Graphite One releases prefeasibility study for Graphite Creek Mine and Washington State battery anode materials manufacturing facility

2022.08.30

Graphite One (GPH:TSXV; GPHOF:OTCQX) has undergone a major de-risking event with the release of the prefeasibility study (PFS) for its Graphite One Project.

Incorporating results from the 2021 drill program, the PFS was prepared by JDS Energy & Mining Inc. with help from various independent technical consultants.

It features a “parallel strategy” to simultaneously develop a battery anode materials manufacturing facility in Washington State and the Graphite Creek Mine in Alaska. Combined they are known as the Graphite One Project. Manufacturing would begin with purchased materials until Alaska production is available.

Graphite Creek property

The Graphite Creek property is situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production, while of course adhering to the necessary regulations that are integral to developing any new mine in the US.

The US Geological Survey has cited Graphite Creek as the largest known graphite deposit in the country.

The updated USGS mineral database highlighted 10 sites with historical graphite production or undeveloped graphite resources (>1,000 tonnes of contained graphite resources and/or past graphite production).

Of these, only Graphite Creek contains more than 8 million tonnes, confirming Alaska Governor Mike Dunleavy’s previous statement that the mine “would be a superior domestic supply of this critical mineral.”

The March 2019 resource estimate — derived from drilling less than 30% of the mineralization — showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

PFS

Resources

In the prefeasibility study there is a marked increase in mineral resources and reserves after incorporating the results from 2021 drilling.

66 holes were completed in the resource area for a total of 10,112 meters. The resource data base consists of 6,412 assays. The resource remains open down dip and along strike to the east and west.

Among the highlighted intercepts to be included in the PFS were:

- 21GOC060 returned 16.03 meters of 6.9% Cg (graphitic carbon), 18.75m of 5.04% Cg and 28.5m of 5.13% Cg in three separate intervals starting from 54m downhole.

- 21GOC061 returned 29.15m of 5.83% Cg, including 3m of 11.73% Cg starting from 51m downhole.

- 21GC062 returned 42.4m of 11.61% Cg from 45m, including 15.21m of 22.2% Cg and 5.81m of 35.78% Cg.

- 21GC064 returned 53.95m of 5.67% Cg from 77.3m.

- 21GOC68 returned 24.99m of 5.56% Cg from 57.73m, including 5.51m of 9.1% Cg.

According to Graphite One, the drill results continue to show consistent, near-surface high-grade intercepts with numerous holes returning grades higher than 10% and up to 35.78% graphitic carbon. In fact they suggest three times the strike length of the existing resource.

In delivering the updated resource estimate, Graphite One says the methodology used was similar to that described in the 2019 NI 43-101 report, with a lower-angle interpretation of the Kigluaik Fault and an additional estimation between interpreted graphite lodes. A lower cut-off grade of 2% Cg was used in 2022, versus 5% in 2019, due to updated mining and processing information, particularly with the integration of the secondary treatment plant (STP), GPH states.

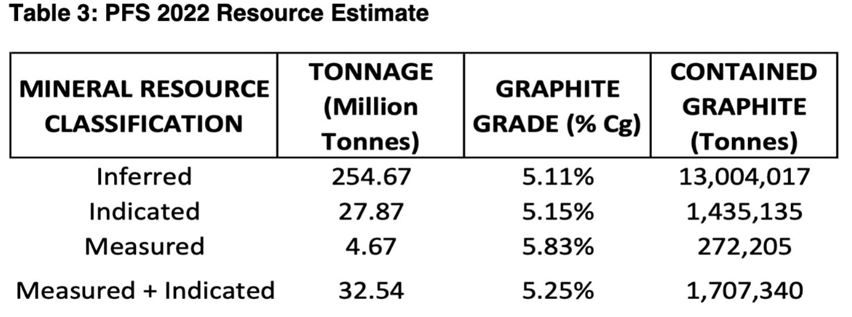

Table 3 below shows 32.54 million tonnes in the measured + indicated categories, at a graphite grade of 5.25% Cg, leaving contained graphite of 1,707,340 tonnes. Note that measured + indicated resources increased 197% over 2019 results. (Table 4).

In Table 4, indicated resources are 201% higher and measured resources are 176% higher, while the inferred category’s tonnage increases 177%. There is a corresponding drop in graphite grade in each category.

Table 5 provides the same comparison as Table 4 between the PFS and the 2019 report but with the results of each report compared at a 2% cutoff grade. The measured and indicated categories increase a respective 70% and 65%, while inferred tonnage is 36% higher. Contained graphite in the inferred category increases 20%, indicated 43% and measured 54%. (measured + indicated = a 45% increase in contained graphite with a corresponding 13% drop in grade).

Reserves

Total proven & probable reserves, outlined in Table 6 below, are estimated at 22,490,000 diluted tonnes, grading 5.6% Cg, leaving contained graphite of 1,258,000 tonnes. The reserves were estimated through the process of pit optimization, pit design, mine scheduling and cut-off grade optimization.

Mine operation

The Graphite Creek Mine would produce, on average, 51,813 tonnes per year of graphite concentrate for its projected 23-year mine life. (At an average grade of 5.6% Cg and a strip ratio of 2.2:1, that works out to 22.5Mt over 23 years. It is expected that peak mine production will be approximately 11,000 tpd).

The deposit would be mined with conventional open-pit mining methods including drilling, blasting, loading and hauling. The strip ratio is 2.2:1 using an ore cut-off grade of 2% graphitic carbon and an average head grade of 5.6% graphitic carbon. The pit would be mined in six phases over 24 years. One year of pre-stripping would occur prior to the start-up of the process facility. Under the PFS plan, ore would be hauled to the facility, to be built adjacent to the pit. Run-of-mine waste would be co-mingled with dewatered process tails and placed in waste dumps.

The process facility would process an average of 2,860 tonnes per day (tpd) for 365 days per year. The flowsheet design is based on metallurgical test work conducted at SGS Canada’s facilities at Lakefield, Ontario. The flowsheet consists of a jaw crusher that feeds a semi-autogenous grinding circuit. After grinding, the ore is subjected to a series of seven flotation/regrind steps, designed to recover the graphite at its largest possible flake size while still maintaining a concentrate with a graphitic carbon grade of greater than 95%. The graphite concentrate would be filtered and dried on site, then bagged and shipped by barge from Nome, Alaska to the anode manufacturing facility in Washington State. The tails from the flotation circuit would be dewatered, co-mingled with the waste rock, and placed in a lined waste storage facility. Any drainage from this facility would be treated through a water treatment plant prior to discharge.

Economic results

Table 1 below summarizes the economic results of the PFS.

The project would generate a pre-tax internal rate of return of 26.0%, using an 8% discount rate, with a net present value of $1.93 billion and a payback period of 4.6 years.

On August 16, 2022, the United States enacted the Inflation Reduction Act, which instituted, among other things:

- A tax credit to producers in the U.S. of anode materials equal to 10% of the costs incurred with respect to the production of anode materials commencing December 31, 2022 and reducing to 75%, 50%, 25%, and 0% in 2030, 2031, 2032 and thereafter, respectively.

- A tax credit equal to 10% of the costs incurred with respect to production of graphite purified to a minimum purity of 99.9 percent graphitic carbon by mass (“purified graphite”) – the phase out provisions set out above do not apply.

- Only production in the United States qualifies for the tax credit.

Graphite One’s production is expected to qualify under the act for tax credits in both categories as it plans to produce both anode materials and purified graphite in the United States.The company will evaluate the act’s impact on the PFS economics and announce the results when available. GPH says the impact is expected to improve upon the post-tax results, which showed a 22% IRR, using an 8% discount rate, with net present value of $1.36 billion and a payback period of 5.1 years.

Three links in the graphite supply chain

China is by far the biggest graphite producer with nearly 80% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Brazil, Mozambique, Russia and Madagascar. The US, as Huston contends, produces no graphite, therefore it must rely solely on imports to satisfy domestic demand.

Graphite One seeks to address this problem, aiming to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The Vancouver-headquartered company in April announced a memorandum of understanding (MOU) with Sunrise (Guizhou) New Energy Material Co., Ltd., a lithium-ion battery anode producer based in Guizhou Province, China.

Sunrise and GPH plan to form an alliance to establish a graphite material manufacturing facility in Washington State. The MOU’s term was recently extended and Sunrise is in the process of preparing anode materials for sample purposes from Graphite Creek concentrate produced from graphite recovered during exploration.

The third link in Graphite One’s US-based graphite supply chain involves battery materials recycler Lab 4 Inc. of Nova Scotia, Canada. Under an earlier MOU, GPH and Lab 4 will work collaboratively to design and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 provides laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

The recycling facility will be located next to the Washington State manufacturing facility and engineered to accept used EV batteries for feedstock.

Parallel strategy

The Graphite One Project is planned as an integrated business operation to produce lithium-ion battery anode materials and other graphite products for the US domestic market using primarily natural graphite from Alaska. The project combines the operation of an advanced graphite manufacturing facility (the “STP” or secondary treatment plant) with the supply of natural flake graphite from the company’s proposed Graphite Creek Mine in Alaska.

Graphite One anticipates that there will be a business opportunity presented by the projected strong US demand for anode materials during this decade; the PFS plans the parallel design, permitting and construction of the STP and the mine.

The estimated initial capital and sustaining capital costs with their respective contingencies are summarized in Table 1, reproduced below. Also presented are the average annual production costs for the life of the project on both the basis of annual totals and costs per tonne of production.

Total capex is pegged at $1.485 billion, with the mine budgeted at $824 million and the STP estimated to cost $661 million. The combined operation is expected to cost $237 million annually or $3,590 per tonne of production. A significant profit margin is envisioned, with the average graphite product price estimated at $7,301 per tonne.

Product forecasts and prices have been developed based on numerous graphite market reports commissioned by or purchased by the company, combined with internal information. The long-term market forecast used is based on Wood Mackenzie’s ‘Graphite Market 2021 Outlook to 2050’, updated by its ‘Global Graphite Market Strategic Planning Outlook – Q2 2022’. Purchased graphite prices have been supported by non-binding indications of supply from current producers.

Secondary treatment plant

Permitting and construction of the STP is estimated to take three years. The STP would operate during the first four years by processing purchased graphite. The mine would begin production in the third year of STP operation and begin supplying graphite to the STP in its fourth year of operation. By the fifth year, it is anticipated that Alaska graphite would supply 100% of the STP’s planned natural graphite requirements at full capacity. If the mine begins production sooner, purchased graphite would be reduced accordingly.

Based on the PFS’s updated graphite resource estimate, the mine’s life for the purposes of the study is 23 years. The PFS assumes the STP’s operational life is 26 years, based on its start-up with purchased graphite and continued operation with graphite from the mine.

On average over its life, the STP would produce about 75,000 tonnes per year of graphite products. About 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy unpurified graphite products. The anode materials are comprised of four products:

- CPN: Coated, spherical natural graphite;

- BAN: Blended natural and artificial graphite;

- SPN: Secondary particle natural graphite; and,

- SPC: Secondary particle composite.

The STP is designed to produce lithium-ion battery anode materials on a commercial scale for the U.S. domestic market using natural graphite from Alaska as soon as it is available. At full capacity, it requires about 34.5 hectares (85 acres) of land, consists of 17 buildings, and would annually produce about 77,000 tonnes of manufactured graphite products. The products are grouped into battery anode materials, specialty purified graphite products, and traditional unpurified graphite products. The products are manufactured from natural graphite concentrate, artificial graphite precursors, coke and pitch. Key components of the manufacturing process are the purification of natural graphite and graphitization of artificial graphite precursors in high-temperature, electrically heated furnaces. The STP’s preferred location is in Washington State to access both its relatively lower power rates from hydro-generated electricity, and its skilled workforce.

The plant would be constructed in two phases, each with almost identical equipment and production capacity. An exception is that Phase 2 has three furnace lines, Phase 1 has two. Phase 1 is assumed to operate at 90% capacity for the first year to allow for start-up adjustments. Thereafter it would operate at full capacity.

The STP at full capacity (Table 2), is designed to produce 51,167 tpy of anode materials for the electric vehicle and energy storage battery markets; 7,585 tpy of purified, sized material for the speciality graphite market; and 18,622 tpy for the unpurified, traditional graphite market. Total annual production would be 77,374 tonnes based on the expected annual production capacity. The average annual production over 26 years in the PFS is 75,026 tonnes.

The PFS will be incorporated in a National Instrument 43-101 technical report that will be available under Graphite One’s SEDAR profile at www.sedar.com, and the company’s website, within 45 days of the Aug. 29 news release.

Financing

Along with delivering a robust prefeasibility study on its proposed Alaska graphite mine and Washington State battery anode manufacturing facility, Graphite One also has important financial news to report.

On Aug. 29 GPH announced an up-size of its previously posted $15.525 million non-brokered private placement, to $21.275 million. Up to 18,500,000 units will be issued and offered for $1.15 per unit.

This follows a shares for debt arrangement reported earlier this month between Graphite One and Taiga Mining Company, Inc. Under the “debt settlement transaction”, Graphite One will issue Taiga 9,812,791 GPH shares at a deemed price of CAD$0.90 per share, in full settlement of Graphite One’s outstanding debt of USD$6,775,230, which includes US$1,819,230 of accrued interest owing pursuant to an unsecured loan facility from September, 2019, between the two parties.

Taiga now holds 28,407,697 GPH shares and 6,509,232 warrants.

“Graphite One is very appreciative for Taiga’s continued support as the Company continues to advance its Graphite One Project and execute on our vision to become an American producer of high-grade anode materials,” President and CEO Anthony Huston commented in the Aug. 23 news release.

Conclusion

Relieved of its debt obligations, and a private placement in the offing that could fill Graphite One’s coffers with up to $21.2 million, I feel

confident about the company’s financial wherewithal to advance the Graphite One Project through to its next stage of development, a feasibility study.

2021 drilling has successfully upgraded the 2019 resource estimate, delivering nearly a 200% increase in measured and indicated resources. The PFS also portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite product price of $7,301 per tonne.

Tax credits in the Inflation Reduction Act are expected to improve upon the post-tax PFS economic results, which showed a 22% IRR, using an 8% discount rate, with net present value of $1.36 billion and a payback period of 5.1 years.

All in all, the news is great for GPH shareholders, whose patience during a difficult market has been rewarded with a 26% gain over the past year. While the shares have fallen back from a 2022 high of $1.97 in mid-April, they hit a one-month pinnacle of $1.32 with the release of the PFS on Monday, Aug. 29. This shows me that the market is paying close attention to what Graphite One is doing, even in the dog days of summer when many investors are tuning out.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.29, 2022.08.29

Shares Outstanding 83.3m

Market cap Cdn$113.2m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.