Max pursuing new high-grade gold target and hunting for copper-gold porphyry

- Home

- Articles

- Uncategorized

- Max pursuing new high-grade gold target and hunting for copper-gold porphyry

2019.07.20

In one sense, mineral exploration is a complex process with a lot of moving parts, including money-raising, bringing on partners, marketing, surveying, sampling and drilling. In another sense, looking for metals is simply coming up with a theory about where the minerals are and how they got there, then testing that theory.

It is the science behind mineral exploration – the fact that theories must be proven or disproven before continuing – that often gets lost in the story of a discovery. If the first theory is not borne out by the evidence, the exploration company must come up with another, or a different area of mineralization to be tested. And so on, until the evidence proves the hypothesis, then more detailed work can continue, based on that hypothesis.

The science is also why it is crucial for an explore-co to have good geologists on the payroll and/or directors with mineral exploration experience, who can come up with the theories and test them, and just as important, to know when the theory is wrong so that they can move on and test another theory. This is especially important because most juniors have limited exploration budgets and no revenues; it’s pretty easy to blow the budget by continuing to test an incorrect hypothesis.

All of this is background for telling the next chapter of the Max Resource (TSX-V:MXR) story.

Conglomerates

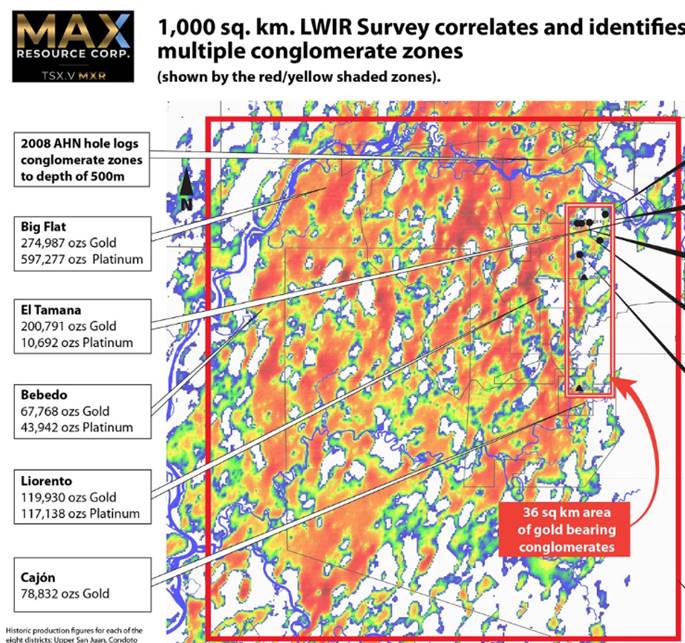

Max has a conglomerate gold project in the Choco region of Colombia; conglomerated free gold, at surface, is potentially spread across 1,000 km, as shown in an LWIR (long wave infrared) satellite survey below.

Earlier this year, Max updated investors on the results of two samples taken from a 1,000-square-kilometer new exploration zone containing surface gold and platinum.

A concentrate made from the first sample graded 340.84 grams per tonne (g/t) gold and 111.03 g/t platinum, for a combined 451.87 g/t gold and platinum.

The second concentrated sample was 222.06 g/t gold and 113.83 g/t platinum.

North Choco

On May 8 Max announced it entered into a binding letter of intent (LOI) with Noble Metals and Buena Fortuna Mining, to acquire 100% of those two companies’ interest in Andagueda Mining, which has the first recorded mining agreement with the Tahami indigenous group – the landowner – to explore a 500-square kilometer mining area.

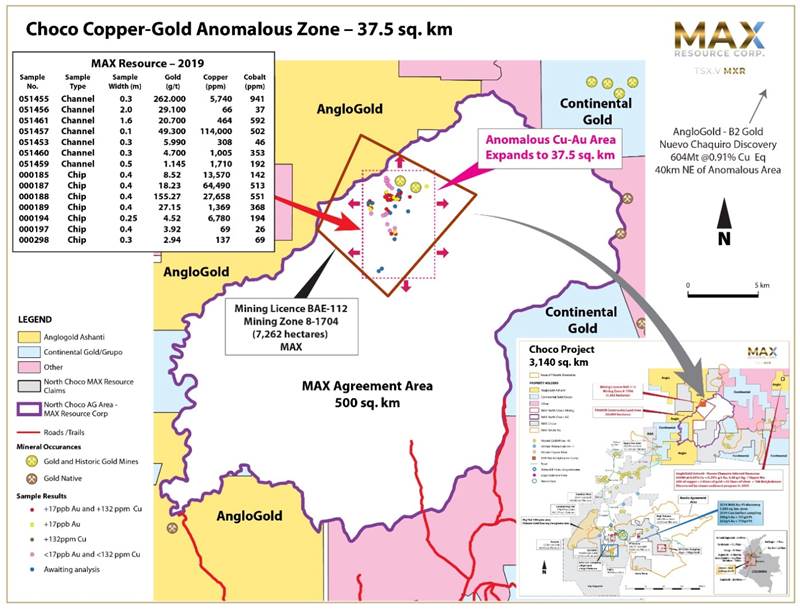

Three weeks into a 10-week exploration program, seven of 23 chip samples returned grades ranging from 2.9 grams per tonne (g/t) gold, to a glittering highlight of 155.27 g/t over a 0.4m intersection. Of the seven samples, three showed copper grades in excess of 1% Cu, in a vein zone containing pyrite, chalcopyrite (the copper mineral) and galena.

The chip samples were taken over various widths from four locations within a 400- by 700m exploration area centered on North Chocó’s historic gold mine.

Read more at Max in the chips at North Choco with high-grade gold/ copper

When added to Max’s Choco Precious Metals Project, the 500-square-kilometer North Choco property expands Max’s land holdings in the department of Choco, Colombia, from 2,140 square kilometers to 2,640 sq. km.

Surrounded by success

Of note to Max investors is historic exploration at North Choco.

North Choco is contiguous to properties held by AngloGold Ashanti and Continental Gold. Forty-seven kilometers to the northeast, AngloGold’s Nuevo Chaquiro copper porphyry discovery has an inferred resource containing 3.95 million tonnes of copper (@0.65% Cu) and 6.13 million ounces of gold (@0.32 g/t); it is one of five known porphyry centers concentrated within a 15 sq. km area.

“Outlined by >0.3% Cu limit, the Nuevo Chaquiro mineralization forms a body elongated in shape by 1,200 m in the E-W direction with dimensions of approximately 500 m in width and vertically. On the eastern flank, the porphyry mineralization occurs at 350 m depth whereas in the west it is first encountered at somewhat deeper depths (400-500 m depth),” reads a technical paper on the Nuevo Chaquiro discovery. It adds:

“Nuevo Chaquiro is a significant copper-gold porphyry deposit clearly demonstrating the potential for future new porphyry discoveries in the Middle Cauca Miocene volcanic belt of Colombia and demonstrates what can be achieved from sediment sampling programs.”

AngloGold’s initial reconnaissance work at North Choco, in 2005, identified pyrite, chalcopyrite, galena, sphalerite and arsenopyrite, in a matrix of quartz and calcite from historic gold mines and copper porphyry prospects. However, there was no follow-up because of access restrictions but not before a number of porphyry anomalies were identified

Fast forward to January 2019, when Andagueda Mining took 14 channel samples from historic gold mines located on the property. Among the assays, highlights included 0.3m at 262.0 g/t gold + 0.57% copper + 941 ppm cobalt, and 0.3m at 49.3 g/t gold + 11.4% copper + 502 ppm cobalt.

High-grade gold is nice, but the real prize at North Choco glints red, not yellow.

Porphyry close-ology

Based of historic exploration and initial field reconnaissance management at Max Resource thinks there is strong potential for finding a copper-gold porphyry – defined as a large mass of mineralized igneous rock, that is often suitable for bulk mining – within the 500 km of North Choco.

Their first clue is the high-grade gold and chip samples recently taken by Max. Verification is also coming from consultants Max is working with including the top geologist employed by Lundin Gold, which is finishing construction on its Fruta del Norte project and aiming for production in the fourth quarter.

The underground gold and silver mine will be Ecuador’s largest, and is expected to produce 4.6 million ounces of gold over 15 years.

Sol Gold has also been active in the same vicinity as North Choco. The connection between them and Max is the geological formation continues from of northern Ecuador and through to the Choco belt, Colombia.

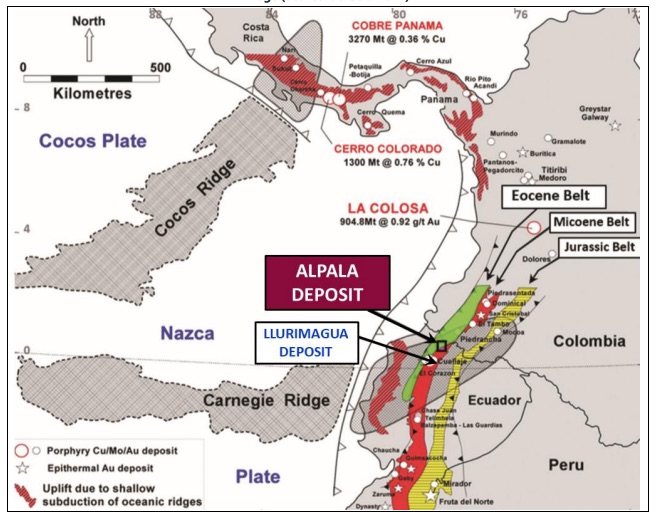

First, a bit of background on Sol Gold historical exploration together with sediment and channel sampling was the catalyst of the discovery that is now the company’s flagship Cascabel project in northern Ecuador, which borders Colombia to the south, contains the Alpala deposit with a measured and indicated resource of 10.9 million tonnes of copper and 23.2 million ounces of gold.

A PEA released in May details the geology of the deposit:

The Eocene Alpala porphyry deposit lies in a zone of overlap between the Eocene and Miocene Andean porphyry belts that extend from Colombia through Ecuador and Peru into Chile and Argentina. The basement rocks consist of tholeiitic basalts of the Dagua-Piñon Terrane, an oceanic plateau that is believed to have accreted to South America in the Late Cretaceous. The magmatism in northern Ecuador and southern Colombia is characterised by the lack of a well-developed arc and erratic pluton distribution. This suggests a low-angle subduction environment, conducive to compression and porphyry mineralisation.

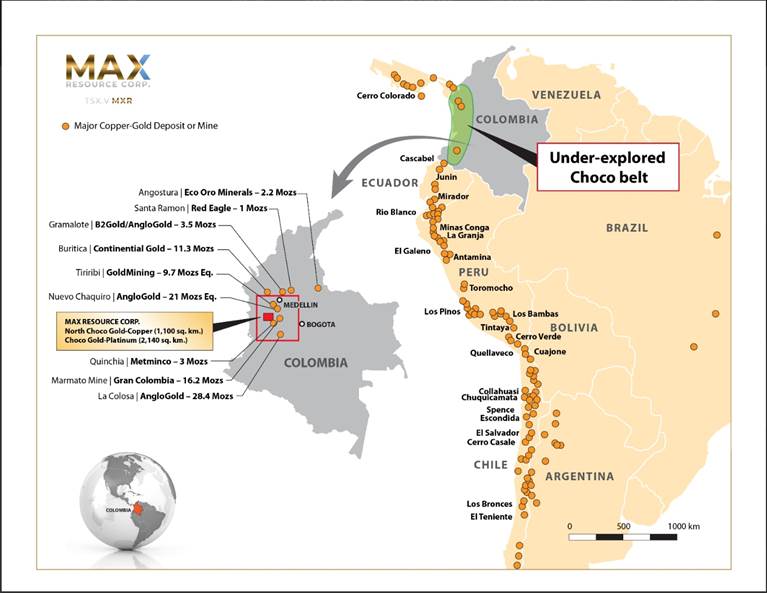

How does that relate to North Choco? Northern Ecuador is within the Andean Copper Belt, which runs from Chile in the south, through Ecuador, up to Colombia and then turns northwest into Panama. The Andean Copper Belt hosts some huge copper-gold porphyry deposits including Escondida, the world’s largest copper mine that Sol Gold says has the same-age rocks as Cascabel.

You can see the extent of the Andean Copper Belt in the map below, produced by Max Resource. Notice the orange dots showing a major copper-gold deposit or mine, running along the coast of South America and into Central America. One of the few areas (in green) without an orange dot is the Choco department of Colombia containing Max’s Choco Precious Metals Project, and its adjoining North Choco property.

Now compare that map to the one published by Sol Gold in its PEA technical report. The Eocene, Miocene and Jurassic belts shown in green, red and yellow, are not far south of North Choco and Continental Gold’s Buritica project, assigned a star. Buritica will be a mine. The fully permitted gold project has been under construction since 2017 and is expected to go into production in 2020.

North Choco appears to have close-ology in its favor. What are the chances of a high-tonnage copper porphyry monster lying beneath North Choco, a 500-square-kilometer land package, with major copper-gold deposits to the north and south of it on the Andean Copper Belt, and AngloGold’s Nuevo Chaquiro neighboring copper porphyry discovery being one of five known porphyry centers concentrated within a 15 sq. km area? We’d say the chances are pretty good.

Max’s CEO, Brett Matich, told Ahead of the Herd the plan is to take a two-pronged approach to its properties in Colombia over the summer, with the hope for a discovery – likely a copper-gold porphyry – by October.

One team will take on North Choco, conducting similar exploration strategy as AngloGold and Solgold entailing extensive soil and steam sediment sampling and follow up ground magnetics work to target elephant size porphyries lurking under the dense jungle and forest canopy. The ground crew will be searching for very large orebodies characteristic of porphyries. They typically contain hundreds to thousands of million tonnes, low to medium grade at 0.3 to 1.5% copper. Most of the world’s copper-gold deposits are in the Pacific region and they usually contain 0.3 to 1.6 g/t gold.

A second crew will remain at the Choco Precious Metals Project to work a new target that has been identified about 10 kilometers east of the conglomerates. El Tambita was previously discovered in 2013 by Condoto Platinum, along Rio Tamana, where 605,110 ounces of placer gold was plucked from the riverbed between 1906 and 1990.

A gold-bearing shear zone featured channel samples averaging 63.25 grams per tonne over 9.8 meters; one of the grab samples returned a whopping 220 g/t.

“El Tambita is one largely untested high-grade gold target, historic exploration data suggests strong potential for the discovery of additional gold zones” Matich stated in a news release, adding: “Max field crews are currently mobilizing to El Tambita to follow up the outlying anomalies to locate the source of the Rio Tamana alluvial gold.”

Rock and stream samples, and samples from panned concentrates, will also be studied to identify new exploration targets, along with the results of a recent LWIR survey over the area.

As for the conglomerates, Matich said the longer plan is to identify the point of contact where the conglomerates, identified at surface and near-surface, meets the bedrock. Experts Max has consulted suggest this is where the high-grade material should be.

Imagine the area as one huge placer gold system, with ancient rivers carving channels in the rock and depositing gold where the water slowed, like river bends. The challenge is identifying the “old” rivers from the “new” (existing) waterways.

To do that, Max plan to conduct an “induced resistivity” survey on the best targets within the 1,000-square-kilometer, LWIR-surveyed area that identified multiple conglomerate zones. This type of ground survey, versus aerial survey, runs electrical current through the ground, then measurements are taken to calculate the resistivity of sub-surface rocks, yielding data about the geology.

“To find out where the richer grades are, you need to go to target the spots you know and pick up the river channels,” says Matich. “It’s used by a number of companies in Colombia including Continental Gold. The consultants have indicated that It will undoubtedly map out the profiles and more than likely do the horizons as well. That will differentiate between the old creek beds and the new.”

The end game is to find a partner Max can link up with, who can help finance more exploration as the company continues to advance its Colombia projects.

Conclusion

We started covering Max when there was limited information about their Choco property, other than it was once an important area for platinum mining and it had potential as a gold play – since gold had been discovered in conglomerates, the same type of gold mineralization that fed an area-play frenzy a few years ago in the Pilbara, Western Australia.

It’s been interesting to see Max growing and shifting focus to other historic gold and porphyry areas over their vast landholdings as it gathers more information about this under-explored Choco region of Colombia. We now know Max has first-mover advantage at Choco. There are no other companies like Max that has the sole rights to explore, through the local indigenous groups that actually own the mineral rights – which is absolutely key to developing a project of this scale.

We know that high-grade precious metals mineralization occurs at surface. Remember, a concentrate made from a surface sample graded a combined 451.87 g/t gold and platinum.

We understand that an exploration company needs to test hypotheses and figure out to best spend the treasury. Max just closed the first tranche of a $1.2 million private placement. The number of accredited investors with shares in Max is growing.

The theory of pit samples containing richer grade gold has not yet been proven. But Max has other irons in the fire. The game plan now is to explore El Tambita for high-grade gold, and to discover an elephant-sized gold-copper porphyry at North Choco.

I’m pumped for the news flow likely to come out of Max’s dual-strategy exploration in Colombia this summer.

Max Resource Corp

TSX.V:MXR, FSE:M1Di

Cdn$0.12 July 11th

Shares Outstanding 66m

Market cap Cdn$7.9m

Max website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Max Resource Corp (TSX.V:MXR), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of MXR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.