Magna releases initial resource estimate for Margarita silver project; PEA study imminent

- Home

- Articles

- Metals Precious Metals

- Magna releases initial resource estimate for Margarita silver project; PEA study imminent

2022.04.23

Magna Gold Corp. (TSXV: MGR, OTCQB: MGLQF), which is already producing gold from the former San Francisco mine in Sonora, Mexico, could soon be adding a second producing asset to its portfolio to bring the company closer to mid-tier status.

Margarita Maiden Resource

A year and a half since its acquisition of the Margarita silver project in Chihuahua, Mexico, Magna has now completed an initial mineral resource estimate for the Margarita silver deposit, on schedule and on budget.

The indicated mineral resources are estimated to be 1.85 million tonnes grading 204.9 g/t Ag, and the inferred resources are estimated at 454,000 tonnes grading 153.4 g/t Ag, above a 75 g/t Ag cut-off grade. These estimates equate to total silver metal contents of 12.22 million oz indicated and 2.21 million oz inferred.

Contained within the deposit is the Margarita vein high-grade core that has demonstrated excellent continuity. Resources within this core are estimated to be 780,000 tonnes at 332.1 g/t Ag (indicated), for a metal content of 8.32 million oz of silver.

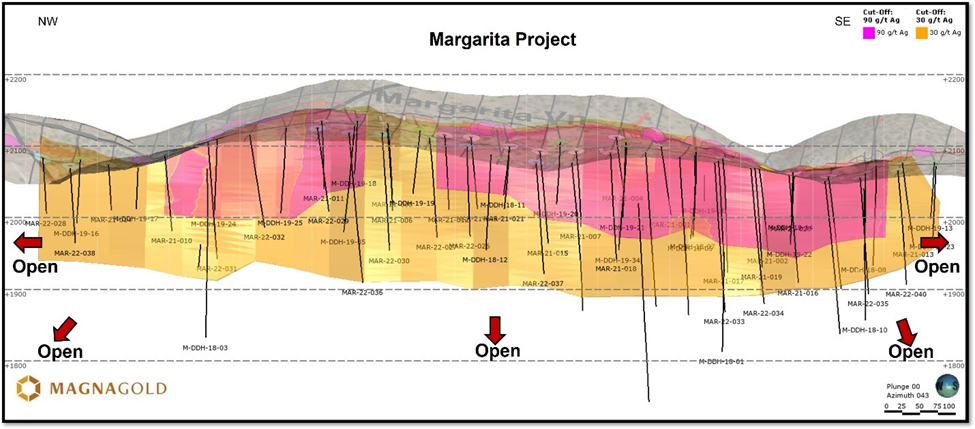

The maiden resource incorporated results of Magna’s ongoing 10,000m drilling campaign focused on defining the high-grade mineralization contained within the Margarita vein system, which is open in all directions and at depth (see figure below).

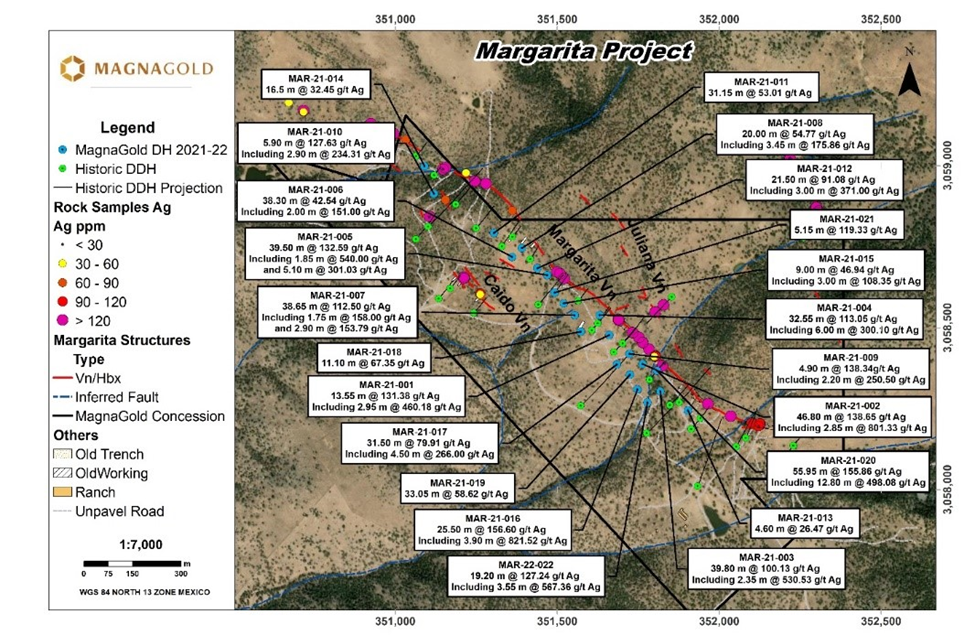

Assays for 22 drill holes have been received to date, all of which intersected significant near-surface silver mineralization over significant widths (i.e. 12.80m at 498.08 g/t Ag within 55.95m at 155.86 g/t Ag, starting 3m from surface). These are detailed below:

Multiple drill holes also returned anomalous gold values with grades up to 0.31 g/t; some had significant zinc and lead values with grades up to 5.64% and 2.36% respectively.

Magna’s drilling also indicated that the system appears to be much wider than previously thought, and there are multiple vein systems running parallel to the main Margarita vein, most notable of which were the Juliana and Caido veins.

These veins are also strongly mineralized, and follow-up drilling will focus on defining additional resources in these veins to be included in subsequent resource updates. The current resource estimate only includes mineralization in the main Margarita vein.

“Our exploration program defined a high-grade resource and discovered several parallel structures. We look to add the newly discovered structures in our next resource update and anticipate material increases in the mineral inventory,” Magna’s president and CEO Arturo Bonillas commented in a news release.

Having completed the initial resource estimate for Margarita, the company is now on track to release a PEA in the coming months and expects to make a construction decision on the project before the end of 2022.

About Margarita Property

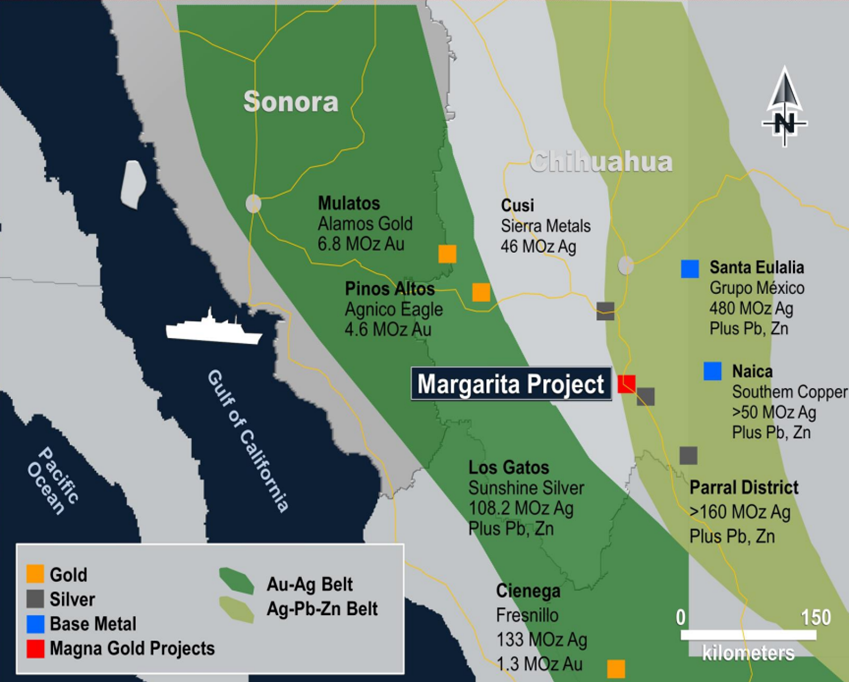

The Margarita silver project comprises two mining concessions covering over 125 hectares, located within the prolific Sierra Madre gold belt, which is known to host numerous multimillion-ounce gold-silver deposits. The property lies 15 kilometres northwest on strike with Sunshine Silver Corp.’s Los Gatos mine.

Magna announced its acquisition of the Margarita property back in November 2020. The company paid a total of C$5.8 million to junior miner Sable Resources Ltd. for an option to buy the project, and immediately exercised that option by making another C$2.7 million payment.

The property is host to as many as five quartz-barite and minor calcite epithermal veins-breccias of low to intermediate sulphidation. The vein structures vary in thickness, from a few centimetres to more than 12 metres.

The Margarita vein is the main structure on the property, and can be traced on surface for at least 1.6 kilometres. Samples collected at surface on this structure returned several values over 100 g/t Ag and up to 909 g/t Ag.

Sable previously conducted two core drill campaigns along 1,700 metres of the Margarita vein during 2018-2019, totalling 5,245 metres in 35 holes. Some of those drill intercepts returned values over 1 kg/t AgEq; some also had widths of over 48 metres of silver mineralization.

The four remaining outcropping vein structures have not seen drilling to this day.

The El Caido vein is a secondary braided vein system consisting of four individual quartz-barite structures that crop out for at least 800 metres. Its strike is parallel to the Margarita vein. Samples collected on this vein system returned values of up to 174 g/t Ag.

The Juliana vein is located in the footwall of the Margarita vein and can be traced on surface for at least 650 metres. Samples collected on this structure returned values of up to 405 g/t Ag.

The Fabiana vein is a parallel structure located in the hanging wall of the Juliana vein and only 15-20 metres apart.

The Marie vein, which crops out at the easternmost part of the property, can be traced for at least 400 metres. Samples collected on this structure returned values of up to 1,235 g/t Ag.

All the veins in the property returned high-grade silver values along with strongly anomalous lead, zinc, arsenic, antimony and barium, indicating the robustness of the Margarita epithermal veins system.

The latest drilling campaign by Magna confirmed that the Margarita system is even wider, higher grade and closer to surface than previously thought. Significant upgrades to the current resource for Margarita is now a matter of when, not if.

“Based on what we have seen so far I am confident the Margarita project will generate significant value for our shareholders for years to come,” Magna CEO Arturo Bonillas said in the latest news release.

Mexico’s Next Mid-Tier Producer?

Speaking of generating shareholder value, Magna has already taken significant steps to become Mexico’s next mid-tier gold-silver producer by restarting the former San Francisco mine.

Located 150 km north of Hermosillo in Sonora, Mexico, the San Francisco property consists of two previously mined open pits (San Francisco and Chicharra) and associated heap leaching facilities, covering a total area of more than 47,300 hectares.

The mine was previously operated from 1995 through 2000. During that time, approximately 13.5 million tonnes of ore at a grade of 1.13 g/t Au were treated by heap leaching, and 300,834 ounces of gold were recovered.

Mining operations ceased in 2001 as a result of low gold prices, although leaching and rinsing of the heap continued for approximately one year after.

In 2005, Timmins Gold (now Alio Gold) acquired the mine and processing equipment and began commercial operations in 2010. Since then, the mine has produced more than 820,000 ounces of gold, making it one of Mexico’s most successful gold mining operations in recent history.

Looking to re-establish San Francisco as a profitable mine, in March 2020, Magna agreed to take on the project, with a long-term view of improving the mine operation.

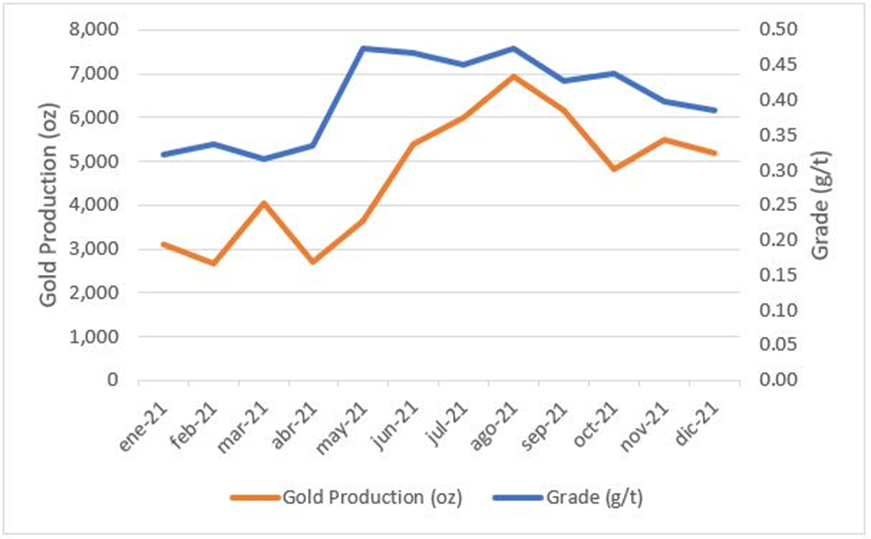

After rebooting the operation in Q3 2020, the company has since achieved commercial production status and saw its production improve year-on-year. In Q4 2021, the mine produced 15,499 oz of gold, which more than doubles the amount produced in the same quarter of 2020.

Having met its 2021 production guidance of 55,000-65,000 oz, this year, management is targeting gold production of 65,000-75,000 oz after successfully ramping up operations at San Francisco.

At full capacity, though, the San Francisco mine is capable of producing upwards of 90,000 oz annually, the project’s prefeasibility study shows. This is based on total proven and probable reserves of 47.6 million tonnes, graded at 0.495 g/t Au, for 758,000 ounces of contained gold.

There is also ample room for resource expansion, with an estimated upside of 3 million gold ounces plus 50 million ounces of silver.

Conclusion

Besides the San Francisco gold mine and the Margarita silver project, Magna also has a handful of intriguing gold and silver assets spread across the mineral-rich states of Sonora and Chihuahua, Mexico. Making, imo, MGR an exciting prospect for mine investors.

And with the release of an initial resource estimate and imminent PEA study for its Margarita property, it’s about to take a step up and evolve into a multi-mine precious metals producer.

Magna Gold Corp.

TSXV:MGR, OTCQB:MGLQF

Cdn$0.63, 2022.04.21

Shares Outstanding 90.1m

Market cap Cdn$56.7m

MGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Magna Gold (TSXV: MGR). MGR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.