Lomiko sharpens focus on green metals with lithium property acquisition

2021.05.11

The new “green economy” rejects dirty sources of energy and transportation, namely coal, oil and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage, as well as mobile technology (5G) and rapid adoption of artificial intelligence (AI) technologies needing increased computing power.

Transportation makes up 29% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles, as well as high-speed rail, is an important part of the plan to wean ourselves off fossil fuels.

Latest reports estimate the global electric car market to grow at a CAGR of 37.1% from 2021 to 2028, reaching $1.9 trillion by the end of the forecast year.

US going green

In the US, President Biden promised earlier in the year to replace its entire federal vehicle fleet – some 645,000 vehicles in all – with fully electric vehicles, made “right here in America by American workers.”

As part of its aggressive climate change goals, the US is looking at a $174 billion spending over the next eight years in an attempt to “win the EV market.” This includes building more charging stations, and more rebates for consumers.

Supply insecurity

Yet there is a problem: for most of the metals used in clean energy and electrification, the United States relies on imports.

Since Donald Trump’s presidency, the US has been planning to reverse its dependence on foreign rivals especially China, which has the largest EV market and dominates the global battery supply chain.

Under an executive order issued by Trump, a report was published by the Interior Department in 2018, highlighting 35 minerals that are critical to the US national and economic security, 14 of which are 100% dependent on imports.

The current president, too, is aware of America’s vulnerabilities. In late February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

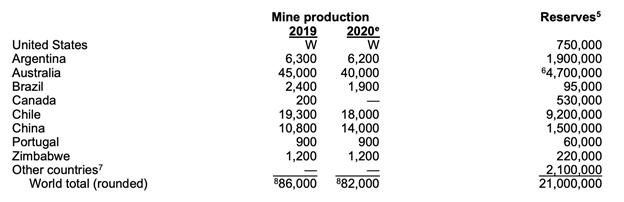

A glance at the US Geological Survey’s mine production data, shows how little of these materials the United States mines.

For example, in 2020 (and earlier) the only lithium production in the United States was from Albemarle’s Silver Peak brine operation in Nevada.

No natural graphite, needed to make spherical graphite used in the EV battery anode, was mined in the US in 2020. The world’s inferred resources of recoverable graphite exceed 800 million tons, but domestic sources are “relatively small,” states USGS.

Canada-US cooperation

Fortunately the US and Canada are planning to execute a home-grown strategy to explore for and mine critical minerals in North America.

In January 2020, the two governments announced the Joint Action Plan on Critical Mineral Collaboration. The agreement would increase production and establish supply chains for numerous critical minerals the US is dependent on for imports.

Ottawa recently released a critical minerals list like the list of 35 published by the US in 2017; the 31-metal catalogue includes cobalt, graphite, lithium and rare earths.

Earlier this year, the governments of Ontario and Canada announced a plan to each spend $295 million to help Ford upgrade its assembly plant in Oakville to start making electric vehicles.

At this year’s PDAC conference in Toronto, Francois-Philippe Champagne, Canada’s minister of innovation, science and industry, told Invest in Canada’s CEO Ian McKay that Canada is uniquely positioned to be a global leader in EV manufacturing.

“Canada offers renewably generated electricity, a skilled workforce, a stable and predictable jurisdiction to operate in, the rule of law – a commodity very much in demand these days – and an abundance of the critical minerals needed for the batteries that power electric vehicles,” the minister said.

This type of government support for a mine-to-battery-to-EV supply chain right here in North America, is great news for exploration companies focused on battery and energy metals.

Lomiko Metals

One of these is Lomiko Metals (TSXV:LMR, OTC:LMRMF, FSE:DH8C), exploring for lithium and graphite in the Canadian province of Quebec.

The mining-friendly jurisdiction placed in the top 10 of the Fraser Institute Annual Survey of Mining Companies 2020, for investment attractiveness. Also last year, the province unveiled the Quebec Plan for the Development of Strategic Minerals 2020-25, signaling its intention to transition to a lower-carbon economy. Quebec has also established a list of 22 minerals considered critical and strategic, among them lithium, graphite, nickel, cobalt and rare earth earths.

Lomiko’s flagship project is the La Loutre flake graphite property, located 117 km northwest of Montreal, and 53 km east of Imerys Carbon and Graphite’s Lac des Iles mine.

Originally explored for base and precious metals, historical reports showed graphite to be present on the property in quartzite and biotite gneiss, and in shear zones where the graphite content ranges from 1-10% on surface including visible flakes. A recent grab sampling and mapping program confirmed a graphite-bearing structure of approximately 7 km by 1 km, with results up to 22% graphite in multiple parallel zones 30m to 50m wide. Another 2 km x 1 km area consisting of multiple parallel zones, 20m to 50m, includes up to 18% graphite.

The property already has a resource of 18.4 million tonnes carbon flake graphite (Cg) grading 3.19% in the indicated category, and 16.7Mt @ 3.75% inferred. Using a 3% cut-off grade, the resource amounts to 4.1Mt @ 6.5% Cg indicated, and 6.2Mt @ 6.1% inferred.

Lomiko is currently working on a preliminary economic assessment (PEA) at La Loutre, and in 2019 completed a drill campaign at the EV Zone. Highlights from the 21-hole, 2,985-meter program featured 7.74% Cg over 135.60m, including 16.81% Cg over 44.10m; 17.08% Cg over 22.30m and 14.80 Cg over 15.10m; and 14.56 Cg over 110.80m.

The new PEA will include the latest results from both the Graphene-Battery and the EV zones.

“La Loutre has proven to be a large and high-grade area worthy of further investment,” stated A. Paul Gill, CEO, in the March 4, 2021 news release. “The only operating graphite mine in North America is the Imerys Graphite & Carbon at Lac-des-Îles, 53 km northwest of La Loutre which reported proven reserves of 5.2M tonnes at a grade of 7.42% Cg in July 1988 before the start of production.”

Earlier this year Gill referenced President Biden’s above-mentioned review of US supply chains including EV batteries, with respect to its nearest neighbor, Nouveau Monde Graphite, being “recently provided a mine permit which bodes well for other groups in Quebec such as Lomiko,” he stated in the Feb. 26 news release. “Although we are only starting our development process, it is good to know there has been nearby success.”

Lomiko has also made progress recently with the project’s metallurgy. A metallurgical flowsheet development program was carried out on samples from both the Graphene Battery Zone and the EV Zone. The program culminated in a locked cycle test (“LCT”) that generated a combined concentrate grading 97.8% total carbon at 93.5% graphite recovery — meeting the program’s objective of upgrading La Loutre mineralization to at last 95% total carbon.

“These very encouraging results of initial testing suggest that La Loutre graphite may be suitable for high-end industrial use,” Gill stated in the April 7 news release.

However the most exciting news from Lomiko, came on April 27, when the company announced it has optioned a lithium property, in the James Bay region of Quebec, known as the Bourier project.

“This option agreement with Lomiko will allow the Bourier property to be explored in detail for battery mineral discoveries, such as lithium, nickel, copper and zinc,” said Jean-Sébastien Lavallée, CEO of Critical Elements.

The project boasts a total ground position of 102.5 square kilometers in a region that hosts other lithium deposits and known mineralization. According to Lomiko, Bourier is “potentially a new lithium field in an established lithium district.”

“Recent consumer interest in electric vehicles has increased investor interest in lithium and graphite, two of the major components of a lithium-ion battery”, said Gill, in the April 27 news release. “Quebec is in a unique position of having ample supply of both commodities and now Lomiko has opportunities in additional battery materials.”

Conclusion

Lomiko is exploring for lithium and graphite during what looks to be a “perform storm” of supply and demand considerations for these markets, resulting in upward price mobility for the foreseeable future.

According to the most recent report from Wood Mackenzie, mining companies will need to spend a whopping $1.7 trillion over the next 15 years, to supply enough lithium, graphite, cobalt, copper and nickel for the shift to a low-carbon world.

The commodities consultancy says meeting new emissions targets being set by countries like Canada, the US, Britain and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

A North American EV supply chain, from mine-site to showroom, is still in its infancy, but progress is being made. In April CNBC reported that General Motors and South Korean battery-maker LG Chem will invest over $2.3 billion in a second EV battery plant, in Tennessee.

Other large automakers and battery companies are jumping on the EV train, including Ford Motor Co. and SK Innovation. The latter and LG Chem recently struck a $1.8 billion deal to end a trade dispute between them, allowing SK to finish building a lithium-ion battery plant in Georgia, that will supply batteries to Ford and Volkswagen.

Rising demand for lithium is stoking prices for the white metal, and padding the bottom lines of large producers like Albemarle and Livent Corp.

According to Benchmark Mineral Intelligence, an index of lithium prices has climbed 59% since April 2020, prompting Albemarle, Livent and Chile’s SQM, to increase production.

A few years back this led to a glut in the market and a period of low prices, but lithium CEOs and analysts expect it to be different this time.

Paul Graves, the CEO of Livent, which supplies Tesla, was quoted saying the rising demand “reflects what feels like a real and fundamental turning point in our industry.” However, he also warned that “it will be a challenge for the lithium industry to produce sufficient qualified material in the near and medium term.”

Chris Berry, an independent battery metals expert, told Reuters, “The next few years are going to be critical in terms of whether there’s enough available lithium supply, and that’s why you’re starting to see commodity prices start to ramp.”

Benchmark forecasts lithium demand to more than triple between 2020 and 2025, rising to a million tonnes by the forecast year and out-pacing supply by 200,000 tonnes.

“Companies across the lithium-ion supply chain are in the best position they’ve been in for the last 5 years,” Reuters quoted Pedro Palandrani of the Global X Lithium & Battery Technology ETF, which has doubled in value in the past year.

The outlook for graphite, used in the EV battery anode (versus the cathode, containing lithium) is even more bullish.

Benchmark Mineral Intelligence forecasts graphite demand is set to increase by 15 times over the next decade, rising from 200,000 to 3 million tonnes annually. The batteries segment is expected to be the fastest-growing application for natural graphite, and the largest usage category, by 2024.

Yet global graphite supply is expected to remain tight for the foreseeable future. Last year, total output came to 952,600 tonnes, a 15% decline over 2019, according to UK-based analytics firm GlobalData.

The supply-demand imbalance has meant a rising price environment for the mineral since 2017. Roskill analysts believe prices will likely remain high with resilient demand for EV raw materials, and major suppliers getting hit by covid-19, and environmental crackdowns in China.

Putting it all together, we at AOTH see Lomiko’s recent acquisition of a lithium property in Quebec as timely given all of the bullish demand drivers for the white metal. Electrification and decarbonization are long-term investable trends, so we expect the company to have no problem attracting interest and investors, particularly if lithium prices stay buoyant.

We present Lomiko’s $2.178 million financing @ $0.25, announced on March 15, as proof. A second private placement, announced on Monday, May 10, expects to raise $1.445M.

We are equally bullish on graphite, a metal essential to the battery metals theme; like lithium, there are no substitutes for it. China controls the lion’s share of graphite production, but the United States and Canada are keen to reduce their dependence on Beijing. Quebec is a good jurisdiction to develop an upcoming graphite property, having attracted recent provincial government support, and placing highly on the Fraser Institute’s investment attractiveness rankings.

I’m looking forward to seeing what Lomiko has planned for its lithium and graphite properties in Quebec and upcoming shareholder catalysts.

Lomiko Metals Inc.

TSXV:LMR, OTC:LMRMF, FSE:DH8C

Cdn$0.12, 2021.05.10

Shares Outstanding 76.5m

Market cap Cdn$24.6m

LMR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Lomiko (TSX.V:LMR). Lomiko is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.