Graphite One to resume drilling at Graphite Creek, Alaska

2021.07.12

Exploration is continuing at Graphite One’s (TSXV:GPH, OTCQB:GPHOF) Graphite Creek property in Alaska following an involuntary hiatus last year due to the covid-19 pandemic.

Graphite Creek

Located on the Seward Peninsula in western Alaska, Graphite Creek hosts America’s highest-grade large flake deposit.

A preliminary economic assessment (PEA) in 2017 showed 81 million tonnes of resources, mostly in the inferred category at a grade of 7% Cg, containing about 5.7 million tonnes of graphite. The same study envisioned a long-life (40 years) operation — based on drilling less than 20% of the deposit — with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year once full production begins in the sixth year. Tests carried out on the property found that 75% of the flake graphite could be converted into spherical graphite, which is the form used in EV batteries.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a grade of 7.8% Cg, for 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

Looking to advance what would be an integral part of the US graphite supply chain, Graphite One in February announced the completion of two non-brokered private placement offerings, raising gross proceeds totaling C$10 million.

A further top-up to the treasury, in the form of a C$12 million private placement (@$1.00 per unit), brokered by Canaccord Genuity Corp., was announced on June 30.

Proceeds will be used to further develop Graphite Creek, including a prefeasibility study (PFS) scheduled for completion in the fourth quarter.

“With the growing demand for graphite in electric vehicle batteries and other energy storage applications — and recent actions by the Biden administration to secure US supply chains for critical minerals — we see Graphite One’s aim to produce a U.S.-based supply chain solution becoming increasingly significant as a new potential source of advanced graphite products for decades to come,” Anthony Huston, Graphite One’s President and CEO, states in the June 1 news release.

“While the 2017 Preliminary Economic Analysis indicated excellent economics, we are very excited about the potential for the PFS to show a clear path for further development.”

2021 exploration

Towards that goal, Graphite One in June published news of its 2021 drill program. 3,000 meters of HQ core drilling is planned to infill and expand the measured and indicated resources for the feasibility study (FS), the next step after the prefeas.

The company is anticipating a busy field program at Graphite Creek in the coming weeks, including exploratory drilling and an environmental baseline study.

“We’re resuming our studies to advance our understanding of the deposit, how we would mine it and how we would process the graphite for export to a manufacturing facility in the Pacific Northwest,” said Graphite One’s Chief Operating Officer, Stan Foo, in an interview with The Nome Nugget.

A planned mill and processing facility would produce high-grade spherical graphite of the kind needed for lithium-ion batteries used in electric vehicles and energy storage systems. “The rock containing the graphite would be crushed and ground to a fine size, and then a flotation process would separate the graphite from other rock material, producing a 95 percent graphite concentrate,” Foo told the Alaska newspaper.

The concentrate would be bagged and trucked to the Port of Nome in standard sea-going containers, before being loaded onto barges and shipped to a secondary treatment plant, at a yet to be determined location in the Pacific Northwest. From there, the graphite concentrate would be converted to coated spherical graphite used in lithium-ion battery anodes.

America’s graphite vulnerability

The US boasts an abundance of graphite in a remote area of Alaska, according to the US Geological Survey.

In a 2017 critical minerals report, the USGS specifically named the Kigluaik Mountains on the Seward Peninsula as home to a deposit that has both the size and grade to meet growing EV battery needs.

Earlier this year, the deposit known as Graphite Creek, was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). It is considered the largest known graphite resource on the continent, spanning 18 km of the Kigluaik Mountains.

The global supply chain for graphite is severely vulnerable to disruptions due to the near monopolistic nature of the market.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards, and low costs. However as we have seen with rare earths, a market that China manipulated in its favor following a territorial dispute with Japan in 2010, and more recently, with restricted shipments of personal protective equipment from China during the pandemic (China simply used its monopoly on PPE production to cut exports and supply its own population), being overly reliant on foreign suppliers is dangerous.

In the US, China’s biggest economic rival and a main driver of the future EV movement, there is currently no graphite being mined on American soil. The lack of a domestic source meant that US manufacturers had to import roughly 40,000 tonnes of graphite material during 2018, rising to 58,000 tonnes in 2019.

This kind of dependence on foreign suppliers is one of the primary reasons why the United States Geological Survey (USGS) included graphite on its list of 35 minerals considered “critical” to the nation (graphite and cobalt are the top two non-rare earths on the USGS list of mineral commodities at risk for supply disruptions). Many of these are overwhelmingly produced by one nation: China.

In 2020 the US imported a third of its natural graphite from China, with the balance of shipments coming from Canada and Mexico.

For years, the reliance on China for resources had been an “elephant in the room” for Western policymakers, but the executive order issued by President Donald Trump meant that the US had taken steps to rectify that. And now, the Biden administration and like-minded leaders around the world will make their moves to address this supply chain vulnerability.

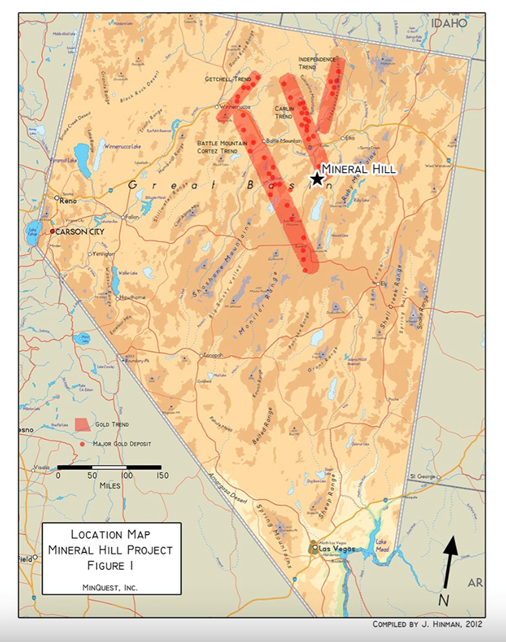

Another key factor for listing graphite as a critical mineral is US domestic demand. The USGS sees a major spike in demand once Tesla’s Gigafactory 1 in Nevada becomes fully operational (although the facility has, with partner Panasonic, been building battery packs for its vehicles and energy storage products since 2017, it is infamously only “30% complete).

Once fully finished, the 10-million-square-foot plant will have the capacity to manufacture enough batteries for roughly half a million Tesla cars per year. This plant alone will need around 35,200 tonnes of spherical graphite per year, which is almost comparable to US annual imports.

(Tesla also has its Fremont Factory outside of San Francisco, where the Model S, Model X, Model 3 and Model Y are built, along with a majority of their components. Plus there’s the Gigafactory 3 in Shanghai, and two more under construction, one in Texas, the other in Berlin. Read more)

“The world’s future energy course is being charted today because of the ramifications of peak oil and a need to reduce our carbon footprints. A whole new industry – a global-wide automotive and industrial lithium-ion battery industry – is going to be built.” — April 17th 2010, Richard Mills, aheadoftheherd.com

A North American EV supply chain, from mine-site to showroom, is still in its infancy, but progress is being made. In April CNBC reported that General Motors and South Korean battery-maker LG Chem will invest over $2.3 billion in a second EV battery plant, in Tennessee.

Other large automakers and battery companies are jumping on the EV train, including Ford Motor Co. and SK Innovation. The latter and LG Chem recently struck a $1.8 billion deal to end a trade dispute between them, allowing SK to finish building a lithium-ion battery plant in Georgia, that will supply batteries to Ford and Volkswagen.

The inevitable demand surge adds further incentive to overcome the deficiencies in the battery metals supply chain.

This is what Republican Senator Lisa Murkowski, who serves as chair of the Senate Committee on Energy and Natural Resources, had to say on the subject:

“It is a greater vulnerability, I believe, than we once had when it came to our need for oil and resources to power ourselves.”

Murkowski has been pushing legislation to boost domestic mining of minerals such as lithium, cobalt and graphite, those essential to the national movement towards batteries and energy storage.

Conclusion

In my opinion, it’s hard to imagine the US being able to fulfill its new clean energy agenda without either a significant increase in critical metal imports that frankly may not be possible in current market conditions, or executing a home-grown strategy to explore for and mine them.

The United States (and Canada) needs secure, cost-competitive and environmentally sustainable sources of graphite, and that means developing graphite deposits into mines.

Once in full production, Graphite One’s manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite (CSG) and 13,500 tonnes of graphite powders per year.

These production figures are based on resource estimates prior to the 2019 update, leaving room for potentially higher production.

Graphite One Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$01.24, 2021.07.12

Shares Outstanding 62.1m

Market cap Cdn$77.7m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security. Richard owns shares of Graphite One Inc. (TSX.V:GPH). GPH is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.