Graphite One Secures C$10 Million in Financings to Advance Graphite Supply Chain Project

2021.02.26

Looking to advance what would be an integral part of the US graphite supply chain, Graphite One Inc. (TSXV:GPH) (OTCQB:GPHOF) this week announced it has completed two non-brokered private placement offerings, raising gross proceeds totaling C$10 million.

The first placement comprised 16 million units of the company priced at C$0.50 each for a total of C$8 million. The second consisted of approximately 2.56 million units priced at C$0.78 each for C$2 million.

Each unit issued under the offerings comes with one Graphite One common share and one additional common share purchase warrant. Warrants issued under the first offering have an exercise price of C$0.61, while those under the second offering can be exercised at C$0.98 a share.

Proceeds of the financings will be used by Graphite One for the exploration and development of its Graphite Creek advanced graphite supply chain project, including a pre-feasibility study that is projected for completion by the end of Q2 2021.

Graphite Creek Project

At the upstream end of its supply chain focus, Graphite One is currently developing the largest known graphite resource found within US borders.

Located on the Seward Peninsula in western Alaska, along the north flank of the Kigluaik Mountains (see map below), the company’s Graphite Creek property hosts America’s highest-grade large flake deposit.

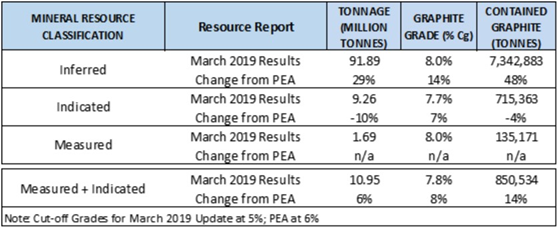

A preliminary economic assessment (PEA) for the project released in 2017 showed provided estimates of 81 million tonnes of resources, mostly in the inferred category at a grade of 7% Cg, containing about 5.7 million tonnes of graphite material.

The same study envisioned a long-life (40 years) operation – based on drilling less than 20% of the deposit — with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year once full production begins in the sixth year.

Results from Graphite One’s drilling in 2018 allowed the company to later upgrade the project’s resource estimates to more than 102 million tonnes, including nearly 11 million tonnes tagged under the measured and indicated categories, for 8.2 million tonnes of graphite resources.

These enhanced results will be incorporated into the ongoing pre-feasibility work to help the company refine the mine design, knowledge of recovery and size distribution.

Unique Qualities

Besides having the advantage of size, Graphite One’s deposit in Alaska boasts high-quality graphite materials with characteristics that are ideally suited for the EV battery industry.

According to manufacturing industry consultants at TRU Group, which helped the company complete the 2017 PEA, samples extracted from Graphite Creek have shown morphological characteristics that are “both globally unique and commercially important.”

Tests carried out by TRU found that 75% of the flake graphite found on the property could be converted into spherical graphite, which is the form used in EV batteries. In comparison, only 30-40% of the large flake graphite found in other known deposits around the world can be turned into spherical graphite.

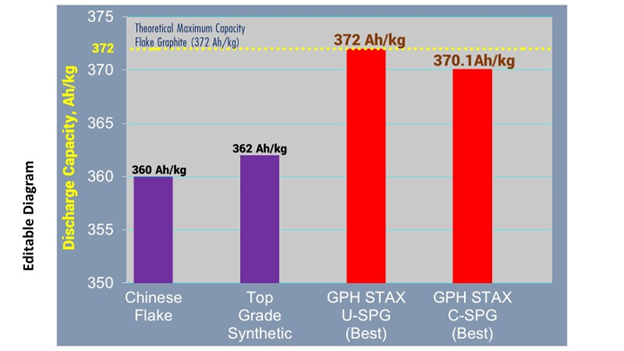

Furthermore, battery tests have demonstrated that the company’s graphite product has the ability to reach and closely approach the theoretical maximum discharge capacity, highlighting its performance potential in battery applications.

US Supply Worries

As with most mining projects, timing is everything. Under current macro conditions, there could not have been a better time for Graphite One to continue its exploration and development on the Graphite Creek property.

Commodities have been firing on all cylinders since the new year. These include metals that are critical components to electric vehicles as governments worldwide go ‘all-in’ on a clean energy economy. Recently, nickel prices soared to their highest since 2014 on the back of growing demand for EV batteries globally.

Graphite, being the second largest EV battery component by weight (about 40-60 kg per vehicle), is without question an indispensable part of the EV manufacturing process. Benchmark Mineral Intelligence forecasts that demand for graphite used in batteries is set to increase by 15 times over the next decade, rising from 200,000 to 3 million tonnes annually.

Another major contributing factor to the battery metals rally is tightening supply, with global production of graphite currently on the decline. Total mined supply of natural graphite came to 952,600 tonnes last year, a staggering 15% decline over 2019, according to analytics firm GlobalData.

As the world’s biggest economy, the US produces a grand total of zero tonnes of graphite, meaning it has to import all of the material from abroad. Last year, the nation imported a third of its natural graphite from China. In December alone its graphite imports were up 60% over the same period in 2019, and 42% more than the previous month. But this level of foreign reliance can’t last forever – and in those applications where advanced graphite is required by the US Defense Industrial Base, reliance on China can’t end soon enough.

This month, US President Joe Biden announced his administration’s plans to conduct a review of its key supply chains, including those for semiconductors, high-capacity batteries, medical supplies and critical minerals and rare earth metals.

On February 24th The White house issued: Fact Sheet: Securing America’s Critical Supply Chains

The purpose of President Biden’s executive order is to determine how reliant the US economy is on imports from key rivals such as China, currently the world’s largest producer of several critical minerals including graphite.

“The United States must ensure that production shortages, trade disruptions, natural disasters and potential actions by foreign competitors and adversaries never leave the United States vulnerable again. Today’s action delivers on the President’s campaign commitment to direct his Administration to comprehensively address supply chain risks.”

US policymakers are already fretting over the nation’s supply of rare earth minerals, a group of elements used in everything from smartphones to fighter jets, amid reports that the Chinese government may curb its exports. About 80% of America’s rare earth imports came from China last year. But rare earths are only part of the picture: Raw materials for electric vehicles, too, represent an area of concern for the US government.

“Graphite One welcomes the recognition of renewable batteries, and EV batteries in particular as a critical supply chain. The fact that graphite is essential to three ‘critical supply chains named in the Executive Order underscores the importance of Graphite One’s supply chain approach.” Anthony Huston, Chief Executive Officer of Graphite One.

President Biden’s Executive Order follows the designation of Graphite One’s Graphite Creek project as a High-Priority Infrastructure Project (HPIP) in both the “renewable energy” and “manufacturing” sectors by the U.S. Government’s Federal Permitting Improvement Steering Committee (FPISC), the culmination of a process that began when the Project was nominated for HPIP designation by Alaska Governor Mike Dunleavy in October 2019.

The High-Priority designation allows Graphite One to list on the U.S. Government’s Federal Permitting Dashboard, which ensures federal agencies coordinate their project review authorities, resulting in a more efficient process with more transparency for state agencies and the public.

This new executive order will give leverage to domestic supply chain projects such as Graphite One during the permitting process and open-up sizable financing opportunities to fast-track these projects towards production.

Conclusion

The FPISC determination, is, in my opinion, strong validation of Graphite One’s Graphite Creek Project’s importance to America’s critical minerals supply chain. There is no doubting that such recognition signals critical minerals projects, like Graphite Creek, are an essential part of a sustainable US infrastructure supply chain.

The latest C$10 financing is another vote of confidence as Graphite One nears completion of its PFS work. Market interest in the company, too, has intensified since the federal government’s recognition of the project.

About 760,000 shares, nearly five times its daily average volume, were traded on the day of the announcement. That momentum sent Graphite One’s shares to a 52-week high of C$2.40 earlier this month, drawing additional investor interest coinciding with the financings.

Graphite One Inc.

TSX.V:GPH, OTCQB:GPHOF

Cdn$01.55, 2021.02.24

Shares Outstanding 43,109,143m

Market cap Cdn$68.3m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard does not own shares of Graphite One Inc.

(TSX.V:GPH, OTCQB:GPHOF). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.