Lithium prices take off, graphite demand to surge 9X on EV battery growth

2021.03.06

Currently, only 1% of the world’s vehicles are electric, but by 2030 they are expected to represent about 11% of new car sales, according to commodities consultant Wood Mackenzie.

And while there are several obstacles to increasing that percentage of EVs to regular vehicles, including charging station infrastructure and making the sticker prices of electric vehicles affordable to the average person, recent research suggests the battery storage market is growing in leaps and bounds.

According to an analysis by Adamas Intelligence, in 2020 a total of 134.5 gigawatt hours (GWh) of battery capacity was deployed globally into newly sold passenger BEVs, PHEVs and HEVs, an increase of 39.6% compared to 2019.

The added capacity is on trend with a report last year from Roskill, which found that lithium-ion battery demand is expected to increase more than 10-fold.

“The pipeline capacity of battery Gigafactory’s is reported by Roskill to exceed 2,000GWh in 2029, at over 145 facilities globally,” the report reads. “Driven by demand from the automotive and energy storage markets, NCM/NCA type cathode materials are expected to remain dominant, though other cathode types will take market share in niche environments or applications.”

The bulk of these sprawling new battery-making facilities are likely to be in China, which currently produces around three-quarters of the world’s lithium-ion batteries.

According to sector expert Simon Moores, of Benchmark Mineral Intelligence, the United States is falling further behind China in the global battery arms race, with the country only holding 9% of lithium battery market share.

Last year there were 136 EV battery plants in operation or being planned, with 101 in China and 8 in the US; incredibly, China is building a battery Gigafactory at the rate of one a week.

These plants are not only pumping out batteries for EVs, which is by far the fastest-growing market for them, but utility-grade energy storage, and consumer electronics such as smart phones and power tools.

New energy storage systems in the United States are growing in leaps and bounds. According to a 2020 report by commodities consultancy Wood Mackenzie, and the US Energy Storage Association, over 2,000 megawatt-hours (MWh) were brought online in the fourth quarter of last year.

That figure is a 182% increase from Q3, making Q4 the new record for US storage, states Woodmac. Moreover, the United States installed more storage in 2020, 1,464 megawatts or 3,486 MWh, than the seven years leading up to it, @ 3,115 MWh.

And there’s more to come. The firm’s head of energy storage, Dan Finn-Foley, predicts the US energy storage market will add five times more megawatts of storage in 2025 than was added in 2020, with front of the meter (FTM) storage continuing to contribute between 75-85% of new MW each year.

Lithium market update

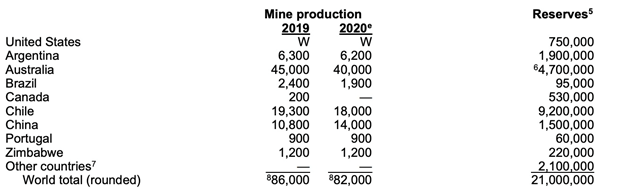

World production of lithium came to 82,000 tonnes in 2020, according to the United States Geological Survey (USGS). This represents a 4.8% decline from the prior year, primarily due to oversupply and lower lithium prices.

The production figure is meager compared to total lithium resources identified by the USGS, which is 86 million tons worldwide, 7.5% higher than 2019. (21Mt reserves versus 17Mt)

An oversupplied market continued to push prices down in 2020, with the average price of lithium carbonate fetching just $8,000 per ton, according to Statista.

However, the demand-side dynamics may reverse the price slide should the EV revolution continue its course.

In fact, we already see this happening.

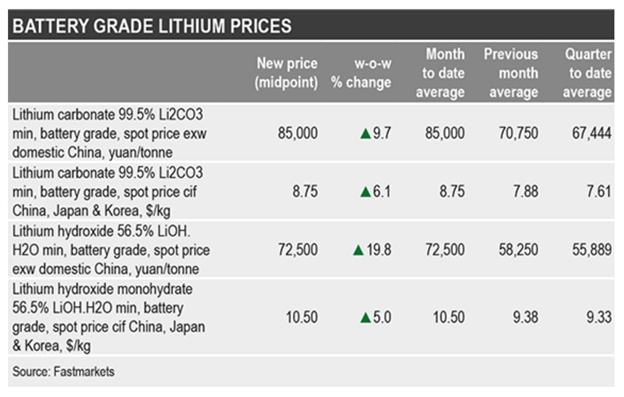

Benchmark Mineral Intelligence recently came out with data indicating that Chinese battery-grade lithium prices are on a tear in 2021, having bottomed out in the second half of 2020 following a lengthy slump.

The price of ex-works lithium carbonate in China (≥99.5% Li2CO3) rose 68% during the first two months of the year, on the back of high battery demand, according to Benchmark. The country’s battery production totaled 12 GWh in January, an increase of nearly 320% compared to the same month last year, when China began dealing with the first cases of coronavirus.

Interestingly, demand was particularly strong for cathodes with lithium iron phosphate (LFP) chemistries, compared to the more popular nickel-cobalt-manganese (NCM) and nickel-manganese-aluminum (NCA) cathodes. LFP battery production is up nearly 500%, year on year.

Surging Chinese lithium carbonate prices, which now hold a premium over hydroxide prices for the first time since April 2018, helped push the Benchmark Lithium Price Index up by 14.4% in February 2021, its second-largest move on record after January 2021, Benchmark, the leading data provider for the Li-ion battery supply chain said.

Three years of falling lithium prices reportedly failed to incentivize sufficient investment into the supply chain.

It is not only lithium carbonate that is enjoying a reversal of fortune. All 11 of Benchmark’s lithium prices, including lithium hydroxide, up 8% year to date, saw increases in February. The reason? Producers of spodumene, a mineral containing lithium, and lithium chemicals worldwide have started to sell out inventories and fill order books through to the end of the second quarter, according to Benchmark.

On March 3, Metal Bulletin ran with the following headline: ‘Chinese lithium hydroxide up 20% in tight market’.

S&P Global Platts appears equally bullish on lithium prices. In the firm’s China Battery Metals Outlook for 2021, China’s demand for battery grade lithium carbonate and hydroxide is expected to increase in 2021 on stronger electric vehicle sales, pushing domestic prices higher.

Over half (56%) of respondents to its survey believe there will be a big recovery in the battery sector this year, with most expecting domestic (Chinese) lithium carbonate prices would reach yuan 80,000 per tonne ($12,371/mt) this year, an increase of more than 20% from early January.

Lithium carbonate and hydroxide prices have rebounded by 88% and 21% from lows over July-August 2020, surging by 32% and 13%, respectively, in January alone, according to Platts.

Some survey respondents noted that with few new projects in the pipeline this year, spodumene supply could struggle to keep up with demand, ensuring prices are well supported.

On the demand side, Platts refers to China’s Association of Automobile Manufacturers, which predicts EV sales this year will hit 1.8 million units, up 40% from a year earlier, based on a recovering economy and policies that boost electric vehicle purchases.

Cypress Development Corp.

The US currently supplies only 1.2% of the world’s lithium, ranked 7th globally, despite having lithium reserves that are comparable to Australia’s. However, this will change when Nevada undertakings like Cypress Development’s (TSX.V:CYP, OTC:CYDVF) Clayton Valley Lithium Project start production.

Interestingly, the lithium at Cypress’ Clayton Valley deposit would be mined from neither brine nor hard rock, but claystone. This is similar to the Sonora deposit in Mexico, which is the world’s largest in terms of reserves, being developed by Ganfeng Lithium and its partners.

Cypress’ project has a pit-constrained mineral resource of 432.4 million tonnes averaging 1,088 parts per million (ppm) Li in the measured category and 160.9 million tonnes at 1,032 ppm Li in indicated, for a total of 593.3 million tonnes at 1,073 ppm Li (measured and indicated). The amount of lithium contained in the pit-constrained M&I resource totals 636.4 million kg, or 3.387 million tonnes of lithium carbonate equivalent (LCE).

An average production rate of 15,000 tonnes per day to produce 27,400 tonnes LCE annually over a +40-year mine life means Cypress’s lithium project stacks up extremely well against any of the 10 deposits listed here.

The company in our opinion is extremely undervalued, trading at just $1.15 per share with a market value of $113 million, especially having already completed a preliminary economic assessment (PEA) and prefeasibility study. Cypress is well-liked by the market. Starting 2020 at $0.20/sh, CYP had a 10-timer, reaching a high of $2.21 on Jan. 12, 2021.

In January of this year Cypress said progress has been made in a scoping-level study of chloride-based leaching to recover lithium from claystone; and in February, announced that a previous C$8.5 million bought deal financing was doubled to $17 million due to strong demand from investors. A total of 13.6 million units were sold @ C$1.25 per unit.

Cypress Development Corp.

TSX.V:CYP, OTCQB:CYDVF

Cdn$1.15, 2021.03.05

Shares Outstanding 103,884,670m

Market cap Cdn$113.5m

CYP website

Graphite market update

Like lithium, graphite is indispensable to the global shift towards electric vehicles; it is the second-largest component in lithium-ion batteries by weight, with each EV containing between 40 and 60 kg of material.

Contrary to popular belief, there is actually more graphite in a lithium-ion battery than lithium. Graphite in spherical form is in the anode while lithium is used for cathodes.

From graphite mining to battery cell production, China holds over 70% of graphite market share.

Spherical graphite can only be produced from flake graphite, a form of natural graphite, upgraded to a high purity level, but its manufacturing process is expensive and wastes up to 70% of the flake graphite feed.

Out of the approximately 1.2 million tonnes of natural graphite processed worldwide each year, only 40% is flake graphite. This figure is far from enough to sustain the growing demand for battery materials.

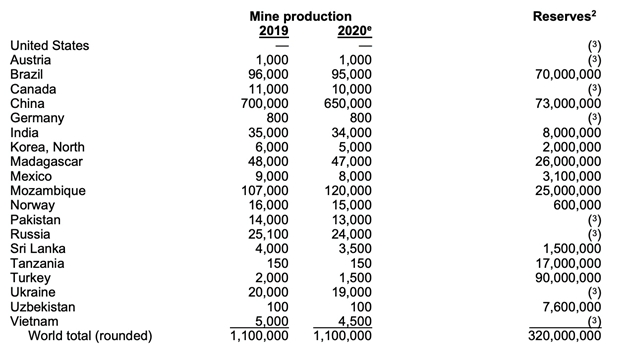

The World Bank forecasts that lithium batteries will require 4.5 million tonnes of graphite per year by 2050. This is a 500% increase over 2018 production levels and a 318% increase over total mined graphite in 2019. According to the USGS, only 1.1 million tonnes of graphite was mined in 2020.

Tesla’s Gigafactory 1 in Nevada, once complete, is expected to need around 35,000 tons of spherical graphite per year, which is the same as total graphite consumed by the US in 2020, after importing 41,000 tons of natural graphite.

The company’s second US Gigafactory, in Texas, would have upwards of 30 times the battery-making capacity of Gigafactory 1.

If expected graphite demand comes to fruition, Tesla should have no trouble filling orders. Benchmark Mineral Intelligence expects to see double-digit growth from 2022 onwards for the battery segment.

Based on the number of Gigafactory’s being built or proposed, the London-based firm estimates graphite demanded by battery anodes to be 1.75 million tonnes by 2028. That is roughly nine times 2017 mined graphite production, and higher than last year’s 1.1Mt total!

Remember, the mining industry still needs to supply graphite for all its other uses, including brake linings, lubricants, powdered metals, refractory applications and steelmaking.

“Demand from the lithium-ion market alone is expected to rise from nearly 200,000 tonnes per year in a 700,000 to 800,000 tonne market at current to nearly 3 million tonnes a year in a 4 million tonne market by 2030,” George Miller of Benchmark said at a webinar back in December.

As mentioned China currently produces over two-thirds of the world’s graphite, however according to Fast Markets, Decreased availability of graphite products from China due to strong domestic consumption, coupled with increased transportation costs, has fostered interest in material from other sources, with producers reporting increased demand for material ranging from large sizes to amorphous flake.

Graphite One Inc.

This bodes well for companies like Graphite One (TSXV:GPH, OTCQB:GPHOF), developing a huge graphite deposit in Alaska.

Located on the Seward Peninsula in western Alaska, the company’s Graphite Creek property hosts America’s highest-grade large flake deposit.

A preliminary economic assessment (PEA) released in 2017 showed 81 million tonnes of resources, mostly in the inferred category at a grade of 7% Cg, containing about 5.7 million tonnes of graphite.

The same study envisioned a long-life (40 years) operation — based on drilling less than 20% of the deposit — with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year once full production begins in the sixth year.

Tests carried out on the property found that 75% of the flake graphite could be converted into spherical graphite, which is the form used in EV batteries. In comparison, only 30-40% of the large flake graphite found in other known deposits around the world can be turned into spherical graphite.

Last month, US President Joe Biden announced his administration’s plans to conduct a review of its key supply chains, including for semiconductors, high-capacity batteries, medical supplies, critical minerals and rare earth metals.

President Biden’s Executive Order follows the designation of Graphite One’s Graphite Creek project as a High-Priority Infrastructure Project (HPIP) in both the “renewable energy” and “manufacturing” sectors by the U.S. Government’s Federal Permitting Improvement Steering Committee (FPISC), the culmination of a process that began when the project was nominated for HPIP designation by Alaska Governor Mike Dunleavy in October 2019.

The High-Priority designation allows Graphite One to list on the U.S. Government’s Federal Permitting Dashboard, which ensures federal agencies coordinate their project review authorities, resulting in a more efficient process with more transparency for state agencies and the public.

This new executive order will give leverage to domestic supply chain projects such as Graphite One during the permitting process and open-up sizable financing opportunities to fast-track these projects towards production.

Graphite One Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$1.44, 2021.03.05

Shares Outstanding 43,109,143m

Market cap Cdn$88.8m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Graphite One Inc.

(TSX.V:GPH, OTCQB:GPHOF). GPH is a paid advertiser on his site aheadoftheherd.com

Richard owns shares of Cypress Development Corp.

(TSX.V:CYP, OTCQB:CYDVF) CYP is not a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.