Graphite One: the key link in America’s future battery minerals supply chain

2022.03.03

The global race to secure more EV battery materials is well and truly on. As seen with prices of commodities like lithium and nickel, there is an unprecedented level of intrigue and investment in this sector.

While the spotlight has mostly been on those metals, which are essential battery cathode materials, the anode material — graphite — has often been overlooked by the market, which is just waking up to the mineral’s critical role in the EV revolution.

Graphite – Critical Mineral

The anode is what determines how fast the vehicle’s battery can be charged and helps to extend the driving range per charge.

Due to its relatively high energy density, power density and long cycle life, graphite is deemed the perfect anode and has dominated the anode materials scene since the birth of lithium-ion batteries.

Today, graphite is found in all EV battery anodes, mostly in powder form (known as spherical graphite). The material is either synthetically produced (artificial graphite) or mined from the ground (natural graphite), then heavily processed before being baked onto a copper foil to serve as battery anodes. For natural graphite, only flake graphite concentrates upgraded to 99.95% purity can be used.

Despite the attention on other metals (namely lithium), graphite is actually the largest component in Li-ion batteries by weight, with each battery containing 20-30% graphite. That means to build more electric vehicles, there would be much more graphite needed than any other mineral.

According to the World Bank, graphite accounts for over half (53.8%) of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of total demand.

An electric car may contain more than 200 pounds (>90 kg) of coated spherical graphite (CSPG), about 10 to 15 times the amount of lithium needed to make an EV battery.

Every 1 million EVs then requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

By estimates, at least 125 million EVs are expected to be mobile by 2030. That’s more than 8 million tonnes of additional battery-ready graphite needed this decade, considering the mining industry is able to supply 1.1 million tonnes.

According to BMI, the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand could easily outstrip supply in a few years.

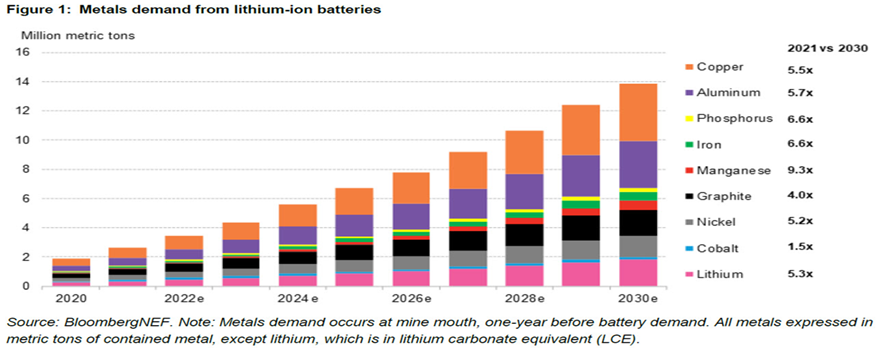

BloombergNEF expects demand for key battery minerals to remain robust through 2030, with graphite demand increasing by four-fold.

Countries with ambitious EV goals like the US and Canada have firmly placed graphite amongst the list of “critical minerals” that are considered the building blocks of a low-carbon and digitized economy.

In the coming years, graphite will be a resource that the major economies will look to prioritize, and for which reliable supply sources must be established to avoid falling behind the “global battery race”.

As vehicle electrification continues, it is estimated that the natural flake graphite market could reach a deficit as early as 2023, with few new sources being developed around the world.

US Supply Bare

For the US, the reason to list graphite as a “critical mineral” goes beyond its key role in decarbonizing the economy. The world’s most powerful nation is also vying for the top spot in the global EV space, a position that is comfortably held by its main rival China.

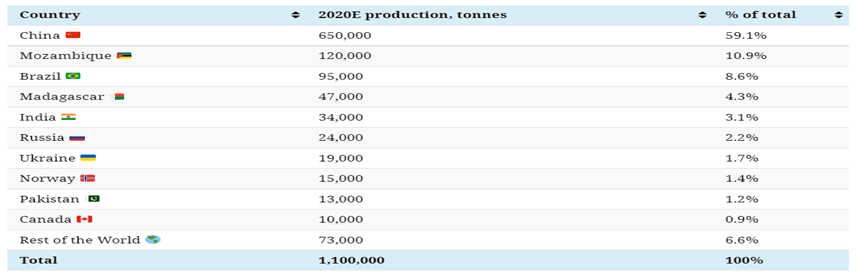

At the moment, nearly all the graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. More than half of the world’s mine production also comes from China, making it a dominant player in every stage of the supply chain. In 2020, its natural graphite production totalled 650,000 tonnes, compared with the 450,000 tonnes supplied by the rest of the world.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US, on the other hand, produces a grand total of zero tonnes of natural graphite, and therefore must rely solely on imports to satisfy domestic demand.

The level of foreign dependence has increased over the years. From 2016 to 2018, US graphite imports nearly doubled from 38,900 tonnes to 70,700 tonnes. Although imports leveled off in recent years, the numbers are still significant and alarming for the future of America’s EV economy.

According to the USGS, in 2020 the US imported 42,000 tonnes, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers were China (33%), Mexico (23%), Canada (17%) and India (9%).

But once taking into the fact that China controls all spherical graphite processing, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. Therefore, it comes as no surprise that graphite is included in the US critical minerals list; it is also one of only four minerals that the USGS considers to be essential to all six industrial sectors.

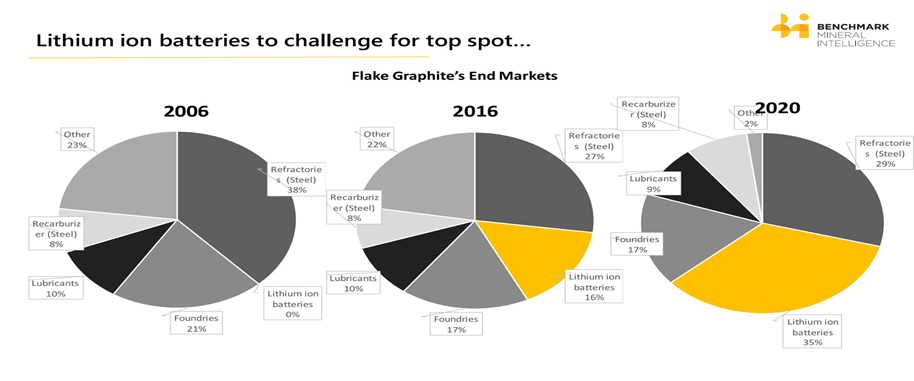

The increased use of Li-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year, posing a serious threat to the global supply chain as the mineral is already used in a variety of industries (graphite consumption for all uses totalled 1.1Mt in 2020).

Remember: Only flake graphite upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries. China produces nearly 80% of all synthetic graphite and 60% of natural graphite, but as the main producer of the battery material, will its production be able to keep pace with a surging global demand? For that we have reasons to doubt.

Evidently, the world’s mine supply has been stagnant over the years. Between 2018 and 2019, total production actually declined by 20,000 tonnes. Global production in both 2019 and 2020 was exactly the same at 1.1 million tonnes.

There’s also the rising electricity costs and reduced power supply in China that are hampering production. Should the Chinese government continue to impose limits on energy consumption, then the days of affordable, abundant graphite from China could be over.

With no other nation stepping its game to bolster the global supply of graphite, the US is presented with a tremendous opportunity to take a foothold in this market. A White House report on critical supply chains recently showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

First Graphite in US?

Since there is no substitute for graphite in an EV battery, and given its total dependence on foreign imports, the time is now for the US to begin creating a reliable and sustainable graphite supply chain.

Fortunately, there is plenty of graphite available for local consumption, if industry and government can find the collective will to make it happen.

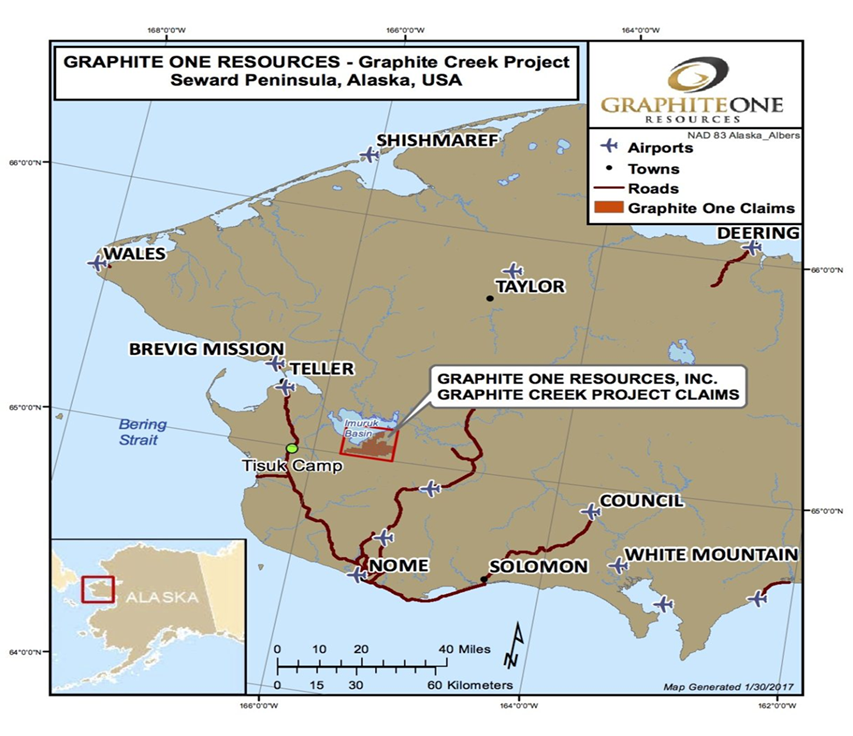

The Kigluaik Mountains on Alaska’s Seward Peninsula hosts a deposit with the size and grade to meet the nation’s growing need for graphite in Li-ion batteries.

The Federal Permitting Improvement Steering Committee (FPISC) last year granted High-Priority Infrastructure Project (HPIP) status to Graphite One Inc. (TSXV: GPH, OTCQX: GPHOF), which aims to be America’s first high-grade producer of coated spherical graphite (CSG), integrated with a domestic graphite resource.

The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

The company’s Graphite Creek resource near Nome, Alaska, is currently the highest-grade and largest known flake graphite deposit in North America, spanning a distance of 18 km.

The Graphite One project is envisioned as a vertically integrated enterprise to mine, process and manufacture high-quality CSPG for the lithium-ion electric vehicle battery market. The company aims to become the first US vertically integrated domestic producer to do so.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A Preliminary Economic Assessment (PEA) supports a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

On a pre-tax basis, the project has a net present value of $1.03 billion using a 10% discount rate, with an internal rate of return (IRR) of 27%.

Once in full production, Graphite One’s proposed graphite products manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year. A location in the Pacific Northwest is currently being considered.

Advancing Graphite Creek

Over the past year, Graphite One has been making significant progress at its large deposit in Alaska, including a drill program of more than 2,000m. Results of the 2021 drilling, which would generate additional data for an updated resource and pre-feasibility study (PFS), are expected shortly.

While all required drilling for the PFS is completed, the Graphite Creek deposit remains open at depth and along strike both east and west. Exploration to date has only covered 20% of the projected 18 km trend of graphite mineralization, supporting the potential for a long-life mine operation centered on Graphite Creek as an essential part of the US (and global) graphite supply chain.

“Given the demand growth every end-user mentions to me, and their concerns about surety of supply, we’re putting a priority on demonstrating that Graphite Creek is a robust, low-risk source for graphite far into the 21st Century,” Graphite One’s CEO Anthony Huston said in a recent news release.

The company expects to initiate the project’s feasibility study (FS) soon, including plans to conduct a 2022 drill program focused on infill drilling and step-out drilling with the aim of increasing Graphite Creek’s long-life resource.

Huston also pointed to the latest developments in the anode space as well as other markets as an opportunity to supply advanced graphite material.

“With the World Bank and International Energy Agency projecting graphite demand to rise by 25 times between 2020 and 2040 (IEA), or more than 490% from 2020 to 2050 (World Bank) — and new efforts to simultaneously build out energy storage systems underway, multiple uses of the same renewable battery technologies are beginning to compete for the same material supply,” he said. “As a result, global graphite shortfalls initially projected for 2024 or 2025 are now predicted to begin as early as 2022.”

Meanwhile, the US has been in a graphite shortfall for decades, having last produced natural graphite from its own soil in the 1950s. As a nation striving for dominance in the global EV market, the US simply can’t afford to keep relying on its rivals for such a key battery material, and carmakers that want to build EVs domestically would also agree.

“Elon Musk said recently there is currently no graphite anode production in the US. He’s right – and our goal at Graphite One is to change that,” Huston remarked.

“I agree with Jim Farley, the CEO of Ford Motor, who recently said: ‘We have to bring battery production here, but the supply chain has to go all the way to the mines. Are we going to import lithium and pull cobalt from nation-states that have child labour and all sorts of corruption, or are we all going to get serious about mining? We have to solve these things, and we don’t have much time.’”

Just last week, US President Joe Biden reiterated his nation’s EV supply chain vulnerability, and is willing to place billion-dollar bets on items ranging from mineral extraction to battery recycling.

Market Outlook

Advancement of Graphite One’s project comes at a time when many are expecting graphite to catch on to the red-hot battery metals rally of 2022. Lithium, in particular, has surged by more than 50% to start the year.

While graphite had sustained higher prices during the second half of 2021, with average Chinese flake graphite prices rising by 25% between May and December, most of that was to do with rising power costs rather than a true reflection of demand.

This year, analysts are expecting graphite demand from the battery segment to continue rising with increased EV adoption globally, which would serve well for graphite prices.

According to price reporting agency Fastmarkets, EV battery production indicates that demand for graphite from the battery sector will rise by 36% to approximately 594,000 tonnes in 2022, from around 437,000 tonnes in 2021.

That means over half of the ~1Mt produced globally would be needed to build EV batteries, but given most of the world’s graphite is currently used in other industrial applications, the EV sector could be severely undersupplied for years and even decades.

This also goes in line with the prediction that, barring a significant jump in output, a global graphite deficit could happen as soon as this year. From that point on, the gap would only get bigger each year.

Benchmark Mineral Intelligence data shows demand for natural graphite from the battery segment could scale up to 3 million tonnes by 2030, compared with 400,000 tonnes last year. Demand for synthetic graphite is also expected to increase five-fold from 300,000 tonnes in 2021 to 1.5 million tonnes by 2030.

Conclusion

With all the talks of vehicle electrification in the news, not much has been said about the one mineral fundamental to the entire process.

Graphite is an excellent conductor of heat and electricity, and is corrosion and heat resistant, making it the perfect anode material. There is currently no substitute for graphite in the lithium-ion battery used in electric vehicles. Graphite is also widely used in other industries such as aviation, automotive, sports, steel and plastics.

With demand projected to surge in the coming years, the world is soon facing a graphite supply problem. Most of its production and processing are concentrated in just one nation, China, with a select few nations providing the rest. Global production has stagnated over the years, with no significant sources coming onto the scene.

The US meanwhile has no supply, and is 100% reliant on imports from its main rivals — an issue that the government has identified by placing graphite in the list of critical minerals. Steps have already been taken for the US to secure a domestic graphite source with the designation of Graphite One as a high-priority project.

Hosting the largest known graphite deposit in the country, within the Kigluaik Mountains of Alaska, this could well be America’s first graphite source and an integral part of America’s “mine to battery to EV” supply chain.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.60, 2022.03.01

Shares Outstanding 85.5m

Market cap Cdn$136.8m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.