Manning Ventures plans drilling at three iron ore properties in Quebec

2021.09.24

Iron ore is the primary source of the mineral substance that goes into steel, the foundation of the world’s industrial activities.

Thanks to a robust growth in global demand and strong fundamentals, the commodity has had an impressive rally at the start of the year, culminating in an all-time high of $235.55/tonne in May.

Iron ore miners and their shareholders, too, have reaped the rewards, with record profits and dividends from the likes of BHP and Rio Tinto.

While iron ore prices have slumped in recent months as China, the biggest consumer, looks to reduce its steel output for H2 2021, government stimulus leading to massive investments in steel infrastructure isn’t likely to go away, especially in the longer term.

The World Steel Association projects global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. China’s consumption, more than half of the global total, will keep growing from record levels.

Since China’s planned steel production cuts this year are partly to help the country to reduce its carbon emissions, some believe that such measures only help to “cool” iron ore prices for the time being.

Relative to its price, inflows of iron ore into China (and around the world) remain stable. According to Reuters columnist Clyde Russell, limiting its steel output will only have a marginal impact on the quantity of iron ore China needs to import.

Furthermore, in a recent podcast, BMO Capital Markets asserts that the Chinese narrative of planned steel production cuts in 2021 looks to be “an impractical suggestion” after such a strong first half.

Rather, the messaging has switched to ensuring exports don’t rise, instead of curbing production. H1 exported steel volumes of just under 75 million tonnes per annum would have to drop to 34Mtpa in the second half, to see no year-on-year growth.

“If that’s going to be the case, that should support global steel prices… we still expect a pretty high premium for high-grade iron ore products given where we expect steel prices to be, and given the pressure on the rest of the productive capacity in China to operate at high levels,” said podcast host Colin Hamilton, commodities analyst with BMO Capital Markets.

The investment bank this week raised its second-half price estimates for most base metals. The prices of nickel, aluminum, zinc and lead were adjusted upward by 7-8%, while for iron ore, BMO slowed the pace of its forecasted decline.

That brings us to the “Evergrande Moment”.

Investors world-wide are concerned that Evergrande’s unraveling could affect the Chinese property sector and the commodities that feed it, such as iron ore, steel and copper.

First off, we don’t believe Evergrande is another Lehman Brothers. A deal will be done to stabilize Evergrande’s debt and restructure bonds and loans by selling most of its assets; some investors will be repaid with real estate.

Second, while there is certainly the risk of commodity prices coming off the boil — China consumes half the world’s steel and its property sector accounts for about 20% of global demand — a look at previous property bubble bursts shows a muted reaction. When Japan’s housing market went bust in 1991, its steel output fell by only 20%. South Korea’s steel production did drop by a third in 1997, the year of the Asian financial crisis, but it recovered quickly, the following year.

The Washington Post notes that, for all the government’s promises of [steel] output curbs, usage as of July this year was running nearly 10% higher still.

The influential newspaper believes the health of the Chinese steel industry is good reason to think the markets are over-reacting to Evergrande. I agree. Take a look at rebar.

The price of the reinforcement bar used on construction sites is at almost the same elevated level it was two months ago, before its key ingredient — iron ore — starting falling and Monday drifted below $100 a tonne for the first time in over a year.

That suggests that end-use demand is still pretty much where it was before this panic started, which should deliver mill owners handsome profits, WaPo states, before concluding that, we’ve not yet seen the reckoning with its steel addiction that China, and the world, ultimately needs. Until that happens, and it certainly hasn’t, don’t assume this market is dead.

BloombergNEF came out with a report this week, stating that the transition from fossil fuels to clean energy could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades. Energy metals like lithium, nickel and cobalt, and industrial metals such as copper and steel, are driving the next commodities supercycle.

Iron Ore Exploration Ramps Up

Despite the current market conditions, exploration activities on iron ore projects haven’t missed a beat.

Brazil has even adopted a new policy that would see mining projects fast-tracked in the world’s second-largest iron ore producer. Australia, the top producer, just had its highest exploration spending quarter in seven years on the back of commodity prices.

It’s business as usual when it comes to exploration around the world. In Canada, some of the country’s most promising iron ore projects are getting ready to be advanced further.

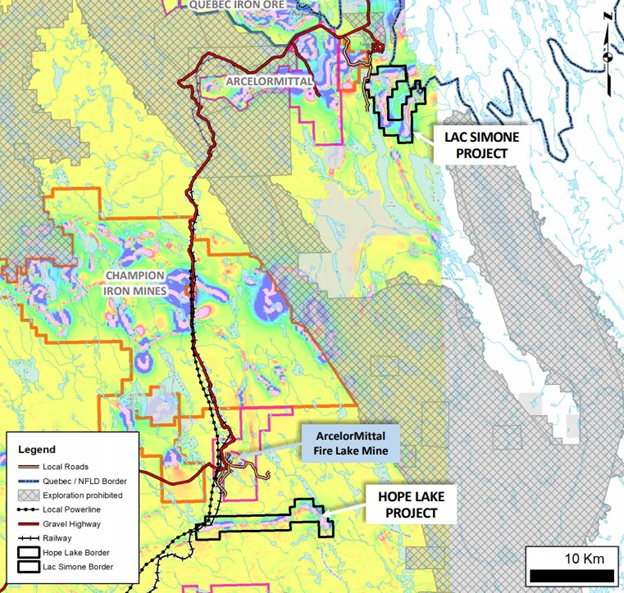

This week, Manning Ventures Inc. (CSE: MANN) (CNSX: MANN.CN) (Frankfurt: 1H5) announced it has finalized drill targets at three of its 100%-owned projects located in the Wabush-Fermont iron ore district of Quebec.

As previously reported by the company in June, the Phase 1 ground mapping and sampling program has successfully confirmed the analytical results of iron formation at the Lac Simone, Hope Lake and Broken Lake properties. A total of 14 outcrop samples returned results of greater than 30% Fe (total).

Permitting is currently underway, with drilling expected to take place later this year.

The drill program will test the thickness of iron formation, where positive surface sampling results have been obtained, and magnetic surveys have indications of thicker accumulations of iron formation.

The company expects to complete between five to eight drill holes on the highest priority target areas. More information on the drill program will be released in the coming weeks.

Property Background

Lac Simone

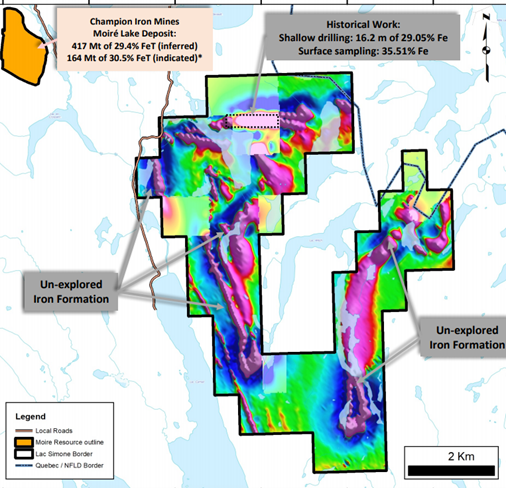

The Lac Simone property is situated proximal to the south of Fermont, Quebec, comprising 63 mineral claims in two claim blocks totaling nearly 3,300 hectares.

The project shares many of the same attributes as the more advanced staged properties nearby, notably the Moiré Lake deposit held by Champion Iron Mines about 3 km to the west. This deposit has a resource estimate of 164 million tonnes grading 30.5% FeT in the indicated category and 417.1 million tonnes grading 29.4% FeT inferred.

In comparison, Lac Simone is significantly less developed. However, the magnetic signature of property, along with the regional mapping and historical work, indicates several iron formation horizons are present.

Historical work between 1956 and 1964 by Jubilee Iron Corp. included test pits that produced bulk samples with an average head grade of 35.51% Fe from iron formation at the north end of the Lac Simone property. The material was then upgraded to a concentrate grade of 66.02% Fe.

Of the three drill holes completed, mineralized intervals of up to 16.15 metres of 29.05% Fe were recovered.

No further work was documented until 2011, when Nevado Resources Corp. conducted a heli-borne magnetic survey at a spacing of 100 metres.

In the same year, Champion Iron collected 8 samples from the eastern part of the current property with an average of 28.7% FeT, indicating that Lac Simone is host to high-grade quartz-hematite +/- magnetite iron formation.

Hope Lake

Like Lac Simone, the Hope Lake property was primarily explored in the past by Jubilee Iron, and followed by Champion Iron Mines in recent years.

The project, consisting of 68 mineral claims totaling more than 3,500 hectares in one contiguous claim block, is located approximately 60 km south of Fermont. ArcelorMittal’s Fire Lake mine, which has been in operation since 2006, is located 6 km to the north.

Between 1959 and 1962, Jubilee completed ground and airborne magnetic and geological surveys at the northernmost magnetic anomaly, plus two diamond drill holes. Twelve samples were collected at the east end of the property, with average results of 34.18% FeT. Later testing on surface samples returned concentrate grades of 68.4% and 68.1% Fe.

In 2011, Champion Iron collected 8 samples from the eastern part of the current property, returning an average grade of 28.7% FeT. It followed up with 8 more samples in 2013 from the western part of the property, which had average results of 33.7% FeT.

Both sampling programs indicated that the Hope Lake property, similar to Lac Simone, hosts high-grade quartz-hematite +/- magnetite iron formation.

A 2014 assessment report completed on behalf of Champion Iron stated that “Careful perusal of all available data on the Hope Lake claims suggests that the iron formation that underlies the claim block contains a potential iron-ore resource. The true grade and amount of iron-ore deposits most amenable to mining have yet to be determined, but there exists a demonstrably strong potential for deposits of economic grade.”

Broken Lake

The recently acquired Broken Lake property features an approximate 18 km long trend of iron formation that has been historically drill-tested. A well-mineralized interval exceeding 84 m has been reported on this 4,500-ha property, although no assays were documented.

A 6 km long belt of highly magnetic rocks in the area, which has not yet been drill-tested, has been mapped as a magnetite-rich iron formation and currently represents a prime exploration target.

According to Manning, the project contains magnetic signatures and geological mapping that suggest structural thickening and possibly overturned sequences of rocks that have the potential to create favorable iron formation horizons.

Other Iron Ore Projects

In addition to the above, Manning also holds two other iron ore exploration projects in Quebec, both acquired along with Broken Lake as part of a property purchase agreement in May 2021.

Heart Lake is a 2,855-ha property featuring approximately 10 km of linear-style iron formation. Recent drilling intersected 26.7% Fe over 25.6 m and ended in high-grade iron formation. The claims are along strike with Champion Iron’s ground, where iron formation on the same trend, approximately 6 km away, contains a drill hole with two separate iron formations of 31.2% Fe over 50.8 m and 30.8% Fe over 42.2 m.

Hydro, a 2,122-ha property, features approximately 12 km of linear-style iron formation. Several historical rock samples, amongst three separate zones, have been collected along the trend and average approximately 32.5% Fe. The trend does not have any documented historical drilling.

With the latest acquisitions, Manning now has an expanded landholding of over 16,000 hectares covering 311 claims in Quebec’s Wabush-Fermont iron ore district.

Conclusion

Manning’s timing for its upcoming drill program is excellent, as the long-term outlook for iron ore remains healthy. Steel-intensive infrastructure will continue to serve as one of the key pillars of the global economy.

By the time these projects reach a more advanced stage, the iron ore boom would have been reinvigorated. Evidently, companies around the world are still ramping up iron ore exploration.

For Manning, its location works well in its favor, given the projects’ proximity to known resources and established operations.

Right next to the Lac Simone project is Champion Iron Mines’ Moiré Lake deposit, which contains 164 million tonnes of indicated resources grading 30.5% FeT, plus another 417.1 million tonnes inferred grading 29.4% FeT.

The Hope Lake property is crossed at its western end by a rail line that services ArcelorMittal, the world’s leading steel company, and its iron ore operations in the region.

Plenty of work remains to be done on both projects (and the newly acquired properties), and Manning’s drilling will certainly reveal more exciting details on these iron ore assets.

Manning Ventures Inc.

CSE:MANN, FSE:1H5

Cdn$0.14, 2021.09.21

Shares Outstanding 42.6m

Market cap Cdn$6.1m

MANN website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Manning Ventures (TSX.V:MANN). MANN is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.