Max kicks off 2023 exploration with six priority drill targets – Richard Mills

2023.04.08

In exploration, a number of techniques are employed to find mineral deposits. They include mapping, soil sampling, rock chip/ channel sampling, geochemical surveys and aerial geophysical surveys.

Drilling is the final and most important step, undertaken after the completion of many of the above.

Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2)

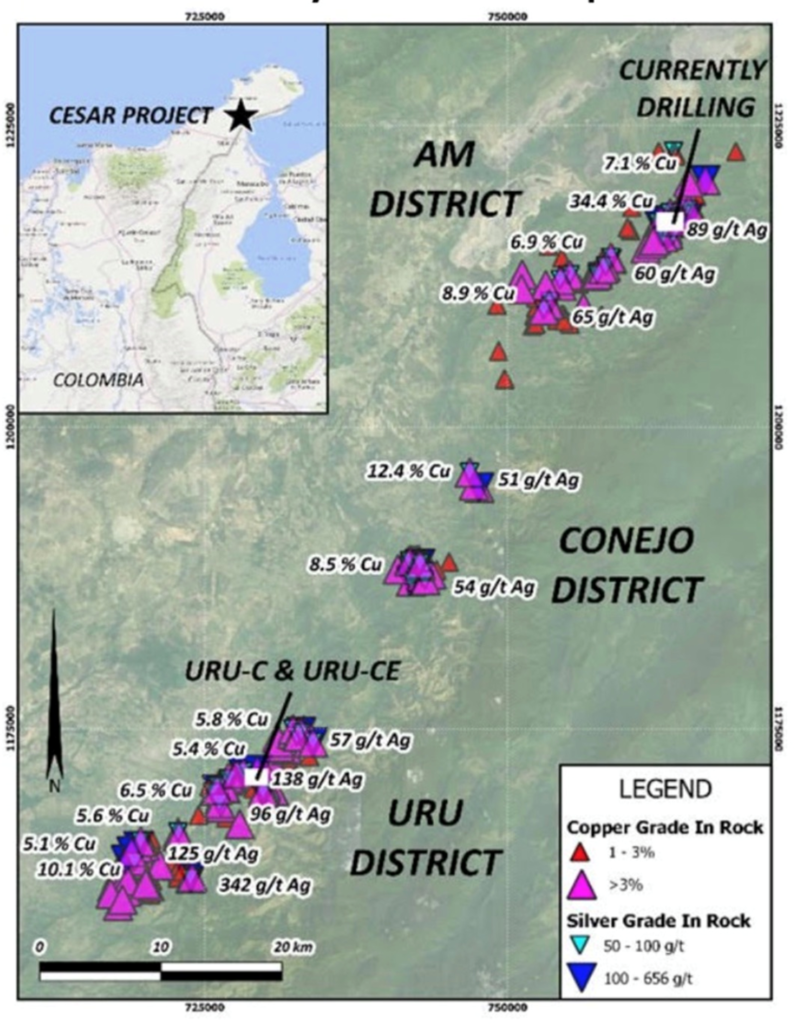

Specifically, there are two primary depositional models being used for MAX’s massive copper/ silver CESAR Project: red-bed/Kupfershiefer-style stratiform copper mineralization at AM, and Central African Copper Belt as well as structurally controlled mineralization at URU and Conejo.

AM District

“Geological mapping and historical artisanal mining at the Herradura and Sierra targets, located within the AM mining concessions, indicates that mineralization occurs in at least four horizons in the stratigraphic sequence. To confirm the continuity of mineralization and its hypothesis, Max drilled two scout holes down dip from surface exposures at Herradura in January, 2023. The holes were spaced 250 metres apart and drilled to a depth of approximately 350 m. Both intersected multiple copper-replacement beds containing malachite and chalcocite with copper values.”

URU district

“In late 2022, Max commenced its inaugural drilling program at the URU district in the southern portion of the Cesar project. The objective was to test the continuity of the structurally controlled copper silver mineralization within the volcanic host rocks in the sub-basinal environment of the Cesar sedimentary basin. Drilling consisted of 12 holes at the URU-C target and 2 holes at the URU-CE target, located 750 m apart for a total of 2,244 m.

Twelve holes intersected mineralized zones, with six intersecting significant copper silver mineralization, including 10.6 m at 3.4 per cent copper and 48 g/t silver. ALS Metallurgy is conducting metal recovery analysis of the high-grade URU-C mineralization where chip channel sampling returned 7 per cent copper and 115 g/t silver over nine m.

In addition, ALS are conducting leach recovery testing of samples from URU-CE drill hole URU-9, which intersected broad copper mineralization with associated alteration zone implying potential for a bulk tonnage system, returning 33 m of 0.3 per cent copper, including 16.5 m of 0.5 per cent copper.”

MAX has confirmed their depositional models, “a red-bed/Kupfershiefer style stratiform copper mineralization at AM and Central African copper belt style, as well as structurally controlled mineralization at URU and Conejo.”

Relations

Max currently has 188 km² of ground, representing the largest area for copper in the prolific Cesar sedimentary basin. There are no conflicts with forestry or indigenous, and public hearings have been held. Max has spent two years establishing relationships with local communities and has, accordingly to recent government directives, reaffirmed their support.

Some of the positive local reception is due to the area Max is working in. The Cerrejon coal mine, located in southeastern Guajira department, is one of the largest open-pit mines in South America and the continent’s biggest coal pit. Local populations understand the kind of footprint, infrastructure and jobs that accompanies a mining operation. There is also oil and gas drilling in the Cesar basin.

President Gustavo Petro, elected in August, 2022, has promised to fight climate change and to promote renewable energy over fossil fuels thereby reducing the country’s dependence on fossil fuel exports (coal, oil and gas) as it shifts to clean energy.

“It boils down to where we are, being there for well over two years, and having established good relationships within the community,” said CEO Brett Matich, in an April 5 interview with Ahead of the Herd.

Priority targets

The CESAR Project covers a massive area, to your author’s way of looking at things that’s a lot of glory, a massive property with so much copper/ silver at surface, but it’s also a bit of a nightmare in trying to figure out how to efficiently spend the treasury to explore it.

The company this week announced it has started the 2023 exploration season with about $15 million in the treasury, building on the 6,500 surface rock samples it has collected over the past two years.

The goal is to determine which geophysical techniques best identify the copper mineralization based on the two deposit models. Among the different surveys being being tested are magnetic, gravity, induced polarization (IP), electromagnetic (EM) and magneto telluric (MT). Historical seismic data collected over the prospects is also being re-processed and interpreted.

Six priority target areas have currently been identified, four at URU — Molino, Potrero Grande, URU South Target 1 and Target 2 — and two at AM — Herradura and Sierra (see map below).

“The quickest way to find the feeders is to map the area of the clusters and the alteration, that’s what we’re doing,” said Matich, adding: “We use the clusters as part of the geological mapping, then combine the geological mapping with regional geophysics.”

To be clear, the clusters are not the drill targets; they are more like a starting guidepost as to where the copper is coming from, the so-called feeders. You find, and drill, where the copper is coming from.

In fact, Max is taking a two-pronged approach to exploring CESAR, the first being to evaluate and prioritize existing targets within the 188 km² of mining concessions for drill testing; and the second to continue its regional sampling and prospecting program to identify additional copper-silver targets along the 90-km long CESAR belt.

“The ultimate goal of our detailed mapping and geophysical surveys is to delineate multiple drill-ready targets along this massive copper system within Max’s wholly-owned CESAR Project,” Matich said in the April 4 news release.

AM District

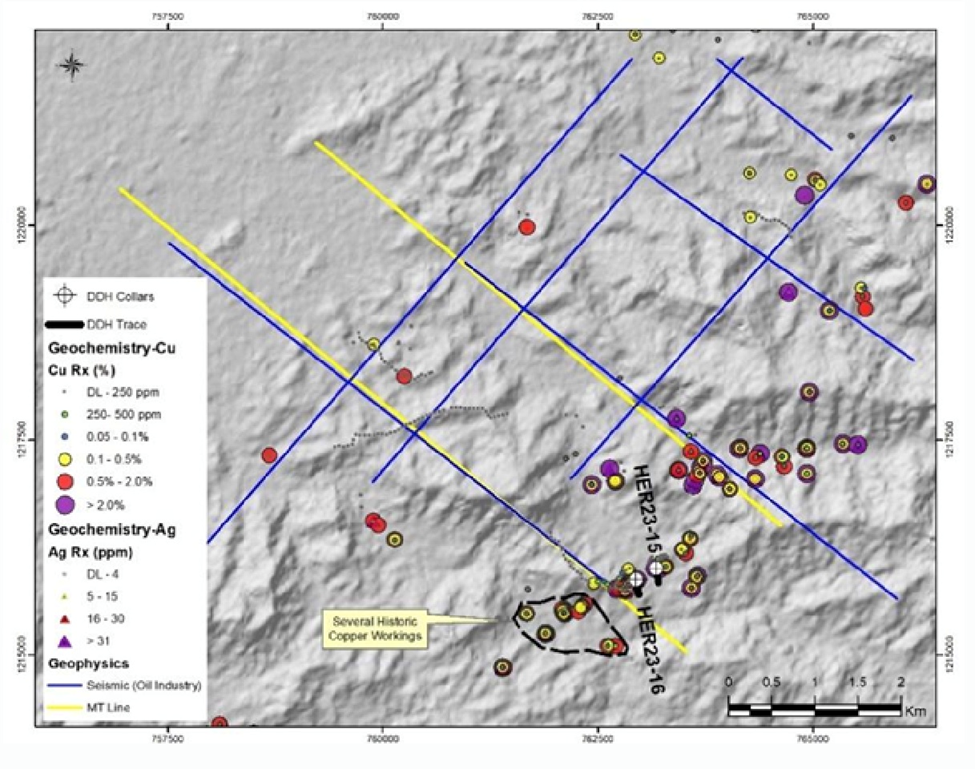

Recent drilling at the AM District has confirmed the presence of Kupferschiefer-style mineralization.

Geological mapping and historical artisanal mining at the Herradura and Sierra targets indicate that mineralization occurs in at least four horizons in the stratigraphic sequence. To confirm the continuity of mineralization and its hypothesis, Max drilled two scout holes down dip from surface exposures at Herradura this past January. The holes were spaced 250m apart and drilled to a depth of approximately 350m. Both intersected multiple copper-replacement beds containing malachite and chalcocite, with copper values ranging from 0.04% to 0.96% Cu.

In February Max engaged Southern Rock Geophysics to commence an MT orientation survey on two 8-km lines within the AM mining concessions. The lines cover where drilling, mapping, geochemical sampling and artisanal mining have defined compelling copper-silver targets. MT is useful in mapping the major lithological units and identifying potential deep-seated mineralizing structures.

URU District

Metallurgical testing of URU-C and URU-CE drill samples is currently underway. Max started its inaugural drill program at CESAR in late 2022, with a focus on the 74 square-km URU District. The objective was to test continuity of the structurally controlled copper-silver mineralization within the volcanic host rocks.

Six of the 14 holes intersected significant copper-silver mineralization, including 10.6m at 3.4% Cu and 48 g/t Ag.

According to Max, ALS Metallurgy is currently conducting metal recovery analysis of the high-grade URU-C mineralization, where chip channel sampling returned 7.0% Cu and 115 g/t Ag over 9.0m.

ALS is also doing leach recovery testing of samples from URU-CE drill hole URU-9, which intersected broad copper mineralization with associated alteration zone implying potential for a bulk tonnage system, returning 33.0m of 0.3% Cu, including 16.5m of 0.5% Cu.

“It’s important to know what the recovery is because the recovery is directly related to the economics on a potential bulk target, we need to know whether the 0.3 to 0.5% copper, which is typical in porphyry, has high leach recovery.” Matich told me over the phone, Wednesday.

RT property

While CESAR is its priority, Max is also making progress on its other property, RT in Peru.

The project encompasses a bulk tonnage primary gold porphyry zone, and 3 km to the northwest, a gold-bearing massive sulfide zone. Historical drilling in 2001 returned values ranging from 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0 meters.

Max recently completed an NI 43-101 report on RT that will be available on SEDAR, including assay results. The next steps are to conduct an environmental survey and apply for a drill permit, which could potentially happen before the end of the year.

Conclusion

It’s well understood that an exploration company has to test hypotheses and figure out the most effective way to spend the treasury advancing their project. Major miners, who by the way are everywhere in Colombia looking for copper, would want to see two things; first is proof of concept, check, second is properly worked up targets, MAX is checking off this second box now.

Six priority targets have already been identified, four at URU — Molino, Potrero Grande, URU South Target 1 and Target 2 — and two at AM — Herradura and Sierra.

I see a steady flow of news from Max over the next few months, as the 2023 field program at CESAR gathers pace.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.14 2023.04.06

Shares Outstanding 160.2m

Market cap Cdn$22.6m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.