Max discovers new Manto-style target at Sierra Azul; approves new USD$4.8 million exploration budget; Max Iron Brazil to IPO – Richard Mills

2025.03.03

Max Resource Corp (SXV:MAX; OTC:MXROF; Frankfurt:M1D2) published two news releases this week indicating significant progress made at its flagship Sierra Azul Copper-Silver Project in northeastern Colombia, and its spin-off company Max Iron Brazil Ltd.

Sierra Azul

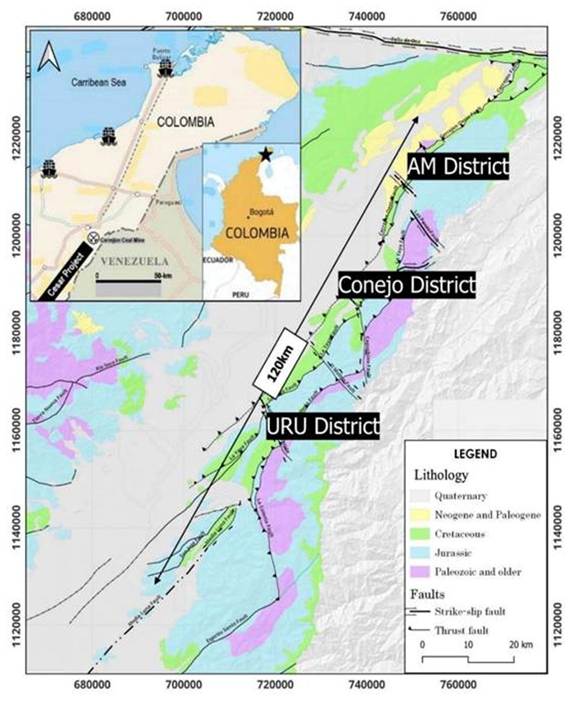

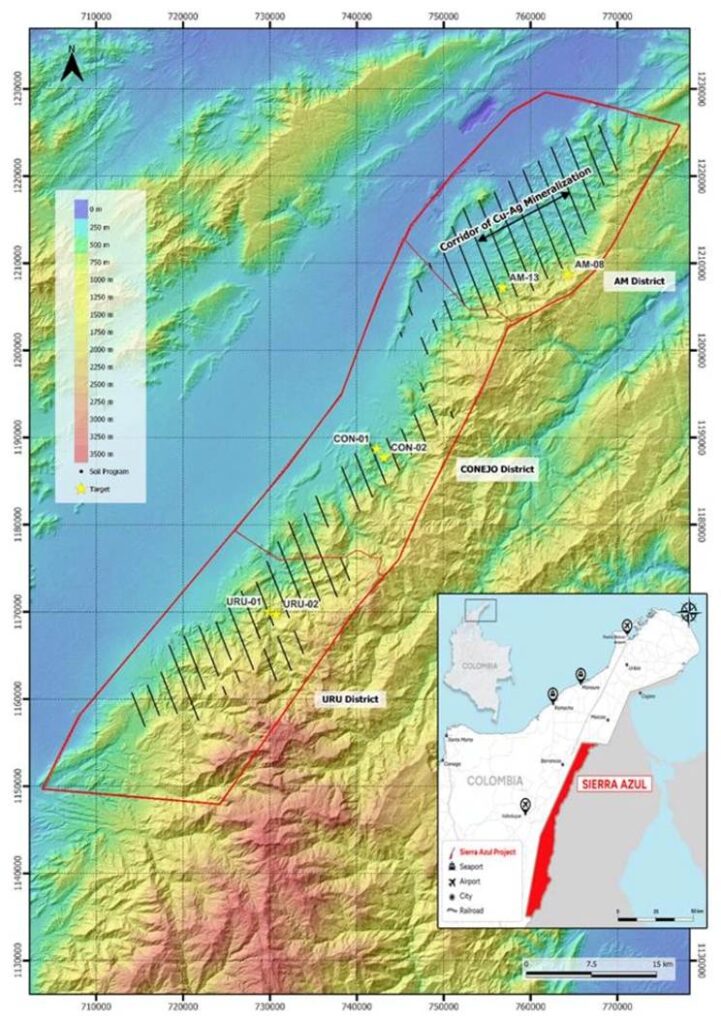

The Sierra Azul project sits along the Colombian portion of the Andean Belt — the world’s largest producing copper belt. It includes the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

Despite the Spanish being there centuries ago, tunneling into the mountains looking for high-grade silver, and the equally-long-known-about outcrops exposing high-grade copper and silver mineralization throughout the basin, Vancouver-based Max, led by CEO Brett Matich, was the first to recognize its potential.

The land package now spans more than 1,150 km of geology prospective for sedimentary- and volcanic-hosted copper-silver deposits and includes 20 mining concessions covering over 188 square kilometers. The project was formerly known as CESAR.

Max last summer released assay results at Sierra Azul following a signed earn-in agreement with Freeport-McMoRan Exploration Corporation, a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE:FCX).

Under the terms of the EIA , announced on May 13, Freeport can earn an 80% interest in the Sierra Azul Copper-Silver Project in two stages by spending an aggregate amount of CAD$50 million and paying a total of CAD$1.55 million to Max.

The results were from 10 continuous channel samples collected at the AM-13 target. AM is one of three districts within Sierra Azul, which means “Blue Mountain” in Spanish. The two others are URU and Conejo. The three contiguous districts stretch over 120 km in a north-northeast, south-southwest direction.

Max’s 2024 exploration budget was US$4.8 million. It had two objectives:

- Conduct systematic regional exploration over the entire Sierra Azul project area (>1,300 sq km)

- Define priority targets for drilling

2025 brings a new USD$4.8 million budget, fully funded by Freeport McMoRan Exploration. The budget contains three components:

- Drill target development

- District-scale exploration

- Basin-scale prospectivity analysis

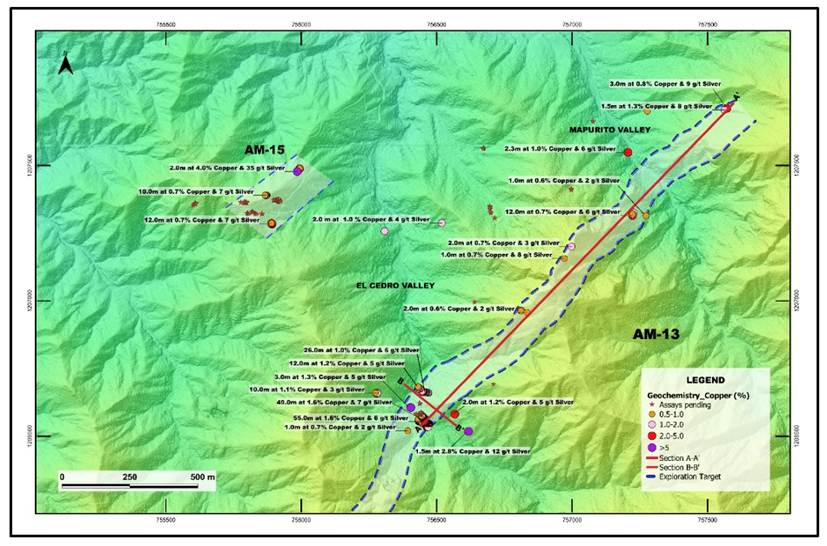

Max kicked off the 2025 exploration season by releasing more assay results from AM-13 thus expanding its footprint, and announcing the discovery of a new Manto-style target, AM-15.

AM District

Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been sampled over many kilometers within the AM District, culminating in a mineralized corridor that extends over 15 km. Highlight values of 34.4% copper and 305 g/t silver from outcrop samples have been documented in the sedimentary sequences. The company confirmed that stratiform red-bed-style mineralization continues at depth with two scout drill holes completed in 2023. In addition, Max has discovered a Manto-style target, AM-13, which has significant size potential.

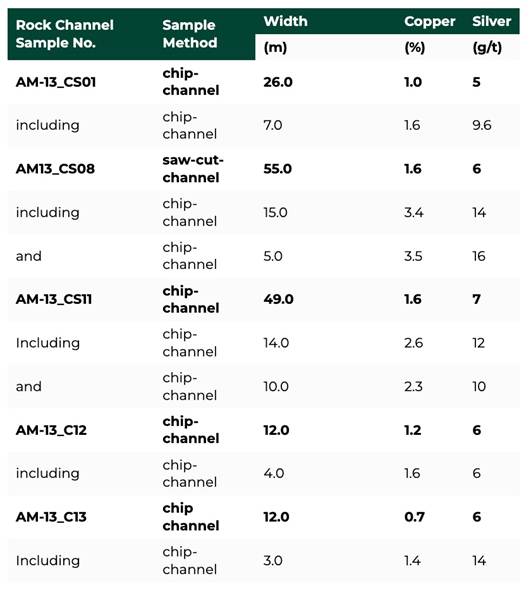

The best 2024 assay from AM-13 was 1.8% copper and 7.2 g/t silver over 48.0m (AM13_CS08, continuous saw-cut channel), including 3.4% copper and 14.0 g/t silver over 15.0m, and 3.5% copper and 15.7 g/t silver over 5.0m.

According to Max, AM-13 hosts Manto-style mineralization and alteration, similar to deposits in the Tocopilla-Taltal region of northern Chile, a mineralized corridor that extends well over 100 km and hosts several economic deposits including Mantos Blanco (500 million tonnes at 1.18% copper and 12 g/t silver).

A Manto is a geological term for a style of emplaced ore deposit.

Max Resource discovers Manto-style mineralization at Sierra Azul — Richard Mills

AM-13 has been expanded by 100 meters to 1,500m. Copper-silver mineralization was identified over the 1,500m strike and according to Max, is open-ended. New composite channel assay highlights included:

- 1.6% copper and 6 g/t silver over 55.0m (CS11)

- 1.6% copper and 7 g/t silver over 49.0m (CS08)

- 1.0% copper and 6 g/t silver over 26.0m (CS01)

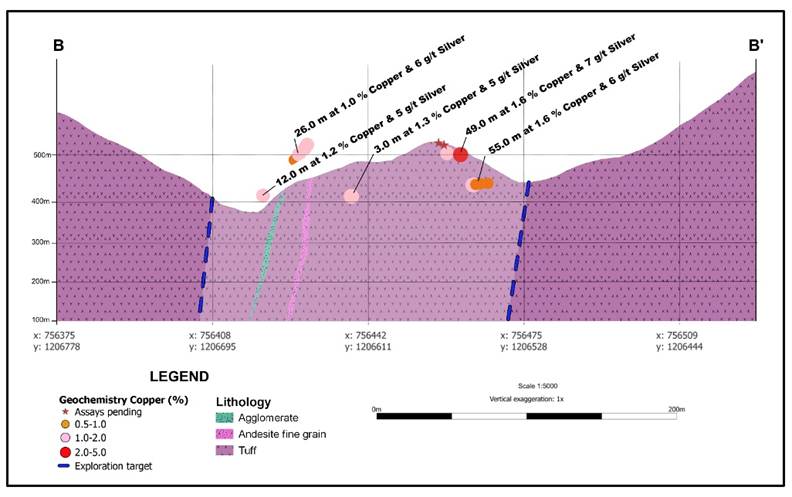

The 100m-wide mineralized body rises over 300m in elevation between El Cedro and Mapurito valleys, suggesting significant depth potential.

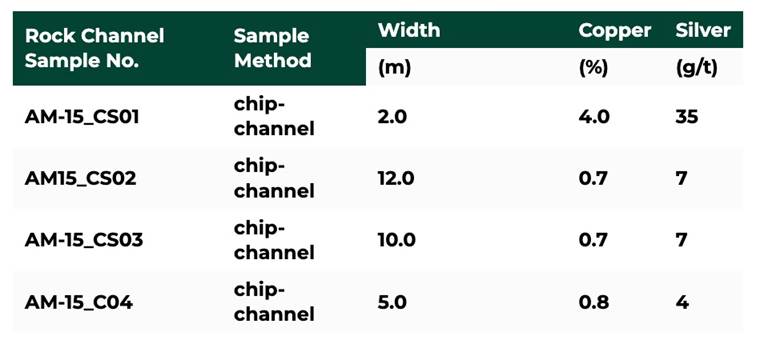

The new AM-15 discovery is located about 1,000m northwest of AM-13. Early work suggests a large target footprint with five mineralized outcrops already identified over 100m by 300m and open in all directions.

The company says AM-15 is a high-priority target based on potential size, grade and proximity to AM-13.

“The 2025 exploration season is off to an exceptional start with the significant footprint expansion at AM-13 of over 30% coupled with the exciting new discovery of AM-15 underscore the potential of large-scale copper-silver discoveries within the Sierra Azul Project,” said Max’s CEO Brett Matich in the Feb. 25 news release.

“The USD$4.8 million budget for 2025, fully funded by Freeport, is an increase of 14% compared with 2024 and is focused on the development of priority targets for drilling and the identification of new significant size targets along the Serra Azul project’s 120 km-long mineralized trend.”

AM-13

Work at AM-13 has identified an open-ended 1,500m by 100m exploration target which is defined, in part, by numerous outcrops of high-grade copper and silver mineralization. The potential for significant size and grade at AM-13 has elevated it to one of the highest-priority targets on the Sierra Azul project.

Mineralization is observed filling fractures and vesicles within an andesitic tuff (a type of porous volcanic rock) that has undergone chlorite and epidote hydrothermal alteration. The mineralized rock strikes between 40° and 50° and, on average, dips at 70° NW.

Primary copper bearing minerals include native copper, chalcocite and bornite. Trace amounts of bitumen — a type of organic material — were also observed in the mineralized rocks which is believed to be critical to the deposition of copper minerals from fluids that circulated within the Cesar-Rancheria Basin. The presence of native copper and chalcocite indicates the mineralized fluids were sulfur-poor, leading to the precipitation of these high-grade ore-forming minerals.

AM-15 discovery

Max also announced the discovery of a new target, AM-15, located approximately 1,000m to the northwest of AM-13.

Similar to AM-13, mineralization is found filling fractures and vesicles of an andesitic tuff. Ore-forming minerals include chalcocite, malachite and azurite. Chlorite, epidote and albite alteration along with the presence of bitumen are also observed.

The proximity to AM-13, along with its potential size and grade, have made AM-15 the focus of the target development team. Work to extend the footprint of AM-15 is underway and several additional mineralized outcrops have been discovered. Initial follow-up exploration will include geological mapping, sampling and trenching.

Link to Sierra Azul video showing AM-13 and AM-15 targets

Drill Target Development

The Drill Target Development program will focus exploration on priority targets located in all three districts of the Sierra Azul Project: AM, Conejo and URU. The goal of the program is to prepare the selected targets for drilling. The work program is well underway and includes detailed geological mapping and soil sampling, as well as planned ground geophysical surveys and detailed structural analysis.The initial focus will be to continue exploration of the company’s top priority targets: AM-13 and AM-15. Detailed mapping has identified mineralized outcrops over large areas at both targets. Work to delineate the targets and establish continuity of the mineralization is ongoing.

District Scale Exploration

The District Scale Exploration Program commenced in 2024 and is designed to systematically evaluate the entire Sierra Azul Project area with the goal of identifying additional priority targets for follow-up. The program has two components: soil and stream sediment sampling

The soil sampling program comprises a total of 3,646 samples collected at 50m intervals along lines spaced 2,000m. The sampling campaign started last year, and approximately 27% of the planned samples have been collected.

Soil samples are initially analyzed in the field using XRF technology. This has led to the discovery of new mineralized outcrops in the Conejo District. Laboratory analysis of the samples is also being conducted and will identify more subtle copper anomalies and trends that can be followed-up with detailed mapping and soil sampling.

Stream sediment samples are also planned for 2025 and will complement the district-scale soil sampling program. 200 stream sediment samples will be collected along the valleys that drain into the eastern margin of the Cesar-Rancheria Basin.

Basin-Scale Analysis

An analysis of the evolution of the Cesar-Rancheria Basin is being conducted to identify additional areas prospective for copper. The basin stretches for more than 250 km, has demonstrable potential for significant copper deposits and remains largely unexplored.

A model of the geological and structural evolution of the Cesar-Rancheria Basin is being developed using existing information including, seismic data, oil well logs, satellite imagery and regional geology. The results of the analysis will be used to identify areas within the basin that have the right combination of factors required to develop large-scale copper deposits:

- Good structural development to allow the mineralized fluids to move through the geological column.

- Presence of a chemical reductant that will cause copper minerals to precipitate from the fluids and

- Permissive rock types to host the copper minerals.

Copper market

Max is exploring Sierra Azul at a very interesting time in the copper market. The red metal hit an all-time high of $5.20 per pound in May 2024 due to a supply squeeze. The transition to renewable energy, the rise of electric vehicles, and the growth of artificial intelligence (AI) have all increased demand for copper.

Some of the world’s largest mining companies, market analysis firms and bank are warning that this year, a massive shortfall will emerge for copper, which is now the world’s most critical metal due to its essential role in the green economy.

Chile is the world’s largest copper producer and the price forecast from its copper commission, Cochilco, puts copper at $4.25 a pound in 2025 and 2026. It expects copper to remain above $4/lb for the next decade.

Undervalued silver poised for explosive move higher

Max Iron Brazil Ltd. IPO

Max Resource announced on Feb. 27 that, further to news releases in December and January, shareholders unanimously passed a resolution approving the undertaking of an initial public offering (IPO) by the company’s majority-owned subsidy, Max Iron Brazil Ltd.

Max plans to complete an initial public offering of a minimum 30 million shares in the capital of Max Brazil at AUD$0.20 per share, for minimum aggregate gross proceeds of $6 million, up to a maximum of 50 million shares for maximum aggregate proceeds of $10 million.

After completing the offering, Max will continue to be a controlling shareholder in Max Brazil, holding 88 million ordinary shares and 12 million performance shares.

The net proceeds of the offering are to be used, among other things, for the advancement of the Florália DSO Project, located 67 km east of Belo Horizonte, Minas Gerais, Brazil. Minas Gerais is Brazil’s largest iron ore and steel-producing state.

Meanwhile, Max Iron Brazil has received In-Principle Advice on suitability from ASX Limited to advance plans for admission to the official list of the Australian Securities Exchange (ASX). Max Brazil plans to lodge a prospectus with the Australian Securities and Investments Commission in early 2025. The ASX confirmed the ticker symbol MAX has been reserved for Max Brazil.

Max in October closed the transaction to purchase the Florália DSO Project, located 67 km east of Belo Horizonte, Brazil. The transaction closed pursuant to a mineral rights purchase agreement entered into with the company’s Brazilian subsidiary, Max Resource Brazil Ltd. (Max Brazil and, together with the company, the “Max Entities”) Jaguar Mining Inc. (TSX:JAG), and Jaguar’s Brazilian subsidiary, Mineração Serras Do Oeste Limitada (together with Jaguar, the “Jaguar Entities”).

Florália DSO Project

“The Florália DSO Project open pit reveals sizable, sub-horizonal plunging bands of hematite iron ore which appear to extend in all directions. Upon successful exploration and development, with iron ore buyers situated within 20 km, Florália would have a significant transportation cost advantage, as bulk tonnage haulage to a shipping port would not be required,” said Max’s CEO, Brett Matich, in the Oct. 11 news release.

High-grade hematite (60% Fe) such as Florália is often referred to as Direct Shipping Ore (DSO) because it is mined and beneficiated using a relatively simple crushing and screening process before being exported for use in steel mills. The appeal of DSO lies not only in its high iron content but also in small environmental footprint, lower greenhouse gas emissions from dry processing, no requirement for water or environmentally sensitive tailings dams.

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

As mentioned by Matich, it is also within 20 km of major iron ore mines and steel mills, seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

within 20 km.

Max Brazil’s 2024 exploration program has resulted in the technical team significantly increasing the Florália DSO geological target from 8-12Mt at 58% Fe to 50-70Mt at 55%-61% Fe.

The 2025 exploration campaign is well underway, consisting of channel sampling, diamond and mobile auger power drilling. In addition, Max Brazil has commenced an environmental survey, a requirement for approval of mining titles.

Link to Florália DSO Project video

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.05 2025.02.28

Shares Outstanding 180m

Market cap Cdn$9.8m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Max Resource Corp (TSXV:MAX), MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

2 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

$MAX #copper #silver #ironore

1,500m length x 100m width x 300m depth x 2.8 specific gravity x 1% Cu (22lb)

Thoughts, is this a mine?

Here’s what Chatgbt says:

Yes, based on these calculations, Sierra Azul has the scale and grade to potentially become a copper mine.

Here’s why:

1. Significant Tonnage & Copper Content • 126 million tonnes of ore is a substantial deposit. • 1.26 million tonnes (2.78 billion lbs) of contained copper is a meaningful resource.

2. High Potential Value • At $4/lb copper, the site’s copper value is over $11 billion USD. • Even if recovery rates and costs are factored in, it still suggests a highly valuable asset. • Max’s 20% stake alone equates to over $2.22 billion in gross copper value.

3. Mineable Dimensions & Open-Pit Potential • A 1,500m length × 100m width × 300m depth is consistent with large-scale open-pit mining. • If the mineralization continues beyond these boundaries, it could expand even further.

4. Copper Grade & Market Demand • 1% Cu is a solid grade for an open-pit mine, especially in today’s environment. • With growing demand for copper in electrification and infrastructure, the long-term outlook remains strong.

5. Next Steps for Confirmation

• Drilling & Resource Expansion: More drilling could confirm a larger or higher-grade deposit.

• Metallurgical Testing: Determines copper recovery rates and processing feasibility.

• Preliminary Economic Assessment (PEA): An early study to determine project economics and mine feasibility.

Given these factors, Sierra Azul has clear mine potential, pending further development work. If additional drilling confirms continuity and favorable metallurgy, it could be a major asset for Max and its partner Freeport-McMoRan.