Interest on the debt on track to exceed military expenditures – Richard Mills

2023.05.24

The US national debt is again in the spotlight, as congressional leaders try to hammer out an agreement on how to raise the government’s $31.4 trillion debt ceiling ahead of a possible debt default on June 1st.

The two key actors in the drama are Democratic President Joe Biden and House Speaker Kevin McCarthy, a Republican. McCarthy has been pressuring the White House to agree to spending cuts in the federal budget, and has said he is not willing to consider Biden’s plan to cut the deficit by raising taxes on the wealthy and closing tax loop holes for the pharmaceutical and oil industries. (Reuters, May 22, 2023)

Any deal to raise the debt ceiling must pass both the House and the Senate, meaning it requires bipartisan support. The Republicans control the House 222-213, while the Democrats hold the Senate 51-49.

Failure to reach an agreement by the June 1 deadline could lead to an unprecedented debt default that market watchers think could lead to a US and even worldwide recession. One of the most serious outcomes would be a hike in interest rates, which have already risen substantially over the past 19 months, as central banks tighten credit to tackle inflation.

On May 4th the US Federal Reserve raised its key lending rate by a quarter percentage point — its 10th hike in 14 months — pushing the federal funds rate to between 5% and 5.25%, the highest in 16 years.

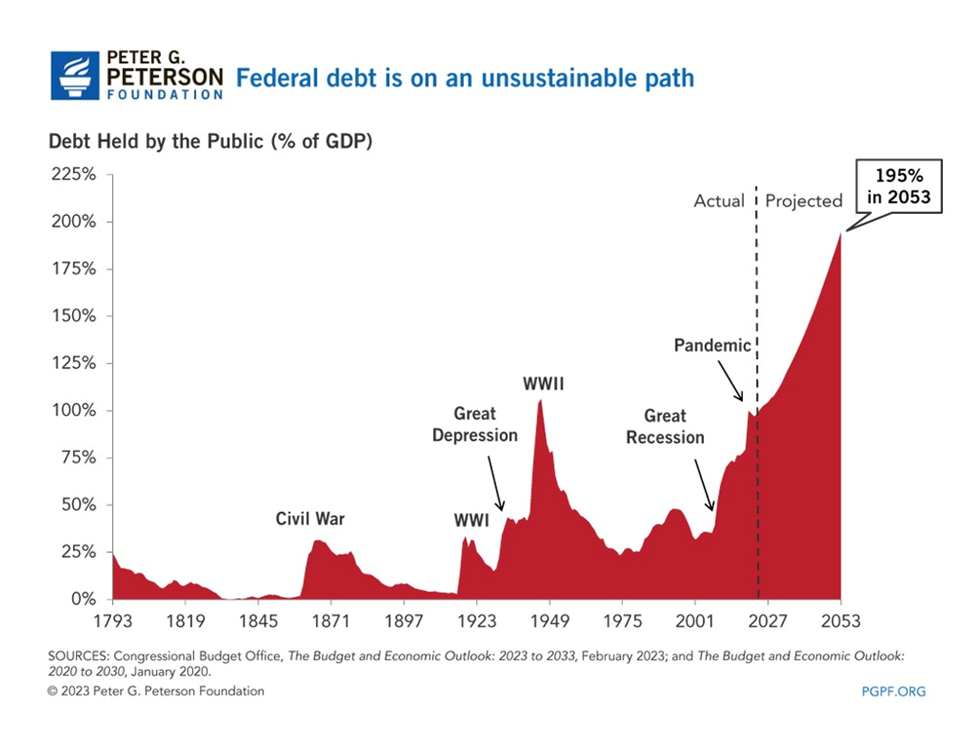

Along with causing alarm in financial markets, the debt ceiling issue has also focused attention on the increasingly unsustainable national debt, which according to usdebtclock.org, currently sits at $31.8 trillion.

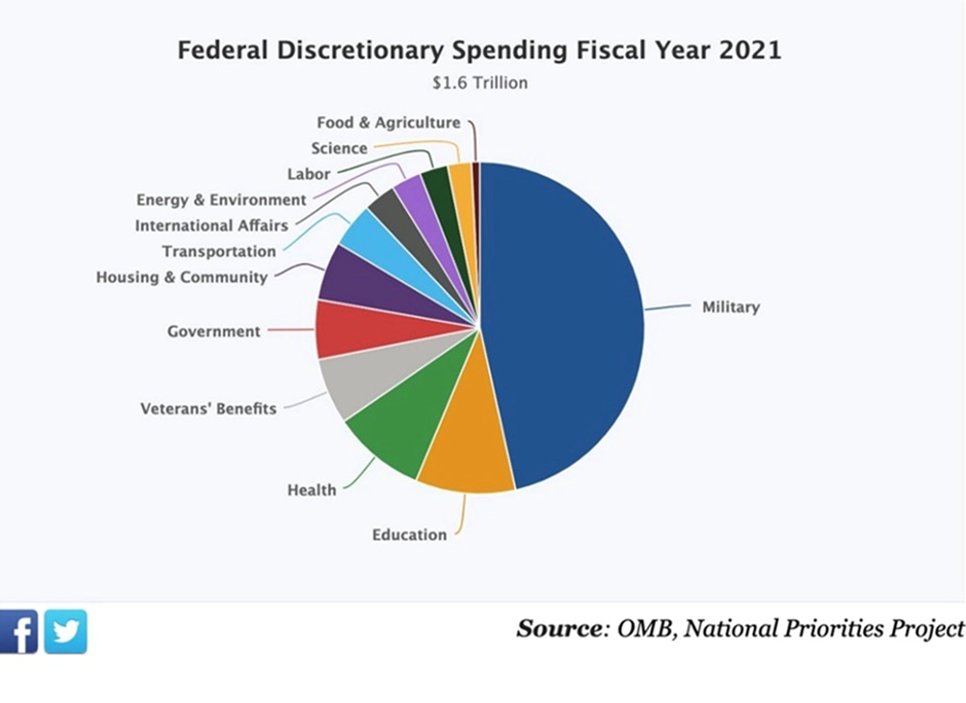

Here we pick apart the largest components of the federal budget — Social Security, Medicare/ Medicaid, and defense, coming to the conclusion that, in the near future, interest on the debt could easily surpass spending on the US military, which actually dwarfs Social Security and Medicare as the budget’s top line item.

Ready for war

According to Breakingviews, via Reuters, the United States as top military power spends 10% of its budget on defense and has 2.3 million personnel. The US spends more on defense than the next nine countries combined.

According to World Population Review, the 10 countries with the highest military expenditures (2020 figures) are:

United States ($778 billion)

China ($252 billion [estimated])

India ($72.9 billion)

Russia ($61.7 billion)

United Kingdom ($59.2 billion)

Saudi Arabia ($57.5 billion [estimated])

Germany ($52.8 billion)

France ($52.7 billion)

Japan ($49.1 billion)

South Korea ($45.7 billion)

As the pie chart shows, the amount the United States spends on defense is by far the largest category of federal discretionary spending.

But this number is misleading. It grossly underestimates how much public money is actually plowed into the US military, through different departments.

On March 8, the Biden administration submitted to Congress a 2024 budget request of $842 billion for the Defense Department, an increase of $26 billion over 2023 levels and $100 billion more than 2022. The Air Force is allocated $61.1 billion, including funding for the F-22, F-35 and F-15EX fighters, along with the B-21 bomber, mobility and specialized support aircraft and unmanned aircraft systems, i.e. drones. The Navy will see $48.1 billion and the Army will receive $13.9 billion.

Other parts of the base defense budget are nuclear modernization ($37.7B), missile defense ($29.8B) and $11 billion worth of lethal precision weapons.

The DOD will also spend $33.3 billion on space-based systems.

Now let’s look at what the $842 billion doesn’t include. The DOD budget does not count black ops, interest on the defense portion of the debt, and ongoing military obligations to veterans.

The DOD budget also doesn’t include the cost of overseas wars. That money is allocated to Overseas Contingency Operations. A report from the Costs of War project at Brown University revealed that since 9/11, wars have cost the US an estimated $8 trillion. None of this shows up under Department of Defense expenditures.

The budget for nuclear weapons is split between the Defense Department and the Department of Energy. According to the Congressional Budget Office (CBO), the DOD and the DOE have submitted plans for nuclear forces covering the period 2021-30. The $634 billion total averages out to just over $60 billion per year.

US nuclear forces consist of submarine-based ballistic missiles (SSBNs), land-based intercontinental ballistic missiles (ICBMs), long-range bomber aircraft, shorter-range tactical aircraft carrying bombs, and the nuclear warheads those delivery systems carry.

Almost two-thirds of the nuclear budget is within the DOD, with the largest costs being ballistic missile submarines and intercontinental ballistic missiles. The remaining third, paid for by the Department of Energy, is primarily for nuclear laboratories and supporting facilities.

US defense expenditures are usually counted as the second largest category of the federal budget behind Social Security, but if we include all the items not normally tallied under defense spending, and departments in which much of their spending is devoted to the military effort, we find that defense spending actually exceeds Social Security. Not only that, it’s more than the expected budget deficits forecast for the next decade.

Mandatory spending in 2022 was estimated at $4.018T, of which the biggest expenses were Social Security, budgeted at $1.196T, followed by Medicare at $766B and Medicaid at $571B. (‘U.S. Federal Budget Breakdown’, The Balance, June 24, 2022)

The discretionary budget for 2022 was $1.688T. Much of this went towards military spending, of which the largest expense was the Department of Defense budget, @ $715B. But wait. Because military spending includes Homeland Security, State and Veterans Affairs, and other defense-related departments, these costs combined came to $752.9B. If we add the bill for nuclear forces, @ $60B, total expenditures for the US military amounted to $1.527 trillion!

This exceeded Social Security, @ $1.196T and was more than Medicare and Medicaid put together ($1.337T).

The CBO projects a cumulative deficit for 2022-31 of $12.1 trillion, or an average of $1.2T per year. Total US military expenditures in 2022 of $1.5T surpassed the $1.2T deficit the CBO expects the government to run each year from 2022-31.

Remember, these figures were assembled prior to Russia’s invasion of Ukraine. Since the war began, in February 2022, the Biden administration and the US Congress have directed more than $75 billion in assistance to Ukraine, more than half ($46.6B) of which has been earmarked for defense. The assistance in 2022 amounted to 5.6% of US defense spending.

Unfunded liabilities

Considering how much the United States spends on its military, when it comes to making budget cuts, it is unlikely the politicians will tighten the defense budget’s purse strings.

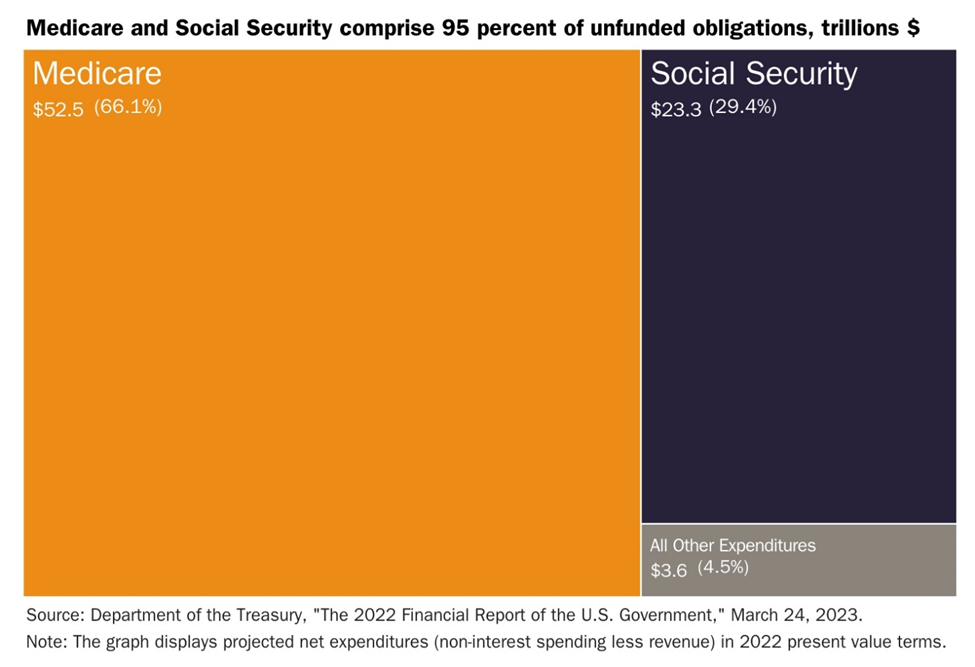

Much more likely to be on the chopping block are Medicare and Social Security. These two programs are unsustainable as currently structured.

According to the Cato Institute, spending on Medicare this year amounts to $1 trillion, or 3% of US GDP. For Social Security, it’s $1.2 trillion, or 4.7% of GDP.

Over the next decade, Medicare and Social Security spending are both expected to double. The Cato Institute says that by then, the government will spend more on Social Security annually than on the entire defense and non-defense discretionary budget.

Cato also says that when Social Security’s funds are depleted, in 2033, all beneficiaries regardless of age, income, or need will face a 20% cut in their benefits.

Also running out of cash is the Medicare trust fund, which supplements payments to hospitals and nursing homes. According to NPR, unless changes are made, in 2031 the fund will run dry, resulting in an 11% pay cut to health care providers.

It is often said that Medicare and Social Security are “unfunded liabilities”. What does this mean? Unfunded is the amount by which future promises to pay benefits exceed the tax revenues that are supposed to pay for those benefits. (Social Security for example is paid for by payroll taxes. The unfunded liability is the difference between promised benefits and expected payroll taxes).

The table below, printed by Forbes, explains a lot:

The first row shows that the discounted value of everything we have promised between now and 2095 is almost three times our national income of $23.39 trillion. In a sound retirement system, we would have $68.1 trillion in the bank earning interest—so that the funds would be there to pay the bills as they arise. In fact, we have no money in the bank for future expenses and there is no serious proposal to change that.

The second row extends that accounting beyond 2095 and looks indefinitely into the future. The result: under current law we have already promised future retirees an unfunded amount that is almost seven times the size of our economy…

Interest on the debt

Servicing the debt is one of the federal government’s biggest expenses.

CNN reports that During fiscal 2022 alone, the federal government made $475 billion in net interest payments, up from $352 billion the prior year, according to the US Treasury Department. For context, that’s more than the government spent on veterans’ benefits and transportation – combined. And it’s nearly as much as the $677 billion spent on education.

Obviously, with 10 straight interest rate increases over the past 14 months, pushing the federal funds rate to 5.25%, interest payments this year will be substantially higher.

The Congressional Budget Office projects net interest outlays (the difference between interest paid and interest received) will rise from $663 billion in 2023 to $1.4 trillion in 2033, more than doubling over a decade.

Remember, in 2022 total expenditures for the US military amounted to $1.527 trillion, more thanSocial Security, @ $1.196T and more than Medicare and Medicaid put together ($1.337T).

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now sitting at $31.4 trillion.

House Speaker Kevin McCarthy put it more succinctly, telling Fox News on Monday that, in the context of raising the debt ceiling, [Republicans are] “looking at where we can actually put us on a better path. If you go the president’s path he’s going to increase the debt to a place that we can’t afford, right now it’s going to be $0.17 on every dollar we bring in goes to interest, we will pay more money in interest in the next 10 years than we paid in the last 83 years. It will be $10.5 trillion. Don’t you hate paying the interest on your credit cards? Well now what’s happening is every single American that has a new baby, that baby gets charged $94,000 for coming into this world. I think that’s wrong.”

Conclusion

McCarthy is a politician like any other, so we can expect him to frame the issue in partisan terms. In fact the Democrats and the Republicans are equally to blame for allowing the debt, and the interest on it, to climb so high.

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2007-09 financial crisis and the covid-19 pandemic in 2020-22.

There is certainly no sign that defense spending will drop, no matter who becomes president in 2024 and regardless of which party ends up controlling Congress.

Global tensions are mounting. The war in Ukraine shows no signs of ending, and North Korea is back to firing off missiles. China is beefing up its military and so is India and Japan. To maintain its position as the world’s strongman, the United States will have to keep spending on equipment, technology and troops. The government continues to be pressured by its allies and the defense industry lobbyists in Washington to contribute more and more.

Yet something has to give.

As the table below shows, in a comparison with Europe, the United States is behind only Greece and Italy as one of the most indebted countries in the world.

As the furore over raising the debt ceiling has shown, budget cuts are inevitable; they are needed just to keep the government solvent. Where will the reductions occur? The answer is Social Security and Medicare/ Medicaid. We’ve already shown that both programs are unsustainable the way they are currently structured.

Over the next decade, Medicare and Social Security spending are both expected to double. Yet the government has no money in the bank for future expenses and there is no serious proposal to change that.

How high will they have to raise the debt ceiling to afford these expensive, unfunded liabilities? How much interest will have to be paid on this higher debt?

With 17 cents out of every dollar now going to paying the interest on the debt, it won’t be long before debt servicing costs are the biggest line item, surpassing even the true, bloated defence/ war-making budget. And who is to blame? Both the GOP and Dems.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.