Graphite One releases high-grade, near-surface drill intercepts; prefeasibility study expected in 1.5 months

2022.06.10

Energized by a set of stellar drill results and two new hires, Graphite One (TSXV:GPH, OTCQX:GPHOF) is expecting to put out a much-anticipated prefeasibility study on its Graphite Creek property in Alaska, within 45 days.

Drill results

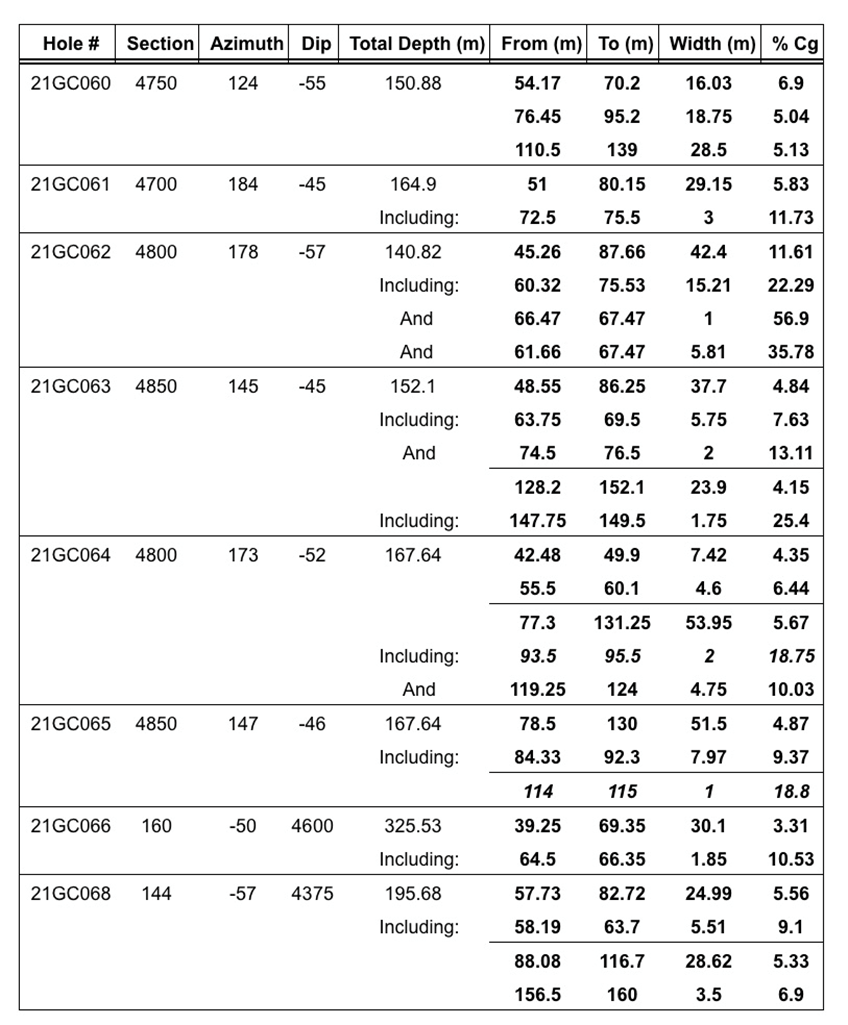

The company this week announced results from a 2,150-meter, 8-hole drill program at Graphite Creek conducted last year between July and October.

Among the highlighted intercepts, to be included in the upcoming prefeasibility study (PFS), were:

- 21GOC060 returned 16.03 meters of 6.9% Cg (graphitic carbon), 18.75m of 5.04% Cg and 28.5m of 5.13% Cg in three separate intervals starting from 54m downhole.

- 21GOC061 returned 29.15m of 5.83% Cg, including 3m of 11.73% Cg starting from 51m downhole.

- 21GC062 returned 42.4m of 11.61% Cg from 45m, including 15.21m of 22.2% Cg and 5.81m of 35.78% Cg.

- 21GC064 returned 53.95m of 5.67% Cg from 77.3m.

- 21GOC68 returned 24.99m of 5.56% Cg from 57.73m, including 5.51m of 9.1% Cg.

According to Graphite One, the drill results continue to show consistent, near-surface high-grade intercepts with numerous holes returning grades higher than 10% and up to 35.78% graphitic carbon. In fact they suggest three times the strike length of the existing resource.

The deposit remains open down dip and along strike to the east and west, “demonstrating the potential for Graphite One to become a generational domestic graphite asset.”

“Our 2021 drill results continue to demonstrate excellent continuity with our past exploration programs and should provide the opportunity to increase the resource and reserve estimates for the PFS,” said Anthony Huston, Graphite One’s CEO, in the June 8 news release. “With our planned mine area of approximately one kilometre of the overall 16-kilometre anomaly, our deposit remains open down dip and along strike to the east and west of the known resource — demonstrating that Graphite Creek has potential to become a critical domestic graphite supply for the United States for a long time to come.”

New appointments

Mining industry veteran Mike Schaffner will join the company as Senior President, Mining, effective July 1, the same day that Graphite One’s COO, Stan Foo, will retire.

Prior to his appointment, Schaffner worked at Ambler Mining, where he oversaw engineering work for the Arctic prefeasibility study and managed the metallurgical test work program for the company’s drill program. He joined Ambler after 15 years with Newmont Mining (TSX:NGT), rising through positions of increasing responsibility to the level of General Manager at the Carlin Gold Mine, Cripple Creek and Victor mines, managing operating budgets over $750 million and a workforce of 1,200. Schaffner began his mining career with Echo Bay Mining and Coeur Mining at operations in Nevada.

“I’m excited to join the Graphite One team as the company moves into its next phase of development,” Schaffner stated in the June 1 news release. “I’ve been involved at every stage in the development process, from design to start-up, into operation and closure. I’m ready to help the team realize G1’s tremendous potential of becoming America’s first US graphite mining operation since 1990.”

Graphite One has also made a change at the board level, appointing Scott Packman to its board of directors in early May. Packman served as general counsel and executive vice president of Madison Square Garden Entertainment (NYSE:MSGE). He was also general counsel of MGM Holdings,the owner of the iconic MGM movie and television studio, for over a decade.

“Scott is highly regarded as a corporate strategist, successful operator, trusted advisor and as a pre-eminent negotiator and attorney. His addition to our Board of Directors is evidence of Graphite One’s focus on enhancing and broadening the skillset of its Board of Directors,” said Huston.

High-Priority Infrastructure Project

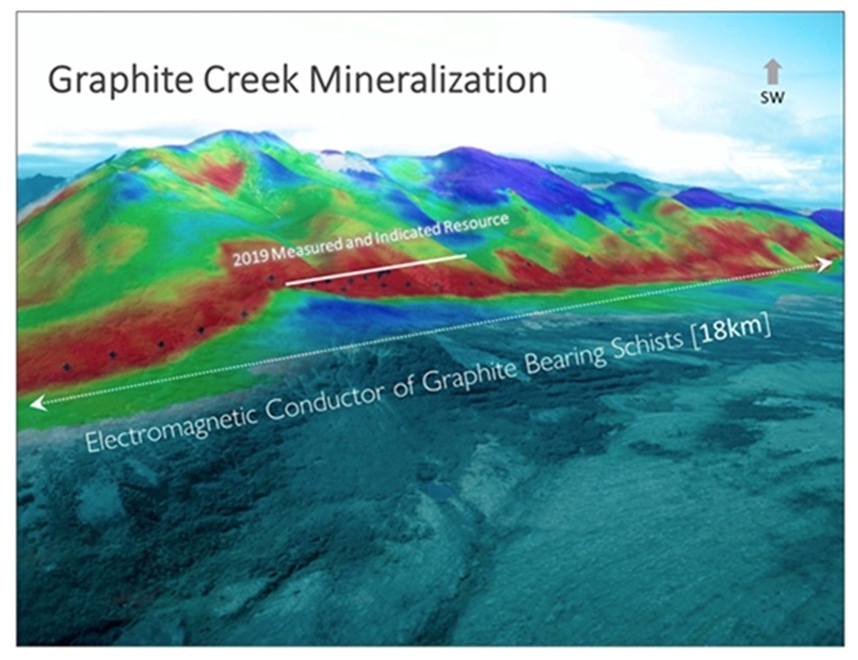

The Graphite Creek property is situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production, while of course adhering to the necessary regulations that are integral to developing any new mine in the US.

“Designating the Graphite Creek project as a high-priority infrastructure project will send a strong signal that the US intends to end the days of our 100% import-dependency for this increasingly critical mineral,” Alaska Governor Mike Dunleavy said in his 2019 letter nominating Graphite One for HPIP status.

According to the FPISC’s notice letter, the FPISC has “… determined, in consultation with [Office of Management and Budget] OMB and [Council on Environmental Quality] CEQ that this project clearly qualifies under the manufacturing and renewable energy sectors, among several other sectors.”

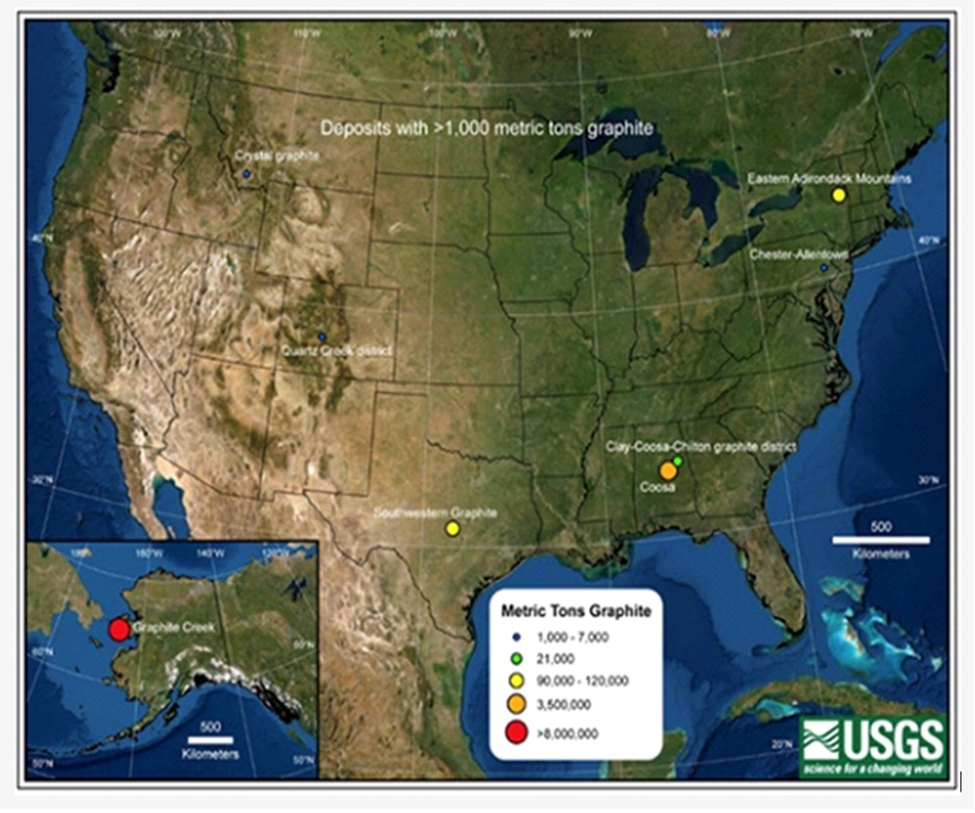

The US Geological Survey has cited Graphite Creek as the largest known graphite deposit in the country.

The updated USGS mineral database highlighted 10 sites with historical graphite production or undeveloped graphite resources (>1,000 tonnes of contained graphite resources and/or past graphite production).

Of these, only Graphite Creek contains more than 8 million tonnes, confirming Gov. Dunleavy’s previous statement that the mine “would be a superior domestic supply of this critical mineral.”

USGS involvement is a huge confidence-builder for Graphite One. The organization sent geologists to the property last year to conduct field work, leading them to assess Graphite Creek as the biggest graphite deposit in the continental United States.

Exploration

During 2021, Graphite One completed a drill program of 2,150 meters on Graphite Creek. To date, only 20% of the mineralized trend has been explored by the company.

The latest resource estimate (March 2019) — derived from drilling less than 30% of the mineralization — showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A preliminary economic assessment (PEA) on Graphite Creek supports a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

The next steps for Graphite Creek include an updated resource model and new technical data for a prefeasibility study (PFS), which will incorporate results of the 2021 drill program.

Last year’s exploration also included engineering and environmental studies in proposed mill site and tailings/mine rock management areas, and along the proposed access corridor connecting to the state-maintained road system on the Seward Peninsula. The field program also continued environmental baseline studies across the project area. According to Graphite One, this work will provide input for the PFS that is anticipated to be completed by mid-2022, and will also help guide this year’s field program and the anticipated feasibility study (FS) to follow.

PFS

The prefeasibility study is expected to be filed 45 days from the issuance of the June 8 news release. The study will update the known resource while providing new economic guidance on the project.

“The PFS will include the results from our 2021 program and should increase confidence that Graphite Creek is a generational asset — a vital graphite resource in the United States,” said Huston, adding, “The United States currently has no domestic production and relies 100 per cent on importing graphite to meet the nation’s energy transition needs.”

Graphite supply chain: 3 links

China is by far the biggest graphite producer with nearly 80% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Brazil, Mozambique, Russia and Madagascar. The US, as Huston contends, produces no graphite, therefore it must rely solely on imports to satisfy domestic demand.

Graphite One seeks to address this problem, aiming to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The Vancouver-headquartered company in May announced a memorandum of understanding (MOU) with Sunrise (Guizhou) New Energy Material Co., Ltd., a lithium-ion battery anode producer based in Guizhou Province, China.

Sunrise and GPH plan to form an alliance to establish a graphite material manufacturing facility in Washington State.

The plan for the materials facility — the second link in Graphite One’s US supply chain solution for advanced graphite products, mining is the first — will be detailed in the upcoming PFS.

What we know so far, is that Sunrise will help to design, construct and operate the plant, which will source natural graphite from Graphite One’s Graphite Creek deposit near Nome, Alaska.

Once in full production, the plant is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year.

Note: this level of prospective production would cover the amount of graphite the US imports in most years!

The third link in Graphite One’s US-based graphite supply chain involves battery materials recycler Lab 4 Inc. of Nova Scotia, Canada. Under an earlier MOU, GPH and Lab 4 will work collaboratively to design and build a recycling facility for end-of-life EV and lithium-ion batteries. Lab 4 provides laboratory and engineering support to mining companies with a focus on recycling graphite, manganese and other minerals.

The recycling facility will be located next to the Washington State manufacturing facility and engineered to accept used EV batteries for feedstock.

Circular economy

This year, Graphite One proceeded with the second link of its proposed supply chain strategy by selecting a location for the graphite products manufacturing plant. Now, with a recycling facility planned nearby, the company has closed the loop on its “circular economy” blueprint.

The company’s journey to becoming the first vertically integrated, domestic battery producer that not only mines graphite, but processes it into graphite end-products and provides a means of recycling lithium-ion batteries, coincides with the Biden administration highlighting electric vehicles and EV infrastructure as central to its “green energy” policy.

According to Simon Moores, renewable energy analyst at UK-based Benchmark Mineral Intelligence, “What we expect from the Biden administration is to simply make one of their policies to make gigafactories across the whole country at scale in order to turbocharge and protect their biggest automobile companies such as Ford Motor Co. (NYSE:F) and General Motors Co. (NYSE:GM).”

Indeed Tesla is not only automaker vying for graphite and other battery metals. With every major carmaker adding electric models to their lineup, the number of EVs being built is expected to expand from about two million this year to more than 25 million by 2030 and 55 million by 2040.

The administration allocated $7 billion as part of a huge infrastructure bill aimed at developing a US battery supply chain and weaning the auto industry off its reliance on China. In a July 2021 report, the White House said the number of mineral commodities the US is reliant on imports, has jumped to 58 from 21 in 1954.

Biden is reportedly invoking War powers to encourage domestic production of critical minerals for batteries.

Adding minerals like graphite, lithium, nickel, cobalt and manganese to the list could help mining companies access $750 million under the 1950 Defense Production Act (DPA). The presidential directive would fund production at current mining operations, productivity and safety upgrades, and feasibility studies.

“With this new defense designation under U.S. law, graphite joins a select group of ‘super-critical minerals’ that are essential to commercial technology and national security applications,” said Huston. “This action by President Biden validates Graphite One’s strategy of creating a full supply chain for advanced graphite materials located in the United States.”

The president has also tucked $500 million into the Ukraine aid bill he signed into law last month. The half a billion would expand funds available under the DPA, to obtain critical battery minerals like nickel, cobalt, lithium and graphite.

Another $3 billion is being tapped to support domestic manufacturing of batteries used in electric vehicles and energy storage. This money comes from the above-mentioned $1.2 trillion infrastructure bill passed by Congress last year. A separate $60 million program for battery recycling is also being made available.

Conclusion

Simon Moores of Benchmark Mineral Intelligence makes an interesting point: he says the US government should be expected to make battery factories across the country “to turbocharge and protect their biggest automobile companies such as Ford Motor Co. (NYSE:F) and General Motors Co. (NYSE:GM).”

Clearly, the government should be involved in making the transition from fossil fuel-powered to electric vehicles. Building public charging infrastructure and offering rebates for new EV owners come to mind.

But what about the car companies themselves? Ford and GM are North American icons. Here they have a chance to invest in a company that can supply the graphite raw material they need to make their own electric vehicle batteries, without relying on China as they do currently. Not only that, Ford, GM and other customers of Graphite One don’t have to build the anodes, that will be done for them at the manufacturing facility planned for Washington State. They also have the opportunity to invest in a battery recycling facility that will address many people’s concerns about dead EV batteries taking up space in landfills. That has to be good not only for their marketing, but the environment.

Let us be clear: the industry can no longer afford to source their battery raw materials from China, a country we have been, and continue to be, at trade war with, that has a terrible environmental record when it comes to mining/ tailings waste disposal, and an equally awful history of human rights abuses.

Are Ford and GM just going to sit and wait for the government to fund Graphite One to production? I suggest one of them take the initiative with an investment in GPH, to help secure a US domestic supply of graphite.

Arguably, with demand for a number of EV raw materials set to out-run supply, there is no time like the present for the world’s automakers to start building their supply chains for electric vehicles literally from the ground up, sourcing the metals directly from the companies that mine them.

In developing the largest graphite mine in the US, and with plans to build an anode manufacturing facility and a recycling plant in Washington State, Graphite One is perfectly positioned to become America’s first fully integrated graphite supply chain.

In fact, the company is providing the template for a brand-new circular economy that merges mine production of battery-grade graphite, the manufacturing of battery anodes, and other graphite products, with the processing and recycling of lithium-ion batteries needed for the future green economy.

A template that, importantly, is being strongly supported by government.

With Graphite One positioning itself not only as a graphite miner but an anode builder and a battery recycler, the company meets the criteria for receiving tens of millions of dollars in public funding to build their supply chain strategy composed of three links: the mine, the manufacturing plant and the recycling facility.

Biden’s recent invocation of the Defense Production Act is expected to untap a torrent of funds for activities required to build mines, including feasibility studies.

In April Senators Lisa Murkowski (R-AK) and Joe Manchin (D-WV), former and current chairs of the Senate Energy and Natural Resource Committee, sent a letter to President Biden urging him to make a DPA Title III designation to “invoke the Defense Production Act to accelerate domestic production of lithium-ion battery materials, in particular graphite, manganese, cobalt, nickel, and lithium.”

When Secretary of Energy Jennifer Granholm testified in her nomination hearing in the Senate, she reportedly had a very detailed back and forth with Sen. Murkowski on critical minerals issue, before distilling the main point into a simple yet very strong statement: “We can buy electric car batteries from Asia, or we can make them in America.”

I think that government and Graphite One will keep working together to build Graphite Creek into a mine, making it the posterchild of industry-government collaboration.

Indeed with all the company has going for it, I am of the opinion that, at $1.56 a share, Graphite One is undervalued.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.56, 2022.06.09

Shares Outstanding 85.5m

Market cap Cdn$134.3m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH) GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.