Graphite vs lithium

2022.01.28

The electrification of the global transportation system doesn’t happen without lithium and graphite needed for lithium-ion batteries that go into electric vehicles.

A battery contains two electrodes — an anode (negative) on one side and a cathode (positive) on the other. An electrolyte sits in the middle and moves ions between the electrodes when charging and discharging.

An EV uses the same rechargeable batteries as found in phones or laptops, only bigger. The cathode requires lithium, nickel, manganese and cobalt — expensive metals found in one of the most common battery chemistries, NMC 8-1-1. (eight parts nickel to one part manganese and one part cobalt). Other familiar chemistries include NCA (nickel-cobalt-aluminum) and LFP (lithium-iron-phosphate).

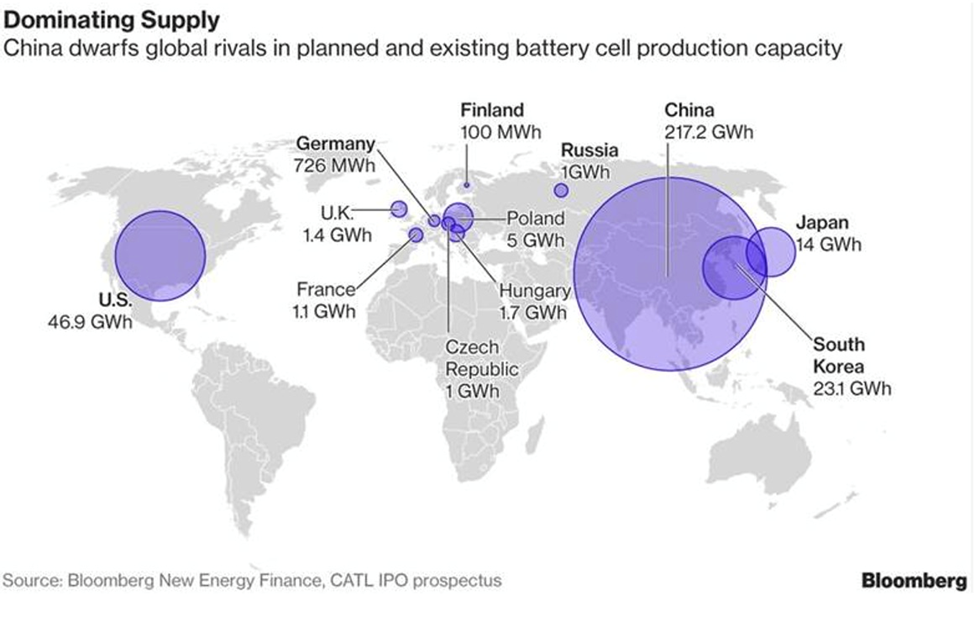

The anode is typically made of copper foil coated with graphite, a critical metal that is harder to source than lithium. These materials need to be mined and processed into high-purity chemical compounds, then made into suitcase-sized battery packs, a procedure that is dominated by China, which accounts for roughly 75% of global lithium-ion battery capacity.

Recently, battery metals investors have been captivated by lithium’s strong showing. The ultra-light element started 2022 on a record high, continuing its fine form from last year. Data from S&P Global Platts showed that lithium carbonate prices in China have risen 35% on month, and are up 531% on the year.

Like lithium, graphite is indispensable to the global shift towards electric vehicles. It is the largest component in lithium-ion batteries by weight, with each battery containing 20-30% graphite. But due to losses in the manufacturing process, it actually takes 30 times more graphite than lithium to make the batteries.

The anode material, called spherical graphite, is manufactured from either flake graphite concentrates produced by graphite mines, or from synthetic/ artificial graphite. Only flake graphite, upgraded to 99.95% purity, can be used.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

By estimates, at least 125 million EVs are expected to be mobile by 2030, nearly 20 times the global EV stock in 2019. That’s more than eight million tonnes of battery-ready graphite needed by the next decade. Last year, the mining industry was only able to supply 1.1 million tonnes.

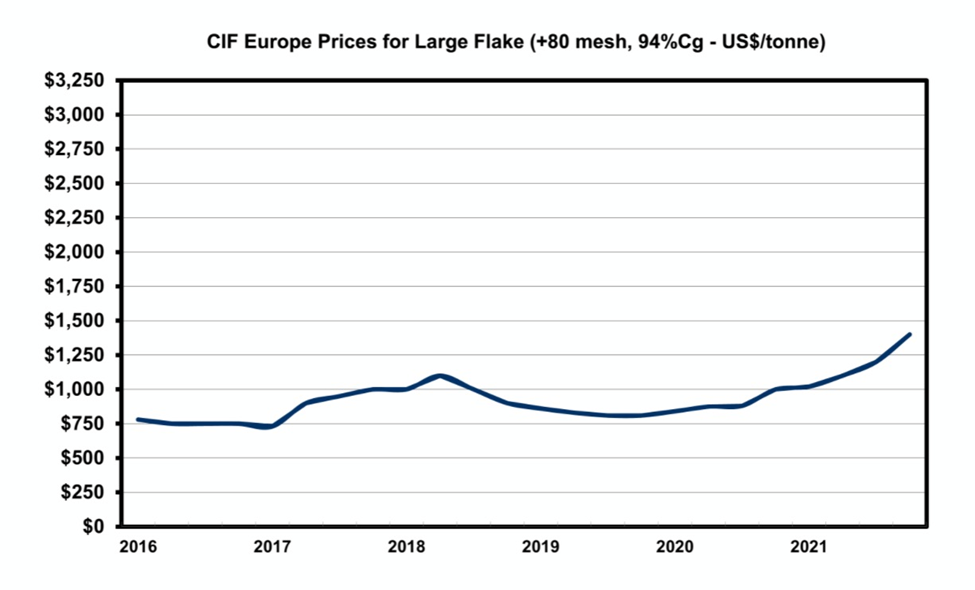

Yet despite the pressing need for graphite, and other battery metals, to keep up with the surging number of EVs rolling off production lines, graphite prices haven’t moved very much in the past five years or so. Certainly they haven’t run at the pace of lithium prices, as the charts below show.

The divergence puzzled me, prompting this deep dive into the lithium and graphite markets.

Lithium

Currently there are two primary means of extracting lithium: from brines in evaporated salt lakes known as salars, and hard rock mining, where the lithium is mined from pegmatite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite. A third, new method is claystone mining.

Lithium carbonate is largely produced from brines or salt flats, while lithium hydroxide is mined from hard rock sources and is the preferred form for EV battery use. Both forms occur naturally, but the methods of extraction for each differ.

For lithium carbonate, the process involves pumping the brine into a series of evaporation ponds, crystallizing the other salts out of the brine and leaving a lithium-rich liquor; this may take up to two years. Lithium carbonate is then produced after removing impurities, and the end product can be further processed into the higher-grade lithium hydroxide, but at an additional cost.

The most important lithium hard rock minerals are found in granitic pegmatites, which are intruding rock units formed from mineral-rich magma. Spodumene (in Greek meaning “burnt to ashes”), a lithium-bearing mineral that occurs as crystals in a range of colors, is most prevalent in pegmatites. The extraction process involves crushing and heating the rocks into powdered form, with the help of sulfuric acid, and then mixed with soda ash to create lithium hydroxide.

The world’s lithium supply chain is oligopolistic in structure: there are currently eight countries with known lithium production. Three of those – Australia, Chile and China – account for nearly 90% of global output.

Also, only a handful of companies control most of mined output. These include Chile-focused producers like Albemarle and SQM, and Chinese miners Tianqi Lithium and Ganfeng Lithium.

The divergence puzzled me, prompting this deep dive into the lithium and graphite markets.

Lithium

Currently there are two primary means of extracting lithium: from brines in evaporated salt lakes known as salars, and hard rock mining, where the lithium is mined from pegmatite orebodies containing spodumene, apatite, lepidolite, tourmaline and amblygonite. A third, new method is claystone mining.

Lithium carbonate is largely produced from brines or salt flats, while lithium hydroxide is mined from hard rock sources and is the preferred form for EV battery use. Both forms occur naturally, but the methods of extraction for each differ.

For lithium carbonate, the process involves pumping the brine into a series of evaporation ponds, crystallizing the other salts out of the brine and leaving a lithium-rich liquor; this may take up to two years. Lithium carbonate is then produced after removing impurities, and the end product can be further processed into the higher-grade lithium hydroxide, but at an additional cost.

The most important lithium hard rock minerals are found in granitic pegmatites, which are intruding rock units formed from mineral-rich magma. Spodumene (in Greek meaning “burnt to ashes”), a lithium-bearing mineral that occurs as crystals in a range of colors, is most prevalent in pegmatites. The extraction process involves crushing and heating the rocks into powdered form, with the help of sulfuric acid, and then mixed with soda ash to create lithium hydroxide.

The world’s lithium supply chain is oligopolistic in structure: there are currently eight countries with known lithium production. Three of those – Australia, Chile and China – account for nearly 90% of global output.

Also, only a handful of companies control most of mined output. These include Chile-focused producers like Albemarle and SQM, and Chinese miners Tianqi Lithium and Ganfeng Lithium.

Lithium prices have taken off in China, with soaring electric-vehicle sales underpinning a five-fold gain over the past year. Bloomberg reports that Chinese lithium carbonate prices tracked by Asian Metal Inc. hit a fresh record Monday, as data showed a 35% month-on-month jump in electric-vehicle registrations in December.

Driving the latest lithium rally are near-term risks that are threatening deeper shortages in the metal’s supply, from plant maintenance and Winter Olympics curbs in China to pandemic-related labor shortages in Australia.

A sign of the times? One of the world’s largest lithium miners, Ganfeng Lithium, said its profits in 2021 will be up as much as 437%. The Chinese firm in November signed a long-term supply contract with Tesla.

In a survey by Platts, 80% of respondents expect that China’s average battery-grade lithium carbonate prices will be about 316% higher than they were at the start of 2021. On Dec. 31, battery-grade lithium hydroxide prices Duty Paid Delivery (DDP) China were 319% higher, year on year.

The S&P Global Platts China Battery Metals Outlook for 2022 says China’s lithium market is set to face tightening supplies throughout 2022 as the demand-supply mismatch widens.

According to the China Association of Automobile Manufacturers, EV sales in the country will reach 5 million units this year, up 40% from 2021.

Meanwhile, prices for the hard rock lithium mineral spodumene surged 512% in 2021, also on market tightening. Platts assessed spodumene concentrate @ 6% lithium oxide purity at $2,350 per tonne FOB Australia on Dec. 31.

The seaborne market is following the domestic (Chinese) lead, with respondents to the Platts survey expecting the average price for lithium carbonate to remain above $30,000 a tonne on a CIF North Asia basis, in 2022. Most respondents expect similar prices for lithium hydroxide.

Platts assessed lithium carbonate at $33,800/t on Dec. 31, up 432% from a year earlier, while lithium hydroxide prices were assessed at $31,700/t, up 252% from Dec. 31, 2020.

Caspar Rawles, chief data officer at Benchmark Mineral Intelligence, notes that early transactions from 2022 suggest that “lots of legs” are left in the lithium rally.

Gavin Montgomery, research director for battery raw materials at Wood Mackenzie, recently said in a Financial Times article that lithium prices are unlikely to crash, as they did in previous cycles.

“We’re entering a sort of new era in terms of lithium pricing over the next few years because the growth will be so strong,” he added.

According to a December report from S&P Global, further demand growth in 2022 will mean a lithium deficit this year as use of the material outstrips production and depletes stockpiles.

Supply is forecast to jump to 636,000 tonnes of lithium carbonate equivalent in 2022, up from an estimated 497,000 in 2021 — but demand will climb even higher to 641,000 tonnes, from an estimated 504,000, the report said.

Beyond the short-term, there are challenges for lithium supply to expand fast enough to avoid a prolonged market squeeze over the coming years.

Skeptics point to Rio Tinto’s controversial lithium project in Serbia, now on hold due to environmental protests, and growing concerns around the sustainability of South America’s lithium brine production, as long-term threats to global supply.

“Customers are realizing that new supplies are very difficult to bring on,” Tony Ottaviano, CEO at Australian lithium miner Liontown Resources, told Bloomberg. His company recently signed an agreement to ship lithium to South Korean battery giant LG Energy Solution from 2024, when its project is scheduled to start.

Bloomberg New Energy Finance (NEF) estimates that, by 2030, consumption of lithium (and nickel) will be at least five times current levels.

More evidence of a smoking-hot lithium market comes in the form of consolidations. In October China’s battery-making giant Contemporary Amperex Technology (CATL) shored up its lithium supply by acquiring Canada-based Millenial Lithium, in an all-stock deal valued at US$297 million. Millenial is exploring for lithium in Argentina’s side of the “lithium triangle” of South America. The deal was on top of CATL’s 8% stake in Neo Lithium, another Canadian firm.

Earlier in 2021, CATL purchased an 8.5% stake in Australian lithium miner Pilbara Minerals, and announced a partnership with Tesla to supply the American EV-maker with lithium-ion batteries from 2022-25.

Graphite

There are two types of graphite: natural and synthetic. Synthetic graphite is made by treating amorphous carbon materials at high temperatures. In the US the primary feedstock is calcined petroleum coke and coal tar pitch. Manufacturing synthetic graphite costs up to 10X more than natural graphite, therefore it is less appealing for most applications.

The natural graphite market is 1-1.2 million tonnes per year and consists of three forms of graphite – flake, amorphous and lump. Historical applications primarily use amorphous and lump, however most new technologies and applications require large flake graphite. Of the approximately 1.2 million tonnes of graphite that are processed each year, just 40% is flake.

Graphite has long been used in the aviation, automotive, sports, steel and plastic industries, as well as in the manufacture of bearings and lubricants. Graphite is an excellent conductor of heat and electricity, is corrosion- and heat-resistant, and is strong and light.

Currently, the automotive and steel industries are the largest consumers of graphite with demand across both rising at 5% per annum. The steel industry uses graphite as liners for ladles and crucibles, in the bricks which line blast furnaces, and to increase the carbon content of steel. Graphite has replaced asbestos in automotive brake linings and pads and is used for gaskets and clutch materials. Sparks plugs are also made incorporating graphite.

Newer applications — flexible graphite sheets, graphene, lithium-ion and vanadium batteries, fuel cells, nuclear, wind and solar power — are requiring more and more graphite production. Graphene seems to be a wonder material and a lot of time, effort and money is being spent researching it. Read more about graphite applications

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to the national economy and national security. Two years ago the European Commission placed natural graphite on the EU’s 2020 Battery Critical Raw Materials list, along with lithium, antimony, cobalt and vanadium.

A report from the Commission stated, “Gaps in EU capacity for extraction, processing, recycling, refining and separation capacities (e.g. for lithium or rare earths) reflect a lack of resilience and a high dependency on supply from other parts of the world”.

Supply

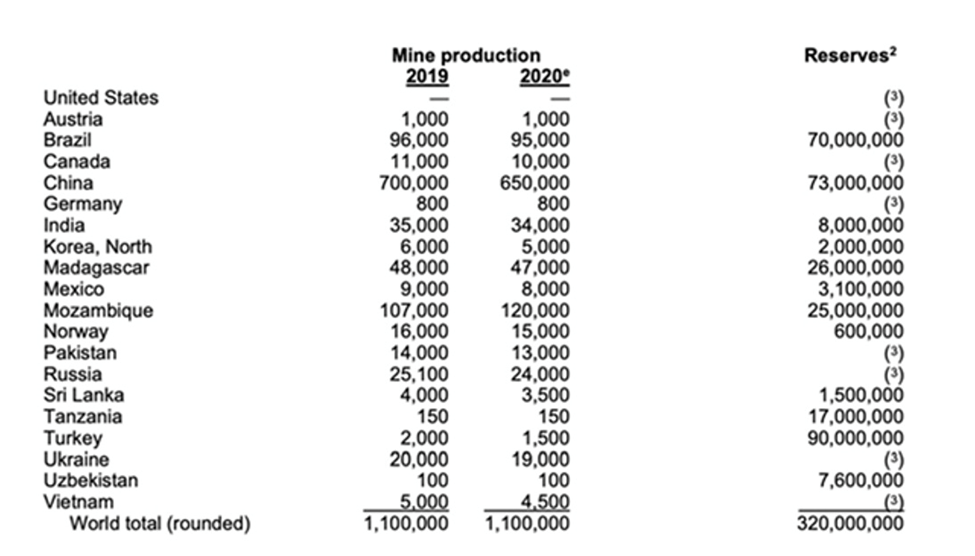

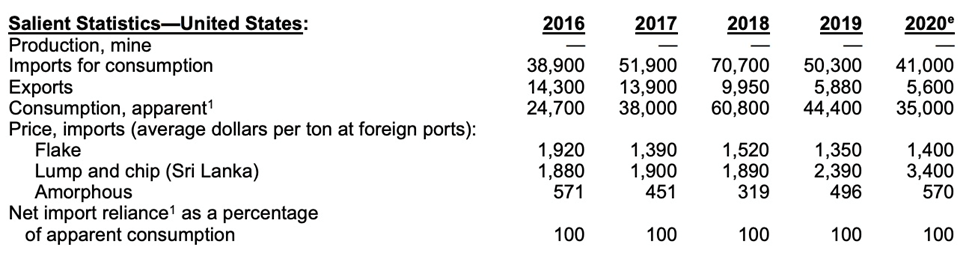

North America produces just 4% of the world’s graphite supply, from mines in Canada and Mexico. No US natural graphite production was reported to the USGS in 2019 or 2020.

China, Brazil and Mozambique are responsible for most graphite mining, with China producing about two-thirds.

According to the USGS, in 2020 the US imported 41,000 tons, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers were China (33%), Mexico (23%), Canada (17%) and India (9%).

Demand

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of a 2020 market, all uses, of 1.1Mt) — only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries.

Global graphite consumption has been increasing steadily every year since 2013, although in 2019 there was a reduction of 14%. Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per year.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

The global lithium-ion battery industry is expected to grow at a CAGR of 16.4% within the next five years, reaching a value of $94.4 billion by 2025. Sustained demand from developed nations in North America and Europe, and expanding Asian markets such as China, India, and South Korea will be the driving forces behind this growth.

According to Benchmark Mineral Intelligence, the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand will easily outstrip supply in a few years.

According to analysts Visual Capitalist Elements, via Battery & Energy Storage Technology, demand for graphite from battery makers is expected to expand 10.5-fold to 2030. They forecast the natural graphite market could be in deficit as early as 2023, due to a shortage of new sources outside China.

The USGS sees a major spike in demand once Tesla’s Gigafactory in Nevada becomes fully operational.

Once complete, this 10-million-square-foot plant in Nevada is expected to be able to manufacture enough batteries for roughly half a million Tesla cars per year. This plant alone will need around 35,200 tonnes of spherical graphite per year, which is almost comparable to US annual imports.

Remember there is no substitute for graphite in an EV battery and lithium-ion batteries are expected to be the technology that runs electric vehicles for the foreseeable future, making graphite indispensable to the global shift towards clean energy.

The question is, can the mining industry crank out 5-6% more graphite every year to match this demand? There is reason to be skeptical. Between 2018 and 2019, world mine production actually declined by 20,000 tonnes, or 1.8%. Global production in 2019 and 2020 was exactly the same, 1.1 million tonnes.

Synthetic graphite accounts for just over half of market demand. According to consultancy Avicenne Energy, via Reuters, artificial graphite in battery anodes is expected to nearly double between 2020 and 2025, from 165,000 tonnes to 320,000 tonnes. In a report, China’s ShanShan and Sinuo each hold around a fifth of the market for artificial graphite.

Demand for natural graphite is expected to rise at a similar pace, from 125,000t in 2020 to 225,000 in 2025.

According to Reuters, Synthetic graphite is increasingly favoured by battery makers because its molecules are more uniform than mined graphite. However, higher costs have traditionally made it less competitive.

Outlook

Often-cited commodities consultancy Wood Mackenzie expects to see strong growth in batteries, with the total lithium-ion battery market growing 35% this year.

Benchmark Mineral Intelligence data, via Investing News Network, shows demand for natural graphite from the battery segment amounted to 400,000 tonnes in 2021, with that number expected to scale up to 3 million tonnes by 2030. Demand for synthetic graphite is predicted to quintuple, between 2021 and 2030, to 1.5Mt.

As for pricing, Metal Bulletin reported in October that Chinese graphite prices were heading higher in the fourth quarter due to rising electricity costs and reduced power supply, as well as insufficient inventories and inadequate availability of feedstock for spherical graphite processing.

Wood Mackenzie believes prices will continue rising early this year, at least until production reopens following Chinese New Year celebrations.

According to FN Media Group, in 2019 the global graphite market was valued at $14.9 billion. By 2027, it’s expected to be valued at nearly $22 billion.

China’s dominance

Almost all lithium-ion battery manufacturing currently takes place in China because of the ready availability of graphite, weak environmental standards and low costs.

Currently there are no producing graphite mines in the United States, and only 10,000 tonnes a year is being mined from two facilities in Canada. The fact is, for the United States to develop a “mine to battery” supply chain at home, it currently has no choice but to import its raw materials from foreign countries.

For battery-grade graphite, that means China, which is growing increasingly adversarial, economically, politically and militarily.

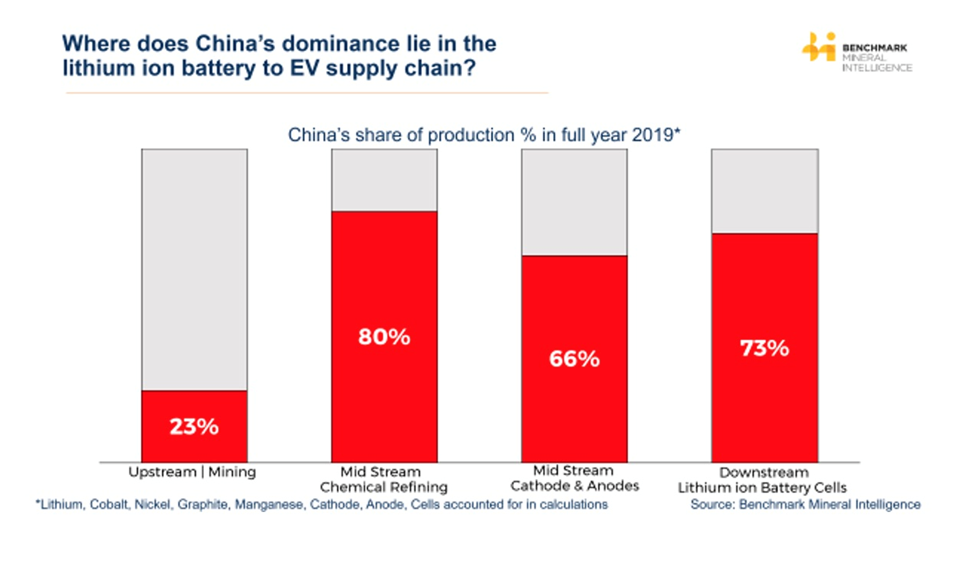

A 2020 article by Benchmark Mineral Intelligence aptly demonstrates China’s battery-metals strength. BMI’s chart below shows China’s share of global battery production, broken down by each stage of the battery supply chain — upstream (mining), midstream (refining, cathode/anode production), and downstream (lithium-ion battery cells).

A few observations. The chart clears up the misconception that China mines most of the world’s battery metals. In fact its mine production represents less than a quarter of global supply. Compare this to China’s dominance in chemical production of battery-grade raw materials, at 80% of total global production.

China represents a combined two-thirds of global cathode and anode production, however when broken down, we find that 86% of anodes (natural and synthetic graphite) are produced in China, while 100% of natural graphite anodes are made there.

Much has been made of the number of battery “gigafactories” being build worldwide, but again, China is top of the heap. BMI found that in 2019, 73% of battery cell production was within China, and of the 136 lithium-ion battery plants in the pipeline to 2029, 101 (74%) are in China.

In a December 2021 article (paywall), Benchmarks says China’s dominance of the graphite market could pose problems for western automakers as demand for anode material is set to rise by over seven times this decade.

Automakers will need to diversify their sources of graphite to reduce the risks of relying on one country for a critical battery material.

Indeed with most graphite coming from China, and all anodes in the lithium-ion battery requiring graphite, all countries making batteries need to source this material.

No matter where a battery is made, much of the graphite originates in China, and from there it either gets further processed in China, or it moves to South Korea or Japan, for manufacturing by LG or Panasonic, for example.

Most battery manufacturers are Asian. According to data from SNE Research, via Visual Capitalist, the top three battery makers — CATL, LG and, Panasonic — combine for nearly 70% of the EV battery manufacturing market.

China’s dominance of the graphite supply chain has shaken the confidence of the world’s top EV automaker, Tesla, in having a reliable source of graphite.

In December both Tesla and SK Innovation, a South Korean battery maker investing billions in two US battery plants, called for a waiver of tariffs on both artificial and natural graphite imported into the US from China.

Tesla claims it can’t source the graphite in sufficient volumes outside of China to make its battery anodes, and therefore wants the 25% tariffs, imposed during the Trump administration, lifted.

Where are EV/ battery makers getting their graphite?

AOTH research into some of the world’s largest electric vehicle makers and battery manufacturers shows that these companies are attempting to diversify their graphite supply chains away from China. Or in the case of China’s CATL, switching from synthetic to natural graphite due to supply issues.

Metal Bulletin observes, With over 90% of anode materials produced in China, there is significant potential for new, geographically diversified graphite producers to attract interest from major automakers seeing to reduce dependence on Chinese supply.

CATL

As Chinese battery and EV makers scour the globe looking for electric-vehicle raw materials like lithium, nickel and cobalt, they are dealing with graphite supply problems at home.

Reuters reports the country’s and world’s largest battery manufacturer, CATL, is “desperate” to secure supply of key ingredients such as graphite to keep up with rising orders.

Yet the Chinese graphite market is tightening ahead of the Beijing Winter Olympics. With the media spotlight about to shine on the country, authorities are ordering highly-emitting industries like graphite processing closed, so that pollution isn’t a distraction from the sporting events.

Exacerbating the situation, northeastern China’s graphite mines often close during the winter due to extreme cold.

“Graphite consumers, whether within China or outside, are fighting over a limited stock of material,” an anonymous source told Reuters.

Graphite supply tightness reportedly has CATL looking to source natural graphite over synthetic, because more is available.

Meanwhile demand for the metal has not let up. In the first 11 months of 2021, China’s auto sector sold nearly 3 million EVS, 170% more compared to the same period in 2020. The resulting demand-supply imbalance has buoyed graphite prices.

In mid-December, anode-grade graphite prices in China were up nearly 40%, year to date, to $707 per tonne, testing record highs seen in 2018, according to BMI.

Tesla

As mentioned Elon Musk’s company is looking for a break on Chinese graphite import levies. However, the California-based EV maker has gone a step further in signing an offtake agreement with Australian graphite miner Syrah Resources.

Syrah’s Balama graphite mine in Mozambique is one of the world’s largest, with an ability to produce 350,000 tons of flake graphite per year. The supply deal will have Tesla buy up to 80% of what Syrah’s processing plant in Vidalia, Louisiana, produces, 8,000 tons of graphite per year, starting in 2025.

Simon Moores of Benchmark Mineral Intelligence, an industry thought leader, told the LA Times the deal is part of Tesla’s plan to ramp up capacity to make its own batteries so that it can reduce its dependence on China. He notes the company’s biggest constraint in making nearly a million cars a year, is sourcing enough batteries.

(Tesla has a deal with Panasonic to make battery cells at its Nevada gigafactory. Moores says even when the new factory in Texas is available, Tesla will have to keep buying batteries from other manufacturers, at least until the end of the decade.)

Tesla’s agreement with Syrah will run for an initial four years, with an option to purchase additional volumes subject to further expansion at Vidalia’s plant — which would become the first US-based source of graphite anodes.

A Syrah presentation quoted by Bloomberg states that Vidalia’s 10,000-ton-per-year production rate would have the capacity to supply about 3% of US-based battery demand by 2025 — leaving plenty of room for other market players.

LG Chem

Korea’s LG Chem has reportedly earmarked $5.2 billion over the next four years to build out its battery materials business. According to Tech Crunch, The investments will focus on boosting the production of anode materials, separation membranes, cathode binders and other essential battery components. This includes plans to build a massive cathode plant in the South Korean city of Gumi, which will increase the industrial giant’s anode production capacity by seven-fold, from 40,000 tons to around 260,000 tons by 2026.

LG is also preparing a joint venture with an un-named mining company for the supply of metals and other raw materials for battery components, says the company whose customers include Volkswagen, General Motors and Tesla.

Samsung SDI

Another Korean “chaebol” (family-run conglomerate), Samsung SDI, struck a deal about two years ago with Australia-listed battery material developer Novonix, to supply synthetic graphite anode material for lithium-ion batteries.

In a statement to the Australian Securities Exchange, Novonix said it will ship at least 500 tonnes of artificial graphite to a manufacturing plant it is building in Tennessee, starting in the first phase from October, 2020.

The company sources its material as a byproduct from the petrochemical industry.

Conclusion

We started this article wondering why graphite prices haven’t moved to the same extent that lithium prices have shot higher. Intuitively, it makes no sense. Graphite and lithium have the same market drivers, lithium-ion battery demand fueled by a massive escalation of electric vehicles, as countries move further along the road to electrification and decarbonization.

Both are benchmark-priced in China, the largest market for electric vehicles.

Consider: from Jan. 1, 2020, to present, lithium carbonate prices in China went up by a factor of 7, from 50,000 yuan (US$7,851) to 367,500 yuan ($57,631) as of Jan. 27. That’s insane.

Flake graphite’s performance? Meh. It’s tough to find a comparable chart, but we can see from the third pic from the top, not much has happened in the five years between 2016 and 2021. As we reported, graphite prices have gone up in the fourth quarter 2021 and in the month of January on tighter supply in China. Pricing data from FastMarkets to the week ended Jan. 20 shows FOB China large flake graphite (+80 mesh, 94% Cg (carbon in graphite)) at US$1,200 per tonne, unchanged from the previous week. CIF Europe prices for large flake graphite (+80 mesh, 94% Cg) were also static, @ US$1,395/t.

We can’t say why there is such a price discrepancy, but we can comment on the vulnerability of large electric-vehicle companies like Tesla, that require a lot of battery raw materials, as well as major battery makers such as SK Innovation, LG and Samsung, to having their graphite supply chain interrupted by China, which has a near-monopoly on graphite processing.

To reiterate, almost all lithium-ion battery manufacturing currently takes place in China because of the ready availability of graphite, weak environmental standards and low costs.

The country produces two-thirds of global cathodes and anodes; 86% of anodes (natural and synthetic graphite) are made there, and 100% of natural graphite anodes.

There is also the question of technical know-how. For years graphite end-users in the West didn’t bother to source their graphite from anywhere but China, or maybe Mozambique. Mining companies didn’t make the investments. Chinese companies knew how to mine it, and refining the stuff is messy, and takes a lot of energy, so why bother? It reminds us of the rare earths problem.

The United States was once the largest producer of permanent magnets, used in dozens of industrial applications including electric vehicle motors and for wind turbines. Permanent magnets are built from the rare earths neodymium, praseodymium and dysprosium.

That was until the mid-1990s, when the US ceded control to China, which now has a monopoly, either mining or processing over 90% of the 17 elements on the Periodic Table, used in everything from smart phones to weaponry.

Without a domestic supply, the US must rely on Chinese rare earths and technology to build “made in America” military and space equipment. (For the fascinating story on how this happened, read How the US Lost the Plot on Rare Earths

China’s stranglehold on rare earths has been, and could continue to be, replicated for graphite, but it doesn’t have to be. End-users in the West are finally getting smart about diversifying their supplies beyond China. We see this most prominently with Tesla, which has just inked an offtake agreement with Syrah Resources and its Mozambique graphite mine. The four-year deal starts in 2025.

Another Australian company, Novonix, is already supplying synthetic graphite anode material to Samsung SDI.

LG Chem is building a new cathode plant in South Korea, where the company will be able to up its anode capacity seven-fold.

Tesla’s deal with Syrah is a good start for the United States and its graphite dilemma (there is currently no domestic production), but it leaves a lot of capacity to fill.

At AOTH, we know of a company working to do just that.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.