Leveraging The Doomsday Clock

2017.03.03

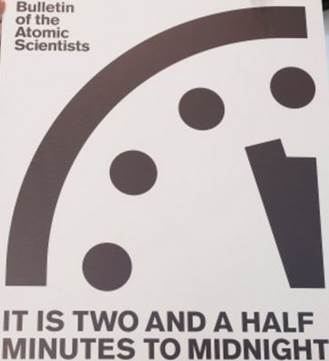

The Doomsday Clock was first used in 1947 (it started at 7 minutes to midnight) as a measure of how close humanity is to destroying our civilization. The Bulletin of the Atomic Scientists recently moved its iconic clock ahead 30 seconds, taking the world to 2½ minutes to midnight.

The scientists said: “Tensions between the United States and Russia that remain at levels reminiscent of the Cold War, the danger posed by climate change, and nuclear proliferation concerns – including the recent North Korean nuclear test – are the main factors influencing the decision about any adjustment that may be made to the Doomsday Clock.”

Since its inception, the clock has moved ahead only 18 times. This new time is the closest to midnight since 1953, when the US government added the Hydrogen bomb to its nuclear arsenal.

Since its inception, the clock has moved ahead only 18 times. This new time is the closest to midnight since 1953, when the US government added the Hydrogen bomb to its nuclear arsenal.

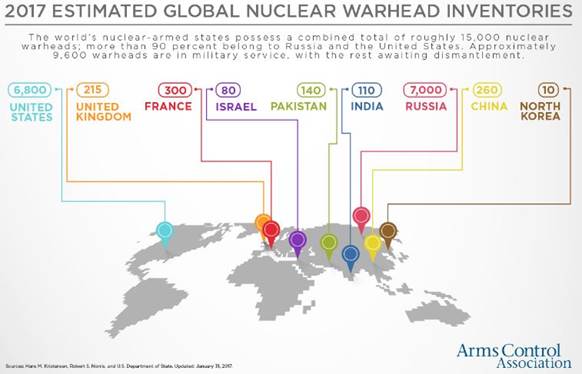

Russia currently has 7,000 nuclear weapons, the U.S. has 6,800. Winston Churchill, talking about the start of the first nuclear arms race between the US and the Union of Soviet Socialist Republics (USSR) said:

“If you go on with this nuclear arms race, all you are going to do is make the rubble bounce.”

Militarily right now, there’s a lot going on in the world.

Russia is flexing it’s still considerable might, North Korea’s flinging it’s nukes helter skelter, Japan’s rearming, the rest of Asia is arming, South American’s have been on a weapons buying spree, so has the Middle East and Europe is waking up and realizing they cannot rely on the U.S. to protect them if they won’t help themselves by increasing military spending.

It’d be hard to go back in history and pick a period of time, other than WWII, when globally we weren’t so militarized.

“In FY 2017, total US government spending for defense (including military defense, veterans affairs, and foreign policy) is budgeted to be $853.6 billion.”

U.S. President Trump is looking to up the military spending portion of the budget by seeking what he called a “historic” 9 percent increase in military spending.

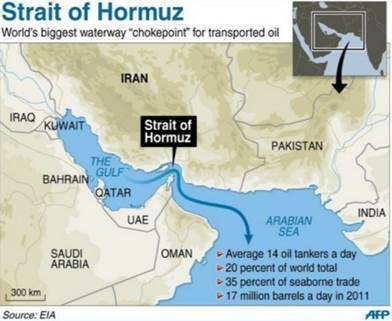

Trump wants more money for the navy so it can establish “a more robust presence in key international waterways and choke points” such as the Strait of Hormuz and South China Sea.

|

|

Trump’s UD$54B military wish list also includes:

- Expanding the Army to 540,000 active-duty troops from its current 480,000.

- Increasing the Marine Corps to 36 battalions from 23.

- Boosting the Navy to 350 ships.

- Raising the number of Air Force tactical aircraft to 1,200 from 1,100.

To pay for his increased defence budget Trump, working with the Republican controlled Congress, will do away with the sequester process that automatically cuts $500 billion in defence over the next decade.

Russia has plans of its own to beef up the countries conventional military forces. “By 2021, we plan to more than quadruple the combat capabilities of our strategic conventional forces, which will fully meet the demands of [Russia’s] conventional deterrence.” Russian Defense Minister Sergei Shoigu

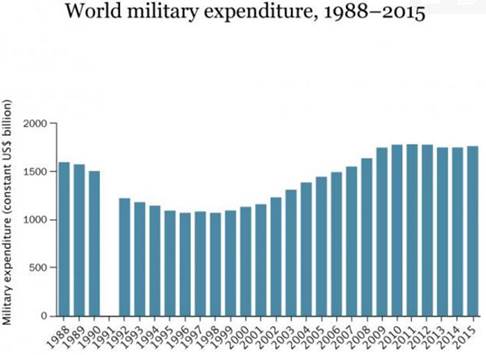

Jane’s has the following to say about the next decade of global arms spending: “After a lackluster 2015, global defence spending rose in 2016 to $1.57 trillion, kicking off what is forecast to be a decade of stronger global defence expenditure, according to the annual Jane’s Defence Budgets Report.” 2016’s $1.57 Trillion Global Defence Spend to Kick off Decade of Growth.

Nuclear Arms Race

The Nuclear Non-Proliferation Treaty requires the U.S. to pursue the “cessation” of a nuclear arms race between superpowers, and to take steps towards mutual disarmament.

In December 2016 Trump told MSNBC “Let it be an arms race.” He later tweeted that the U.S. should “Greatly strengthen and expand its nuclear capability.”

Most recently, in February 2017, Trump said: “If countries are going to have nukes, we’re going to be at the top of the pack.”

In his first call with Russian leader Vladimir Putin, President Trump denounced the 2010 New START treaty that caps U.S. and Russian deployment of nuclear warheads as a bad deal for the United States.

“We need to enhance the combat capability of strategic nuclear forces, primarily by strengthening missile complexes that will be guaranteed to penetrate existing and future missile defense systems.” Russian President Vladimir Putin

What could be the most explosive area on the planet is the hotly disputed Kashmir. “Flexing its nuclear muscles, India carried out back-to-back tests of two nuclear-capable missiles in December and January…Islamabad responded to India’s latest Agni tests by staging its own tests of missiles capable of carrying nuclear warheads, the Babur-3 and the Ababeel.” South Asian nuclear arms race accelerates amid India-Pakistan standoff.

Trump did not start the new nuclear arms race between the U.S. and Russia, Obama did. “The Obama administration is planning to spend over $1 trillion in the next 30 years on an entire new generation of nuclear bombs, bombers, missiles and submarines to replace those built during the Reagan years.” A New Arms Race Threatens to Bring the U.S. and Russia Back to the Nuclear Brink.

“The $100 billion global weapons trade is booming, and the United States remains the industry’s firmly entrenched leader, accounting for 33 percent of the world’s arms exports.” A $100 billion global arms race Trump wants to win

Climate Change

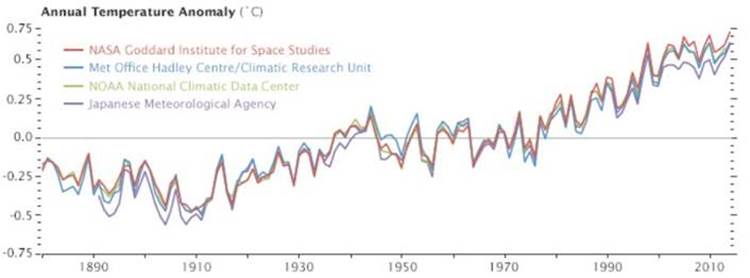

According to NASA’s Goddard Institute for Space Studies (GISS), the average global temperature on Earth has increased by about 0.8° Celsius (1.4° Fahrenheit) since 1880.

Historically small rises, or falls, in temperature (because of more or less sunlight) cause a rise, or fall, in what we today call greenhouse gas. Because these changing atmospheric CO2 and methane levels physically linked the Northern and Southern hemispheres the entire planet would warm or cool as a whole.

Many scientists say it’s very likely that most of the warming since the mid-1900s is because our burning of fossil fuels for energy production and transportation increases greenhouse gas emissions.

Current climate models predict that Earth’s average temperature will keep rising.

Consequences

According to science the world is going to continue to get warmer, polar ice caps will melt, so will the Greenland ice sheet and most glaciers. More sunlight will be absorbed by the Earth’s oceans, causing increased evaporation. Water vapor is a greenhouse gas and amplifies twofold the effects of other greenhouse gases. With Earth’s ice gone there will be significantly less sunlight reflected back into space, vast expanses of Arctic tundra will thaw releasing unbelievable amounts of methane, a greenhouse gas twenty times more potent then CO2.

The polar jet stream has already been altered, wide swinging north-south deviations (meanders) have become the norm – deviating far from its normal path and meandering north into Canada, the jet stream brings warm air while dipping far south over Europe, the polar jet stream brings record cold and snow.

Ocean currents will be altered further impacting our climate and sea levels will rise. Freshwater aquifers will suffer from saltwater intrusion, once habitable zones will become uninhabitable.

Because of increased average global temperatures the tropical rain belt will have widened considerably and the subtropical dry zones will have pushed pole-ward, crawling deep into regions such as the American Southwest and southern Australia, which will be increasingly susceptible to prolonged and intense droughts.

A report by the Intergovernmental Panel on Climate Change (IPCC) concluded that climate change will amplify extreme heat, heavy precipitation, and the highest wind speeds of tropical storms. Extreme weather events are going to happen with increasing frequency, the climate for the area you live in is, if it hasn’t started already, going to change. We are all watching and experiencing these events and changes in real time because changes that use to take tens and tens of thousands of years are now happening in decades.

Earth’s average temperature is expected to continue to rise even if the amount of human caused greenhouse gases in the atmosphere decreases. But the rise would be less than if greenhouse gas amounts remain the same or increases.

Peak Gold

The reality of peak gold production has recently been acknowledged by Bloomberg.

In 2006 South Africa was the world’s number one gold-producing nation producing 8.75 million ounces of gold. South Africa’s gold production has fallen steadily since then and the country is now in 7th spot at 4.5 million ounces in 2016.

In the 1980s 14 more than 20 million oz deposits were found, eleven were found in the 1990s. But only two have been discovered in the past eight years. And none in the past five.

The number of deals in the gold sector in 2016 was the highest since 2011. Companies are looking to shore up their balance sheets by replacing reserves by buying other company’s because they cannot discover large enough deposits to make a difference to their bottom line.

Miners have been high grading, focusing on mining the higher grade ore, to make their balance sheets look better for investors. This practice shortens mine life.

Mining is a self-depleting industry meaning mines have an inherently limited lifespan. Every day a mine operates, it is that much closer to running out of ore. The industry needs to find new deposits in order to replace these ever-depleting mines.

According to the CEO of Randgold Resources Mark Bristow, peak gold production could be reached in the next three years.

“Falling grades and production levels, a lack of new discoveries, and extended project development timelines are bullish for the medium and long-term gold price outlook.” Kevin Dushnisky, Barrick Gold

“We were all talking about how production was going to increase every year. I think those days are probably gone … you are not going to see massive production increases in the industry.” Nick Holland, Gold Fields

Leveraging the Food Chain

For the past decade junior exploration and development companies have outperformed miners at finding new mineral deposits and generating wealth for stakeholders.

“MinEx Consulting…analyzed the performance of explorers and producers operating in Canada between 1975 and 2014. What the consultancy firm found is that, in the last decade, junior companies were responsible for more than three quarters of all new mineral discoveries and were approximately 30 percent more effective than senior companies at generating wealth…In 2009, 2010 and 2012 senior companies failed to make a single new discovery. Juniors handily beat the seniors when it comes to the total number of discoveries. Of all the deposits found, over three quarters were made by junior miners.”

Historically junior resource companies have offered the greatest leverage to increasing demand and a rising gold and silver price. In effect, buying shares in junior resource companies could be the greatest leverage possible to a rising gold and silver price caused by fears of global militarization, climate change (and its denial) and peak gold.

A junior resource companies place in the resource sector food chain is to explore for, find, and develop to a certain point, the world’s future mines – what the world’s larger mining companies need to replace reserves and grow their asset base.

Today the relationship between juniors and majors is so inextricably linked that it’s doubtful a major mining company could replace its mined reserves, let alone grow them, without keeping a close eye on junior’s activities and a check book handy.

FACT – Without our juniors many of today’s operating mines simply would not exist.

Conclusion

Your author believes gold and silver shares and bullion have never been better investments then right now because of:

- Global Militarization

- Climate Change (and it’s denial)

- Peak Gold

- Leverage to the above

All four need be on all our radar screens. Are they on yours?

If they aren’t, they should be.

Richard (Rick) Mills

aheadoftheherd.com

Richard lives with his family on a 160 acre ranch in northern British Columbia. He invests in the resource and biotechnology/pharmaceutical sectors and is the owner of aheadoftheherd.com.

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.