Harvest Gold CEO Shareholder Letter

Dear Harvest Gold shareholders and followers,

This is my first “e-mail blast” in a very long time, but, happily for us all, we are financed and drilling, so it is time to resume sending an occasional note to our list of 1,000, or so, directly.

I think you will enjoy this short read from a July interview which introduces our largest shareholder, Crescat Capital (they now own 19.9% of Harvest Gold) and their lead Technical Advisor, Quinton Hennigh, who has a quote in our recent closing press release. We have come to know him and the Crescat management team very well. Quinton often interacts with our Geo team to our great advantage.

I love his reference in the interview below to our properties being “the mirror image” to the Windfall property splay for which Goldfields recently paid Osisko Mining $2B for the remaining 50% of the Windfall deposit and a very large property package along the Urban Barry belt. Here are Windfall’s numbers:

Measured & Indicated Mineral Resources:

The Windfall project has an estimated 4.1 million ounces of gold within 11,061 Mt at around 11.4 g/t.

Additionally, there are 3.3 million ounces in inferred resources, contained within 12,287 Mt at approximately 8.4 g/t.

Total: ~7.4 million ounces in combined measured, indicated, and inferred resources.

So, we begin the search for Gold with very high hopes to discover the next Windfall.

Thanks to Rick Mills and Bob Moriarty for interviewing Quinton.

Have a great weekend,

Rick Mark, CEO Harvest Gold

Rick Mills Founder Ahead of the Herd:

Quinton, how did you come to be involved with Crescat Capital?

Quinton Hennigh, Geologist, Geologic & Technical Advisor, Crescat Capital:

I’ve been working with Kevin and Tommy for about five or six years, Kevin came to me in 2019 said he wanted to invest in mining companies particularly junior mining companies, for exploration exposure, and I can remember in the fall of 2019 pointing him to opportunities like Vizsla, which was just coming out of the gate at that time, Great Bear which was kind of in its earlier days of discovery, and he did quite well, those both paid off big time.

But in the early part of 2020 when covid came along Kevin was short the market and actually made quite a bit of money in it, the period March-April-May I think something like that.

And then he decided to establish a precious metals fund at Crescat and asked me if I could help deploy money and we did, we deployed a considerable amount of money, I think it was around $80 million at the time into a lot of junior exploration companies primarily, and that’s sort of been our main investment strategy.

It’s pretty rare to see a fund do this in this day and age, there’s not too many of us left, but we are either the last of the dinosaurs or the first of the mammals, I’m not sure which.

RM: Bob and I were talking three months ago, when we first started this little conversation we’re having every week, and we were looking for stocks that were cheap and there was no other rationale or anything, we thought we were at the start of a gold bull market and one of the first stocks we talked about was Harvest Gold Corp. (TSX.V:HVG).

Why were you interested in Crescat investing in Harvest?

QH: There’s actually a little bit of the history before their acquisition in the projects they have now over by Windfall. Originally Harvest was targeting a porphyry gold complex in BC, they drilled a couple of holes, didn’t hit the big one unfortunately, they did a hard pivot and picked up the projects in Quebec, this is over near the Windfall deposits, basically the same greenstone belt.

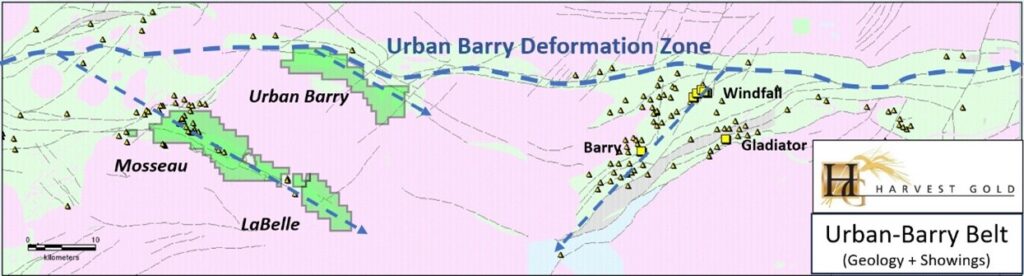

Part of that was I did have interaction with them around screening some opportunities they were looking at, and this one looked pretty good, mainly because it looks like the mirror image, if you look at the greenstone belt and look at the position of the Windfall deposit, which was sold here recently to Gold Fields (Z:GFI), you can see that the mirror half of that belt is expressed in there I believe it’s the Mosseau property to the west, so it basically looks like an early-stage prospective version of the Windfall target.

Not a lot of data on the property, but the guys had done a pretty systematic job, we did help fund them last summer to get some technical work done, really build up their geophysical data, their surface geo-chem data and other things and that data has now put them in a position where they have quite a few drill targets they’re going to start testing.

Is this a slam dunk? No, is it a really interesting prospective piece of greenstone belt? Yes, very much so, and this is the kind of thing I like. I like to see companies go after big targets.

Rick Mills

Ahead of the Herd Under the Spotlight

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.