Mantaro unveils exploration plans at Golden Hill, Santas Gloria – Richard Mills

2023.04.22

Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) is progressing its South American gold and silver properties, on April 19 publishing a corporate update announcing its 2023 work program.

The Vancouver-based junior is planning a 15-hole, 2,500-meter drill campaign at its 100%-owned Santas Gloria silver project in Peru, and hopes to put out a preliminary economic assessment (PEA) on its Golden Hill gold project in Bolivia in the second quarter.

Golden Hill

Located within Bolivia’s underexplored Precambrian Shield, Golden Hill hosts at least six gold deposits along a 25-km-long strike.

The fully permitted, 5,976-hectare mining concession was mined historically from alluvial drainages along a 6-km trend. Shallow open pits were also developed, and targeted near-surface shear-hosted gold mineralization over a 3-km trend from Garrapitillia to La Escharcha. Five sub-parallel veins were mined at La Escarcha through limited underground development to 60m below surface.

Gold mineralization is of an orogenic or greenstone-hosted type. This style of mineralization can be observed across the region and notably 2 km to the north of the property at the Puquio Norte gold mine, which produced over 350,000 oz between 1997 and 2003.

According to Mantaro, these deposit types have the potential for kilometers of strike extension and kilometer-depth potential.

From a regional perspective and compared with other greenstone belts, Golden Hill is undoubtedly an attractive project.

The Bolivian Pre-Cambrian shield is larger than the famous Abitibi greenstone belt in Canada, yet the Bolivian shield has produced less than 10 million oz compared to 170+ million oz in the Abitibi.

Similarly, the gold endowments of the West African shield, the greenstone belts of northeast South America (Venezuela, Guyana, Suriname and Brazil) and the Yilgarn province of Western Australia, were much greater than equivalent areas of the Bolivian shield, as the latter remains largely underexplored.

As with other greenstone belts and mineralized provinces, mineralization in the Bolivian shield is hosted along major crustal structures with juxtaposing lithologies.

Regional-scale structures focus mineralizing fluids, while rocks of different competencies provide a regime for both ductile and brittle deformation, creating a space for deposition of quartz, pyrite and gold.

Mafic volcanics are especially favorable hosts due to the high iron content that reacts with sulfur in mineralizing fluids to form pyrite — causing gold to precipitate from the fluids.

At Golden Hill, maps of underground workings confirmed multiple sub-vertical shear zones exceeding 4-6m true width. A 10-tonne bulk sample taken from the 45m underground level of the C3 vein at La Escarcha confirmed a head grade of 5.53 g/t Au and demonstrated that recoveries of 73.6% are achievable by gravity separation and 94% by cyanidation.

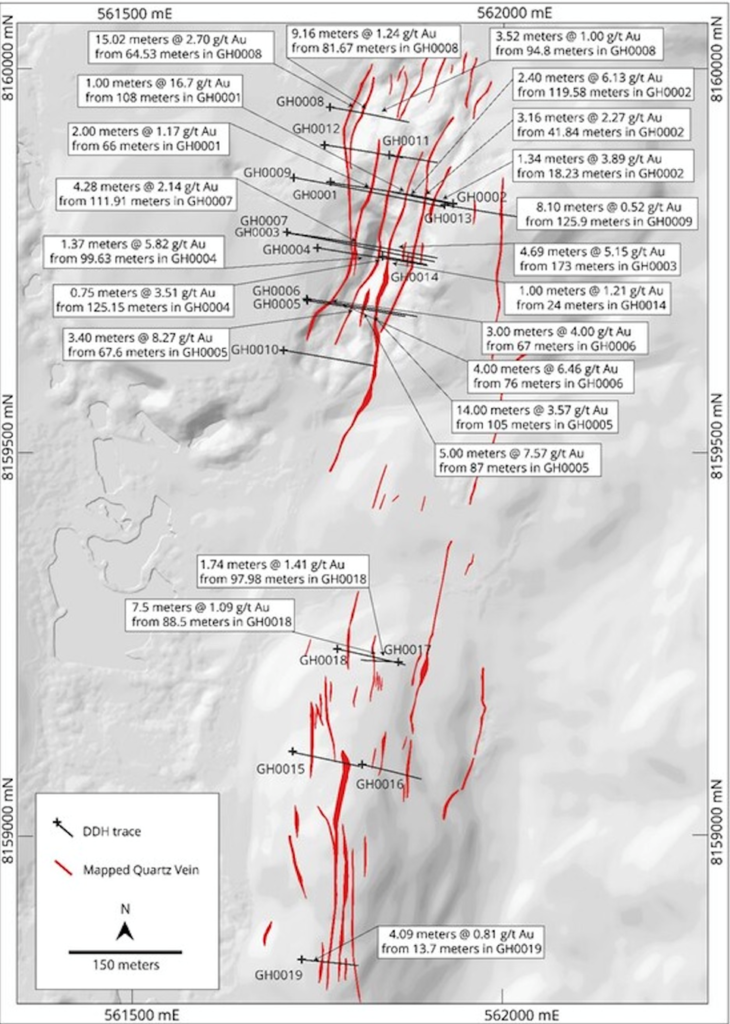

In 2022, the company completed a maiden 21-hole diamond drill program totaling 3,009m. Fourteen holes were drilled at La Escarcha along strike of historical workings. The other seven were scout exploration holes drilled at Gabby, Brownfields and Westfields. According to Mantaro, these holes intersected multiple high-grade shear zones over true widths of between 1 and 11.5 meters.

Intercepts of 11.82 g/t in hole GH0005 and 12.73 g/t in GH0006 within a broader halo of more than 4 g/t, are consistent in width and grade with greenstone-hosted gold discoveries worldwide.

Of the five scout holes drilled at Gabby over a 450-m strike, three hit gold mineralization, highlighted by 7.5m @ 109 g/t from 88.5m down hole, at vertical depths of 10-65m. Further drilling is warranted.

Significantly, only 350m of strike at La Escarcha was drill-tested to vertical depths of 75-100m. The system remains open in all directions. (see the Jan. 12 news release for full results of the initial drill program)

Midway through the 2022 drill program, Mantaro exercised its option to acquire a 51% majority interest, showing the degree of confidence it has in the Golden Hill project.

The Golden Hill team has also obtained a new environmental license covering the entire property, allowing open pit, underground and alluvial mining for an indefinite term.

The company is currently preparing a resource estimate for Golden Hill due out sometime in Q2, and is undertaking a petrographic study using mineralized core from the drill program. The study will assist Mantaro in better understanding the gold grains, assist with modeling the mineralization, and provide input into the design of gravity-recovery flow paths.

The junior is also looking to re-process the tailings on site or sell them to a third party. Sixteen samples at 5 kg apiece were previously taken for metallurgical test work. The tailings head grade ranged from 0.31 to 7.83 grams per tonne gold, for an average head grade of 1.33 g/t. Gold recovery by cyanidation averaged 96%.

It shouldn’t go un-noticed how far advanced the Golden Hill property is, with a significant amount of prior exploration and loads of upside. To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was limited to the La Escarcha pit area.

Furthermore, Mantaro has the opportunity to sell the tailings, or produce gold from tailings re-processed on site, conferring a cash-flow advantage not often seen in such an early-stage junior.

Santas Gloria

Mantaro’s other project, Santas Gloria, is located in the Miocene epithermal gold-silver belt of Peru, southwest of the Toromocho mine containing some of the country’s largest copper reserves.

Mineralization is described as intermediate sulfidation style over-printed by a gold-rich sulfidation phase. Many of the larger silver-base metal mines in this part of Peru are epithermal (shallow) deposits containing steep (over 600m) ore shoots containing high silver-base metal grades.

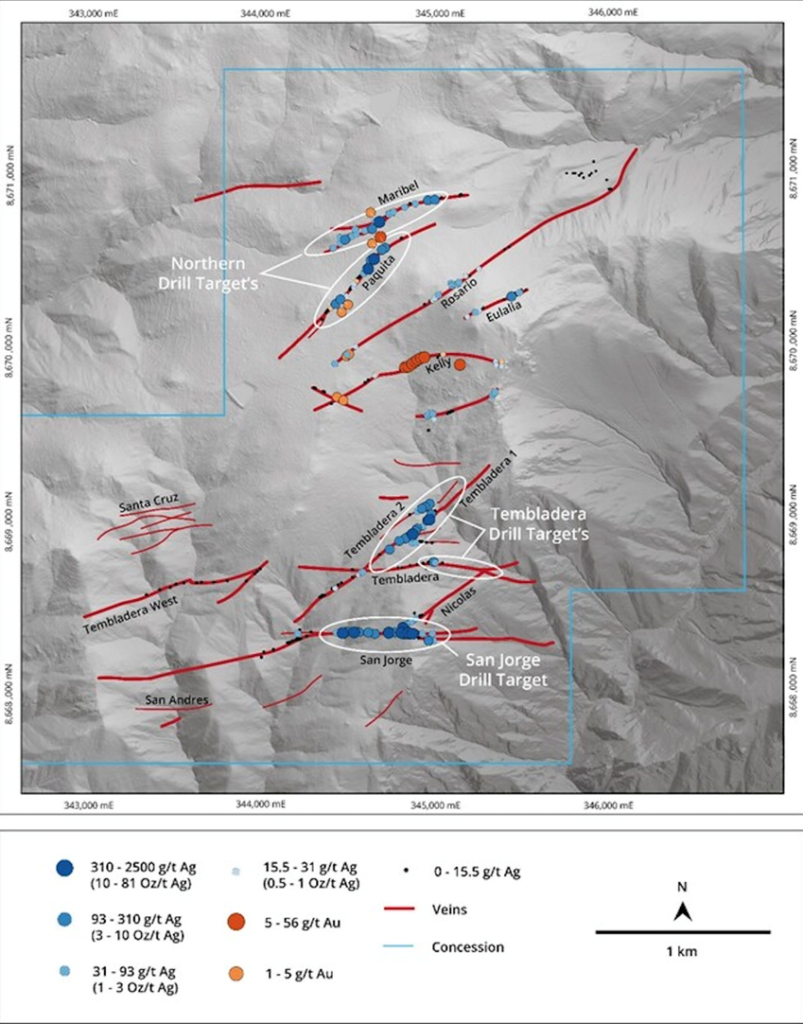

Santas Gloria is no exception. The property is known for very high (i.e. off the charts) silver grades over 10,000 grams per tonne (352 oz/t) in underground channel samples, and gold grades up to 56 g/t in surface channel samples.

Mantaro has re-sampled mine workings from two of the veins, enabling them to define drill targets based on the locations of the highest-grade shoots. The property has yet to be drill-tested despite the presence of over 12 km of half-meter to 5-meter wide epithermal veins, several of which have strike lengths over 2 km.

To illustrate, the Tembladera vein system has a cumulative strike length of 4 km, the San Jorge vein’s total strike length is 3 km, the Paquita vein crops out in the north of the property over almost 1.25 km of strike, and the Maribel vein outcrops over a strike length of nearly 1.3 km.

Grades from previous underground channel sampling range from less than 5 g/t silver to 10,000 g/t, with surface channel sampling returning <5 g/t Ag to 2,500 g/t.

Because Santas Gloria is a silver-base metal vein system, otherwise known as Cordilleran silver-base metal type, the exploration targets are likely to be characterized by high grades with excellent depth.

According to Mantaro, the project 100 km from Lima has excellent access, is at a relatively low altitude of 3,300m, and has a community access agreement valid until 2028. The company has been authorized to drill from 20 pads and its applications for environmental and water permits have been accepted.

Mantaro expects to re-start drill pad construction at the end of the wet season in May, after which a 15-hole, 2,500m drill program will commence, subject to financing. “The program will target the strike and depth extensions of the extremely high grades defined in surface channel sampling and underground workings at the Tembledara, San Jorge, Paquita and Mirabel veins,” Mantaro states in its April 19 news.

Mantaro Precious Metals Corp.

TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ

Cdn$0.05, 2023.04.21

Shares Outstanding 69.8m

Market cap Cdn$3.4m

MNTR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Mantaro Precious Metals Corp. (TSXV:MNTR). MNTR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MNTR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.