Industry-government graphite collaboration bodes well for US critical minerals supply

2021.09.27

The global lithium-ion battery industry is expected to grow at a CAGR of 16.4% from 2020 to 2025, reaching USD$94.4 billion by 2025 from $44.2 billion in 2020. Growth will be driven not only by the need for plug-in electric vehicles and hybrids, but grid storage applications for which the dominant technology is lithium-ion.

An average hybrid-gasoline electric vehicle carries up to 10 kg of graphite and a plug-in EV has seven times that amount – around 70 kg. Every million EVs, which is only about 1% of the new car market, requires in the order of 75,000 tonnes of natural graphite. This represents a 10% increase in flake graphite demand. The need for lithium batteries not only for EVs, but energy storage, handheld tools like drills, and an array of consumer electronics like cell phones and laptops, is almost certain to outstrip supply. The current lithium-ion battery manufacturing capacity currently under construction would require flake graphite production to double by 2025.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards, and low costs. However as we have seen with rare earths, a market that China manipulated in its favor following a territorial dispute with Japan in 2010, being overly reliant on foreign suppliers is dangerous.

The United States (and Canada) needs secure, cost-competitive and environmentally sustainable sources of graphite, and that means developing graphite deposits into mines.

Criticality

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the national economy and national security.

In 2017 then-President Trump signed an executive order to encourage the exploration and development of new US sources of these metals. In 2018, the US Government’s Critical Minerals List was published. It includes flake graphite as one of the “Listed Minerals”.

North America produces just 4% of the world’s graphite supply, from mines in Canada and Mexico. No US natural graphite production was reported to the USGS in 2019 or 2020.

China, Brazil and Mozambique are responsible for most graphite mining and processing, with China producing the lion’s share at around 62%. China’s production is about 40% amorphous and 60% flake. The country processes most of the world’s spherical graphite, the kind needed for the anode part of a lithium-ion battery.

China imports a significant amount of North Korea’s large flake graphite production, raising doubts about China’s ability to ramp up its own graphite supply. Indeed, China has already taken steps to retain its graphite resources by restricting its export quota — the country imposed a 20% export duty, a 17% VAT and also closed state-owned enterprises.

“The days of cheap, abundant graphite from China are over,” says Industrial Minerals magazine.

Large graphite deposits are being developed in Madagascar, northern Mozambique, Namibia, and south-central Tanzania. The world’s largest graphite mine, Syrah Resources’ 50-year Balama operation in Mozambique, achieved commercial production in 2019.

According to the USGS, in 2020 the US imported 42,000 tons, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers were China (33%), Mexico (23%), Canada (17%) and India (9%).

It’s thought that the increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year (out of a total 2020 market, all uses, of 1.1Mt) — only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries. The USGS believes that large-scale fuel cell applications are being developed that could consume as much graphite as all other uses combined. Tesla’s Nevada Gigafactory alone consumes around 35,000 tons of spherical graphite per year. We have clearly come to the point when much more graphite needs to be discovered and mined.

Global graphite consumption has been increasing steadily every year since 2013, although in 2019 there was a reduction of 14%. Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per year.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

There is no substitute for graphite in an EV battery and lithium-ion batteries are expected to be the technology that runs electric vehicles for the foreseeable future making graphite indispensable to the global shift towards clean energy.

The question is, can the mining industry crank out 5-6% more graphite every year to match this demand? There is reason to be skeptical. Between 2018 and 2019, world mine production actually declined by 20,000 tonnes, or 1.8%. Global production in 2019 and 2020 was exactly the same, 1.1 million tonnes.

Let’s assume the industry can meet the demand. Where is the graphite going to come from?

Currently there are no producing graphite mines in the United States, and only 10,000 tonnes a year is being mined from two facilities in Canada. The fact is, for the United States to develop a “mine to battery” supply chain at home, it currently has no choice but to import its raw materials from foreign countries. For battery-grade graphite, that means China, which is growing increasingly adversarial, in terms of trade, foreign policy and militarily.

For many years the United States didn’t mind being dependent on out of country suppliers for critical mineral like rare earths, lithium, graphite and manganese. Mining can be messy and the political will hasn’t been there to develop domestic mineral deposits even though the United States and Canada, in most cases, have ample reserves. An attitude of NIMBYism prevailed — let China mine the stuff and we’ll buy it from them, preferably on the cheap. Cobalt from the DRC? No problem. Palladium from Russia? Bring it on.

Political support building

From the very beginning of the Trump presidency, the US has been planning to reverse its dependence on foreign rivals especially China, which has the largest EV market and dominates the global battery supply chain.

Under an executive order, a report was published by the Interior Department in 2018, highlighting 35 minerals that are critical to the US national and economic security, 14 of which are 100% dependent on imports.

The current president, too, is aware of America’s vulnerabilities. In late February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

For example, about 85% of the world’s neodymium is concentrated in a few Chinese mines, and most of the world’s cobalt production comes from the politically unstable Democratic Republic of Congo (DRC).

Fortunately, there are a growing number of US politicians who want to reverse this dependency, they like the idea of developing domestic critical metal mines, and are working with the mining industry to achieve results.

Among the most vocal and active, is Alaska Republican Senator Lisa Murkowsi. Murkowski helped draft the bipartisan infrastructure bill currently making its way through the House of Representatives, after overcoming the hurdle of being passed by a Senate almost evenly split along party lines.

The $1.2 trillion proposal includes money for research and demonstration projects and other efforts aimed at lessening the reliance on China for the supply of critical minerals like lithium and graphite.

Another provision calls for streamlining the permitting process for mining and extracting critical minerals. It can take 12 years now to line up the federal permits needed to open a mine, making businesses hesitant to deploy investment capital.

“We are trying to move these along — jump start them if you will,” Murkowski said in a recent article by Utility Dive, a trade publication covering the utilities industry.

“My bill aims to improve the timeliness of the federal permitting and review process,” she said of legislation incorporated into the bipartisan infrastructure bill.

Murkowski’s Strategic Energy and Minerals Initiative (SEMI), which she announced in an April speech to the Senate, would enable US companies to better compete in global markets by promoting responsible domestic production of oil, gas and minerals.

The SEMI act will position the United States to compete in global energy and critical mineral markets by supporting an all-of-the-above energy strategy, pushing back against multilateral development banks restricting fossil fuel and coal development, and promoting energy and mineral exports, reads an April 23 press release from the Alaska senator.

In discussing America’s dependence on foreign nations such as Russia and China to meet its resource needs, Murkoswski said:

“We need a rational, clear-headed, eyes-wide-open approach to energy and mineral development. We don’t want to go back on energy, and we can’t be caught flat-footed on minerals. We have the resources, and we have the highest labor standards in the world, the highest environmental standards in the world. Our energy workers, our miners, they hold themselves to that standard. So instead of importing more from places like Russia and China, we need to free ourselves from them to the extent that we can and establish ourselves as this global alternative.”

Murkowski also stressed the importance of allowing responsible resource development in the United States generally and particularly in Alaska, home to deposits of 30 of the 35 critical minerals.

“Know that Alaska is ready, willing, and able to play a role on all these fronts. We have tremendous stores of resources. But equal to those tremendous stores of resources is the responsibility that I believe Alaskans feel to be good stewards as we access those resources to allow for a level of sustainability — whether it is with our fisheries or subsistence, the livelihoods of those who rely on the food and animals on the land. We believe we can contribute to our national security and our global competitiveness while at the same time working to protect the environment. But what we need is the chance to be able to do so,” she said.

Graphite One

Lately Murkowski has been getting behind efforts to develop what would be America’s largest graphite mine, Graphite Creek owned by Graphite One (TSXV:GPH, OTCQB:GPHOF).

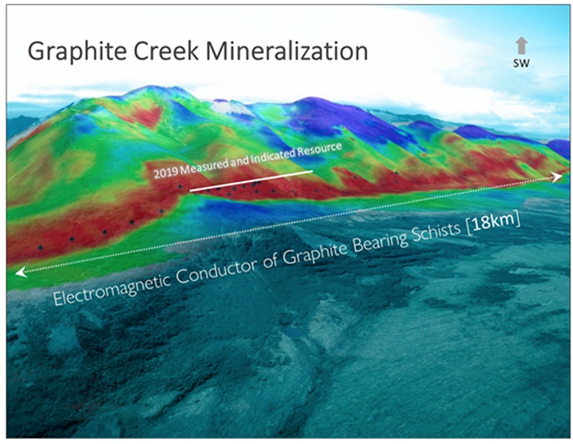

The deposit is the highest-grade and largest known flake graphite deposit in the US, spanning 18 km.

Located on the Seward Peninsula, Graphite Creek earlier this year was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Graphite One aims to become the first vertically integrated domestic producer to serve the EV battery market.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg, for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A preliminary economic assessment (PEA) for the project envisions a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

Graphite One is continuing with exploratory drilling and an environmental baseline study program to gather more data for an upcoming Preliminary Feasibility Study (PFS), scheduled to be released in the fourth quarter.

A 3,000-meter drill program at Graphite Creek this year was designed to infill and expand the project’s resource of graphitic carbon for a Feasibility Study (FS), the next step after the PFS.

Once in full production, Graphite One’s proposed graphite products manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year.

These production figures are based on resource estimates prior to the 2019 update, leaving room for potentially higher production.

Material produced from Graphite Creek would be almost sufficient to supply the entire nation’s graphite demand given current import totals.

At the Clean Energy Week Policy Makers Symposium, Sept. 20-24, Sen. Murkowsi said, “If they, Graphite One, were able to open tomorrow the US could go from being fully reliant on foreign countries for our graphite to Graphite One being able to supply nearly all our graphite demand.” Listen to the speech

The Alaska senator also called Graphite One’s fully integrated process of mining and producing graphite products “a very exciting project.”

Murkowski isn’t the only US politician to support Graphite One’s bid to become America’s number one source of battery-grade graphite, and the overarching theme of making the United States critical minerals-independent.

When new Secretary of Energy Jennifer Granholm testified in her nomination hearing in the Senate, she reportedly had a very detailed back and forth with Sen. Murkowski on critical minerals issue, before distilling the main point into a simple yet very strong statement: “We can buy electric car batteries from Asia, or we can make them in America.”

Sec. Granholm is used to breaking through barriers and agitating for change. She is only the second woman to lead the US Department of Energy and was the first woman elected Governor of Michigan, serving two terms from 2003 to 2011.

Not only are well-placed politicians talking up critical minerals, support in the form of government funding is beginning to materialize. The Department of Energy under the Trump administration has to be credited for issuing new guidance for applicants to its Loan Programs Office, stating a preference for projects related to critical minerals.

Aiming to boost the domestic supply chain of critical minerals in support of two of President Trump’s executive orders, the September 2020 order regarding the nation’s reliance on foreign sources for critical minerals, and the December 2017 order the implementation of a federal strategy to ensure a domestic supply of those minerals, the new guidance concerns two LPO programs: the Title XVII Innovative Technology Loan Guarantee Program and the Advanced Technology Vehicle Manufacturing (ATVM) Loan Program.

According to a DOE press release, the LPO is to “interpret the Title XVII Program and the ATVM Program broadly to encourage applications from potential projects involving the production, manufacture, recycling, processing, recovery, or reuse of critical minerals and other minerals.”

Over $40 billion in loans and loan guarantees are available through the two programs, which together have backed more than $30 billion in deals over the past decade, including large-scale solar farms, electric vehicle manufacturing, electric transmission and nuclear energy.

Conclusion

While it is still early days as far as the United States becoming graphite independent, the US government appears to be doing everything it can to make that happen sooner rather than later.

Perhaps symbolically, given that the issue is attracting bipartisan support, the efforts are being led by Republican Senator Lisa Murkowsi, and Secretary of Energy Jennifer Granholm, a Democrat.

Graphite One CEO Anthony Huston has been working behind the scenes, urging public officials to support not only domestic mining of critical minerals, but the Graphite Creek project itself. Too often junior mining CEOs are passive actors when it comes to moving their projects forward, from acquiring drilling permits to passing the necessary environmental reviews to getting final permits to mine. They really need to be more actively involved, especially in emerging sectors like the mining and processing of electric vehicle components.

So far Huston has successfully arranged a meeting between Senator Murkowski and company representatives in Nome, Alaska, and she has spoken favorably about the project at the recent Clean Energy Week Policy Makers Symposium. This is in addition to the Alaska senator’s proposed legislation to improve the timeliness of the federal permitting and review process, that has been incorporated into the bipartisan $1.2 trillion infrastructure bill Democrats hope to pass through Congress this fall, and Murkowski’s Strategic Energy and Minerals Initiative (SEMI), enabling US companies to better compete in global markets by promoting responsible domestic production of oil, gas and minerals.

Reflecting on the High-Priority Infrastructure Project designation, Huston earlier this year told The Northern Miner it highlighted that their project has dual interests for the American economy as it seeks to move forward:

“Our project was found to qualify under both the ‘renewable energy’ and ‘manufacturing’ sectors, which shows the versatility of natural graphite as a tech metal essential to the U.S. economy,” he said. “You’ve seen the surge in attention that renewable energy is getting: electric vehicles (EVs), energy storage systems, lithium-ion (Li-Ion) batteries of all types. So getting the High-Priority designation is a very strong signal of the role our project will play in the US’s 21st century technology development.”

With the U.S. almost entirely dependent on imported graphite, Huston told the Miner he believes the Graphite Creek project is essential.

“We’re seeing strong statements on the importance of the renewable energy transition, and an understanding that materials like the advanced graphite we plan to produce are essential to that renewable transition.”

I wholeheartedly agree.

The Graphite Creek project is the perfect opportunity for a junior miner to do something great for the state of Alaska and the entire country, as the United States begins the monumental task of transitioning from a fossil-fueled to an electrified economy powered by critical minerals like graphite and lithium.

With the right amount of government support, so far expertly stick-handled by CEO Huston, Graphite Creek is also a chance for the Biden administration to show the mining industry it can not only talk the talk, it can walk the walk, on the road to US critical minerals independence.

Graphite One Inc.

TSXV:GPH | OTCQB:GPHOF

Cdn$1.56, 2021.09.24

Shares Outstanding 81.5m

Market cap Cdn$127.1m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.