Historic squeeze shows just how tight the copper supply-demand equation has become

2021.10.28

Copper has been an essential material to man since prehistoric times. In fact, one of the major “ages” of human history is named for a copper alloy: bronze.

Copper and its many alloys have played an important role in many civilizations, from the ancient Egyptians and Romans to modern-day cultures.

Copper History

Copper was first used by human civilizations some 10,000 years ago.

A copper pendant discovered in what is now northern Iraq has been dated about 8700 B.C. For nearly five millennia, copper was the only metal known to man, and thus had all the metal applications.

Early copper artifacts, first decorative, then utilitarian, were hammered out from “native copper,” pure copper found in conjunction with copper-bearing ores in a few places around the world.

By 5000 BC, the dawn of metallurgy had arrived, as evidence exists of the smelting of simple copper oxide ores such as malachite and azurite.

It was not until about 4000 BC that gold appeared on the scene as man’s second metal. By 3000 B.C., silver and lead were being used, and the alloying of copper had begun, first with arsenic and then with tin.

For many centuries, bronze reigned supreme, being used for plows, tools of all kinds, weapons, armor, and decorative objects. The copper metal was mined principally from the island of Cyprus (from whence its name) and numerous other sites in the Middle East, though the origin of the tin in the bronze remains a mystery.

The Bronze Age suddenly ended at about 1200 BC, with the general collapse of the ancient world and the interruption of international trade routes.

The supply of tin in particular dried up and the Iron Age was ushered in, not because iron was a superior material but because it was widely available. However, the deliberate alloying of iron with carbon to form the first steel did not occur for centuries.

Economy in the use of copper and its alloys was necessitated by these early trade interruptions, and this efficiency in use and re-use has continued from that day onwards.

Modern Uses

Today, copper has become an essential ingredient for modern living.

According to the USGS, copper ranks as the third-most used industrial metal in the world, after iron and aluminum. Its total consumption was 24.4 million tonnes in 2020.

The Copper Development Association divides its uses into four categories: electrical, construction, transport and other. By far the largest sector for copper usage is electrical, at 65%, followed by construction at 25%.

Copper is useful for electrical applications because it is an excellent conductor of electricity.

That, combined with its corrosion resistance, ductility, malleability, and ability to work in a range of electrical networks, makes it ideal for wiring. Among electrical devices that use copper, are computers, televisions, circuit boards, semiconductors, microwaves, and fire prevention sprinkler systems.

In telecommunications, copper is used in wiring for local area networks, modems and routers. The construction industry would not exist without copper; it is essential for piping and wiring in residential and commercial construction.

The red metal is used for potable water and heating systems due to its ability to resist the growth of water-borne organisms, as well as its resistance to heat corrosion.

The transportation industry is reliant on copper for core components of airplanes, trains, cars, trucks and boats. A commercial airliner has up to 190 km of copper wiring, while high-speed trains use up to 10 tonnes of copper per kilometer of track.

Automobiles have used copper and brass radiators and oil coolers since the 1970s. More recent applications include on-board navigation, anti-lock braking systems, heated seats, defrosting wires embedded in windows, hydraulic lines, and wiring for window and mirror controls.

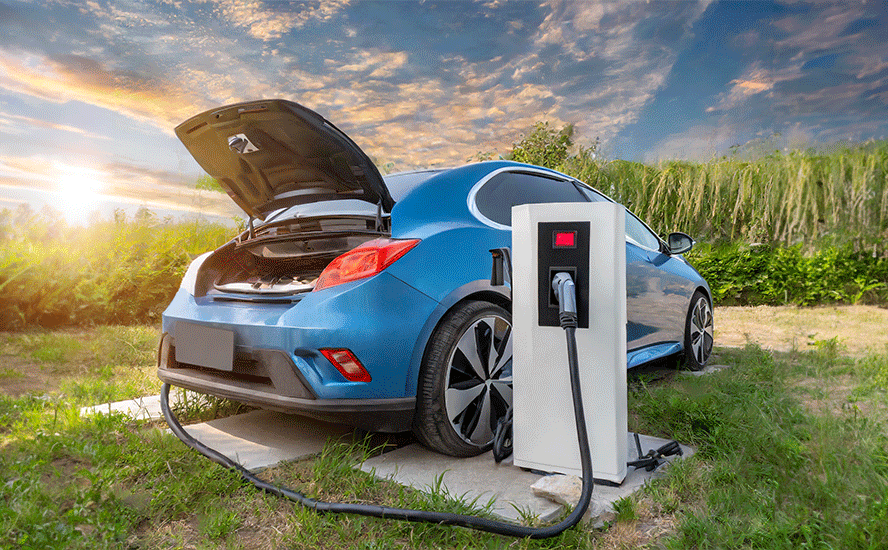

In electric vehicles, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations. An EV contains about four times as much copper as a vehicle powered by an internal combustion engine.

The latest use for copper is in renewable energy technologies, particularly in photovoltaic cells used for solar power, and wind turbines.

Copper Deficit

Given its deep-rooted history in human civilizations and the integral role it plays in modern society, it’s hard to imagine a world without any more copper. But the way we have been consuming the metal, that could be a distinct possibility sooner or later.

According to Cochilco, the copper commission of leading producer Chile, global demand for the industrial metal is expected to reach 24 million tonnes this year, up 2.4% compared to 2020, and 24.7 million tonnes for 2022, a 3% increase.

Compared with last year’s total production of 20 million tonnes, as tallied by the US Geological Survey (USGS), this means the global copper supply must increase by 4 million tonnes, or 20%, in 2021 to satisfy demand, which is simply a tough ask for miners.

Fears of a copper shortage have already begun to percolate through the global markets this year.

Back in April, commodity strategists at Bank of America had already expressed their concerns about the world “running out of copper” amid growing demand for the metal.

At the time, copper inventories were sitting at their lowest in 15 years, enough to cover just 3.3 weeks of demand.

As such, BofA Global Research noted that it is forecasting copper market deficits amid further drops in inventory both this year and in 2022.

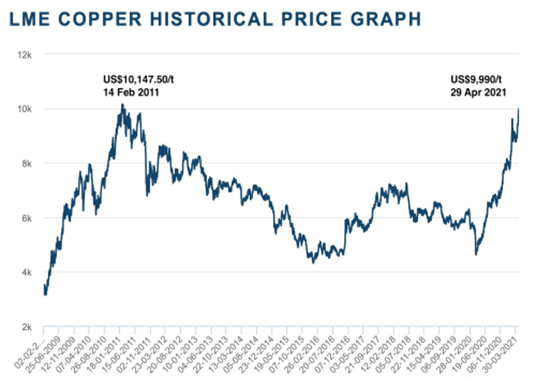

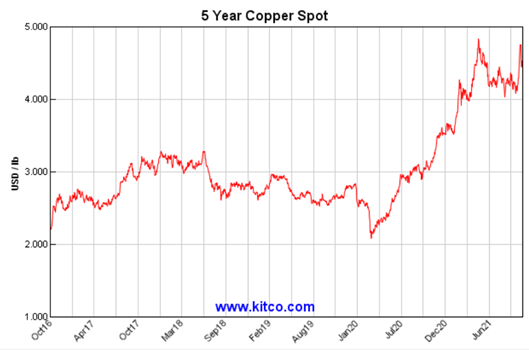

A week after the BofA report, copper prices shot to their highest on record as demand kept surging amid the global push for a green economy that requires more and more of the metal.

Marko Papic, chief strategist at alternative investment firm Clocktower Group, likened the push to a “space race.”

“Everyone is running very fast toward an EV future,” Papic said. “Copper is needed everywhere. It conducts electricity.”

And despite pulling back from all-time highs, the bullish sentiment on copper never really faded as rising demand and tightening supplies continued to support the narrative of a forthcoming market deficit.

Research agency Fitch Solutions recently revised its copper price forecasts for this year and next to $9,200/t and $8,800/t, respectively, from the previous forecast of $8,700/t and $8,370/t, as tight inventories continue to support higher prices.

“Lack of supply, increased demand and excessively loose monetary policy could likely propel copper prices back to, or even above recent highs,” Mike McDaniel, chief investment officer of risk assessment tool Riskalyze, speculated.

Vivek Dhar from Commonwealth Bank of Australia said in June that if copper demand increases 3.5% annually over the next five years, the market could see a supply shortage “very, very quickly.”

Moreover, any copper shortage may not just be a short-term phenomenon. Acuity Knowledge Partners, formerly part of Moody’s Corp., is predicting a widening demand-supply gap that could reach as high as 8.2 million tonnes by 2030.

Recent study by Jefferies Research LLC concluded that the copper market is heading into a “multiyear period of deficits” and high demand from deployment of renewable energy and electric vehicles.

“The secular demand driver in copper is electric passenger vehicles, as the average EV is about four times as copper intensive as the average ICE automobile. Renewable power systems are at least five times more copper intensive than conventional power,” the report stated.

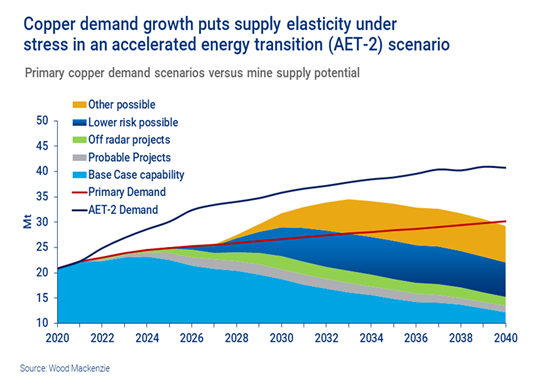

In 20 years, BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles – from the current 20mt a year to 40mt a year.

Copper consumption by green energy sectors globally is expected to jump five-fold in the 10 years to 2030, data from consultancy CRU Group shows.

Historic Copper Squeeze

What happened with London Metal Exchange’s copper inventories perfectly illustrates how tight the market can get when an overwhelming demand begins to drain the supply chain.

The LME was recently caught off guard by a sudden emptying of available copper in its warehouses, which drove inventory levels to their lowest since 1974. Over the past two months, freely available inventories have shrunk by more than 90% in LME-monitored warehouses as orders surged.

The direct consequence was an emphatic surge in spot prices, with contracts for immediate delivery rising to a record premium of more than $1,000/tonne to three-month futures — a level not seen in the last 27 years. That’s the hallmark of a supply squeeze.

Similar situations have also transpired on rival bourses in China and the US, the two biggest economies.

This is a clear sign that copper inventories were at critical levels on the LME, with smelters in Europe not providing enough output to keep pace with a fast-growing demand.

Although some of that can be attributed to logistics and rising energy prices, analysts and industry leaders are still of the belief that the copper market remains physically tight.

“This is an extreme situation,” Oliver Nugent, metals analyst at Citigroup, said in a phone interview with Bloomberg, adding that:

“Across metal markets, one of the big themes has been consumers wanting to build up their working inventories, and that’s escalated a lot of the tightness.”

The supply-demand equation for copper is “very tight,” even amid market-wide uncertainties fueled by Chinese property turmoil and a global energy crunch, according to Diego Hernandez, head of Chilean mining society Sonami, in a separate Bloomberg interview.

“We shouldn’t have big surprises through year-end,” the former chief executive of Codelco and Antofagasta said, adding that “supply and demand in the coming years should remain fairly tight so prices should be not extraordinary, but good — higher than long-term projections.”

Miners’ Output Down

Delving deeper into the copper supply situation, we find that production from some of the world’s biggest miners is falling, which could widen the supply gap even further.

Chile’s Codelco, the No.1 copper company, recently reported a 6.7% year-on-year output drop to 144,500 tonnes for the month of August, dogged by a prolonged strike at its Andina mine near Santiago.

Overall, total output in Chile, the top copper-producing nation, declined 4.6% year-on-year in August to 461,900 tonnes, according to Cochilco data.

Escondida, the world’s largest copper mine held by BHP in Chile’s Atacama Desert, saw an even steeper production drop of 14% to 81,500 tonnes in the same month. The mining group, which was the second-largest producer in 2020, last week announced that its Q3 copper output was 7% lower than the previous quarter.

No. 3 producer Freeport-McMoRan, too, is coming off an underwhelming quarter, during which it produced 987 million lb of the metal, falling short of the 1 billion lb average estimate of analysts tracked by Bloomberg. The production miss was led by lower-than-expected output in the company’s mines in South America and North America.

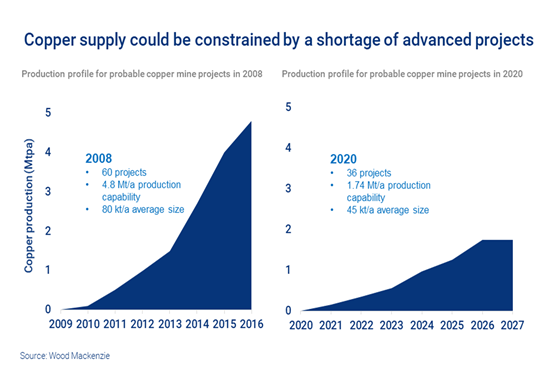

In short, copper output is on the decline as years of underinvestment and lack of new projects are beginning to take effect, giving support for higher copper prices.

Earlier this year, Wood Mackenzie estimated that the industry has committed around $120 billion in capex to expand production to offset the impact of grade decline and depletions. But without additional substantial investment, production will decline from 2024 onwards.

Call For New Discoveries

A recent report by resource investment house Goehring & Rozencwajg Associates found stagnating supply is the key factor pushing “copper prices far higher than anyone expected.”

According to the Wall Street firm, the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

Also, geological constraints surrounding copper porphyry deposits, a subject few analysts and investors understand, will contribute to the problems, their latest report said.

By 2015, the industry’s head grade was already 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion.

According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

It also shines a light on the importance of making new discoveries in establishing a sustainable copper supply chain. Over the past 10 years, greenfield additions to copper reserves have slowed dramatically, with tonnage from new discoveries falling by 80% since 2010.

Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand.

This means that copper producers must, at the minimum, double last year’s production by then to even have a chance of coming close to meeting demand. Such a feat isn’t accomplishable without ramping up investment in projects leading to copper discoveries.

Prospective Copper Projects

At AOTH, we are paying close attention to companies that are holding onto highly prospective copper projects that could draw the attention of global miners that are hunting for deals to expand their production potential.

Just recently, it was reported that BHP is eyeing a stake in the Western Foreland exploration area in the Democratic Republic of the Congo, the largest copper producer in Africa. The Western Foreland territory lies directly next to Ivanhoe Mines’ Kamoa-Kakula mining licence that began production earlier this year, and will ship 100% of its production to China.

Such a deal, should it materialize, represents a shift in BHP’s strategy of avoiding high-risk mining jurisdictions, which goes to show that companies are looking anywhere possible for a commodity they expect to be in demand.

But most of the mining industry would still want to prioritize the more productive, less risky parts of the world in the quest for more copper.

Chile is an ideal elephant copper deposit hunting ground for the big-name major and mid-tier mining companies. Boasting the biggest copper reserves worldwide, at 200 million tonnes, means Chile’s dominance isn’t waning anytime soon.

One company in pursuit of the next porphyry copper discovery in Chile is Pampa Metals Corp. (CSE: PM) (FSE: FIRA), which holds eight projects in the heart of northern Chile’s proven copper belts.

The mid-Tertiary porphyry copper belt of northern Chile is host to three of the world’s top five copper mining districts: Collahuasi, Chuquicamata and Escondida. The adjacent Paleocene mineral belt also hosts a series of important porphyry copper deposits such as Cerro Colorado, Spence and Sierra Gorda.

Together, the company’s properties cover a total area of 59,000 hectares, making it one of only a few juniors with significant landholdings in the Atacama region that is mostly dominated by major miners.

Still, a large part of the region remains underexplored to this day as roughly half of northern Chile is covered by gravel that was deposited after the formation of the porphyries, which means more mineral deposits are likely concealed underneath.

On the other side of the Andean copper belt in Colombia, Max Resource Corp. (TSXV: MXR) (OTC: MXROF) (Frankfurt: M1D2) may be holding onto what could potentially be a massive sediment-hosted system comparable to some of the world’s best.

Max interprets the sediment-hosted stratabound copper-silver mineralization in the Cesar basin to be analogous to both the Central African Copper Belt, which contains nearly 50% of the copper known to exist in sediment-hosted deposits, and the Polish Kupferschiefer, Europe’s largest copper source.

For over a year, the company has not only been finding high-grade copper zones at its flagship CESAR property but expanding these areas to confirm this hypothesis. To date, five copper discoveries have been made along an 80 km belt, demonstrating its significant regional potential.

Max’s goal is to partner up with a major to begin drilling at CESAR. Interest so far has been strong, with multiple non-disclosure agreements in place to advance the project, including a collaboration agreement with an industry-leading copper producer.

Europe, too, has an abundance of porphyry copper deposits that can be traced back to the Paleozoic and Late Cretaceous to Miocene ages. The Baltic Shield, in particular, has often drawn comparisons to the Canadian Shield and cratons in South Africa, and is currently one of the most active mining areas on the continent.

Part of the Shield covers most of Scandinavia, where Norden Crown Metals Corp. (TSXV: NOCR) (OTC: NOCRF) (Frankfurt: 03E) is looking to bring back its gloried copper past.

The company recently began exploration drilling at its Burfjord project in northern Norway. The property is located in the Kåfjord copper belt, which is highly prospective for iron oxide-copper-gold (IOCG) and sediment-hosted copper mineral deposits.

Mineralization at Burfjord belongs to the same deposit clan of the northern Fennoscandia region, a key IOCG province globally. Copper mineralization was mined in the Burfjord area during the 19th Century, with over 30 historic mines and prospects developed along the flanks of a prominent 4 km x 6 km anticlinal structure.

The 2021 drill program is designed to continue testing copper-gold grades and continuity of new targets, historical mines and prospects at the Burfjord property.

In Finland, months of drilling success by Palladium One Mining (TSXV:PDM) (FRA:7N11) (OTC:NKORF) on its Läntinen Koillismaa (LK) PGE-Cu-Ni property have culminated in a much-increased resource endowment, further confirming the project’s potential to host a large bulk-tonnage deposit.

At the Haukiaho Zone there are significant base metals, with two-thirds of the zone’s value in nickel and copper.

The latest resource estimate of 1.2 million ounces palladium equivalent (PdEq) grading 1.15% g/t, comprises only 3 km of strike length; 2 km of strike extent, immediately east of the Haukiaho resource estimate, contains two significant IP chargeability anomalies with sufficient historical drilling to potentially be upgraded to inferred resources with modest additional drilling.

The remaining 12 km of the Haukiaho trend has not been drill tested, though widely spaced historical drilling provides a high level of confidence for potential additional nickel-copper resources to be delineated, says Palladium One.

Palladium Onealso continues to outline a high-grade nickel-copper system at its Tyko Ni-Cu-PGE project in Ontario, where a second-phase drill program started in April and a recently announced expansion increases the size of the property by over a fifth.

All 13 holes drilled at the Smoke Lake target intersected magmatic sulfides, with widths ranging from 1 to 15 meters. A second-phase, 2,000m drill program started in April, following up on high-grade hits of 9.9% nickel equivalent (NiEq) over 3.8m. A number of high-grade intersections were reported, all near surface.

Excited as Palladium One is about its nickel results, there are also notable copper and nickel occurrences, in particular the RJ and Tyko zones located about 18 km west of Smoke Lake. Drilling in 2015 returned several intercepts over 1% nickel + copper with a high of about 1.5% Ni + Cu.

The 7,000-hectare mafic-ultramafic Bulldozer intrusion, which has seen virtually no geological mapping nor exploration, also has significant historical copper showings.

Another place well-known for its copper minerals is British Columbia, Canada, home to big copper-gold and copper-molybdenum porphyries, such as Red Chris and Highland Valley. Here, GSP Resource Corp. (TSXV: GSPR) (FRA: 0YD) is currently looking to bring back the past-producing Alwin mine located 18 km from the town of Logan Lake.

The property lies in the vicinity of several large-scale mine operations. It is southwest of the New Afton and Ajax mines, and right next to Teck Resources’ Highland Valley copper operation.

A drilling campaign is set to begin soon at the Alwin project, aimed at testing the bulk tonnage copper potential of unmined mineralization within and surrounding the historical mine.

In northwestern BC, home to the Golden Triangle historical copper-gold mining district, Mountain Boy Minerals (TSXV: MTB) (OTCQB: MBYMF) (Frankfurt: M9U) is actively exploring its recently acquired Telegraph project.

Covering 23,000 hectares, the Telegraph property was the site of past exploration campaigns by numerous companies, each focused on their own individual small claims. MTB decided to consolidate these claims following compilation of historical exploration data, which suggested evidence of large-scale copper-gold porphyry potential.

According to the company, the Telegraph project features the same oceanic arc volcanic and sedimentary sequences and their associated porphyries responsible for the vast mineralization that the Golden Triangle is famous for. It is located in the same neighborhood as a large number of porphyry deposits including Galore Creek (Teck – Newmont), Schaft Creek (Teck – Copper Fox), Big Red (Libero Copper and Gold), Saddle and Saddle North (GT Gold – Newmont) and the operating Red Chris copper-gold mine (Newcrest – Imperial Metals).

Renforth Resources’ (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) 260-square-kilometer Surimeau property in Quebec hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure.

Summer prospecting on the southwestern part of the Huston target returned 1.9% nickel, 1.3% copper, 1,170 parts per million (ppm) cobalt and 4 grams per tonne silver, from a grab sample taken from strongly foliated diorite.

The little-explored Huston area is located about 18 km northwest of the Victoria West target, where recent drilling, trenching and surface sampling reveal an area of interest that includes about 5 kilometers of strike on the western end of a 20-kilometer magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization.

Renforth management says the spectacular result from Huston (grades above 1% nickel and copper are today considered high grade) is the first documented nickel occurrence in the area.

At its Malartic West property, Renforth plans to follow up channel and grab samples that revealed a copper and silver mineralized system known as the Beaupré Copper Discovery. In the northern part of the property this system has been traced over 175m and remains open. The 53-square-kilometer project is contiguous to Victoria West and adjacent to the western border of Canadian Malartic, Canada’s largest open-pit gold mine.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV: MXR) and Norden Crown Metals Corp. (TSXV: NOCR).

MXR, NOCR, PM, NOCR, RFR, PDM and GSPR are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.