Kodiak Copper starting resource estimate – Richard Mills

2025.01.18

After a topsy-turvy 2024, with spot copper vacillating from $5.10 a pound on May 20 to $3.89 on Aug. 5, the industrial metal is catching a break early in 2025.

Year to date, copper is up 3%, the price increase driven mostly by market expectations that the Trump administration will slowly ramp up tariffs rather than imposing sizeable levies in one go.

According to Bloomberg, The approach is aimed at boosting negotiating leverage and avoiding a spike in inflation, according to people familiar with the matter. That stirred some optimism in Asian stock markets and weighed on the dollar, making commodities priced in the currency more attractive for many buyers.

As the world’s largest copper consumer, what happens in China often gets reflected in the price. The country is expected to use a broad range of stimulus measures to offset the effects of US tariffs and the persistent housing downturn, writes Bloomberg, adding that growth will likely slow this year to 4.5% from a probable 5% in 2024.

Reuters metals columnist Andy Home says “Market optics have turned more bullish,” with metals exchange copper stocks falling from 600,000 tonnes at the end of August to 430,000t at the end of December, led by a steep decline in Shanghai Futures Exchange inventory.

Meanwhile, China is importing more copper. Says Home:

China’s imports of refined copper increased from a 2024 low of 276,000 tons in August to 398,000 tons in November and accelerated further to a 13-month high in December.

The Yangshan copper premium , a closely-watched gauge of China’s import demand, is currently at a one-year high of $75 per ton, indicating China is still hungry for metal.

Another bullish signal for copper is the waning strength of the US dollar. Reuters wrote on Wednesday that the dollar stayed weaker as cooler-than-expected inflation data eased fears that inflation was accelerating and increased the chances of the Federal Reserve cutting interest rates twice this year.

A lower dollar and lower bond yields are generally good for commodities including copper.

Bank of America projects copper will reach $10,750 per tonne ($4.87 per pound) in 2025, in light of potential further interest rate cuts by the Federal Reserve. Also, copper is in a robust position due to strong demand, limited supply, and increased investment in energy transition projects, according to BoA analysts.

A junior resource company’s place in the mining food chain is to acquire projects, make discoveries and advance them to the point when a larger mining company wants to take it over.

Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the world’s next mines.

When was the last time you heard of a major mining company making a greenfields discovery?

Senior miners allocate a relatively small portion of their revenues to exploration, with most expenditures invested in developing existing mines and measures to reduce operating costs. Most majors increase their mineable reserves with mergers and acquisitions (M&A). It increases their reserves, but it does nothing to increase the overall amount of global mineable reserves.

Juniors sit at the very bottom of the mining food chain; their job is to acquire and to advance their project to a resource estimate. Juniors help the majors replace the ore that they are constantly depleting in their operating mines. To be clear, juniors find, and own, the world’s future mines/ resources that majors turn into mineable reserves.

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) is advancing its MPD project, a 338-square-kilometer land package near several operating mines in the southern Quesnel Terrane, British Columbia’s primary copper-gold producing belt. The project is between the towns of Merritt and Princeton, with year-round accessibility and excellent infrastructure nearby.

A key focus of Kodiak’s 2024 drill program was to identify additional near-surface and high-grade mineralization. Drill results from the Adit Zone to date have clearly achieved this.

The holes significantly extend the copper envelope at Adit and when combined with historical drilling, Kodiak’s new results have outlined a sizeable near-surface, high-grade area of mineralization.

The company plans to release a resource estimate on MPD. Kodiak announced on Jan. 16 that it has started work on a National Instrument 43-101-compliant resource estimate that will include seven mineralized zones: Gate/Prime, Man, Dillard, Ketchan, West, Adit, and South/Mid.

Results will be delivered throughout the year, with initial results anticipated in the first half of 2025.

“With successive drill campaigns Kodiak has now successfully outlined multiple mineralized zones across the large MPD property,” said Kodiak’s President and CEO Claudia Tornquist. “Importantly, our work to date has identified several zones with significant higher-grade mineralization, including some right from surface. We are confident that we now have the scale to complete a resource estimate that will reflect MPD’s potential. This work will take place in parallel with our ongoing exploration work as we continue to unlock the exploration upside of the MPD property. It is important to keep in mind that most known mineralized zones are still open in several directions and in addition we have multiple promising and yet-to-be-drilled targets across the whole property.”

Kodiak Copper presents compelling investment opportunity – Richard Mills

Comparing Kodiak Copper to GT Gold (TSXV:GTT) is interesting from an investor’s perspective. Would an investor have made money if they had got in early enough, before the stock price rose following publication of the resource estimate?

GT Gold began exploring its Tatogga project in northwestern BC in 2016. The Saddle South discovery was prospective for gold and silver. While drilling over the next two years outlined a strong mineralized system, it was the much bigger but lower-grade Saddle North porphyry copper-gold deposit that piqued a major’s interest.

A 2017 discovery hole at Saddle North cut 210 meters averaging 0.16% copper, 0.14 grams per tonne gold and 0.28 g/t silver. The grades got stronger the deeper the hole went.

A 2018 hole that undercut the 2017 discovery hit 822 meters averaging 0.26% Cu, 0.42 g/t gold and 0.62 g/t — confirming that the junior was onto a large porphyry reminiscent of the Red Chris mine about 20 km to the southeast.

Intrigued, Goldcorp grabbed an early 10% stake (like Teck has done with KDK), spending CAD$17.9 million in 2019. An additional $8.9M boosted Goldcorp’s stake to 14.9%. (Newmont acquired Goldcorp on April 18, 2019).

With Newmont’s backing, GTT continued to explore Saddle North, resulting in a maiden resource estimate in July 2020.

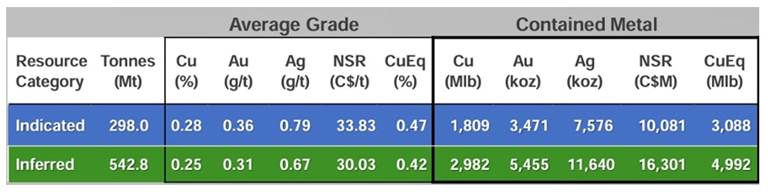

Based on 41 drill holes, Saddle North hosted 298 million tonnes of indicated resources averaging 0.47% CuEq, which translated into 1.81 billion pounds of copper, 3.47 million ounces of gold and 7.58Moz of silver. Inferred resources were 543 million tonnes averaging 0.42% CuEq, yielding 2.98 billion pounds of copper, 5.46Moz of gold and 11.64Moz of silver.

Less than five years after its founding, GT Gold and its Tatogga project was bought out by Newmont, which spent $393 million to acquire the 85.1% of GTT’s shares it didn’t already own.

GT Gold is an example of a company with huge potential to make big money for investors who got in early.

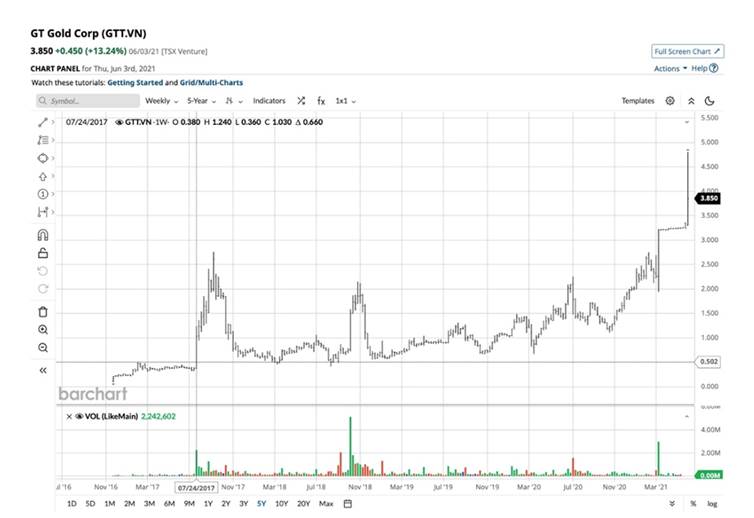

From the chart below, an investor who bought GT Gold for $0.51 in July 2017 and held on until the 2017 Saddle North discovery would have quintupled (5X) their investment. The stock bumped along between $0.50 and $2.50 for the next two years; it was $2.18 at the time of the resource estimate in July 2019 — testing the mettle of investors who had held the stock during the first and second discovery phases when the stock reached peaks of $2.75 and $2.11.

Smart investors though who saw the potential would have bought on the dips and on positive news releases. Those who saw the chance for a takeover by Newmont would have been rewarded handsomely when it happened on March 10, 2021 with Newmont offering $3.25 a share.

The investor who got in at $0.51 and sold at the buyout price of $3.25 would have realized a 537% gain.

GT Gold proves that a junior can make money by putting out a resource estimate, as can investors who play the game right. It wasn’t until Newmont paid $393 million to acquire 85% of the shares it didn’t own that the stock really took off, from $1.92 to $3.21 on March 10, 2021. That’s a 67% gain, but very few investors would have bought and sold on the same day. The most handsomely rewarded would have been those that got in four or five years earlier at <$0.50 to $1.00.

We see no reason why investors won’t do very well for themselves owning KDK; in our opinion it’s an example, brought to you by AOTH, of what patient investors who know how to invest in this sector are paying attention to.

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.39 2025.01.17

Shared Outstanding 75.9m

Market cap Cdn$29.6m

KDK website

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#KodiakCopper #Copper