Lomiko Metals primed to become key provider of high-quality graphite for the North American EV market

2021.12.15

Graphite is a crystalline form of the element carbon with its atoms arranged in a hexagonal structure.

Graphite occurs naturally and is the most stable form of carbon under standard conditions. Under high pressures and temperatures, it converts to diamond, which is another polymorph of carbon but with different molecular structures.

Most of the graphite seen at Earth’s surface today was formed at convergent plate boundaries, where organic-rich shales and limestones were subjected to the heat and pressure of regional metamorphism. This produces marble, schist and gneiss that contain tiny crystals and flakes of graphite.

When graphite is in high enough concentrations, these rocks can be mined, crushed to a particle size that liberates the graphite flakes. They are then processed by specific gravity separation or froth flotation to remove the low-density graphite. The final product is known as “flake graphite.”

Graphite can also be made by heating high-carbon materials like petroleum coke and coal-tar pitch to temperatures in the range of 2500 to 3000 degrees Celsius. At such high temperatures, all volatile materials and many metals in the feedstock are destroyed or driven off.

The graphitic material that remains links into a sheet-like crystalline structure, forming what is known as “synthetic graphite”. Synthetic graphite can have a purity of over 99% carbon, and it is used in manufactured products where extremely pure material is required.

Graphite: Critical Mineral

Owing to its metallic properties — such as thermal and electrical conductivity — as well as chemical stability, graphite is nowadays used in a variety of industrial applications including electric motors and lubricants. It is also a key material in pencils, steel manufacturing and consumer electronics.

However, perhaps the most prominent application, both in the present and future, is electric vehicles, where graphite is used as the anode component of lithium-ion batteries.

In fact, as an EV battery ingredient, graphite is the second-largest component by weight, evening outranking lithium. Each battery is said to contain at least 10, and up to 30, times more graphite than lithium.

More importantly, graphite is currently the only material that can be used in the battery anode, and there are no substitutes. This is due to the fact that, with high natural strength and stiffness, graphite is an excellent conductor of heat and electricity.

Given the global transition from gas-powered cars towards plug-in vehicles, we’re sure to see a spike in graphite usage in the years to come.

According to the World Bank, graphite accounts for nearly 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all Li-ion batteries, accounts for only 4%.

An average hybrid-gasoline electric vehicle carries up to 10 kg of graphite, while a plug-in EV has seven times that amount – around 70 kg. So, for every million electric vehicles, which is only about 1% of the new car market, we need in the order of 75,000 tonnes of natural graphite, representing a 10% increase in the current flake graphite demand.

BloombergNEF estimates that the EV battery market alone will consume well over 1.6 million tonnes of flake graphite per year, resulting in at least a ten-fold increase in demand by 2030.

Years down the line, the USGS believes the large-scale fuel cell applications that are being developed could consume as much graphite as all other uses combined.

The International Energy Agency forecasts that the electric mobility and low-carbon energy sectors will demand 25 times more graphite per year by 2040 than today.

This is worrisome considering that total graphite mined in 2020 for all uses, including lump graphite for pencils and graphite used in nuclear reactors, was only 1.1 million tonnes. At this rate, the natural flake graphite market could easily reach a deficit as soon as 2023, with few new graphite sources under development worldwide.

The energy-related implications of such a shortage is why graphite has been identified as a critical and strategic mineral by several governments across the world, including Europe and the US.

Another big factor behind the designation of its critical mineral status is the reliance by these nations on foreign imports for their graphite supply.

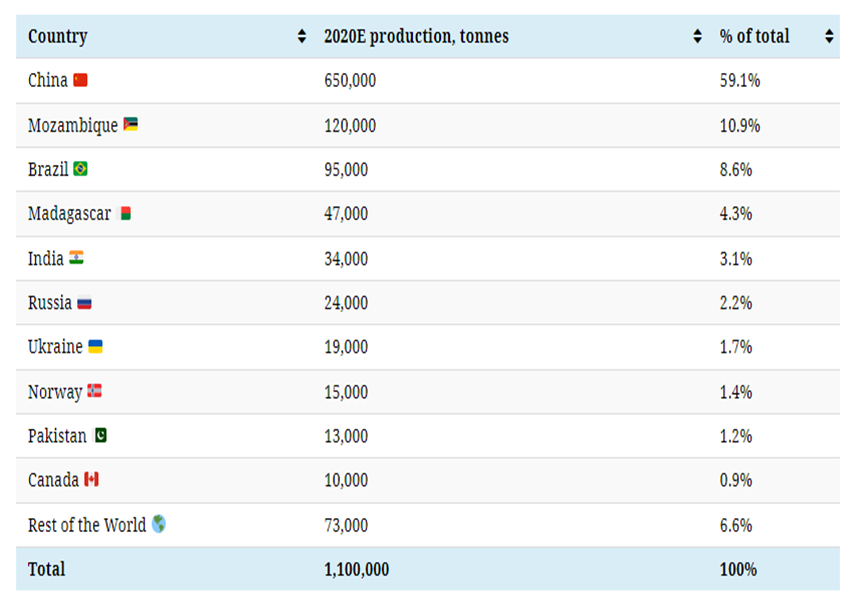

At the moment, nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. Approximately 59% of the world’s natural graphite production last year came from China, making it a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India (see below).

The US, despite boasting a large EV market, does not produce any natural graphite, and therefore must rely solely on imports to satisfy domestic demand. The level of foreign dependence has increased over the years, with the US importing 38,900 tonnes of graphite in 2016, followed by 70,700 tonnes in 2018.

According to the USGS, in 2020 the US imported 42,000 tonnes, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers were China (33%), Mexico (23%), Canada (17%) and India (9%).

But remember, the US is not 33% dependent on China for its battery-grade graphite, but 100%, since China controls all the spherical graphite processing. Such a level of dependence can be considered both unsustainable and uneconomical.

It’s also important to consider the environmental ramifications of persisting with China as the go-to graphite source. Coal still dominates China’s energy mix, which means the carbon footprint of all production, including that of synthetic graphite, is quite high.

One study found that producing 1 kg of synthetic graphite releases 4.9 kg of carbon dioxide into the atmosphere, whereas for natural graphite the CO2 emission is 1-2 kg.

Synthetic graphite currently accounts for 58% of the anode material market share, but its environmental footprint means that the industry is expected to gradually shift towards natural graphite.

In short, the development of graphite mines outside China will be key to not only solving a potential supply deficit, but also accomplishing our climate goals.

Graphite in Quebec

With demand for clean energy metals like graphite taking off and potentially leading to a global supply crunch, the world’s need to raise its mine supply has never been greater.

In Canada, the quest to establish a secure supply of battery materials has already begun. Like its US neighbors, the Canadian government has drawn up a list of “critical minerals” that are deemed to be building blocks for the clean and digitized economy, among those is graphite.

Last year, it produced an estimated 10,000 tonnes of natural graphite, representing 0.9% of the global total.

In 2019, the federal government launched the Canadian Minerals and Metals Plan (CMMP), emphasizing the development of the nation’s critical minerals and improvement of its supply chain resiliency. Several provincial governments have also followed suit with similar initiatives.

For graphite mining, the results are evident. In Quebec, there are several graphite projects under development, many of which are in the advanced stages. The province currently hosts the only graphite mine in North America at Lac-des-Iles, but this operation is slated for closure next year.

Construction has already begun on Nouveau Monde’s (TSXV: NOU) Matawinie project located in Saint-Michel-des-Saints, about 120 km north of Montreal. Commercial production is scheduled to begin by the end of 2023.

At full scale, this operation is expected to produce 100,000 tonnes of spherical purified graphite for the battery electric vehicle and energy storage markets. Interestingly, the proposed graphite mine will also become the first all-electric open-pit mine in the world.

Like NOU, another Quebec-based company that is committed to serving the EV industry and other green energy applications is Lomiko Metals Inc. (TSXV: LMR) (OTC: LMRMF) (FSE: DH8C), who we at AOTH believe is on its way to developing another highly productive graphite mine in one of the most prolific regions in Canada.

La Loutre Graphite Property

Lomiko Metals currently holds a 100% interest in its La Loutre graphite development in southern Quebec, consisting of one large, continuous block with 42 mineral claims for a total area of 2,509 hectares.

The property is located approximately 117 km northwest of the city of Montréal and 53 km east of the Imerys Carbon and Graphite’s Lac des Iles mine. Farther out, Nouveau Monde Graphite and its high-purity mineral reserve at Matawinie are located 230 km to the north.

La Loutre was originally explored for base and precious metals in the late 1980s. However, historical reports have also pointed to graphite being present in different lithologies on the property.

Recent sampling by Lomiko has confirmed a graphite-bearing structure covering an area approximately 7 kilometers by 1 kilometer with results of up to 22.04% graphite in multiple parallel zones of 30-50 meters wide.

Another area has also been identified covering approximately 2 kilometers by 1 kilometer in multiple parallel zones of 20-50 meters wide which include results up to 18% graphite.

The two mineralized areas on the property were later named the Electric Vehicle (EV) zone and the Graphene-Battery zone respectively for the potential applications of the graphite material contained in each.

The project’s first resource estimate (2016) was obtained from only the Graphene-Battery zone (see below), containing a pit-constrained 18.4 million tonnes of 3.19% graphitic carbon (Cg) indicated and 16.7 million tonnes at 3.75% Cg inferred.

Encouraged by the initial estimates, Lomiko pursued further exploration drilling at La Loutre, including the EV zone, to boost its resource base. The latest drill program in 2019 returned positive results, which had high-grade intercepts of 87.9 m of 7.14% Cg, including 21 m of 15.48% flake graphite; and 116.9 m of 4.80% Cg, including 15.2 m of 18.04% flake graphite.

These results allowed the company to expand the project’s resources to about 23.2 million tonnes indicated grading 4.51% Cg (for 1.04 million tonnes of contained graphite), plus 46.8 million tonnes inferred grading 4.01% Cg (for 1.9 million tonnes of graphite).

Based on these resource estimates, a Preliminary Economic Assessment (PEA) for the La Loutre flake graphite project was released in July, delivering positive results.

The PEA outlined an open-pit mine with average annual graphite concentrate production of 108,000 tonnes for the first eight years, and a life of mine average yearly production rate of 97,400 tonnes for 14.7 years.

Cash costs are pegged at $386 per tonne of graphite concentrate and all-in sustaining costs (AISC) are $406 per tonne — both in the lower end of the industry spectrum.

Upfront costs (capex) are reasonably low at C$236.1 million, which includes mine pre-production, processing and infrastructure (roads, power line construction, co-disposal tailings facility, ancillary buildings and water management).

According to the PEA study, La Loutre has the potential to become a major North American graphite producer, with an after-tax net present value (NPV) of C$186 million and a 21.5% internal rate of return (IRR).

Another Matawinie?

The numbers shown in Lomiko’s PEA are compelling, given that the project’s NPV and IRR are considered to be healthy even in weaker scenarios, according to analysts at Vancouver-based Fundamental Research Corp (FRC).

Furthermore, the near 15-year mine life (open-pit and flotation) is considered a conservative estimate, it accounted for only 49% of the indicated and inferred resource at La Loutre.

In fact, the updated resource estimate shown in the PEA was much higher than FRC’s original estimate (141% vs 75%), with weighted average grades increasing by 20% as well.

Also, despite being a smaller-scale project, La Loutre’s estimated annual graphite output is almost identical to that of Nouveau Monde’s Matawinie, one of the premier graphite projects in North America right now. It’s also important to know that La Loutre has an average grade of over 6.5% during the life of mine, which is very much comparable to Matawinie.

For these reasons, FRC believes Lomiko, as a graphite company, is severely undervalued compared to its peers. On an enterprise value to resource basis, FRC determined that LMR is trading at just C$15/tonne versus the sector average of C$27/tonne (as of August 6, 2021).

From this, the research firm arrived at a valuation of C$0.23 per share for Lomiko’s comparables, again indicating that the stock is being overlooked (trading at C$0.09) in the current market.

Conclusion

The La Loutre PEA essentially shows us that Lomiko holds a hugely discounted graphite asset in the current marketplace, offering a great entry point for investors in the EV battery materials space.

It’s also worth mentioning that Lomiko is simultaneously developing the Bourier lithium property, also in Quebec, within a region that already hosts several other lithium deposits and known lithium mineralization. This goes to show that the company is fully committed to developing a critical minerals portfolio in the province.

Taking a step further, Lomiko recently announced a new growth strategy focusing on the acquisition and development of critical minerals assets, along with a new management team of highly regarded professionals in their respective fields. LMR’s new management teams intends to develop the La Loutre project and put it into production.

Lomiko will start Pre-feasibility Study (“PFS”) early in 2022. The PFS will be initiated with infill drilling in Q1 2022 with the goal of converting Inferred mineral resources into Measured and Indicated (M&I). Lomiko will also continue in 2022 with the baseline studies initiated in August 2021 with the goal of submitting environmental registration (Project Notice) in Q3 2022.

Lomiko Metals Inc.

TSXV:LMR, OTC:LMRMF, FSE:DH8C

Cdn$0.09, 2021.12.14

Shares Outstanding 215m

Market cap Cdn$19.3m

LMR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Lomiko Metals Inc. (TSXV:LMR). LMR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.