one of the first things to understand, is that all that glitters may not be gold. Nature plays tricks in different ways. One of the most common is the presence of iron pyrite in potential gold ore. Pyrite’s metallic luster and pale brass-yellow hue so resembles gold, that many early miners mistook it for the real thing, hence its nickname “fool’s gold”. Pyrite is the most common sulfide mineral on Earth.

Another form of nature’s trickery is “the nugget effect”. A gold deposit with the host rocks widely disseminated makes mining extremely difficult, and expensive. Drill core has been known to assay 44 kilograms of gold per tonne in one meter, and 0.1 g/t the next. Even more frustrating is when the core is first assayed by one technique, then re-assayed by another, and the gold disappears. This is a well-known symptom of the nugget effect.

Even if the ore is fairly evenly dispersed throughout the deposit, how the particles occur is a major determinant of how easy it will be to process. Where the gold presents as discrete, coarse particles, it is possible to use a gravity concentrate to directly smelt the ore into gold bars. However, if the ore has ultra-fine gold particles disseminated throughout, the ore will be resistant to standard cyanidation and carbon adsorption processes. This refractory ore generally contains sulfide minerals, organic carbon or both. It requires pre-treatment for cyanidation to be effective in recovering the gold, most commonly flotation and roasting.

Refractory gold ore is therefore complex and costly to process.

Silver is often recovered as a by-product of refining other metals, such as gold, copper or lead-zinc. Silver may also occur as a free mineral (not agglomerated with other minerals), as silver sulfide, silver arsenic sulfide, and silver lead sulfide complexes.

When mining and processing silver, it is important to recognize that virtually none is mined from ore where silver is the main constituent. Only 25% of silver is extracted from ores mined for their silver value, and a full three-quarters of the world’s silver comes from ores that have lead, copper or zinc as their main metal. All three ore minerals are sulfides, ie. lead is present as galena, zinc as sphalerite and copper as chalcopyrite. Silver mineralization appropriate for processing also usually contains argentite, proustite and polybasite.

Max Resource Corp.

Since November 2019, Max Resource Corp. (TSX-V:MXR) has been identifying copper and silver targets within a 120- x 20-km area, at their CESAR copper + silver project in northeastern Colombia.

Max continues to expand the surface mineralization at CESAR, using rock chip panel samples and composite grab samples to identify structures, continuity of thickness, strike length and potential size, prior to drilling.

The Vancouver-based company is following the theory that continuous panel samples are pointing to a giant, sediment-hosted copper + silver mineralized system.

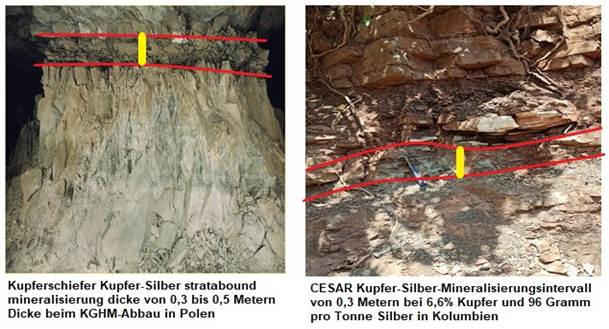

Its recent AM North and AM South discoveries are hosted in well-bedded sandstone-siltstone similar to KGHM’s monster “Kupferschiefer” mines in Poland.

Outlining any copper porphyry is difficult and expensive because so much drilling has to be done to figure out what is the size and shape of the deposit. With sedimentary copper in Colombia, the trick is to find the copper outcroppings, then use seismic/ oil and gas drilling log data to find the orebody that may be dipping beneath the soil cover. After that, it’s a matter of identifying the best drill targets.

Max’s goal is to get to that point of being brought out by a major copper or global mining company , that is attracted by the CESAR copper-silver project from a district-scale perspective and the potentially the next Kupferschiefer. .

Max has already signed two non-exclusive confidentiality agreements (NDAs), one with a leading copper producer, and the other with a global miner. For the time being, both companies wish to remain anonymous.

Silver-bearing copper sulfides

In June, Max entered into a collaboration agreement with “one of the world’s leading copper producers”, starting with a technical study of CESAR by Fathom Geophysics.

The aim of Fathom’s study is to map stratigraphic (rock layers) features that can help to pinpoint stratabound copper-silver mineral horizons at the property.

The collaboration with the un-named major, and the study being carried out by Fathom, complements research initiated by the University of Science and Technology (“AGH”) of Krakow, Poland – one of the most important research centers in the world for the study of these sedimentary-hosted stratiform copper deposits, which are also large repositories of silver.

In an April 21 news release, Max said it sent surface rock samples from CESAR’s stratabound copper + silver mineralization horizons to AGH. Researchers at the university, which has worked extensively with KGHM, the state-owned copper-silver miner, are conducting mineralogical and geochemical studies on the samples; also, a Masters-level student is planning on writing a thesis paper on the results.

Initial results from petrographic analysis of two samples from AM South were released by Max on May 26.

They confirm the presence of native copper, chalcocite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected, having not been found previously. That could be significant, because copper sulfides are more profitable to mine as a result of their higher copper content. The copper is also more easily separated from other minerals, compared to copper oxides.

The study was conducted by the National University of Colombia’s geological engineering department, with assistance from Max’s field team, as part of another Masters-level thesis, on stratabound copper-silver mineralization within the Cesar-Ranchería Basin of northeastern Colombia.

This week, Max announced the presence, at AM South, of native silver and silver-bearing copper sulfides – as reported by AGH’s ongoing mineralogical/ geochemical studies of CESAR.

The university researchers used “Energy Dispersive X-Ray Spectroscopy” (EDS), a technique that bombards the sample with an electron beam, to identify its composite elements.

According to the news release, The presence of silver-bearing chalcocite and covellite as well as native silver was identified using “Energy Dispersive Spectroscopy” (EDS) analysis.

That is meaningful, because it is yet another marker of “Kupferschiefer”-type mineralization. At the huge cluster of silver-copper deposits in Poland, being mined by KGHM, silver most commonly occurs in copper sulfides – chalcocite and bornite. At AM South, the sample Max sent to AGH for analysis also contained chalcocite.

‘It’s telling you where the silver is, before we didn’t know what mineral the silver was contained in, so it’s showing it is very similar to the Kupferschiefer,” Max’s CEO, Brett Matich, told AOTH over the phone, Monday morning.

“The initial AGH results are significant as they identified silver-bearing chalcocite and covellite as well as native silver at AM South. Silver is a key component of stratabound copper deposits, so we are extremely pleased with CESAR’s silver content. The presence of silver further substantiates a Kupferschiefer type system at CESAR,” Matich stated in the Aug. 25 news release.

Max’s technical team continues to build a geological model based on KGHM’s Kupferschiefer, Europe’s largest copper deposit, with production in 2018 of 30 million tonnes grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-meter thickness. The Kupferschiefer deposit is also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine (World Silver Survey 2020). “Our ongoing exploration programs continue to meet Company expectations and support management’s belief in the presence of a significant stratabound copper-silver system at CESAR,” he continued.

Two greenfield discoveries, AM North and AM South, appear to support Max’s theory of the high-grade outcrops being the surface showings of a sizable sediment-hosted copper system underground.

AM South features a stratabound copper-silver horizon, with mineralized structures totaling over 5 km of strike length. Sampling from 0.1 to 25-meter intervals returned highlight values of 5.4% copper and 63 g/t silver (US$324.26 gross metal value per tonne).

On trend 40 kilometers north, AM North consists of a broad 11-kilometre continuous zone of stratabound copper-silver mineralization and is open in all directions. The copper-silver zone also contains a high-grade area with varying intervals grading 4.0 to 34.4% copper + 28 to 305 g/t silver (July 29, 2020). TheAM North target returned values of 10.4% copper and 88 g/t silver (US$605.36 gross metal value per tonne) over a 1-meter interval, along 1,800m of strike.

The AM North horizon returned 24.8% copper + 230 g/t silver (US$1455.13 gross metal value per tonne) over a 4m x 1m rock chip panel discovery.

Max also reported bulk sample assay and QEMSCAN values of 9.4 % copper + 79 g/t silver (US$546.84 gross metal value per tonne) obtained in the vicinity of AMN-2, and 3.5 % copper + 29 g/t silver (US$203.37 gross metal value per tonne) near AMN-1.

In June the company extended the AM North target area from 2.5 km to over 11 km.

Conclusion

At Max’s CESAR project rock chip samples taken thus far have returned high-grade copper and silver assays. The fact that the AM North and AM South targets appear to be large sub-horizontal sheets, that partly outcrop at surface, adds credibility to the Kupferschiefer analogy – as do this week’s results from AGH, indicating the silver mineralogy at CESAR is similar to Kupferschiefer.

In Poland’s Kupferschiefer deposits, continuous mineralization extends down dip and laterally for kilometers. Could the mineralization at CESAR do the same? If so Max could be looking at a district-scale, even a regionally extensive copper-silver mineralized system.

Max has entered into non-exclusive confidentiality agreements with a leading copper producer and a global miner.

The first phase of the partnership with one of the yet-to-be-named companies, involves a technical study by Fathom Geophysics.

The aim of the study is to map stratigraphic (rock layers) features that can help to pinpoint stratabound copper-silver mineral horizons at CESAR.

Though still early-stage, Max’s CESAR, in just 10 months, has, to us at AOTH demonstrated the massive scale needed to interest a major mining company.

Having two major mining companies come in so early – just 10 months into an exploration program – validates Max’s exploration Kuperferschiefer model, and the results.

Max Resource Corp.

TSX.V:MXR

Cdn$0.22, 2020.08.25

Shares Outstanding 39.300.906m

Market cap Cdn$8.64m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Millswebsite/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V:MXR). Max is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.