Max publishes first assays from CESAR drilling; highlights include 3.4% copper and 48 g/t silver over 10.6m – Richard Mills

2023.01.25

Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) has drilled into what appears to be a massive hydrothermal copper-silver system at its flagship CESAR project in Colombia.

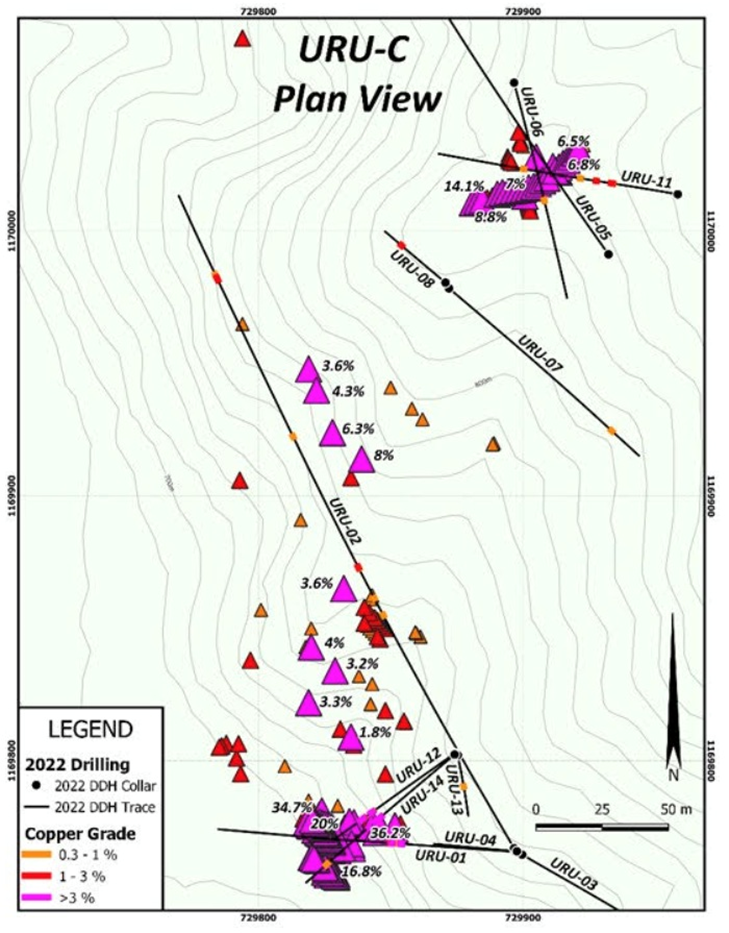

The inaugural drill program at URU-C and URU-CE, the first two targets of many, began in October. It was the first-ever drilling within the 20-km-long, 2 km-wide copper-silver URU District.

The URU discovery spans a major structural corridor and remains open in all directions. It is located on the southern portion of Max’s 90-km-long CESAR copper-silver project in northeastern Colombia, shown on the map below.

On Tuesday, Jan. 24, Max reported that 14 holes collared from seven drill pads are now complete, for a total of 2,244 meters. Twelve of the 14 intersected mineralized zones, and six hit significant copper-silver mineralization. All holes encountered alteration associated with a district-scale hydrothermal system, the company states.

Key to understanding Max’s news, is the fact that drilling has confirmed the mineralization identified by surface rock chip sampling, at depth.

At URU-C, hole URU-12 intersected 10.6m of 3.4% Cu and 48 g/t Ag, verifying that a surface expression of 7% copper and 115 grams per tonne silver continued to a depth of between 61 and 73 meters. This hole also included 0.8m of 18.5% Cu + 292 g/t Ag, with more drilling planned to confirm continuation of high-grade mineralization down dip.

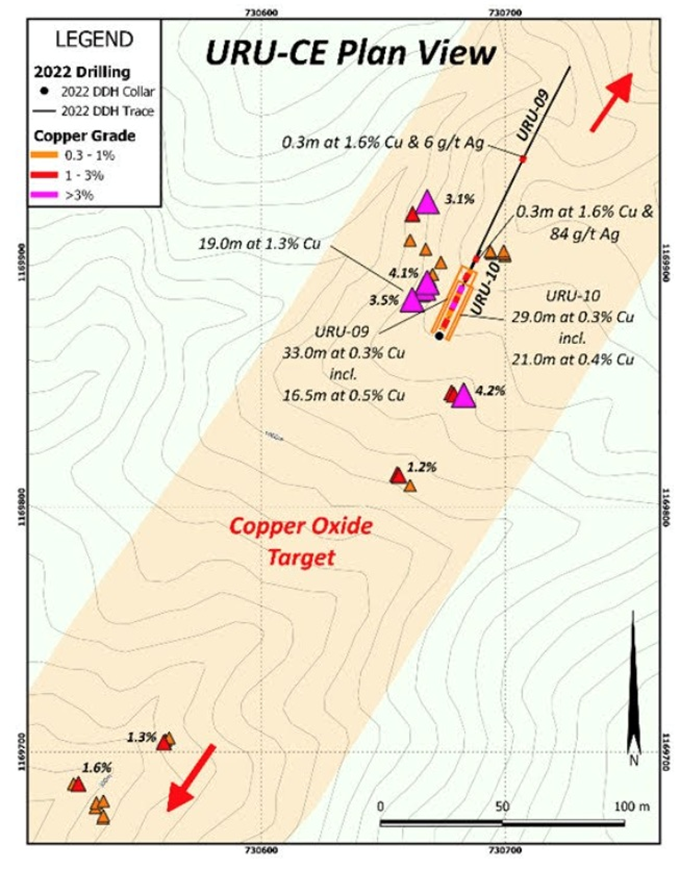

At URU-CE, the 19.0m of 1.3% Cu surface discovery was confirmed by hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% Cu from 4.0m, including 16.5m of 0.5% Cu. According to Max, the broad associated alteration zone implies the potential for a bulk tonnage system. Planned drilling will also target surface higher-grade zones, discovered by rock channel sampling along strike 235 meters to the south.

All identifiable structures appear to be associated with mineralizing events. Most notable is the presence of widespread copper oxide in the form of malachite and primary chalcocite (Figures 3 to 9 below).

“The Company’s exploration team has now commenced its fully-funded 2023 exploration and drilling program,” Max’s CEO Brett Matich said in the Jan. 24 news release, before summing up the progress to date:

“We are pleased that the first drill program has achieved the objective of confirming two discoveries which continue at depth, noting the results are from a 0.75-km partial strike of the 90-km-long copper silver zone. Malachite and chalcocite zones were intersected in 12 of the first 14 holes with significant copper silver mineralization in six holes, including bonanza 18.5% copper + 292 g/t silver over 0.8m.”

According to Max, both the URU-C and URU-CE mineralization consists of favorable primary chalcocite and secondary oxide malachite. The chalcocite forms in significant globular blebs, as disseminations, and also lines the walls of the calcite veining and forms veinlets of massive chalcocite in brecciated areas. Malachite is closely related to the chalcocite in veins and is seen as replacing chalcocite in some of the disseminations. Magnetic and Induced Polarization (IP) surveys were conducted to test the mineralization response and to determine if blind drill targets could be identified as high-probability mineral occurrences (Figures 2 through 8).

The URU-C drill holes (URU-1, 2, 12 and 14) intersected significant grades of copper and silver mineralization. High-grade was intersected in holes URU-1, 12, and 14, interpreted as possibly associated with a low-angle structure dipping to the southeast. URU-12 was the best intercept of the three. Unfortunately, the drill pierced an underground adit in the middle of the high-grade material, but still reported 10.6m of 3.4% copper + 48 g/t silver, including 0.8m of 18.5% copper + 292 g/t silver and 3.9m of 6.3 % copper + 92 g/t silver.

URU-1 and 14 both had significant intercepts, with URU-1 returning 7.0m of 1.4% copper + 8 g/t silver, while URU-14 intersected 12.5m of 1.2% copper + 18 g/t silver, with a higher-grade 5.8m of 2.1% copper + 46 g/t silver.

At URU-C, hole URU-2was the deepest of the program, demonstrating the depth potential of drilling large-diameter HQ holes to approximately 400m down hole. The target was an IP chargeability high 150m west of URU-C and coincident magnetic high. An intersection of a 7.7-metre-wide zone of 0.6% copper + 7 g/t silver, including 1.4m of 2.1% copper + 30 g/t silver, demonstrated that IP and coincident magnetics work well at identifying mineralized targets.

At URU-CE, located 750m east of URU-C, holes URU-9 and URU-10 were drilled from a single pad. From approximately 4.0m from surface, both holes encountered wide intervals of lower grade but favorable oxide copper. URU-9 intersected 33.0m of 0.3% Cu, including 16.5m of 0.5% Cu. URU-10 hit 28.7m of 0.3% Cu, including 20.7m of 0.4% Cu.

The copper mineralization at URU-CE is open in all directions. In addition, rock chip sampling returned highlight values of 1.2 to 4.2% copper extending the URU-CE target zone 235m to the south. The target is also on the eastern end of a 1-km long coincidental IP and magnetic anomaly.

Analysis

For an inaugural drill campaign, Max in my opinion should be feeling good about the assay results delivered from the 14 holes at URU-C & URU-CE.

Three points are worth making.

First, the results prove there is lots of leachable copper. Malachite and chalcocite zones were intersected in 12 of the first 14 holes. Chalcocite is one of the more leachable copper minerals, and while the amount of malachite found within the core samples was a surprise, this is good news because malachite, a copper oxide mineral, is also readily leachable. Leachability should lower the economics of a potential mine.

My second point concerns the grades. The results may not have been the blockbuster grades some investors were hoping for from the high-grade surface samples, which may explain the muted market reaction. However, in my view they are very encouraging. At URU, Max got some decent numbers from holes 1, 4, 9, 10, 12 and 14. Of the high-grade mineralization found in holes URU-1, 12 and 14, URU-12 had the best intercept: 10.6m of 3.4% copper + 48 g/t silver, including 0.8m of 18.5% copper + 292 g/t silver and 3.9m of 6.3 % copper + 92 g/t silver.

URU-CE is lower grade and obviously a bulk tonnage target, but 0.3% Cu, imo, is an excellent starting point.

Onto my third point, it seems abundantly clear that the geophysical studies Max did on the property proved useful for drill targeting. They led Max’s technical team to where the mineralization actually is, verifying that magnetics and IP at CESAR work very well.

That about covers what we know so far. What we don’t know much about, yet, are the structural controls. What kind of structures are controlling the 20-km-long, 2 km-wide copper-silver URU District, that Max first identified through surface outcrop sampling, and that drilling has now confirmed continues at depth?

Clearly more work needs to be done. Max hints at geophysics, stating in the news release that, Additional geophysical techniques including ground Magneto-Telluric (MT) surveys will be deployed to provide a broader basket of tools to explore the AM, Conejo and URU Districts, which collectively cover a 60-km strike length of copper-silver mineralization.

Conclusion

Fact: a number of major mining companies have paid a site to Max’s CESAR. They’ve had an opportunity to kick the rocks and have seen the results of Max’s comprehensive surface sampling. They have a good idea of how many potential targets there are (about 100) on the 90-km-long property, which along with the URU District, also contains AM and Conjeco. Neither of these other two areas has been drilled, and they contain many more drill targets.

Having seen the promising first-pass drill results, imo it’s highly likely the majors won’t be walking away from Max, in fact if anything, their interest should be piqued. After all, in it’s first two drill programs, in an area that has never seen modern exploration techniques used, and has never had a drill program, MAX has hit on both programs. The company has discovered 2 hydrothermal systems almost a kilometer apart. That’s a 100% success rate with 98 more targets to drill.

In fact there are so many more potential targets (and with Max’s healthy treasury of around $19 million they’re not going to run out of money), “drill baby drill” seems an appropriate mantra for Max, at this point in time.

In closing I’d also point out that Max is drilling CESAR at a very opportune time in the copper market. The copper price is above $4 a pound and has shown strength all month, on a combination of a lower US dollar, hopes that US interest rate hikes will lessen, and optimism that the Chinese economy is back firing on all cylinders.

The supply dynamics are an important determinant of the copper price.

While experts say we could be looking at a 10-million-tonne deficit in at little as two years, in fact the shortfall could come even sooner, thanks to a number of supply-side events that have taken place recently.

Peru, the second-biggest copper producer behind Chile, has been rocked by a series of mining conflicts over the past two years, as communities empowered by leftist ex-President Pedro Castillo, press their demands. Castillo was impeached in December and replaced by Vice President Dina Boluarte.

Demonstrations at Peru’s major copper operations, including Glencore’s Antapaccay, Southern Copper’s Cuajone and MMG’s Las Bambas, the country’s fourth-largest copper mine and the world’s ninth biggest, threaten to block access to almost $4 billion worth of copper.

In the latest news to come out of Peru, The nation’s transport regulator reported dozens of highway blockades as of Monday morning, many of them near the southern border with Bolivia.

The copper-rich south of Peru is the heartland of the country’s mining industry, as well as its tourism sector.

On Saturday, the Ministry of Culture closed Peru’s best-known tourist attraction, the Machu Picchu archaeological site, until further notice.

The copper industry is in the grips of a structural supply deficit that, combined with inflationary cost pressures and a creeping resource nationalism in some of the world’s largest copper producers (not just Peru but Chile and the DRC) is only expected to get worse.

Copper prices are forecast to reach higher this year, with Goldman Sachs predicting US$12,000 a tonne by 2024.

Bloomberg New Energy Finance says demand for copper will increase by more than 50% from 2022 to 2040.

Along with the usual applications, in construction, transportation, power transmission and communications, there is the added demand for copper in electric vehicles and renewable energy systems.

Copper is becoming scarcer, and dearer, with each infrastructure initiative and with each ambitious green initiative rolled out by governments. Max Resources, with a district-sized copper and silver project, two successful drill campaigns, a full treasury, 98 more targets and news flow all year is becoming even more interesting.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.27 2023.01.24

Shares Outstanding 160.2m

Market cap Cdn$43.7m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.