Kodiak Copper publishes sizeable maiden resource estimate with lots of room to grow – Richard Mills

2025.12.12

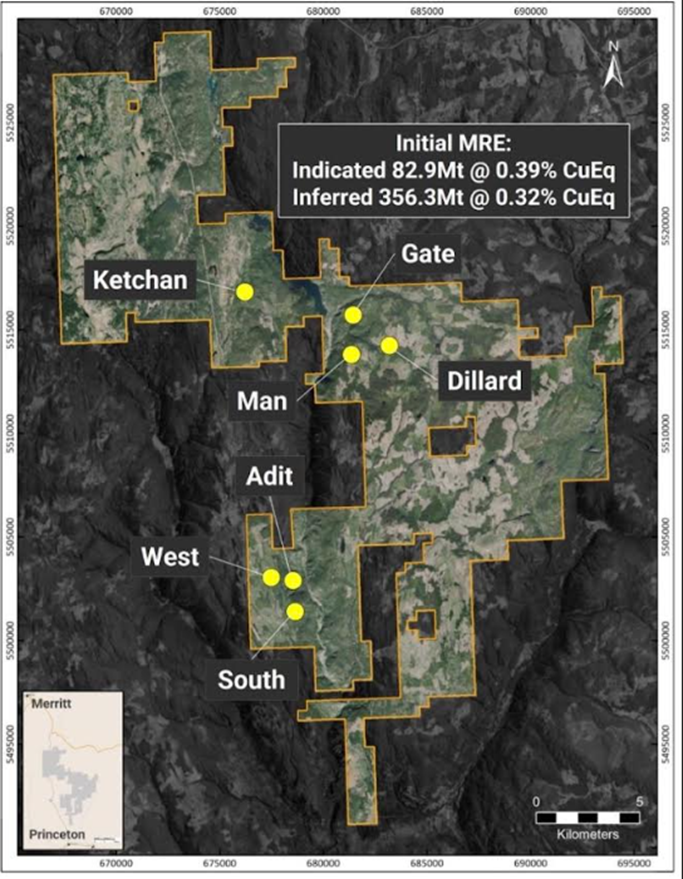

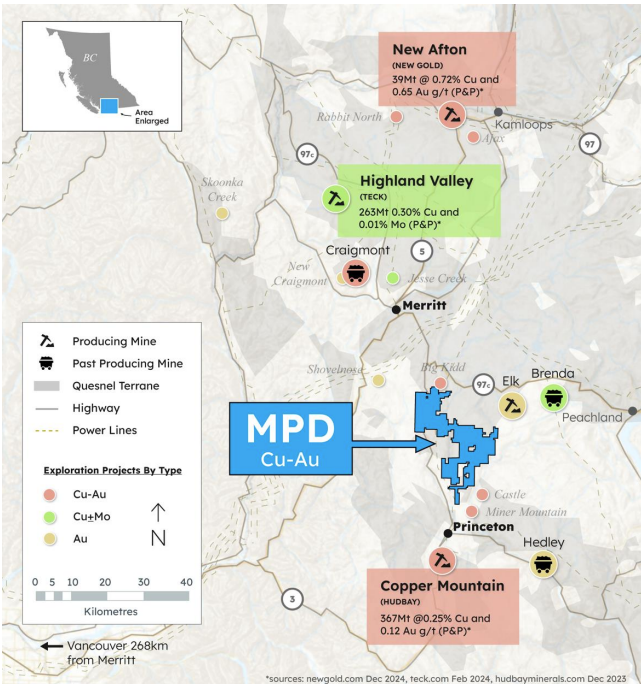

Kodiak Copper (TSXV:KDK, OTCQX:KDKCF, Frankfurt:5DD1) has made good on its promise by the end of 2025 to publish an initial mineral resource estimate on its MPD Copper-Gold Project, located in an long-established mining region in the Quesnel Trough of southern British Columbia.

The Vancouver-based junior reported on Dec. 9 that the resource estimate for MPD includes seven deposits in total, with four deposits reported in June and three reported on Tuesday of this week.

On June 24 Kodiak said the first part of the maiden resource comprised the Gate, Man, Dillard and Ketchan zones.

This was an Indicated resource of 385 million pounds of copper and 250,000 ounces of gold, grading 0.42% copper-equivalent (CuEq).

In the Inferred category, the four zones contained 1.291 billion pounds of copper and 960,000 oz of gold grading 0.33% CuEq.

According to KDK, the first part of the mineral resource estimate was defined using open-pit design shells to constrain the resource models and a cut-off grade of 0.2% CuEq.

Fast forward to the news this week.

Kodiak Copper highlights a large, open-pit initial mineral resource estimate (MRE), which shows the scale and potential of MPD and lays the foundation for future resource growth and development.

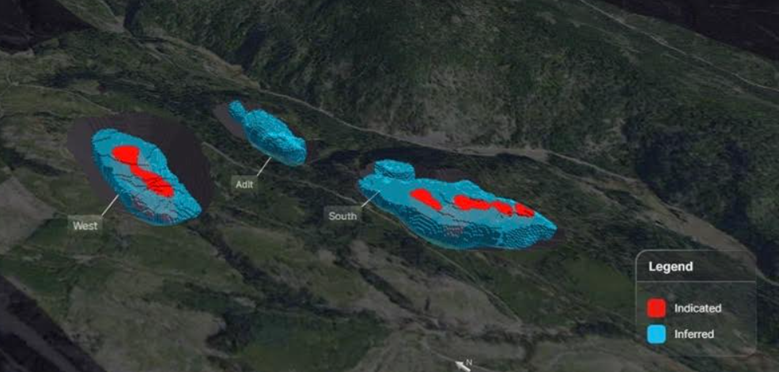

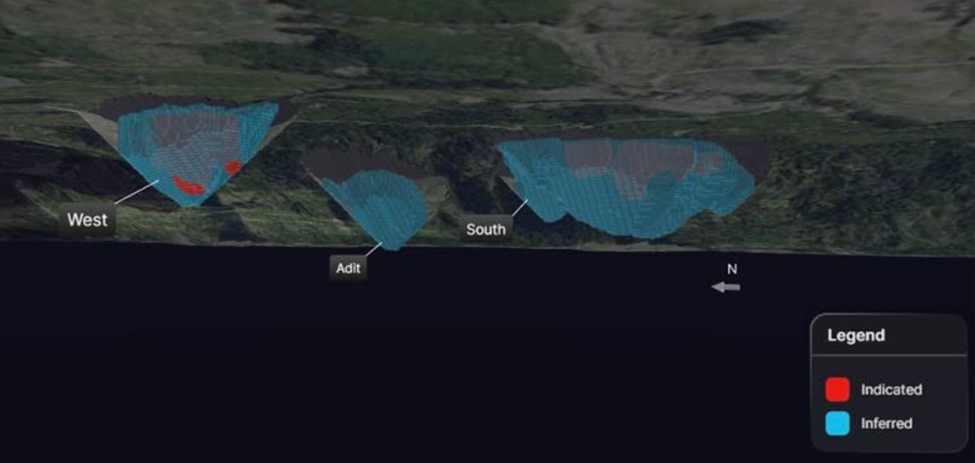

The West, Adit and South deposits all feature shallow mineralization and favorable geometry, characteristics that are expected to support low strip ratios in future economic evaluations. West and Adit host high-grade mineralization from surface, while South is a large bulk tonnage deposit over 1 km in length that is still underexplored.

The MRE is broken into two parts: the total Indicated mineral resource and the total Inferred mineral resource.

The Indicated is 82.9 million tonnes grading 0.39% CuEq for 519 million pounds of copper and 390,000 ounces of gold.

The Inferred is 356.3 million tonnes grading 0.32% CuEq for 1.889 billion pounds of copper and 1.28 million ounces of gold.

Between the Indicated and Inferred categories, the resource amounts to 2.408 billion pounds of copper and 1.67 million ounces of gold.

The MRE is defined using a cut-off grade of 0.2% CuEq.

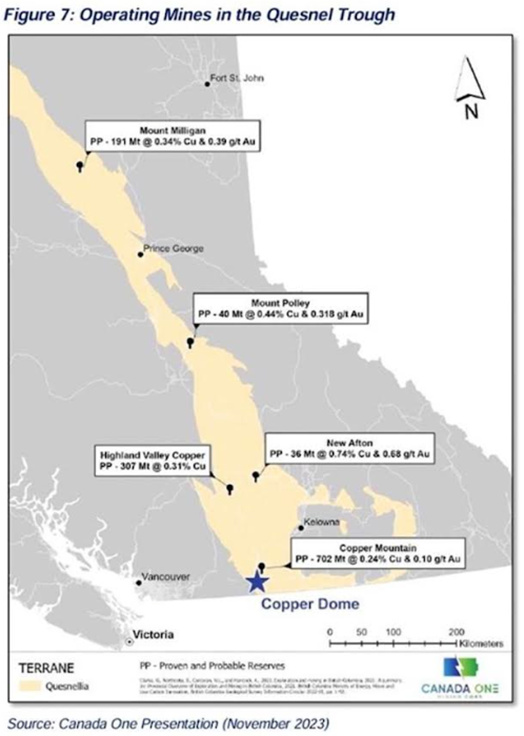

In comparing Kodiak’s copper content in the MRE to that of other copper mines in British Columbia, we find it is within the average 0.3% to 0.4% Cu Eq for large porphyry deposits like Highland Valley and Copper Mountain.

Remember, as stated in the section below, porphyry deposits are usually low-grade but large and bulk mineable, making them attractive targets for mineral explorers.

All deposits at MPD remain open for expansion within and beyond the MRE pit shells, most in multiple directions and at depth.

“I am very pleased to share the resource estimate for the West, Adit and South zones today. These deposits will clearly play a key role in advancing MPD’s overall economic potential. West and Adit in particular host high-grade mineralization right from surface, an important characteristic that positions these zones well as starter pits in a possible future mining scenario,” Kodiak’s President and CEO Claudia Tornquist stated in the Dec. 9 news release. She added:

“Overall, MPD’s maiden resource shows considerable scale, strong growth potential and grades consistent with leading copper porphyry projects in North America. With multiple deposits, MPD offers unique optionality and flexibility for future development pathways. Add to this its strategic location in a well-established, low-cost mining district in southern British Columbia and MPD stands out as a highly promising project with clear economic potential.”

Chris Taylor, Chairman of Kodiak said, “This maiden resource marks a key milestone in MPD’s advancement toward becoming a major mine. With all deposits remaining open for expansion, I have no doubt that continued drilling will drive significant resource growth. It is also noteworthy how clearly the sensitivity cases at lower cut-off grades demonstrate the large in-situ metal endowment at MPD. Next year’s exploration program will prioritize resource expansion and test multiple target areas with the potential to add meaningful tonnage to our existing deposits.

“We also plan to drill several promising copper and gold targets on the property, some supported by encouraging historic drill results, others defined using VRIFY AI-supported targeting. The large number of targets on the property, approximately 20 at current count, underscores MPD’s remarkable prospectivity and the exciting opportunity for yet another major discovery.”

RPEEE 3D pit shells

Kodiak’s work in 2026 will be focused on resource growth. Kodiak also intends to test some of the many underexplored targets on the MPD property, which present opportunities to discover new mineralized zones.

2026-27 catalysts include:

- File NI 43-101 technical report on SEDAR+ – Q1

- Metallurgical test results – Q1

- Soil results and drill targets – Q1

- Resource expansion drilling – Q2 onwards

- Exploration drilling, testing new targets – Q2 onwards

- Geophysical programs – Q2 onwards

- Resource update – Q1 2027

- Ongoing structural studies

Porphyries in BC

The mining industry is on the hunt for large copper deposits that have favorable grades and are in locations amenable to mine development.

Over 80% of the world’s copper production comes from large-scale open-pit porphyry copper mines.

Porphyry deposits are usually low-grade but large and bulk mineable, making them attractive targets for mineral explorers.

In Canada, British Columbia has the lion’s share of porphyry copper-gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

Examples include big copper-gold and copper-molybdenum porphyries such as Red Chris and Highland Valley. Large, undeveloped porphyry deposits along the North American Ring of Fire include Galore Creek in BC and Northern Dynasty’s Pebble project in Alaska.

Of 10 major operating copper mines in Canada, six are in BC.

The Quesnel Trough

The Quesnel Trough, also called the Quesnel Terrane, is a Triassic‐Jurassic aged arc of volcanic rocks that hosts several alkalic copper-gold porphyry deposits. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

The Quesnel Trough extends 1,500 kilometers from Washington State to the Yukon border. It is the longest mineral belt in Canada.

The Southern Quesnel Trough has the largest concentration of major mining companies in BC. That’s because they are looking for additional assets to supplement their reserves.

One CEO I recently talked to said, “It’s Interesting to see that two major mining companies coming from opposite sides of the world (Boliden and Fortescue) decided that southern BC around Kamloops is the place to go to find a new copper-gold porphyry system.”

Perhaps there is no better indication of the majors’ new-found emphasis on copper than Barrick changing its name from Barrick Gold to Barrick Mining.

As shown on the map below, there are at least nine major or mid-tier mining companies operating within the Late Triassic-Alkaline Cu-Au Porphyry Belt, including Taseko (Gibraltar mine), Boliden (Gjoll project), Teck (Highland Valley mine), Hudbay Minerals (Copper Mountain mine), Imperial Metals (Mount Polley mine), New Gold (New Afton mine), KGHM (Ajax project), and Glencore’s shuttered Brenda mine.

Fortescue Canada Resources does not have an operating mine but has staked a significant area, approximately 357,000 hectares, referred to as the Quesnel Regional Project, located between Williams Lake and Cache Creek.

Copper market

Gold, silver and copper are reaching new highs together for the first time in 45 years. Research by AOTH has indicated that for all three metals, supply can no longer meet demand without recycling.

MarketWatch notes that growing industrial demand is becoming an increasingly important factor driving silver and copper prices.

Meanwhile, strong central bank buying of gold has helped boost prices for the yellow metal. All of these fundamental drivers remain firmly in place at the start of December, said Nick Cawley, contributing analyst for Solomon Global.

“A combination of persistent inflation concerns, U.S. interest-rate cuts, fears surrounding dollar devaluation and substantial central-bank gold purchases continue to underpin prices,” he told MarketWatch by email. “These conditions show no signs of changing and should propel all three metals higher in the coming months.”

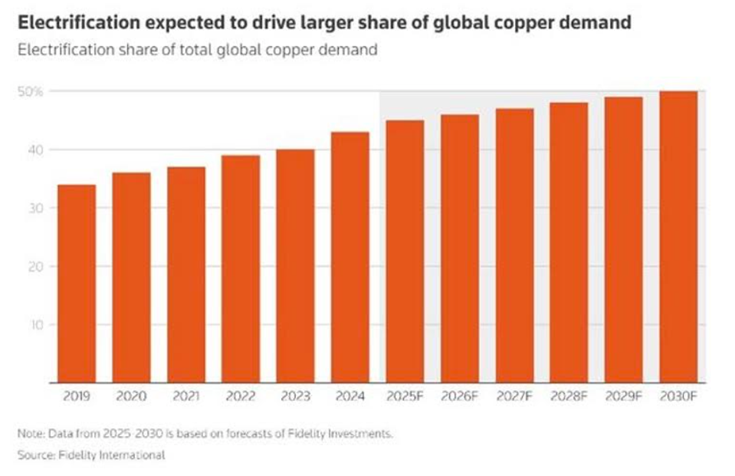

China is the biggest copper buyer, and its purchases have slowed in recent years due to a weaker economy. But Chinese demand has been replaced by a new driver — electrification and decarbonization. Electric vehicles for example need four times as much copper as regular gas-powered ones.

Technology companies are investing hundreds of billions of dollars to build AI data centers requiring reams of copper wiring. Then there’s all the usual uses of copper, such as in construction (wiring and piping), transportation (motors, wiring, brakes), renewable energy (wind turbines, solar panels), plus its antimicrobial properties for healthcare.

Demand for copper — the cornerstone for all electricity-related technologies — is set to grow by 53% to 39 million tonnes by 2040, according to BloombergNEF.

Meanwhile, the copper supply is in trouble.

Due to unexpected closures and operational interruptions, such as the mud intrusion that shut down the world’s second-largest copper mine, Grasberg in Indonesia, the copper market this year is in a deficit. The shortfall is expected to deepen in 2026.

There has been a dearth of new copper discoveries in recent years, and the grades of existing copper mines are dropping, which, when added to operational misses, are making the supply problem worse.

A combination of strong demand and limited supply has vaulted the copper price to record highs above $5 a pound.

You’d think that with copper, gold and silver prices all hitting record highs, mining companies would be itching to build new mines.

Sadly, this hasn’t been the case. A recent post by Tavi Costa, a strategist at Crescat Capital, says that despite high metals prices, aggregate capex — total capital expenditures on mines — is at one of its lowest levels in history; 90% lower than previous highs.

But this is actually good news. As Costa writes, it means this bull market has a lot more room to run and we are nowhere near a top.

Clearly, the major miners would rather “eat each other” than pony up the cash required to build new mines or mine infrastructure.

Companies that were previously only interested in gold (or silver) are embracing copper due to its favorable market dynamics and pricing. Mergers and acquisitions in the copper space is heating up.

Shareholders just approved the merger of Anglo American and Canada’s Teck Resources; the combined entity, a $50-billion miner, will be henceforth known as Anglo Teck.

“Together, we will form a global critical minerals champion, headquartered in Canada, and offering more than 70 per cent exposure to copper, underpinned by a world-class portfolio of assets with exceptional growth optionality,” Anglo American CEO Duncan Wanblad said in a news release.

In BC’s Southern Quesnel Trough, Coeur Mining has put in a $7 billion bid for New Gold, which owns the New Afton copper-gold mine and the Rainy River gold deposit in the Dryden District of northern Ontario.

US-based Coeur is a precious metals producer, with operating mines in Mexico, Alaska, Nevada and South Dakota, along with a silver-lead-zinc exploration project in British Columbia, Silver Tip, so its pivot to copper is significant.

Conclusion

The maiden resource on the MPD Project is based on decades of historical

exploration and Kodiak’s drilling from 2019 to 2025, totalling

approximately 90,000 metres.

A sizeable initial mineral resource estimate of 2.408 billion pounds of copper and 1.67 million ounces of gold has been published. The MRE is a major milestone to MPD becoming a mine.

Those are great numbers, but to me the most important aspect of the MPD story is the potential copper pound and gold oz upside on known resource plus the upside from exploration.

While the company has identified multiple zones, it remains committing to continued exploration to further grow the project, both through zone expansion and the testing of new targets.

Given the positive copper market fundamentals, I think there will be a rerating of Kodiak’s market cap based on the amount of copper in the ground; and that there is more drilling planned on the significant extensions of the zones that have initial resources.

Kodiak says, and I agree, that the maiden resource estimate on all seven zones will be a catalyst to close the valuation gap to more advanced peers.

Kodiak’s share price hit an intraday high of $0.75 on Dec. 9, the day its resource estimate was announced. Year to date, the stock has surged 121%, confirming its position as a top AOTH junior copper company pick.

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.71 2025.12.10

Shares Outstanding 85.8m

Market Cap Cdn$60.9m

KDK website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Kodiak Copper (TSXV:KDK). KDK is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.