Max receives all Mining Concession Contracts for CESAR’s URU Zone

2021.11.25

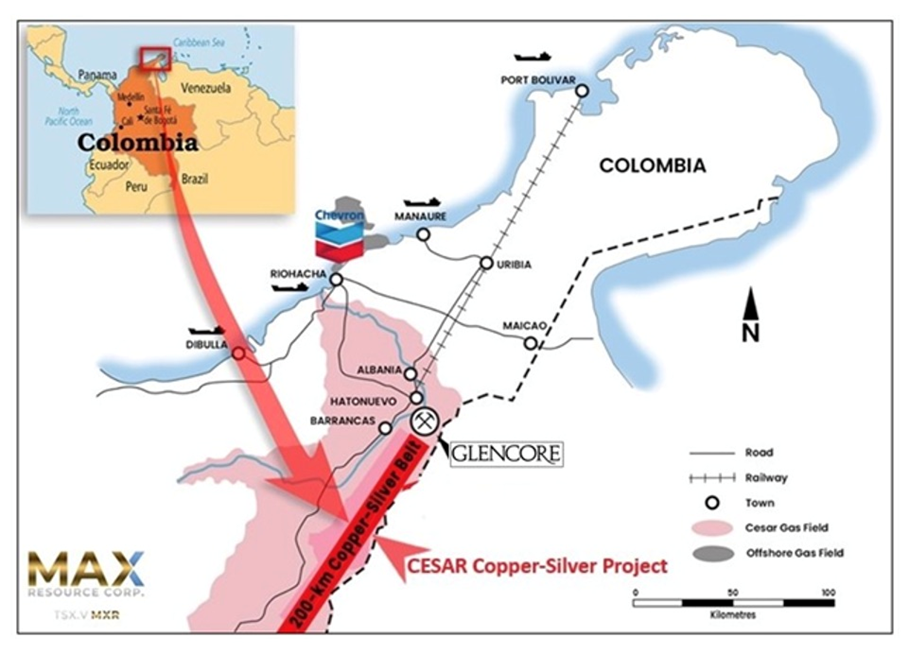

After two years of vigorously surface-sampling mineralized outcrops at its CESAR copper-silver project in northeastern Colombia, Max Resource Corp (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) is preparing to drill the property, considered prospective for hosting a world-class Cu-Ag resource.

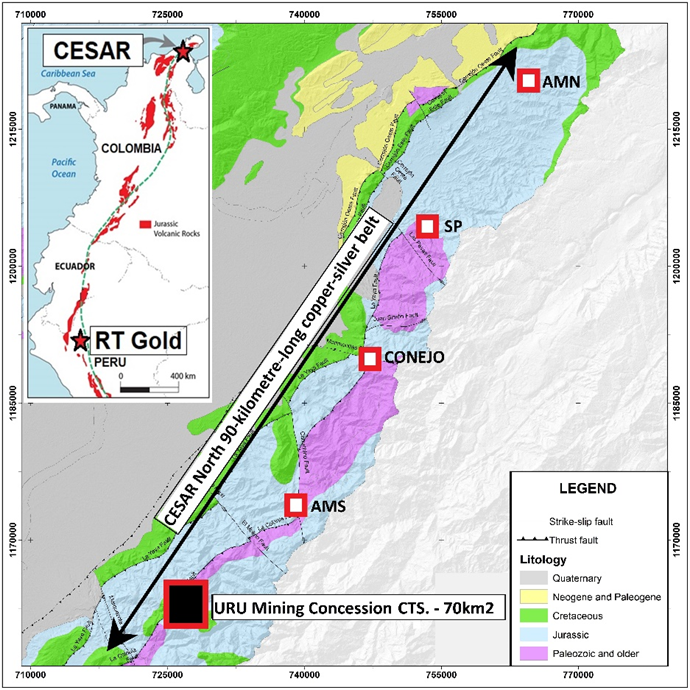

Having obtained its first Mining Concession Contract for the URU Zone Max has been exploring this year, the company on Wednesday announced the receipt of three additional Mining Concession Contracts at URU, located along the CESAR North 90-kilometer-long copper-silver belt.

“These four strategic Mining Concession Contracts provide secure tenure of the URU zone and immediately forge the way for more advanced work programs, surveys and drill permitting,” said Max’s CEO, Brett Matich, in the Nov. 24 news release.

“Achieving this critical milestone expedites Max’s first drill program at URU, being a significant event in the Cesar basin since the discovery of Cerrejón, the largest coal mine in South America and the basis for much of the critical infrastructure in the Cesar Basin,” he added.

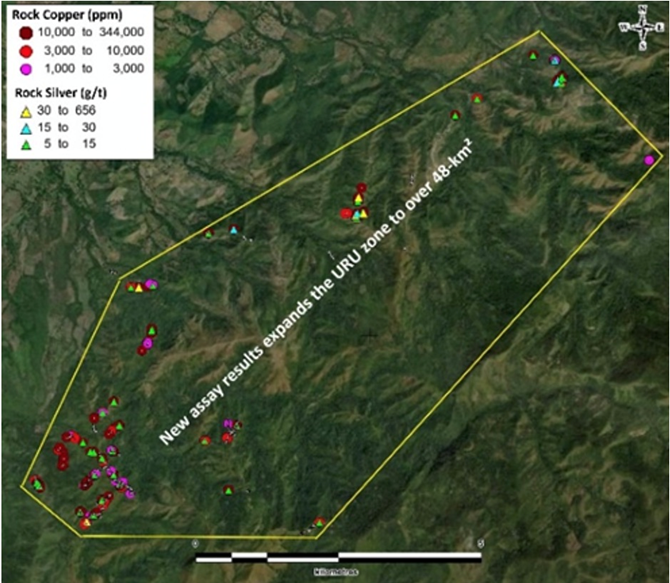

The four contracts encompass a total of 70 square kilometers, including a zone of copper-silver mineralization that has been identified over 48 km². This leaves plenty of room for Max to explore within and “around the edges” of the existing mineralization, which is important given that the outer limits of the Cu-Ag occurrences have not been found; URU remains open in all directions, with highlight values of 14.8% copper and 132 g/t silver, from sampling that included 13 samples in excess of 3% copper, 69 samples over 1% copper, and 14 samples greater than 15 g/t silver. Sample widths range from half a meter to 25 meters.

In Colombia, Mining Concession Contracts are granted for an initial 30-year term, and include an extension for another 30 years. The process includes a detailed Social Management Plan (SMP) followed by a public hearing with the local community.

Max has already completed the SMP with a public hearing taking place on Sept. 2, 2021, after the first contract was issued.

While Max will continue to conduct regional exploration along the 90-kilometer-long CESAR North copper-silver belt, its immediate focus is on URU. The next steps are:

- Infill mapping and sampling of the entire 70 km²

- Ground geophysical surveys to zero in on drill targets

- Environmental and socio-economic surveys for drill permitting

- Phase one drilling of the delineated targets

This is Max’s exploration plan going forward. It’s important to recognize that this plan didn’t exist previously. It’s a new strategy. According to Matich, the company expects to do environmental baseline studies starting in December then start applying for drill permits, followed by drilling late Q1 2022. Note that the enviro-studies are not necessary for every drill permit application, meaning that drilling should proceed smoothly as more URU drill targets are identified and drill permits are applied for and granted.

CESAR

Max has interpreted the sediment-hosted stratabound copper-silver mineralization in the Cesar Basin to be analogous to both the Central African Copper Belt (CACB) and the Polish Kupferschiefer deposits. Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposit in the Congo.

Kupferschiefer, the world’s largest silver producer and Europe’s biggest source of copper, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.48% Cu and 48.6 g/t Ag. The silver yield is almost twice the production of the world’s second largest silver mine.

The URU and CONEJO zones, two discoveries Max made at CESAR North this year, are among five discovery zones identified since the company took ownership of the CESAR project in late 2019.

While the northern part of the 90-km-long CESAR North has been characterized as “Kupferschiefer-style” mineralization, the southern part containing URU and CONEJO are suspected to be more “Central African” in nature.

Kupferschiefer deposits are envisioned as huge flat-lying sheets of sedimentary copper. These slabs of “copper shale” can run for several kilometers but they are relatively thin, with an average mining thickness of just 2 meters.

By comparison, CACB-type mineralization has some thickness to it, and there may be feeder zones running into the orebody.

URU Zone

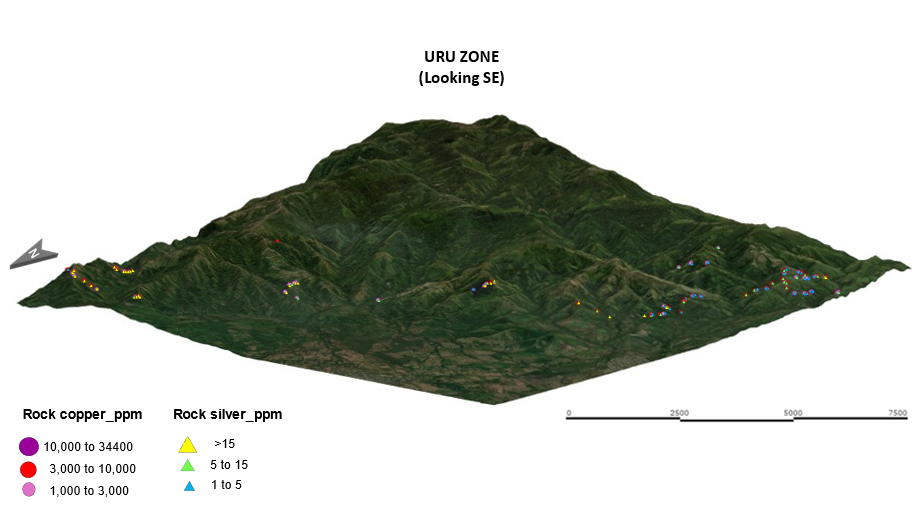

To understand why Max thinks the URU Zone mineralization is Central African, take a look at Figure 3 below.

The image depicts a three-dimensional model of the URU Zone. The model shows the various mineralized occurrences, which range from 1,000 to 34,400 parts per million (ppm) copper and 5 to 656 ppm silver, presenting at surface.

As you can see the topography is mountainous. Some of the mineralization has to extend vertically. When I first saw this diagram of the terrain, I thought “that mineralization had to come from depth.”

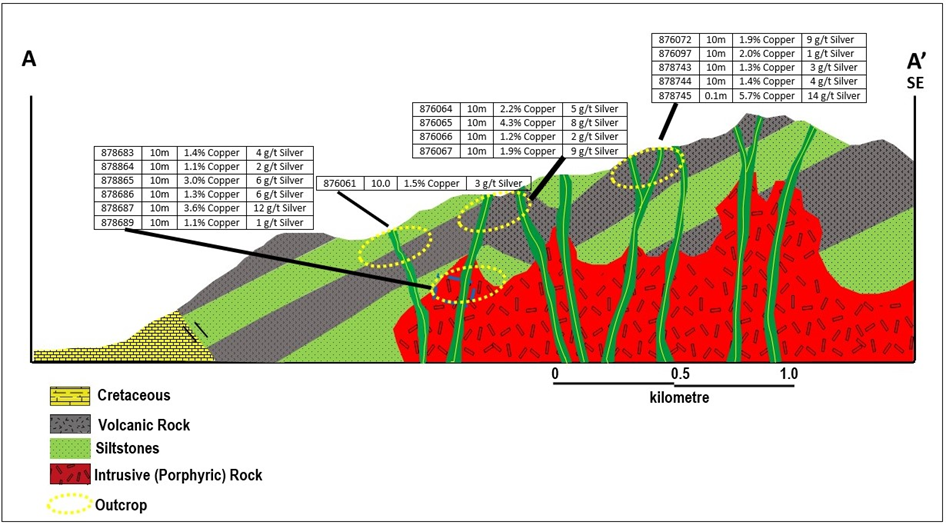

The figure below shows the URU discovery cross-section. Notice that three of the four surface sample locations with grades attached are taken from where the green “ore shoots” rise up to the surface. The fourth sample location is deeper, taken from within the porphyritic intrusion, colored red.

The fact that the mineralization appears to run continuously for 800m (between 400m and 1,200m) through mountainous topography strongly suggests there is a lot of volume to it — it more or less goes from base to hill-top, which could indicate a major copper-silver system emplaced throughout. The zone has been expanded to 48 square kilometers, and it remains open in all directions. That’s an exciting prospect.

Conclusion

We don’t yet know how large CESAR is but we know that Max has successfully identified copper mineralization at surface in a number of areas of the 200-km-long CESAR Basin, making this a potential district-scale copper-silver system.

CONEJO stands out for the grades Max is achieving there. The zone now extends over 3.3-km of strike with average grade of 4.9% copper using a 2% cut-off — unheard of these days when copper grades over 1% are considered excellent. CONEJO doesn’t appear to have the same amount of volume as URU but the high grades suggest it wouldn’t need as much volume to delineate a resource.

URU’s grades are a little lower than CONEJO’s but the mineralization Max is encountering suggests it could have scale.

Major mining companies are only interested in large mineral deposits or deposits that are scalable to their needs. Interest in MAX’s CESAR project has been strong, with multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer. There have been three field visits to the site from undisclosed parties.

The company keeps finding high-grade copper zones and expanding these areas, confirming the potential existence of a massive sediment-hosted system comparable to some of the biggest in the world.

Max Resource Corp.

TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2

Cdn$0.21 2021.11.24

Shares Outstanding 86.3m

Market cap Cdn$21.2m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSX.V: MXR). MXR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.