GSP’s 2021 drilling expands historical Alwin mine

2021.12.11

GSP Resource Corp (TSXV:GSPR, FRA:OYD) has completed its 2021 drill program and all indications point to a porphyry-style copper system similar to the mineralization found at the Highland Valley copper mine in close proximity to its deposit in south-central British Columbia.

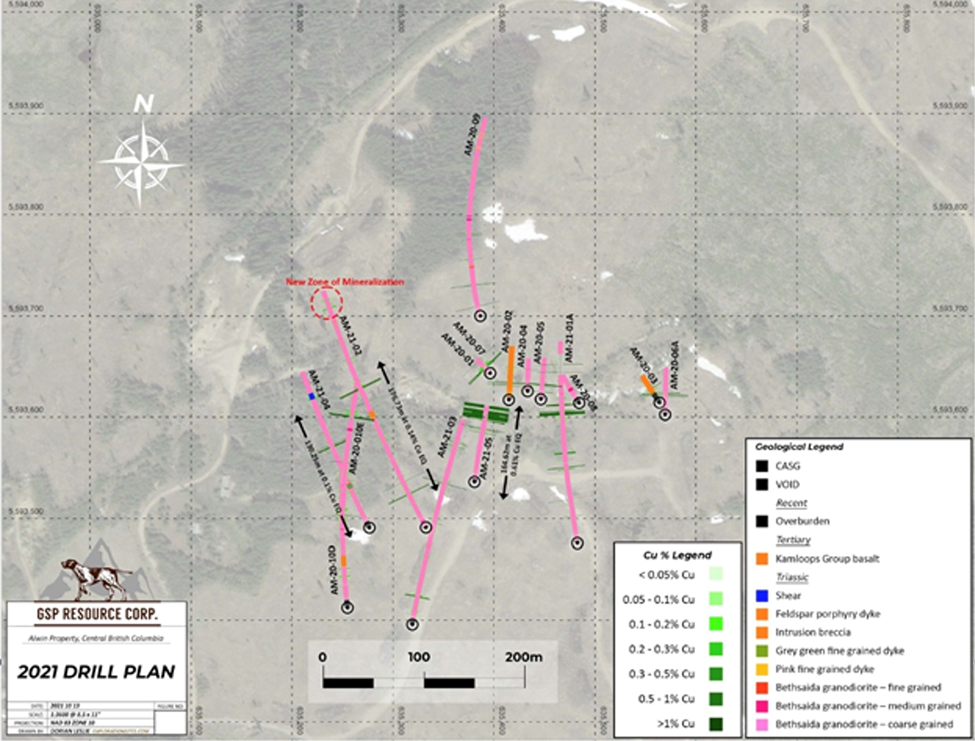

The fall program consisted of three holes totalling 895.5 meters and was designed to further test the bulk grade of the Alwin deposit and surrounding lower-grade rock with the drill holes collared from the north of the historical deposit. Assay results are expected in the first quarter of 2022.

According to GSP, most of the alteration and mineralization observed in the upper and lower portions in all deeper drill holes intersecting rock greater than 20 meters from the shell of the Alwin deposit have copper porphyry-style characteristics similar to that seen nearby in the Highland Valley camp.

The fall drilling program followed up on a five-hole summer program. Together with summer drilling, GSP’s 2021 eight-hole program totaled 2,313 meters, testing the bulk-tonnage copper potential of unmined mineralization within and surrounding the historical Alwin mine.

Alwin Mine Project

The Alwin Mine Project is located 18 km from the town of Logan Lake. The past-producer is southwest of the New Afton and Ajax mines, and less than a kilometer from the Highland Valley copper mine owned and operated by Teck Resource Corp.

Previous underground operators were focused on the high-grade copper-gold-silver mineralization.

Developed to a depth of 300 meters, the Alwin mine produced over 233,000 tonnes from five zones between 1916 and 1981. It milled 3,786 tonnes of copper, 2,729 kilograms (87,739 oz) of silver and 42.6 kg (1,369 oz) of gold.

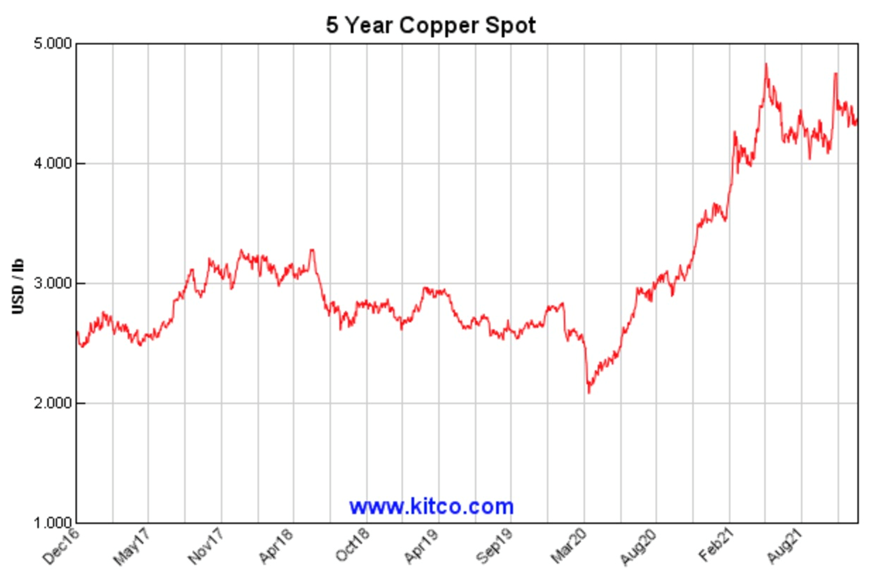

At a 1.5% Cu cut-off grade with copper being less than a dollar a pound, and getting as low as US$0.56, the mine was never considered from a bulk tonnage, open-pit perspective. Ironic, really, considering that is precisely what the Highland Valley has become known for, with five large pits developed over the past 60 years including Teck’s Highland Valley open-cast copper-molybdenum operation.

Fast forward to today, when the economics of copper mining are completely different, with copper currently trading at $4.28 a pound compared to a ballpark average 68 cents during the 1960s and early 1980s. The much higher copper price now makes the lower-grade areas of the Alwin Mine Project more interesting if they can be developed into an open-pit mine.

GSP management believes there is a low-grade halo of mineralization north and south of an east-west trending structure, that could be bulk-tonnage and open-pittable.

A brief digression: most of the mineralized structures in the Highland Valley, including Getty North, Getty South, Lornex and Highmont, run north to south.

Alwin, however, runs east to west.

A lot of historical drilling has been done at the Alwin mine, however most of it was underground with short, tightly-spaced holes targeting the high-grade material. Not much was drilled from surface around the edges of the mine.

Alwin decided to investigate what would happen if they stepped back from the east-west trending structure the Alwin mine sits on, at first pointing the drill south to north.

Drilling last year from the southern property boundary towards the mine, GSP hit numerous low-grade halo structures that proved to be in excess of the Highland Valley pit’s 0.28% CuEq mining head grade. A side note: the Alwin property is so close to Highland Valley that when you stand on it you can see, hear and feel the mining trucks rolling “next door”.

The best intercept from the 2020 drill program returned 62 meters at 0.3% copper equivalent (CuEq), “with some very high grades of silver in the guts of the high-grade zone,” CEO Simon Dyakowski told me.

This year the company decided to expand its step-out drilling. During the summer, three of five holes were “home runs” says Dyakowski, in terms of hitting potential open pitable grades.

Highlights included:

- 0.61% CuEq over 164.6m;

- 0.14% CuEq over 176.7m;

- 0.21% CuEq over 229.7 including 0.28% CuEq over 158.5m and 0.48% CuEq over 79.3m.

The company drilled three more holes in the fall, this time with the drill pointing north-south towards the mine. As mentioned at the top, these holes were designed to test the bulk grade of the Alwin deposit and surrounding lower-grade rock with the drill holes collared from the north of the historical deposit.

Assay results are expected in Q1, 2022.

So far GSP’s plan is working. Mineralization has been identified in deep (>300m) holes more than 20 meters from the mine, which appears to verify GSP’s geological model of a low-grade halo of mineralization north and south of the east-west trending structure.

“We’re starting to be able to envision a sizeable amount of material as bulk tonnage,” says Dyakowski.

But the really exciting part of the project concerns the type of mineralization GSP could be looking at.

During 2021 drilling a new mineralized zone was discovered from hole AM21-02, shown as a dotted red circle on the above map. Previous drilling didn’t go very deep, but hole 2 of the 2021 program was completed to a depth of 367m. Near the end of the hole, the rock was found to be increasing in alteration. From 338m to 351m, the exploration team intersected what GSP describes as “an intensely mesothermal to epithermal clay style altered shear hosting dilational quartz vein fragments hosting coarse-grained pyrite and chalcopyrite.”

In plain English? This is evidence of a porphyry. Dyakowski explains:

“We punched through a lot of pyrite right in the area of a geophysical anomaly so we think that might be the top of an unknown porphyry. That’s something we’re going to save for next spring when we have a whole season of deeper drilling, but one of the main theories on Alwin is it is a skarn replacement system that’s associated with a larger porphyry.”

A porphyry deposit is formed when a block of molten-rock magma cools. The cooling leads to a separation of dissolved metals into distinct zones, resulting in rich deposits of copper, molybdenum, gold, tin, zinc and lead. A porphyry is defined as a large mass of mineralized igneous rock, consisting of large-grained crystals such as quartz and feldspar.

Porphyry deposits are usually low-grade but large and bulk-mineable, economics of scale come into play making them attractive targets for mineral explorers. Porphyry orebodies typically contain between 0.4 and 1% copper, with smaller amounts of other metals such as gold, molybdenum and silver.

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province. Examples include big copper-gold and copper-molybdenum porphyries, such as Red Chris and Highland Valley.

GSP believes the mineralization it is encountering is part of the Highland Valley hydrothermal system associated with the Highland Valley copper mine, which has been operating for 50-plus years. Owner Teck Resources is planning an expansion that would extend the mine life to 2040.

Conclusion

At AOTH we are very encouraged by what we are seeing from GSP at its Alwin Mine Project.

Alwin has always been thought of as a high-grade underground mine and for good reason. During it last phase of production, 1916 to 1981, copper was a fraction of the >$4.00 per pound it is worth today, making any low-grade material surrounding the mine un-economic. Times have changed and the low-grade halo that appears to be north and south of the mine might, at +$4 copper, be a stand alone bulk-mined open-pit.

Clearly that is GSP’s intention and the company, imo, appears to be well on its way to proving the model. Between last years and this summer’s drilling, they have come up with what we consider to be a significant amount of mineralization.

The last three holes drilled this fall are vectoring north-south toward the mine, rather than the previous south-north drilling. GSP describes most of the alteration and mineralization observed in the upper and lower portions of these holes as having “copper porphyry-style characteristics similar to that seen nearby in the Highland Valley camp.”

We are eager to see the assays — they are expected to be available in Q1 — and what GSP is planning next at Alwin, once they have boots back on the ground early next spring.

GSP Resource Corp.

TSXV:GSPR, FRA:0YD

Cdn$0.19, 2021.12.10

Shares Outstanding 20.2m

Market cap Cdn$3.9m

GSPR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of GSP Resource Corp. (TSXV:GSPR). GSPR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.