Max extends CESAR strike to 120 km; buys back royalties – Richard Mills

2023.11.09

Max Resource Corp (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) has significantly expanded its footprint at CESAR, the sprawling copper-silver project it is developing in northeastern Colombia.

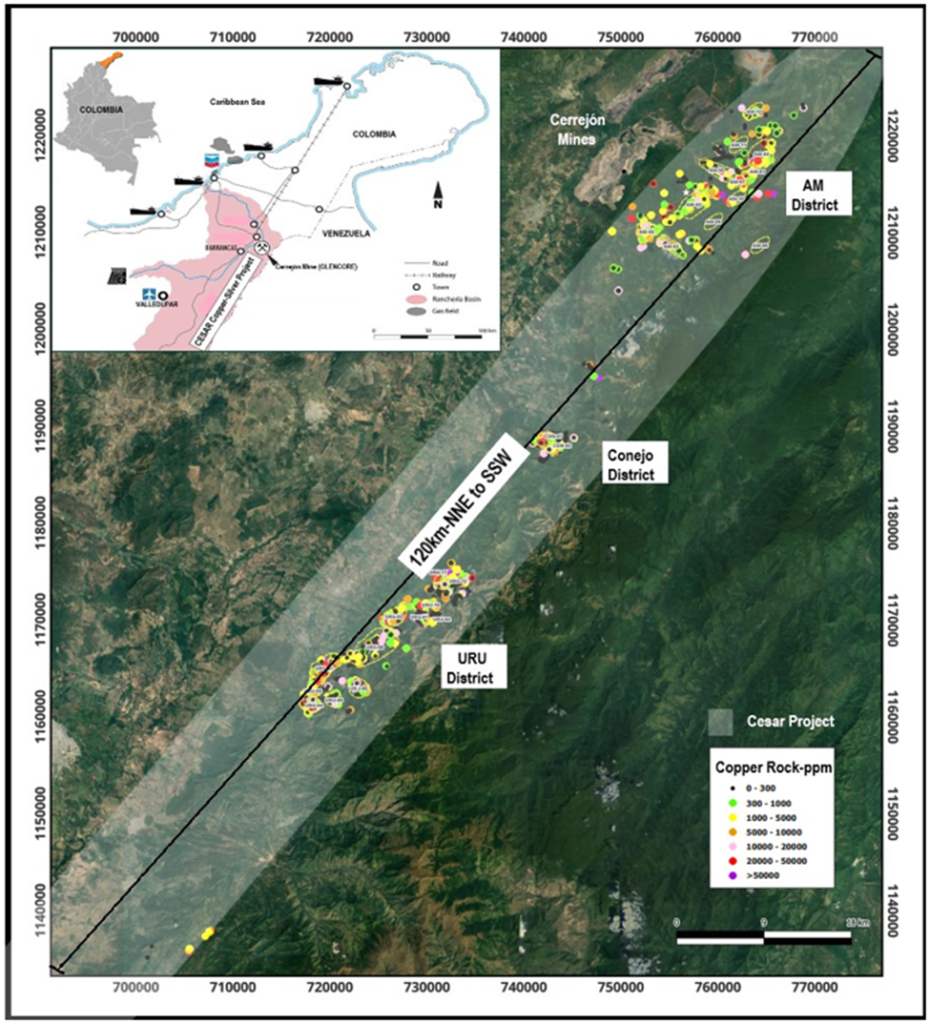

The company announced on Nov. 8 that it has secured 12 more applications for mining concessions covering over 132 square kilometers. It means CESAR now spans 120 along strike, from the previous 90 km, in a north-northeast/ south-southwest direction.

“We continue to strategically increase our land position in the Cesar basin as a result of our field crew’s successes in locating new copper and silver outcrops,” said Max’s CEO, Brett Matich. “The technical team continues to develop our geological and mineralization models as new geological and geophysical data is acquired.”

In addition, Max has acquired the royalties associated with 19 mining concessions and 31 mining concession applications at CESAR.

Bay Street Mineral Corp holds an underlying 3% net smelter royalty on mineral tenures from 2019 through Dec. 31, 2021, over 19 mining concessions covering 184 square km, and 31 mining concession applications covering 796 square km.

The royalty acquisition is through a share exchange agreement Max executed with Bay Street, whereby Max acquires all the issued and outstanding shares of Bay Street, an arm’s length Canadian corporation, in exchange for 14 million Max shares.

“Acquiring the underlying royalties on 19 of the 20 mining concessions and 31 applications significantly enhances the value of the CESAR Project. In addition, the 12 new mining concession applications significantly expand the footprint by 15%. Our 10,000-line-km airborne magnetic and radiometric survey is nearing completion as the Company continues to unlock the value of the Cesar basin,” Matich concluded.

CESAR project

The CESAR project is situated along the copper-silver-rich Cesar Basin of northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations.

Max was the first to recognize the potential for the Cesar Basin and the company’s land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits.

Max’s field teams have so far identified 26 targets across three separate districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

While Max has demonstrated that the Cesar Basin is fertile for copper-silver mineralization over a large area, only a fraction of the basin has been explored. Therefore, Max says its geological teams are dedicated to regional exploration, with the goal of discovering additional copper-silver prospects over 1,000 square kilometers.

Currently, there are two depositional models at the CESAR project. Drilling at AM has confirmed that the sediment-hosted stratiform copper-silver mineralization found in the north end of the project (AM and Conejo) is analogous to the Central African Copper Belt (CACB) and the Kupferschiefer copper-silver deposits of central Europe. Work at the south of the project has identified mineralization hosted along structures (faults) within the volcanic units of the La Quinta formation. It is theorized that the structurally hosted mineralization may represent the feeder system for the stratiform mineralization observed in the sedimentary layers.

Make no mistake. Sedimentary-hosted copper deposits can have staggering size and value. It’s estimated that nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the CACB, headlined by Ivanhoe’s 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

Four new targets

In late October, interpretation of preliminary airborne magnetic-radiometric survey data identified four new targets within the AM district. The targets are AM-9 to AM-12, seen on the map below.

According to Max, the success and effectiveness of the airborne survey has resulted in Max extending the survey by 6,000 line-km; it will now cover all three districts of the Cesar Project: AM, Conejo and URU.

The first 4,000 line-km of magnetic and radiometric data were collected along tightly spaced lines separated by 135 m, providing Max with two detailed data sets that are packed with geological information important to the process of mineral discovery and development.

The airborne survey is targeting the La Quinta formation, a thick sequence of Jurassic-age (163 to 191 million-years before present) volcanic and sedimentary rocks in the Cesar Basin. Copper and silver mineralization has been discovered throughout the entire formation, but it is the sedimentary sequences that are of the greatest interest.

The four new targets were identified within the AM District where the sedimentary rocks are prevalent. The targets were identified in the airborne geophysical data by looking for structural patterns in unexplored areas of the Cesar property that are similar to those seen where mineralization is known to exist.

Radiometric surveys detect and map radiation from rocks and soils. The gamma radiation occurs from the natural decay of elements like uranium, thorium and potassium.

Max Resource unlocking the puzzle of a massive sedimentary basin

Magnetic surveys measure the spatial variations of the magnetic field. The results reflect the variations in the magnetic properties of the underlying rocks, and provide valuable information about their compositions and the structure of the Earth’s crust.

Magnetic and radiometric data were recorded simultaneously during the fixed-wing airborne survey. Max says the data sets will be instrumental for understanding the faults that act as conduits for mineralized fluids to infiltrate the sedimentary rocks and precipitate the copper-silver minerals.

Based on the strength of the data, Max has decided to extend the survey to cover the two districts south of AM: Conejo and URU. In total, 10,000 line-km of data covering 1,150 sq-km will be collected over all three districts of the CESAR copper-silver project.

“It is clear, even at this early stage, the techniques employed by Max will produce essential data sets for our continuing exploration efforts at CESAR,” said Max’s CEO Brett Matich, in the Oct 24 news. “The information from this survey will allow Max to evaluate its growing land package and pin-point new target areas for follow-up exploration. Equally important, the data will be used to expand existing targets through better understanding of their structural environment.”

“Expanding the survey was a logical decision given its obvious effectiveness over the AM District. There is a wealth of information contained in magnetic and radiometric data, and we are excited to see what the interpretation of the final, fully processed data will reveal,” he added.

Max commenced the airborne magnetic and radiometric survey at the end of August. The new targets were identified following an analysis of preliminary survey data for faults, which form the conduits for mineralized fluids to infiltrate the sedimentary rocks in the AM District. The pattern of faulting around known mineralization was evaluated and similar patterns were identified in areas where no exploration had been previously conducted.

Crews will assess each of the areas with prospecting, mapping and sampling in the coming weeks. I expect that additional targets will emerge once the airborne data has been fully processed and a rigorous interpretation conducted.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.135 2023.11.08

Shares Outstanding 161.9m

Market cap Cdn$22.7m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSX.V:MAX) MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.