Lithium industry needs to invest $42 billion by end of the decade to meet demand: BMI

2022.05.18

Despite an economic slowdown in China due to the return of the covid-19 pandemic, demand for lithium is expected to outstrip supply in the long-term, leading to a shortage of the metal that is crucial for lithium-ion batteries — used in electric vehicles, grid-scale energy storage and a plethora of consumer applications ranging from smart phones to hand-held power tools.

Lithium prices soften

2021 was a record year for lithium prices.

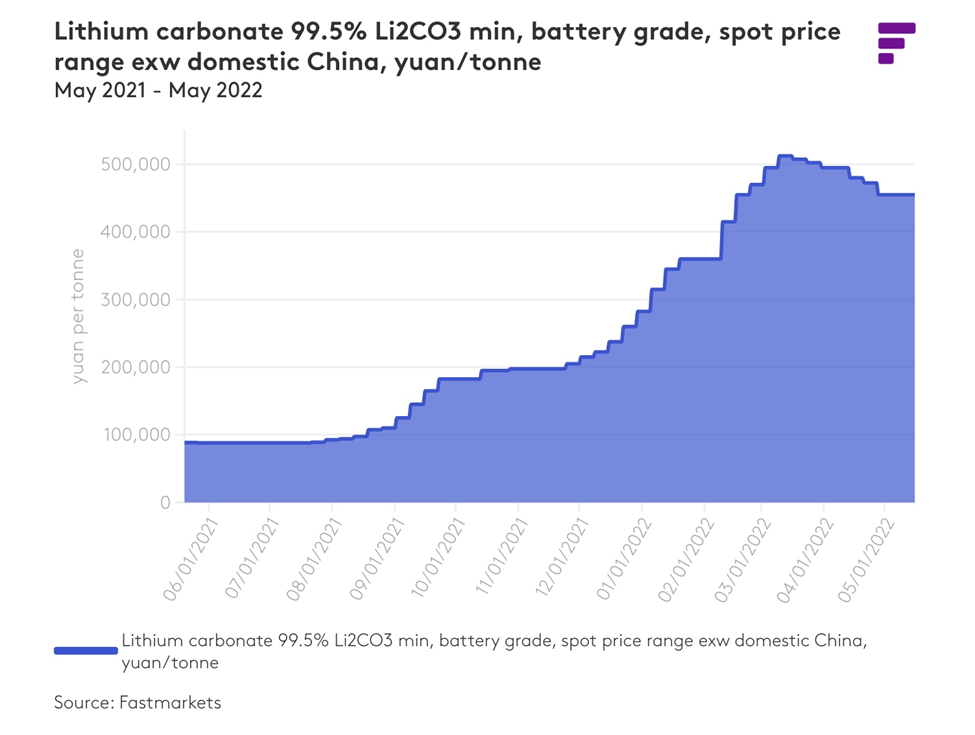

Data from S&P Global Platts in January showed that lithium carbonate prices in China rose 531% on the year, on the back of heavy demand from the automotive sector.

A mad scramble for lithium carbonate in China, which has come to dominate the lithium supply chain (from raw materials extraction to production of battery packs, the Chinese share of the battery market has increased dramatically from 60% in 2018 to 72% in 2020), pushed prices higher in the first quarter of 2022, after more than quadrupling last year.

A mid-March assessment by Benchmark Minerals Intelligence (BMI), a battery supply chain researcher and price reporting agency, found battery-grade lithium carbonate (EXW China, ≥99.5% Li2CO3) averaging $76,700 a tonne. In March of last year it was trading at just $13,400 a tonne.

(EXW (ex-works) is an international trade term that describes when a seller makes a product available at a designated location, and the buyer of the product must cover the transportation costs.)

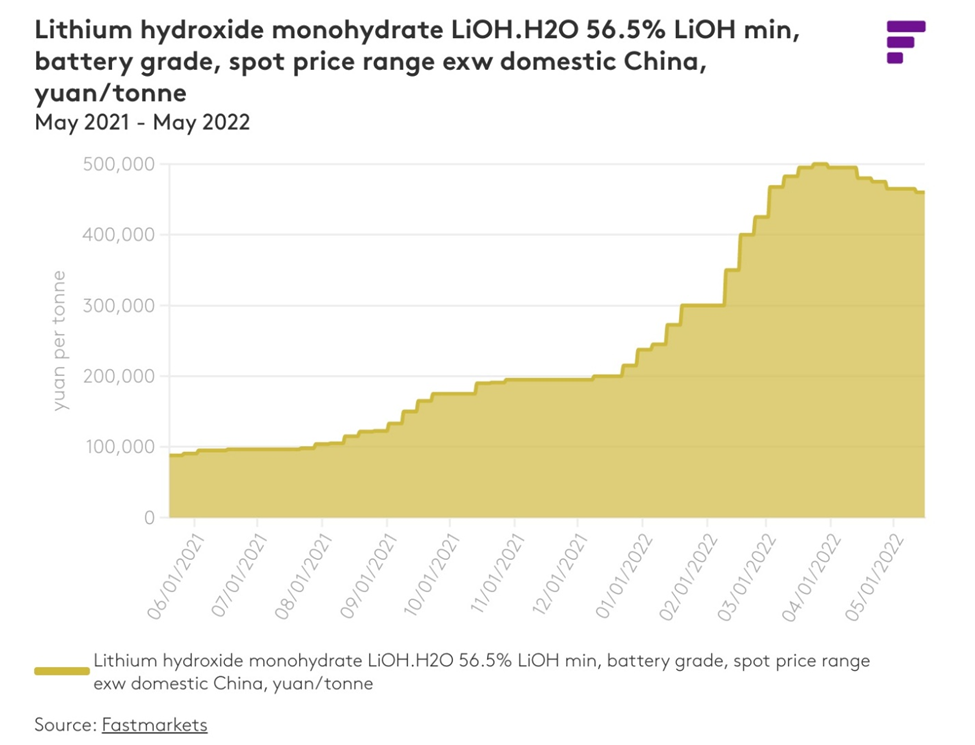

Meanwhile, the price of lithium hydroxide, used in high nickel-content batteries, shot up 120% to mid-March, with Benchmark noting that Chinese inventory levels for hydroxide, carbonate, and spodumene feedstock were very low, sustaining the high price environment.

However, over the past two months, the Chinese lithium market has suffered a setback, after a covid-19 outbreak in April largely paralyzed the entire supply chain.

According to Fastmarkets, as a result of continuing virus control measures in China, the country’s electric vehicle (EV) output fell by 33% month on month to 312,000 units in April, while EV sales declined by 38.3% to 299,000 units, data from the China Association of Automobile Manufacturers (CAAM) showed.

Logistics bottlenecks in locked-down cities like Shanghai are making it difficult to get permits to deliver lithium and other battery materials.

The slow recovery of China’s EV markets, and ongoing supply chain disruptions, have thinned demand for battery metals including nickel, cobalt and lithium. Several cathode producers have reportedly reduced their production by 20-50%, with China’s output of NCM batteries in April falling by 33.9% month on month to 10.3 gigawatt hours (GWh).

According to Fastmarkets’ price assessment, lithium carbonate, 99.5% Li2CO3 min, battery grade, spot price range, exw domestic China, was 440,000-470,000 yuan per tonne on May 12, unchanged since April 28.

Buying appetite for lithium hydroxide, the feedstock for nickel-manganese-cobalt (NCM) batteries, has dropped faster than for lithium carbonate.

Fastmarkets’ price assessment for lithium hydroxide monohydrate, LiOH.H2O 56.5% LiOH min, battery grade, spot price range, exw domestic China, was 450,000-470,000 yuan per tonne on May 12, narrowly down by 10,000 yuan from 450,000-480,000 yuan a week earlier.

But outlook still bullish

Yet despite these headwinds in China, global lithium demand is expected to be resilient this year and beyond. When measured against a tight lithium market, the outlook for the lightweight metal is good, with prices forecast to keep rising.

According to Benchmark, to meet demand, the global lithium industry needs up to $42 billion of investment by the end of the decade. This works out to $7 billion each year from now until 2028, helping it to meet predicted demand of 2-4 million tonnes per annum by 2030, which is four times higher than the 600,000 tonnes of lithium expected to be produced in 2022.

Bloomberg notes the forecast, from a recent BMI report, comes as Europe and North America look to reduce their dependency on Chinese lithium imports and to try to develop their own lithium production.

For example, the Biden administration has earmarked more than $3 billion to help process key battery metals including lithium, while in Canada, this year’s budget includes CAD$3.8 billion to build a domestic critical metals supply chain.

Electric cars are expected to account for nearly 80% of EV market revenues and 83% of battery demand over the next two decades. A recent report by research firm IDTechEx showed EV sales more than doubling in 2021 to 6.4 million.

Shortage expected

S&P Global forecasts that this year, further demand growth could push the lithium market towards a deficit as increased use of the material outstrips production and depletes stockpiles.

Supply of lithium carbonate equivalent (LCE) is forecast to jump to 636,000 tonnes in 2022, up from an estimated 497,000 in 2021 — but demand will move even higher to 641,000 tonnes, from an estimated 504,000, S&P said in its December 2021 report.

Recently, attention has turned to the shortfall of raw materials that is limiting the production of EVs. In Benchmark’s report, CEO Simon Moores said that carmakers may have to get involved in mining if they want to make the cars at scale.

Moores added that, while lithium’s major producers have large investments planned, those alone will not be sufficient and new mines are needed.

His thoughts are echoed by one of the most influential voices in mining, Robert Friedland. Speaking at the Investing in Africa Mining Indaba conference last week, the Ivanhoe Mines founder pointed out the problem with renewable technologies is they are incredibly energy and metals-intensive.

“We’re going to have a freakout as we try to change the world economy unless we develop a lot more mines,” said Friedland via a Mining.com report.

According to his data, a thousand-pound electric vehicle requires 500,000 pounds of raw materials. “So, to transition just the world’s passenger cars to electric, we have to mine more materials in the next 30 years that we mined throughout human history,” he said.

Tesla’s CEO, Elon Musk, reportedly met Indonesia’s President in Texas this month to discuss potential investments and technology. The archipelago nation is a major nickel producer and aims to develop a domestic EV battery materials supply chain. Musk has also made a public appeal for more investment in lithium mining, hinting that the Texas-based automaker would consider mining or refining it after prices rose to “insane levels”.

Miners and battery makers collaborate

Collaboration between mining companies and battery makers is already happening in China. According to a recent Bloomberg story, Gotion High-tech Co. is looking at cooperating with Argentina’s state-owned miners Jujuy Energia, to build a lithium carbonate refinery there. In Zimbabwe, Chengxin Lithium Group and Sinomine Resource Group are joint venturing to explore for lithium, while Chinese mining giant Tianqi Lithium is teaming up with battery maker CALB.

According to S&P Global Platts, the Chinese lithium market is set to face tightening supplies throughout 2022 as the demand-supply mismatch widens.

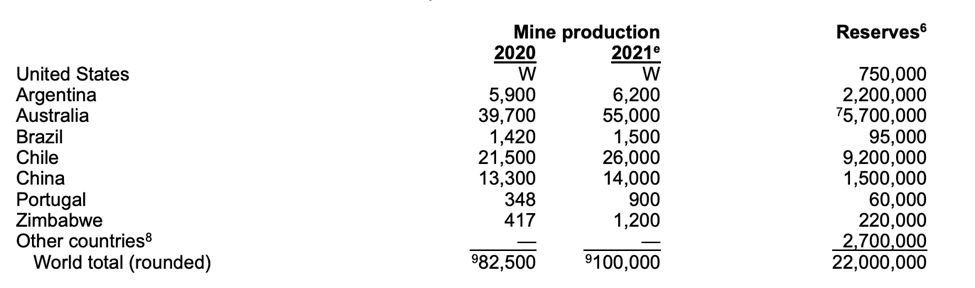

While it has dominated processes that refine lithium and other raw materials into chemicals used in EV batteries, China still relies heavily on imports from countries including Australia, Chile and Democratic Republic of Congo, as the nation currently lacks lithium mines.

US opportunity

A potential lithium supply shortage in China presents an opening for the US to become a crucial figure in the global battery metals supply chain.

The US mines and processes only 1% of the world’s lithium, according to the US Geological Survey. There is only one lithium mine in operation, Albemarle’s Silver Peak, which extracts lithium from brine outside of Tonopah, Nevada, outputting a paltry 5,000 tonnes of lithium carbonate a year.

However, we cannot rule out the United States as a major lithium producer; within its borders are 750,000 tonnes of lithium reserves, ranking it among the top five countries in the world, according to the USGS. In the less certain “resources” category, the US has 9.1 million tons, including continental, geothermal and oilfield brines, pegmatites and searlesite.

Nevada looks to be the focal point of the next “white gold rush” given the abundance of lithium-rich brines and clays, plus its history of lithium production dating back to the 1960s.

Nevada and Canada-focused Victory Resources (CSE:VR, FWB:VR61, OTC:VRCFF) is our top pick in the lithium space. We’re expecting plenty of news flow.

Victory Resources Corp.

CSE:VR, FWB:VR61, OTC:VRCFF

Cdn$0.045, 2022.05.17

Shares Outstanding 110.2m

Market cap Cdn$4.9m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Resources Corp. (CSE:VR). VR is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.