‘Lower for longer’ interest rates + non-transitory inflation keep the shine on gold

2021.07.16

At AOTH we are invested in commodities we expect are going to increase in value, and the companies that are exploring for them. Among the metals we are most bullish on, are gold, silver, copper, zinc, nickel and lithium.

For me, gold stands out due to its rarity and high value, coveted by investors, central banks and jewelry-makers. Silver is an interesting metal to watch for its dual usage, as both an industrial and a monetary metal.

Beyond gold and silver, other rare commodities have been traded by early civilizations and some were even used as money. Two examples are salt and amber.

Salt

According to Time magazine’s ‘A Brief History of Salt’,

The history of the world according to salt is simple: animals wore paths to salt licks; men followed; trails became roads, and settlements grew beside them. When the human menu shifted from salt-rich game to cereals, more salt was needed to supplement the diet. But the underground deposits were beyond reach, and the salt sprinkled over the surface was insufficient. Scarcity kept the mineral precious. As civilization spread, salt became one of the world’s principal trading commodities.

Salt routes crisscrossed the globe. One of the most traveled led from Morocco south across the Sahara to Timbuktu. Ships bearing salt from Egypt to Greece traversed the Mediterranean and the Aegean. Herodotus describes a caravan route that united the salt oases of the Libyan desert. Venice’s glittering wealth was attributable not so much to exotic spices as to commonplace salt, which Venetians exchanged in Constantinople for the spices of Asia. In 1295, when he first returned from Cathay, Marco Polo delighted the Doge with tales of the prodigious value of salt coins bearing the seal of the great Khan.

As early as the 6th century, in the sub-Sahara, Moorish merchants routinely traded salt ounce for ounce for gold. In Abyssinia, slabs of rock salt, called ‘amôlés, became coin of the realm. Each one was about ten inches long and two inches thick. Cakes of salt were also used as money in other areas of central Africa.

Amber

Amber, or fossilized tree sap, has been prized since Neolithic times for its natural beauty. Shaped into jewelry and used in folk medicine, amber was widely traded in the ancient world.

Once dubbed “the gold of the north,” amber was transported from the North Sea and Baltic Sea coasts overland to Italy, Greece, the Black Sea, Syria and Egypt over a period of thousands of years. According to Wikipedia,

The oldest trade in amber started from Sicily. The Sicilian amber trade was directed to Greece, North Africa and Spain. Sicilian amber was also discovered in Mycenae by the archaeologist Heinrich Schliemann. This amber also appeared in sites in southern Spain and Portugal and its distribution is similar to that of ivory, so it is possible that amber from Sicily reached the Iberian Peninsula through contacts with North Africa. After a decline in the consumption and trade of amber at the beginning of the Bronze Age, around 2,000 BC, the influence of Baltic amber gradually took the place of the Sicilian one throughout the Iberian peninsula starting around 1000 BC. The new evidence comes from various archaeological and geological locations on the Iberian peninsula.

From at least the 16th century BC, amber was moved from Northern Europe to the Mediterranean area. The breast ornament of the Egyptian pharaoh Tutankhamun (c. 1333–1324 BC) contains large Baltic amber beads. Heinrich Schliemann found Sicilian amber beads at Mycenae, as shown by spectroscopic investigation. The quantity of amber in the Royal Tomb of Qatna, Syria, is unparalleled for known second millennium BC sites in the Levant and the Ancient Near East. Amber was sent from the North Sea to the temple of Apollo at Delphi as an offering. From the Black Sea, trade could continue to Asia along the Silk Road, another ancient trade route.

This brief delve into economic history serves to place gold in its proper context. Thousands of years after it was first melted into jewelry and shaped into coins, gold is still widely sought after for its beauty, its longevity (much of the gold mined throughout history still exists, either as jewelry, bars or coins, a large portion having been recycled), and most importantly, as a store of value.

While so-called fiat, or paper currencies have lost much of their value over time, gold has locked in some serious price gains.

Due to an increase in inflation every decade except the 1930’s, the US dollar has lost 90% of its purchasing power since 1950.

Gold, on the other hand, has gone from $35 in 1970 to $1,825 in 2021, a 52X increase!

Which is why we continue to own and defend gold, even while critics disparage it as “the barabarous relic” of an earlier time. In fact, gold is probably more relevant today than it has ever been, due to the factors driving gold prices mentioned in an earlier article: negative real interest rates, mounting inflation, and the climbing US debt to GDP ratio.

Lower for longer

The dip in the gold price earlier this year correlated to an increase in US Treasury yields, as bond investors rotated funds into more risky assets like stocks. This caused bond prices to fall and yields to rise.

However, as we stated then, this trend has already been proven transitory. Real interest rates are currently negative and have been for some time. The benchmark 10-year Treasury yield rose to 1.73% in April, amid inflation concerns, but since then, the yield has dropped to 1.3%, while the inflation rate has risen to 5.4%, as of June, leaving a negative real yield of -4.1%!

That’s worth repeating – real interest rates have a negative yield of -4.1%.

The US Federal Reserve has already said it will tolerate inflation above the normal 2% target, and let the economy run hotter before stepping in to cool it with rate hikes. In other words, the Fed plans to keep rates “lower for longer”. What does that mean in practical terms?

According to the CME Group’s FedWatch Tool, there is a 75% probability that interest rates will stay in the 0.00% to 0.25% range a year from now. Yet this is a moving target, and a political one.

Stock markets have grown accustomed to very low interest rates and investors/ traders follow every word of Fed Chairman Jerome Powell’s musings as to when it could raise rates.

In June, the Federal Open Market Committee appeared to depart from a March statement that the Fed wouldn’t raise rates until 2024 — with officials indicating rate hikes could come a year earlier, in 2023, due to inflation fears. Their forecast suggests two rate hikes that year.

The announcement took the markets by surprise, with stocks tanking to their worst week since October 2020, and spot gold plummeting $134, from $1,898/oz to $1,764.

But here’s where it gets convoluted. Though the Fed raised its headline expectation to 3.4%, a full percentage point higher than the March projection, the central bank stood by its position that inflation pressures are “transitory”.

According to the Oxford dictionary, transitory means “not permanent”. Synonyms include brief, temporary or short-term. Please tell me how an inflation rate that has risen from 1% a year ago, to 5.4% in June, can be temporary, when it has increased every month since December 2020?

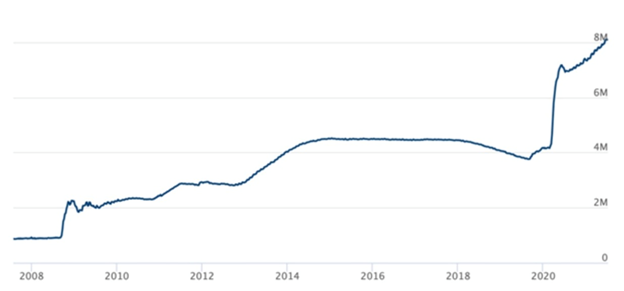

And here’s something you won’t read about in mainstream media. The Fed is severely constrained in how much it can raise interest rates, due to ballooning debt. Following $4.5 trillion spent on pandemic relief, and trillions more to come, through Biden administration spending, along with the continuation of quantitative easing (what I like to call “quantifornication”) to the tune of $120 billion in asset purchases per month, the Fed has in one year doubled its balance sheet to around $8 trillion and the national debt currently sits at $28.5 trillion.

Interest paid by the federal government this year on its debt is estimated at just under $400 billion. As one financial blogger puts it,

If rates returned to even 1990s levels (6% to 8%), interest owed would triple or quadruple and quickly bankrupt the government (or make it even more bankrupt, depending on your perspective)…

In addition, the Fed is well aware of the massive economic damage higher rates will foster, including a massive recession, and bankruptcies at every level (private, corporate and government).

Investors know this too and that is why stocks tank every time the mere mention of higher rates surfaces in the press.

In its quarterly review of monetary policy that covers 90% of the world economy, Bloomberg found that no major western central bank is expected to increase interest rates this year, with China, India, Russia and Mexico among those predicted to cut their benchmarks even further.

The upshot is that low interest rates are here to stay, the higher Treasury yields we saw earlier this year were an aberration, and yields will continue to stay low, to gold’s benefit, for the foreseeable future.

Inflation is here to stay

The Fed’s official line is that inflation is only temporary, however we see things differently.

In June the US consumer price index (CPI) surged by 5.4%, the most since 2008, as economic activity picked up but was constrained in some sectors by supply bottlenecks.

The pandemic has put tremendous pressure on supply chains, and the prices of many agricultural commodities such as grain, corn and soybeans, have skyrocketed. Several industrial metals have enjoyed significant price gains, too, including copper, zinc and lead.

This is due to a number of reasons including demand from China, the world’s largest consumer of commodities whose economy grew at a blistering 18% in the first quarter.

Supply constraints in certain industries plus greater demand for goods and services is a recipe for higher inflation. To the question of whether inflation is temporary, we are seeing increasing evidence it is not, ie., that rising prices are becoming a permanent fixture of the economy.

The first indication of a more permanent trend is the fact that inflation is becoming a global phenomenon. According to an early June CNN article,

Prices are rising quickly across huge swaths of the developed world, with inflation in countries that belong to the Organization for Economic Cooperation and Development surging in April to the highest rate since 2008.

Energy price hikes boosted average annual inflation across OECD countries to 3.3% in April, compared with 2.4% in March, the Paris-based organization said Wednesday. That’s the fastest rate since October 2008, when the global financial crisis delivered a massive shock to the world economy.

It’s one thing to claim, as Jerome Powell does, that US inflation is temporary, but quite another to suggest that global inflation can be easily tamed. The metaphor of quickly turning a fully-laden freighter, or cranking the wheel of the Titanic to avoid the oncoming iceberg, comes to mind.

The London-based Financial Times notes that UK inflation is following the US trend, hitting 2.5% in June, its highest level since 2018:

Most economists and policymakers still consider the trend a transitory phenomenon tied to the lifting of pandemic-related restrictions — rather than a return to 1970s-style inflationary spirals. But many acknowledge that the likelihood of persistently higher inflation may be growing.

Politicians and high-level CEOs are also taking issue with Powell’s “transitory” inflation rhetoric. On July 15, the New York Times reported that many inside the White House now believe that high inflation could be with us for a year or two. That is not, well, transitory, unless you are talking about a long trip.

I agree. Consider what risk-averse savers typically do with their money: put it in the bank. If you’re earning, say, 1.5% in your “high interest” savings account, in one year’s time your principal will be worth 3.9% less! (1.5% minus 5.4% US inflation)

The Times article also quotes Jamie Dimon of JPMorgan and Chase telling analysts on an earnings call that inflation is “a little worse than the Fed thinks,” and Pepsi CFO Hugh Johnston stating that the food & beverage giant will likely raise prices soon. “Is there somewhat more inflationary pressures out there? There is,” he said. “Are we going to be pricing to deal with it? We certainly are.”

BlackRock CEO Larry Fink also thinks that inflation will rise above the Fed’s 2% target, and that the central bank will have to react to the higher rates — presumably either with a “taper tantrum” of scaled-back monthly bond purchases, or raising rates, the former being more likely.

“I am not calling for 1970’s inflation but I just think we are going to have above 2% inflation … probably closer to 3.5% to 4.0%,” Fink said in an interview with Reuters.

Conclusion

The evidence is in: low interest rates and Treasury yields are going to be with us for at least the next two years, maybe longer. Theoretically the Fed can independently hike rates to deal with a post-pandemic inflation that is global, rising, and more permanent than temporary, but the fact is the US central bank is severely constrained in how much it can raise rates.

The United States is much more highly indebted than it was in 2010 following the Great Recession, which restricts its borrowing capacity. The federal government is facing a $3 trillion deficit this year, the second in a row, and the interest it must pay on the debt amounts to nearly half a trillion dollars.

True, the Fed gradually raised interest rates following the financial crisis, but it quickly reversed course when it became clear that economic growth, and inflation, wasn’t rising fast enough. Now we have the opposite problem. Central banks are having to walk a tight rope between keeping rates low enough to keep economic growth going after more than a year of virus-caused economic pain, and stopping inflation from getting out of hand.

In these circumstances gold (and silver) is the only asset that is all but guaranteed to increase in value over time, since prices are not held back by inflation, like investments priced in fiat currencies.

When the prices of many goods and services are climbing, we want to be invested in things that are going up, to balance out what we are losing to inflation. The best way to make money off of rising gold prices, is to invest in quality gold stocks.

Consider: “quantifornication” is still going on in the US, Britain and the EU, meaning that excessive money-printing is continuing to devalue currencies at an alarming rate.

Trillions more in economic recovery spending is promised, with little concern over the mounting debt pile. A few ago the Wall Street Journal reported that the pandemic has pushed global debt to the highest level since World War II, surpassing annual economic output. Despite a budget deficit of $3 trillion for the second year in a row, and fear of inflation, the benchmark 10-year Treasury yield is only 1.3%.

With inflation running at 5.4%, negative real rates are a shocking -4.1! Rates this negative are a flashing buy signal for gold. In June, the United States Gold Bureau pointed out that the gap between the 10-year and the CPI was -3.5%, the highest since 1980. And it’s gotten worse! (currently -4.1%) The gap, states the bullion dealer, has only been more negative than 3.5% for 10 months in the last 70 years, all of which took place in the hyperinflationary 1970s (1974, 1975 or 1980).

Last year was an exceptional year for gold stocks, owing to the exciting gold bull that ran for the second half, “floating all boats” in the gold space. Several of our gold picks did extremely well. Despite a lower gold price in 2021, we’ve already had three winners (NFLD, NFG and FVL), and we expect more successes to come. Companies are out exploring and it will only be a matter of weeks before the first drill assays start rolling in.

The next leg of the gold bull market is only just getting started and our gold juniors are primed for shareholder gains.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares in Exploits Discovery corp (CSE:NFLD). NFLD is a paid sponsor of his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.