How Russia seized control of the uranium market

2019.09.25

Critical Mass – A point or situation at which change occurs.

Just over a year ago Cameco made the difficult decision to close its MacArthur River and Key Lake mines, in response to low uranium prices, leaving the Canadian company’s flagship Cigar Lake facility as its only operating mine left in northern Saskatchewan, home to vast reserves of the nuclear fuel.

The mine closures by Cameco were preceded by 20% production cuts in Kazakhstan, the number one uranium-producing country. The former Soviet bloc nation has said 2020-21 output will not rise above 2019 levels. In Canada, the second largest U producer, 2018 production was cut in half to 7,000 tonnes.

An estimated 35% of uranium supply has been stripped from the market since Kazakhstan’s supply reductions in December 2017.

While the mine closures kicked up the price of uranium in 2018, they haven’t been enough to build momentum. Spot uranium finished last year up just over 20%. Year to date 2019, triuranium octoxide, or U3O8, is down a disappointing 11.9%, trading at $25.25 per pound, as of Sept. 19.

The downward spiral of production and prices is due to a supply glut. When uranium crashed after the 2011 nuclear meltdown at Fukushima, Japan, producers thought they could weather the storm by producing more to compensate for lower prices. The unsurprising result was to create a supply glut that pushed spot to a record low of $17.75 a pound on Nov. 28, 2016. By 2018 the price had recovered to around $20, but that still meant around 95% of producers were operating at a loss. Uranium miners were left with a grim choice: go bankrupt, or significantly cut production, until prices return to a profitable level. And so we wait.

According to the World Nuclear Association, Kazakhstan’s uranium production went from 5,000mt in 2006 to over 24,000mt in 2016. That country is now the leading low-cost producer. Renowned investor Marin Katusa believes uranium will stay low because the world’s largest uranium producer, Kazatomprom, will continue to produce at high levels – the Russians and Kazakhs plan to position themselves as the dominant source of uranium over the next 20 years.

This article traces the rise and fall of US uranium production, and shows how Russia and its proxy, Kazakhstan, managed to outproduce the competition and put a lock on the global supply of uranium.

Uranium protection, redux

We currently have a free market for uranium, although some would argue a market dominated by state-owned enterprises is anything but free. Last year two uranium producers in the United States complained that subsidized foreign uranium, dumped into the US from Kazakhstan and Russia, had damaged the domestic industry and was putting national security at risk.

Energy Fuels Resources and Ur-Energy USA petitioned the US government to impose a quota requiring that 25% of domestic uranium consumption be met by US producers.

The complaint prompted an investigation under the “Section 232” probe, the results of which were published in July. The upshot? President Trump disagreed, writing that he does not think cheap uranium imports threaten to impair national security. Here is his full statement:

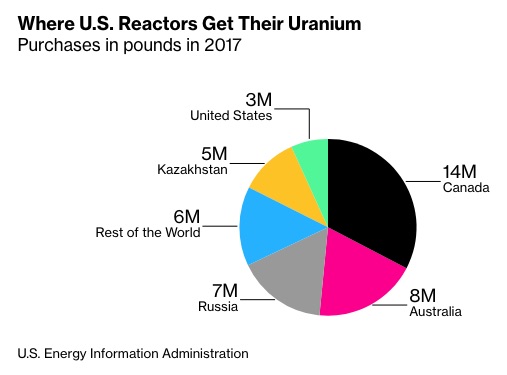

Currently, the country imports about 93% of its commercial uranium, compared to 85.8% in 2009. The Secretary found that this figure is because of increased production by foreign state-owned enterprises, which have distorted global prices and made it more difficult for domestic mines to compete.

“At this time, I do not concur with the Secretary’s finding that uranium imports threaten to impair the national security of the United States as defined under section 232 of the Act. Although I agree that the Secretary’s findings raise significant concerns regarding the impact of uranium imports on the national security with respect to domestic mining, I find that a fuller analysis of national security considerations with respect to the entire nuclear fuel supply chain is necessary at this time.”

Although measures to protect US uranium producers, which supply just 7% of the country’s nuclear power needs, were rejected, the fact that the industry felt the need to ask for the imposition of trade barriers that were torn down 30 years ago, says something about the plight of American uranium mining and nuclear power.

CNBC paints a grim picture indeed:

At the dawn of the atomic age, U.S. government incentives and trade barriers sparked a gold rush for uranium, the chemical element that was fueling the nuclear arms race at the time.

Now, 60 years later, American uranium miners want the government to use similar tools to prevent the collapse of the industry — and the few remaining U.S. companies still producing uranium for the nation’s fleet of nuclear power plants.

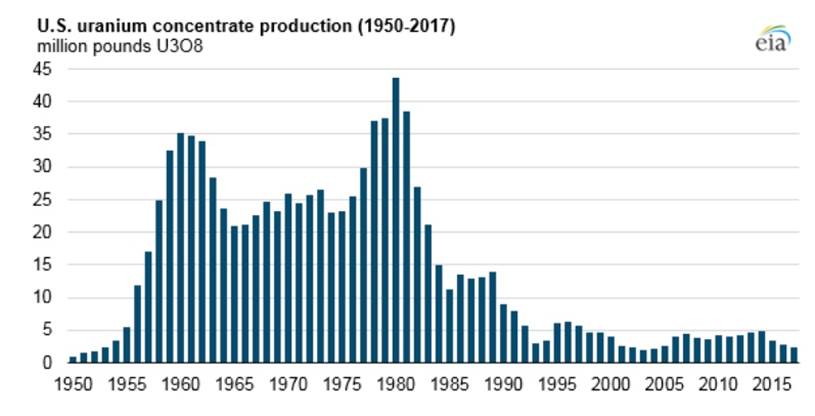

The numbers tell the tale. At the height of activity in 1980, U.S. companies produced nearly 44 million pounds of uranium concentrate and provided most of the supplies purchased by nuclear power plants. [In 2017], American miners produced 2.4 million pounds and supplied just 7 percent of the uranium bought by domestic plants.

The industry, which once supported nearly 22,000 jobs, now employs just a few hundred people each year.

US uranium fizzle

So what happened? The history of US uranium of course is tied to the nuclear arms race that began in the 1950s, after the US developed an inferiority complex following the Soviet Union’s launch of ‘Sputnik’, the first satellite.

The US government was keen on developing nuclear reactors and weaponry during the Cold War. So keen that between 1955 and 1980 it offered generous incentives to shore up nuclear weapons fuel stockpiles. Producers were offered a 10-year price guarantee for the right kinds of uranium ore, and a $10,000 discovery and production bonus for new supplies. Uranium mining took off, particularly in the Western US.

By the 1960s the storehouses were so full, the government felt no need to continue the incentives. Instead, Washington slapped a ban on foreign uranium, until 1975, when it was removed. That opened the door to imports, and by 1987 the US was importing nearly 15 million pounds of low-cost uranium, CNBC reports. Domestic output fell by a third, to around 13 million pounds.

In 1979 the hype around nuclear energy was soured by the accident at Three Mile Island, then seven years later, at Chernobyl. Along with safety concerns, utilities became wary of the time and cost needed to build and permit nuclear plants. That led to less of them being built, depressing demand for uranium; in 1990 US production slumped to a 35-year low.

A 1989 “Section 232” investigation similar to the one just conducted, found that “One of the main problems beyond the U.S. industry’s control is that the richest and most accessible uranium deposits are not found in the United States. The resources of Canada and Australia have higher uranium content and a lower production cost per unit.”

Indeed these two countries account for nearly half of the uranium used in the United States. But the lower-cost imports were hurting US uranium miners. Calls to protect the industry fell on deaf ears at the White House, but the issue resolved itself in the early part of the 21st century when uranium prices took off, due to falling stockpiles and a renewed interest in nuclear particularly from energy-hungry China whose economy was growing at double digits.

Uranium juniors began popping up in pursuit of U3O8, the nuclear fuel, and they had a good run for a few years. But in 2008 the financial crisis put a serious crimp on electricity demand, which was beginning to be satisfied by a new source: shale gas. The advent of hydraulic fracturing and horizontal drilling technology slashed the costs of natural gas production. Utilities flocked to the cheaper fuel, at the expense of less competitive nuclear power.

Still, the heady days of +$100/pound uranium continued through 2010, then it all crashed with the Fukushima disaster of March, 2011.

Price collapse

Uranium prices plummeted from their peak of nearly $140 a pound in 2007, to a range of $20 to $25, which is where they currently sit. The current glut of inventory mentioned at the top, combined with lower demand owing to countries like Germany, Japan and Belgium cutting back or ending their nuclear programs, has smothered prices.

Japan has been a disappointment. Before the 2011 earthquake and tsunami caused three reactors at Tokyo Electric Power’s Fukushima plant to melt down, Japan was the world’s third largest consumer of nuclear power, behind the US and France, operating 54 nuclear reactors.

Eight years later, only nine of 33 remaining reactors have been re-started.

When the Duane Arnold nuclear plant in Iowa shuts down in 2020, and assuming other planned closures occur, it will mean 10 fewer reactors in the United States – from 99 to 89 – by 2025.

CNBC writes that “The U.S. nuclear renaissance has also fizzled as flagship projects have turned into costly boondoggles. The venerable Westinghouse Electric Company filed for bankruptcy last year under the weight of billions of dollars in losses tied to its troubled nuclear power plant projects in Georgia and South Carolina.”

Prolonged low uranium prices have made it tough for non-state-owned enterprises to make a go of it. Uranium production in the US has fallen dramatically, from 43 million pounds in 1980 to just 1 million pounds last year.

Kazakhstan enters the picture

Arguably though, it’s not the industry’s fault; the uranium market is one of haves and have-nots. Not everyone has been decimated by low prices; in fact Russia and Kazakhstan, and upcoming China, are doing just fine, thank you very much. With their low-cost production and state-owned enterprises doing the mining and enriching, they can easily out-compete private industry.

For example Uranium One, the Canadian company that was swallowed up in 2013 by ARMZ, a subsidiary of Russian nuclear giant Rosatom, currently mines uranium in Kazakhstan, the world’s leading uranium-producing country, at an average cash cost of $8 a pound. In-situ mines operated by Uranium One and Kazatomprom dominated the first two quartiles of uranium-mining costs in 2018.

In contrast Cameco, the third-biggest uranium miner behind Kazakh state-owned Kazatomprom, and Orano, reports its only mine left after four closures, Cigar Lake, will be mined at $15-16/lb over the remainder of its life.

Despite having the highest-grade uranium in the world in Saskatchewan’s Athabasca Basin, North America has failed to become uranium-independent and for decades now has needed foreign uranium producers and their lower-cost imports. Between them, Russia and Kazakhstan currently account for over a third of US imported uranium.

The US dalliance with Russia and former Soviet republics over access to uranium began in the early 1990s, when it was determined that the Soviet Union had been dumping cheap uranium prior to its break-up. In 1993 as part of arms control, the Americans agreed to buy 500 tons of weapons-grade uranium that could be converted to civilian use by US nuclear power stations. Over the next 20 years, Russian low-enriched uranium provided fuel for one in three US reactors.

Until Fukushima, the “Megatons to Megawatts” program was the only way Russia could sell its uranium to the United States. In 2011, the same year of the nuclear meltdown in Japan, the Obama administration approved a Rosatom subsidiary to sell uranium to US nuclear power plants. Suddenly the door was kicked wide open for Russian uranium to enter the US.

It was around this time that Kazakhstan – whose economy, like Russia’s, depends to a large extent on oil exports (45% according to the OEC) – began to seriously ramp up its production of U3O8.

From 1972 to 1999 the Central Asian nation generated electricity from a single Russian nuclear power reactor, and had a very small output of uranium. Within a decade the country had become the world’s top uranium producer and the second biggest supplier of yellowcake to the United States.

According to the World Nuclear Organization, in 2009 Kazakhstan had about 28% of world production, in 2010 it was 33%, rose to 41% in 2014 and settled at 39% in 2015 and 2016. Incredibly, between 2001 and 2013, production shot up 11-fold, from 2,022 to 22,550 tonnes.

They did it through a combination of technology, almost zero impediments to production, and currency manipulation.

“Insitu leaching” is where chemicals are pumped into the uranium deposit, the liquid mixture is sucked up through production wells, and the uranium gets separated from the “pregnant” solution. Through this method, the Kazakhs were able to recover uranium for much cheaper than conventional mining, where mineralized ore is broken and treated to remove the uranium before processing. In 2016 nearly half of global uranium production was via insitu leaching.

CNBC notes that, along with Niger, Mali and Mongolia, Kazakhstan had, and has, another key advantage over its competition: lax regulations. Whereas the United States, Canada and France must adhere to strict environmental standards concerning the mining and disposal of uranium (some jurisdictions like British Columbia have banned uranium mining), countries in Africa and Central Asia have weak environmental institutions and virtually non-existent legislation.

As if that wasn’t enough to push down the cost of mining in Kazakhstan, the country in 2014 was hit hard by low oil prices and was forced to “devalue” its currency, the tenge, by removing its peg to the US dollar.

Reuters reported in 2015 that the world’s largest landlocked economy, and second biggest post-Soviet oil-producer after Russia, saw its exports fall 40% in the first six months of 2015, and its imports pull back 20%.

Allowing the currency to float freely, effectively devaluing it, resulted in a 26% drop in the tenge to 255.2 per dollar on the Kazakhstan stock exchange, Reuters said, adding that its top exports including minerals saw major price drops.

Affected commodities included oil and uranium, which make up 70% of exports, iron and steel (6.8%), copper (4.2%), ores, slag and ash (3.4%) aluminum (1%), gems and precious metals (0.9%).

Uranium One deal

Presidential candidate Donald Trump in 2016 was sure to bring up the scandal surrounding his opponent, Hillary Clinton, and the degree of her involvement in the sale of Uranium One, a Canadian company with substantial US uranium reserves, to a subsidiary of Rosatom. At the time, Clinton was Secretary of State.

“Crooked Hillary”, Trump and other Republican stalwarts maintained, had approved the 2011 partial sale of Uranium One, thereby letting go 20% of American uranium supply (among the company’s operations is the Willow Creek Mine in Wyoming).

Even worse, former President Bill Clinton reportedly received a speech fee of half a million dollars from a Russian bank, along with millions in donations to his charitable foundation, from parties with interests in the Uranium One deal, insinuating that the Secretary of State and her husband, President Clinton, had been bribed. The pair denied the allegations but the idea of the Clintons colluding with President Obama to approve the sale was too ripe a plum for Trump to resist.

In a 2017 article, Forbes dismissed the Republican storyline based on the fact it wasn’t only Secretary of State Clinton who approved the sale, but several government agencies on the Committee on Foreign Investment in the United States.

Moreover, the “20% of uranium supply” amounted to so little, it couldn’t possibly have been the reason Moscow was interested in Uranium One. Forbes columnist James Conca explains:

Those U.S. facilities obtained by Russia produce almost nothing. The uranium deposits are of relatively poor grade and are too costly to compete on the uranium market… Theoretically, they could process 20% of our ore, but that will never happen. Uranium One couldn’t give these facilities away.

Besides, Russia can’t export any uranium they produce in the U.S. They do not possess a Nuclear Regulatory Commission export license.

The real reason Russia wanted this deal was to give Rosatom’s subsidiary Uranium One’s very profitable uranium mines in Kazakhstan ― the single largest producer of commercial uranium in the world.

Russia’s trojan horse

I agree. A quick run through Uranium One’s website proves its importance not only to Kazakhstan’s uranium production, but Russia’s.

As a wholly-owned subsidiary of Rosatom, the company is responsible for Rosatom’s entire uranium production outside of Russia. That makes it the world’s fourth largest uranium producer. Uranium One has part-ownership of six producing uranium mines in Kazakhstan, the above-mentioned Willow Creek mine in Wyoming, and a 13.9% interest in a uranium development project in Tanzania.

Russia and Kazakhstan have signed several nuclear cooperation agreements over the past decade or so.

In 2006 the two countries signed three 50-50 joint venture agreements worth $10 billion, to build new nuclear reactors, along with production and enrichment facilities. Another JV with Tenex, the world’s largest exporter of nuclear fuel cycle products, extends a small uranium enrichment plant in Siberia. This site would eventually become an enrichment center for all 6,000 tonnes of uranium production from Russian mining JVs in Kazakhstan, according to the World Nuclear Association.

A 2007 agreement is to advance a global nuclear fuel supply system that “could permit developing nations to pursue nuclear energy without raising weapon concerns,” states the Nuclear Threat Initiative.

Finally, Radio Free Europe reported that President Putin offered Russia’s help for Kazakhstan’s first nuclear power plant, when he met the country’s new interim president, Qasym-Zhomart Toqaev, earlier this year.

Kazakhstan currently has a large plant that makes nuclear fuel pellets. A 2014 MOU is for construction of a nuclear power plant using VVER reactors and with capacity up to 1200 MWe.

Outside of Kazakhstan, Russia has inked nuclear deals with China, Egypt, Iran, Turkey, Belarus and Hungary. Rosatom, the world’s largest builder of nuclear plants, operates 35 nuclear power stations in Russia, and “has been using nuclear power plants as a way of cementing ties with its fellow emerging markets with no nuclear power tradition and the BRICS countries,” the Moscow Times reported.

The company has completed six reactors in India, Iran and China, and has another nine under construction in Turkey, Belarus, India, Bangladesh and China.

Controversially, Russia built Iran’s Bushehr power station in 2013 over the objections of the United States. An expansion of the nuclear power plant is in the works, slated for completion in 2020.

Squeezing out the competition

Clearly, the Russians and Kazakhs are tight when it comes to the development of nuclear power. But it goes further than that. A run through the latest uranium mine closures reveals the strong likelihood that Russia, through its Kazakhstan proxy, aims to seek and destroy any threats to its dominance.

A recent article in The Northern Miner agrees:

With Kremlin-backed Russian interests heavily influencing Kazatomprom and Uranium One, and the Russian government striking numerous nuclear-energy cooperation deals in developing countries across the globe, it couldn’t be clearer that the global nuclear fuel cycle is increasingly controlled by Russia, with all its geopolitical implications for the rest of this century.

While Russian President Vladimir Putin plays the long game, leaders in the West don’t seem to realize any game is being played at all, with domestic U.S. uranium production controlled by Americans reduced to almost nil, and Canada’s uranium leader Cameco forced to indefinitely suspend mining at arguably the richest uranium mine, McArthur River in Saskatchewan, which nevertheless sat in the third quartile of global uranium mines on a cost basis before the suspension.

Other casualties of low U prices and high-cost mining include French state-owned nuclear juggernaut Areva. West Africa-focused Areva went bankrupt and had to be restructured into a new company, Orano. The bloodletting hasn’t finished, however, with the imminent closure of Cominak, Orano’s uranium mine in Niger, announced in May. Its Trekkopje mine in Namibia has already shut down.

Australia’s Paladin Energy placed its Langer Heinrich mine in Namibia on care and maintenance in May 2018, following the mothballing of its Kayelekera mine in Malawi.

The Northern Miner calls out Rio Tinto’s Rossing uranium mine in Namibia as an example of a high-cost mine that was carved up by the Russians and handed over to the Chinese, figuratively of course. The world’s longest-running open-pit uranium mine, opened in 1976, produced the most uranium of any mine. However, with production costs over $70 per pound, and the uranium price still limping along at around $20/lb, it was only a matter of time before too much red ink had spilled; in November 2018, Rio agreed to sell its stake in Rossing to China National Uranium Corp.

Political back-channeling

Back to the Uranium One deal, one publication observes that the “20%” number mooted as the amount of US uranium lost to the Russians is in fact a red herring for the dark shadow the take-over has cast on domestic uranium mining.

The Capital Research Center, which calls itself ‘America’s Investigative Think Tank’, asserts that the Uranium One deal didn’t only have economic implications, in discouraging domestic uranium mining and leading to processing facilities being idled. The deal also had political consequences in that it enabled ARMZ/Rosatom to step directly into Uranium One’s shoes and gain a valuable seat at the table through their existing membership in the Washington D.C.-based Nuclear Energy Institute (NEI) and the Uranium Producers of America (UPA), headquartered in Santa Fe, New Mexico.

As new NEI and UPA members representing Uranium One, representatives of ARMZ/Rosatom (read: Russian government) were suddenly privy to U.S. nuclear industry strategic information, simply by attending meetings of the two trade associations. Details about the U.S. nuclear power industry’s plans, uranium production, conversion, enrichment, DOE’s stockpiled uranium, and the political back-and-forth negotiation that is an inherent part of shaping legislation, all could now be learned openly by the Russians.

Finding the possibility of Rosatom being granted unprecedented access to US nuclear secrets intriguing, Ahead of the Herd dug into this assertion. While neither ARMZ/ Rosatom nor Uranium One has representation on NEI or UPA’s board of directors, according to a search of each’s website, we did find recent evidence of attempts to influence the Trump administration’s nuclear policy, by both Uranium One and Uranium Energy Corp, whose processing facility in South Texas is fed uranium from its Palangana insitu recovery mine.

The Daily Beast reported earlier this year from the Conservative Political Action Conference, the presence of Uranium Energy Corp, which had set up a booth at the annual meet-up of US conservatives. The article clearly implies that UEC was there to lobby Trump conservatives to support the request from its rivals – Energy Fuels and Ur-Energy – for a quota requiring that 25% of domestic uranium consumption be met by US producers:

A leading U.S. uranium producer is confident that President Donald Trump is going to crack down on its foreign competitors. But in the spirit of not taking any chances, the company rented space at the annual Conservative Political Action Conference, enlisted a top Trumpworld public relations executive, and invoked a well-worn Trump attack line on his 2016 campaign opponent to try to nail down a policy win.

The Texas-based Uranium Energy Corporation posted up in the exhibition hall of the annual conservative confab this week, where it courted conservative activists, radio hosts, and at least one senior White House official with its pitch to crack down on foreign competition in the name of national security.

Meanwhile Uranium One was launching a charm offensive of its own to convince the Trump administration to ditch further US sanctions on Russia, specifically those targeting atomic energy.

The company’s CEO, Fletcher Newton, who is also the President of Tenam, a subsidiary of Rosatom, reportedly hired top Republican strategist Bob Weaver, “to head off legislation that would make it harder for American utilities and nuclear power plants to buy nuclear fuel from Russia.”

Weaver was a strategist for John Kasich’s presidential run in 2016, and also advised John McCain during his presidential campaigns, according to Politico.

The US political news-site says the sanctions Uranium One is lobbying against, likely refers to legislation introduced by the Senate in 2018, that would curtail the amount of uranium imported from Russia, starting in 2021. The bill is currently in committee, yet to be put to a Congressional vote.

Another interesting assertion by the Capital Research Center is that, through Uranium One’s control of its Willow Creek uranium mine in Wyoming, the company is able to limit production, thereby creating a domestic shortfall that would necessitate cheaper uranium imports from its mines in Kazakhstan.

Checking Uranium One’s 2017 and 2018 annual reports, AOTH found that this is the case. The company produced 13.3 million pounds of U3O8 in 2017 and 11.3 million pounds in 2018. Willow Creek produced 100,000 pounds in 2017 but only 25,900 pounds in 2018.

We also see the United States purchased $2.1 billion worth of enriched and natural uranium in 2018, which is 4.1% more than in 2017.

We would caution anyone from drawing a 1+1=2 conclusion from this data, but it certainly is interesting.

Trump the spoiler

Of course, despite various entreaties by interested parties, President Trump this past July concluded, after the Section 232 probe, that uranium imports do not threaten to impair national security, therefore no trade barriers would be imposed.

What to make of Trump’s decision? It’s difficult to speculate but we know from past media reports that the president supports nuclear power.

Allowing import quotas would effect an increase in fuel costs for nuclear power plants which are already struggling to compete with low-cost natural gas. The Nuclear Energy Institute notes uranium accounts for around 20% of nuclear operators’ costs.

In March Trump’s energy secretary, Rick Perry, announced $3.7 billion in new loan guarantees, to go towards completion of the first new US commercial nuclear reactor in a generation, at Plant Vogle in Georgia. Nearly one year ago, Trump signed the Nuclear Energy Innovation Capabilities Act (NEICA), which is expected to speed up development of advanced nuclear reactors. As supporters of thorium nuclear reactors, this is music to our ears.

Nuclear power economics questioned

Demand for uranium is underpinned by the nuclear reactor industry. It has always been maintained that nuclear energy, being an efficient means of generating clean, fossil-fuel-free baseload power, will need an increasing supply of U3O8 to fuel an ever-greater number of nuclear reactors being constructed, as countries are forced to meet tighter emissions requirements to head off climate change.

Recent evidence however contradicts this uranium investment thesis. Earlier this year the International Energy Agency sounded an alarm that meeting global warming objectives may be in jeopardy due to a sharp decline in nuclear capacity. The IEA warns that advanced economies stand to lose 25% of their nuclear capacity by 2025, and up to two-thirds by 2040, due to aging plants being decommisioned, and drawbacks surrounding nuclear power.

Even though nuclear is the second-largest source of low-carbon electricity, behind hydropower, accounting for 10% of global power generation, [n]uclear fleets in the United States and Europe are on average more than 35 years old and many of the world’s 452 reactors are set to close as cheap gas and tighter safety requirements make it uneconomical to operate them, Reuters reports.

Among the most interesting findings from the World Nuclear Industry Status Report (WNISR), the first in two decades, is that new wind and solar generators are both faster to commission and cheaper to run than nuclear reactors. Since 2009 the average reactor takes nearly 10 years to build. But we don’t have decades to wait for these plants; the effects of planetary warming are already upon us. A UN report published in 2018 found that humankind only has 11 years to go before warming is irreversible. The longer we wait to substitute new electricity sources for old ones, the less likely that runaway warming, beyond 1.5 degrees C, can be prevented.

The economics here are critical. According to the WNISR, the cost of nuclear energy, $112 to $189 per megawatt hour (Mwh), is now quite a bit more than solar ($36-44/MWh ) and onshore wind ($29-$56/Mwh).

The report estimates that over the past decade, the levelized costs (ie. building and running a plant from inception to closure) of utility-scale solar and wind have fallen by 88% and 69% respectively, per Reuters. Yet the levelized costs of nuclear have risen by 23%. The latter number is surprising considering how cheap uranium is and has been over the past decade – according to the US Nuclear Energy Institute, the cost of uranium fuel is only 14% of a nuclear plant’s total costs.

Another bombshell dropped by the report – China isn’t quite the white knight riding in to save the nuclear power industry, as most uranium bulls think. Last year the Asian energy glutton spent 91 billion dollars on solar, but just $6.5 billion on nuclear. The country currently has 47 operating reactors with a total capacity of 45 gigawatts, but Beijing wants to raise capacity to 150GW by 2030, thereby overtaking the US for the world’s largest nuclear fleet. China’s ambitions have been muted by multiple delays with new reactors over the past few years; no new projects have begun since 2016.

According to the Nikkei Review, the Sanmen plant in Zheijiang Province was supposed to bring its first reactor, Westinghouse Electric’s AP1000 online in 2013 but it was not ready until 2018. An EPR reactor by Framatome was pushed back two years from 2016 to 2018. Six reactors have since been approved for construction, with a combined capacity of 7GW.

Despite the Trump administration’s help, the future of US nuclear doesn’t look particularly bright; according to WNISR, renewables are set to grow by 45MW in the next three years, versus nuclear and coal which will give up a net 24GW.

The cost of solar panels has come down 30% due to an oversupply problem in China, after Beijing cut incentives for buying them, Reuters said, prompting more installations country-wide as utilities take advantage of generous tax credits.

In May of this year the United States surpassed 2 million solar installations, only three years after the country hit a million, which took 40 years to reach. The amount of installed solar capacity in the US now sits at 13.3GW.

From here it’s up and up. The industry has reportedly lifted its five-year outlook by 5.1GW, or 9%, due primarily to new procurement by utilities in Florida.

Wood Mackenzie forecasts 3 million installations in 2021 and 4 million in 2023. By 2024 there will be one solar installation per minute.

Conclusion

The US uranium industry is certainly in a sorry state, and the finger should be pointed directly at the US government which has done little to help domestic uranium producers that have lived under the pall of horrible uranium prices for going on a decade.

While the Trump White House rails against US manufacturing jobs, and marketshare, lost to China and Mexico, nothing has been done to limit Russian (13%) and Kazakh (20%) uranium from entering the United States. Combined, these two countries that are not friendly to the United States, make up 33% of US uranium imports.

The industry provides less than 2% of the uranium that the country needs to produce 20% of its electricity. That’s the lowest domestic supply since before the Cold War, reads an op-ed in the Washington Examiner.

In 2018 owners and operators of US nuclear reactors purchased just 10% of 40 million pounds of uranium used in 2018; the rest, 90% came from other countries, states the US Energy Information Administration (EIA).

Kazakhstan and Russia continue to produce uranium at a fraction of the cost of its rivals. The Kazakhs agreed to remove 20% of production nearly two years ago, but that has had little impact on prices. In 2018 Kazatomprom was the leading uranium producer, at 11,074 tonnes – representing 22% of the top 15 companies. Orano was a distant second at 11%, followed by Cameco at 9%.

It’s troubling to see that China is following in Russia’s footsteps by purchasing Rio Tinto’s stake in the Rossing mine. China also has its fingers in Langer Heinrich and Husab, two major uranium mines in Namibia.

China has a history of state-sponsored domination of critical minerals. Just look at how the country played the United States, in orchestrating a monopoly on rare earth elements. Russia and Kazakhstan are doing the same thing with uranium.

Meanwhile the demand side of the equation for nuclear power appears to be imploding. Declines in the cost of solar and wind have rendered previously cost-competitive nuclear power too expensive for utilities. Consider the long lead time – on average a decade – for building a new nuclear plant, versus solar and wind farms that can be up and running in months, not years. Then throw in the fact that nuclear power plants are expensive dinosaurs of a former age subject to cost over-runs, they create radioactive waste that takes hundreds of years to become inert, and they carry the risk of nuclear accidents that can kill or irradiate people, giving them inoperable cancers if nuclear waste is allowed to escape, and the cons of nuclear power (ie. reactors powered by uranium, not thorium, which in our view, holds much promise) far outweight the pros.

Critical Mass – A point or situation at which change occurs.

If something isn’t done to raise prices and help North American producers, there won’t be a domestic uranium industry. If the operating costs, construction lead times and the huge capital outlay of new nuclear reactors can’t all be reduced to compete with renewables or natural gas, nuclear power is also destined for the scrap heap.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.