Graphite One ‘Graphite without geopolitics’ – Richard Mills

2025.04.15

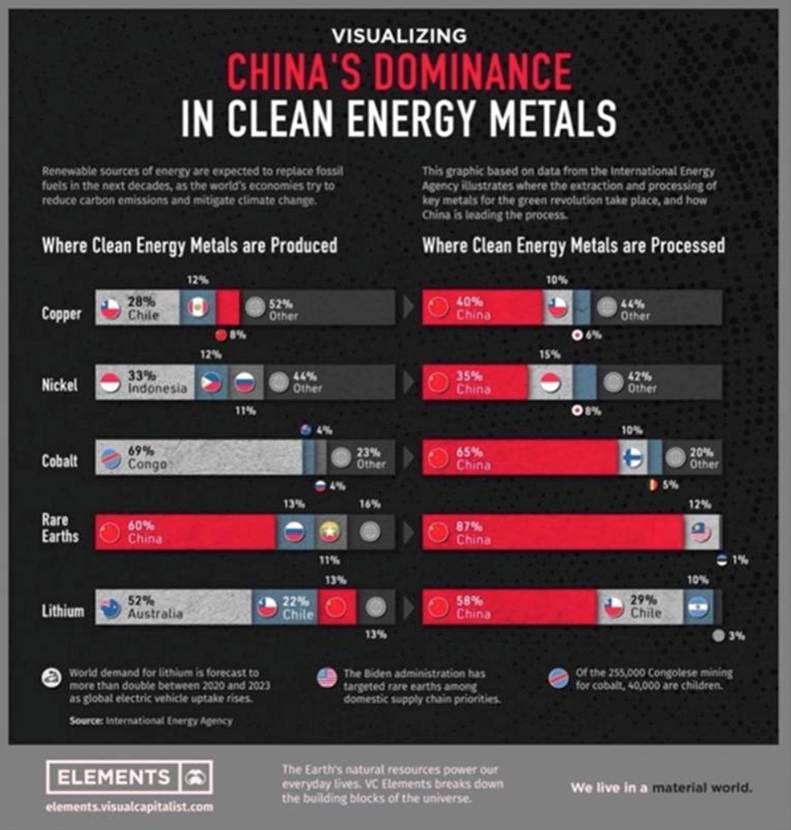

China has a stranglehold on processing critical minerals, meaning it can weaponize them during conflicts with its adversaries, as it has done before with Japan (rare earths), and the United States with export controls on gallium, germanium, graphite, antimony. In December 2023 China banned the export of technology to make rare earth magnets.

On April 4th, 2025, China imposed new controls on the export of seven rare-earth minerals to the US: scandium, samarium, gadolinium, terbium, dysprosium, lutetium and yttrium.

China weaponizes rare earths in retaliation for escalated US tariffs — Richard Mills

For decades, China has dominated critical minerals, with Canada and the US, among other nations, all too willing to let Beijing do the mining and/ or processing and sell the end products, such as rare earth magnets, back to us. Even now, rare earths extracted at MP Materials’ Mountain Pass — the only such mine in the US — are sent to China for processing.

Thanks to its technological prowess in refining, and its willingness to forgo all environmental safeguards, China has established itself as the across-the-board leader in the rare earth/ critical mineral processing business.

Fighting back

An executive order signed on Thursday, March 20th by US President Trump invokes emergency powers to boost the ability of the US to produce critical minerals. The idea is to facilitate domestic natural resource extraction to make the country less reliant on foreign imports.

In response to China’s dominance over critical minerals, the executive order encourages faster permitting for mining and processing projects and a directive for the Interior Department to prioritize mineral production on federal land.

It should be noted that President Trump has always supported domestic production of critical minerals. According to a White House Fact Sheet:

- In 2017, President Trump implemented a federal strategy to ensure secure and reliable supplies of critical minerals.

- In 2019, President Trump signed five presidential determinations finding that domestic production of rare earth elements and materials is essential to the national defense.

- In 2020, President Trump declared a national emergency to expand the domestic mining industry, support mining jobs, alleviate unnecessary permitting delays, and reduce the nation’s dependence on China for critical minerals.

Since being re-elected, Trump has been eyeing to secure critical mineral deals in Greenland, which supposedly has the largest deposits of rare earths outside of China, Ukraine and the DRC.

The Economist notes that Trump’s desire for critical minerals goes beyond the rocks in the ground:

Mr. Trump’s bigger ambitions are at home, where he hopes to supercharge a declining industry that has gained strategic importance. Last month the president told Congress that he planned to take “historic action” to expand production of critical minerals and rare earths in America. On March 20th he set out the boldest measures the mining industry has seen in decades, with an executive order that aims to speed up permitting, prioritise land-use for mining and provide financial support.

The government seems to be motivated by America’s dependency on metal imports, at a time when supply chains are fraught with geopolitical risks. Mr Trump’s boosterism has made industry bosses tentatively hopeful. But there are doubts about whether his proposals are enough to draw investment into America’s mines and towards ore processing. They may not be enough to dig the industry out of its hole.

From its pole position in the 1950s America has fallen far behind on mining and processing metals and minerals.

Alaska Senator Lisa Murkowski has been quite vocal on the need for establishing critical minerals supply chains in the US, to reduce reliance on China and other foreign suppliers.

In a recent panel discussion at SAFE Summit 2025, titled ‘Graphite Without Geopolitics’, moderator Abigail Hunter said Murkowski in 2019 introduced the bipartisan American Mineral Security Act along with Dan Sullivan, a Republican congressman from Alaska, Democrat Joe Manchin, and Arizona Republican Martha McSally.

The act established a framework for the 2020 Energy Act, which helped set the US Geological Survey and Department of Energy minerals and materials lists.

Murkowski said progress has been made not only in terms of legislation, but awareness, while cautioning that more work needs to be done. She said Alaska has 49 of the 50 critical minerals on the USGS list.

Hunter noted that Graphite One’s CEO Anthony Huston was to be included in the session but he was pulled into a high-level meeting.

“The attention he is getting, the project’s getting, is speaking to the dynamic opportunities in the space for US resources in particular,” she said. “Anthony’s project, this is the largest natural graphite resource in North America and based on their recent announcement tripling the size and yet only doing exploration in a very limited portion of that find there, it really is quite extraordinary, it could be the largest natural graphite source in the world,” Murkowski responded.

She criticized both the Trump and Biden administrations for looking outside of the US for critical minerals mining opportunities.

On Trump, she critiqued his interest in Greenland, saying “I would suggest to you that the US big Arctic place, Alaska has those resources that Greenland has and probably a little more cooperative environment hopefully in terms of being able to access those resources.”

With Biden, she pointed to the Department of Energy facilitating resource development in Mozambique. Syrah Resources has a graphite processing facility in Louisiana but gets the raw ore from its Balama mine in Mozambique. Particularly galling was a funding announcement to help build the mine’s infrastructure.

“I’m kind of waving my hand over here in the Alaska corner saying ‘I’ll take a rail, I’ll take a road’ we’ve got the resources here for the same resource that you’re going after in an African nation, and we’re a little bit safer in Alaska,” said Murkowski.

“Sometimes I think we take the attitude that we just want the resource, we want it for our fighter jets, we want it for our fast cars, and we don’t really care where it comes from. We need to care where it comes from, we need to care where it’s processed,” she said to applause.

Most of the Mozambique’s graphite is in Cabo Delgado, a northern province that has been wracked by political violence.

A local media source confirmed that Syrah was one of the mining companies whose operations were affected by the armed conflict in Cabo Delgado. In June 2022, Club of Mozambique reported the supply chain was temporarily suspended due to attacks close to the road the graphite is shipped out on. The mine later had to evacuated due to violence in the area.

A 2022 report by the Hanns Seidel Foundation documents the rise of insurgent group al-Shabaab, which has claimed allegiance to Islamic State. The group has terrorized the population since 2017, in a region known for drug trafficking, human smuggling, illicitly exported timber, illegal wildlife products, and smuggled gems and gold.

African sources of uranium, graphite tainted by conflict — Richard Mills

Graphite One (TSXV:GPH, OTCQX:GPHOF)

Graphite One plans to develop a “circular economy” for graphite. Its supply chain strategy involves mining, manufacturing and recycling, all done domestically — a US first.

Subject to financing the company plans to invest $435 million to build a graphite product manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

The company has significant financial backing from the Department of Defense, a letter of interest from the Export-Import Bank of the United States to provide up to $325 million of debt financing, and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation

G1 expects to submit a formal application to EXIM later this year.

Two Department of Defense grants have been awarded to Graphite One, one for $37.5 million – paying 75% of the cost of the soon to be completed Feasibility Study, the other for $4.7 million — the latter to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite from Graphite Creek.

In addition, G1 qualifies for federal loan guarantees worth $72 billion.

Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation all support the project. In 2023 G1 closed a $2 million private placement from BSNC to support development of the company’s Graphite Creek deposit.

Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

Graphite Creek Feasibility Study

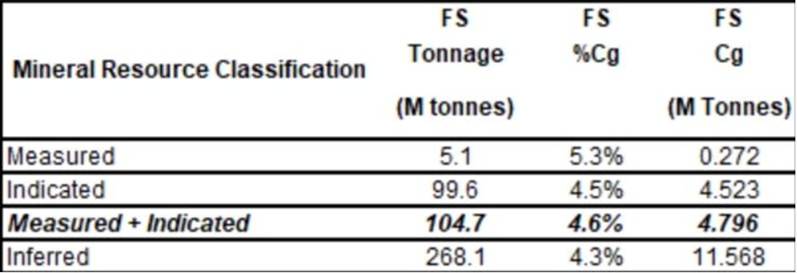

Graphite One (TSXV:GPH, OTCQX:GPHOF) has just announced the updated Mineral Resource and Reserve estimates that will be incorporated into the highly anticipated Feasibility Study due to be released in April 2025.

The NI 43-101-compliant study, which includes the updated Mineral Resource and Reserve Estimates, as well as economic analyses for Graphite One’s Graphite Creek project in Alaska, will be filed under SEDAR+ (System for Electronic Document Analysis and Retrieval) within 45 days of the March 27th news release.

“With grant support under the Defense Production Act Title III authorities, Graphite One was able not only to accelerate completion of our feasibility study by 15 months, but also quadrupled our planned drilling program, producing the results we announce today,” said Graphite One’s CEO Anthony Huston. “We will now enter the permitting process with a production rate triple what we projected just over two years ago. The Proven and Probable Mineral Reserve tonnage is 317% of the PFS reserve estimate and the corresponding contained graphite is 296% of the PFS estimate. All of this is based on results from just 1.2 miles of the total 9.5-mile-long geophysical anomaly.”

“With President Trump’s new Executive Order, G1 is working with Congress, the Administration, and federal agencies to accelerate our Graphite One supply chain project through permitting and into production, to end the nation’s 100% import dependency for graphite,” Huston added. “With these new results, Graphite Creek is now triple the size when the US Geological Survey reported just three years ago that Graphite Creek was the largest flake graphite deposit in the U.S.”

“This new Critical Minerals Executive Order serves as the strongest signal yet that the U.S. Government has not only recognized the national security need for critical minerals including graphite, but that there will now be a ‘whole of government’ engagement to accelerate domestic development,” Huston said in the March 24th news release.

Back to the Graphite Creek project and the announcement of the updated Mineral Resource and Reserve estimates, as Alaska Governor Mike Dunleavy noted in his 2025 State of the State address, “subject to securing project financing, construction could begin by 2027 and the mine could be producing as early as 2029.”

Located on the Seward Peninsula, the Graphite Creek property comprises 9,600 hectares of State of Alaska mining claims. The claim block consists of 176 claims. G1’s deposit is entirely on state land.

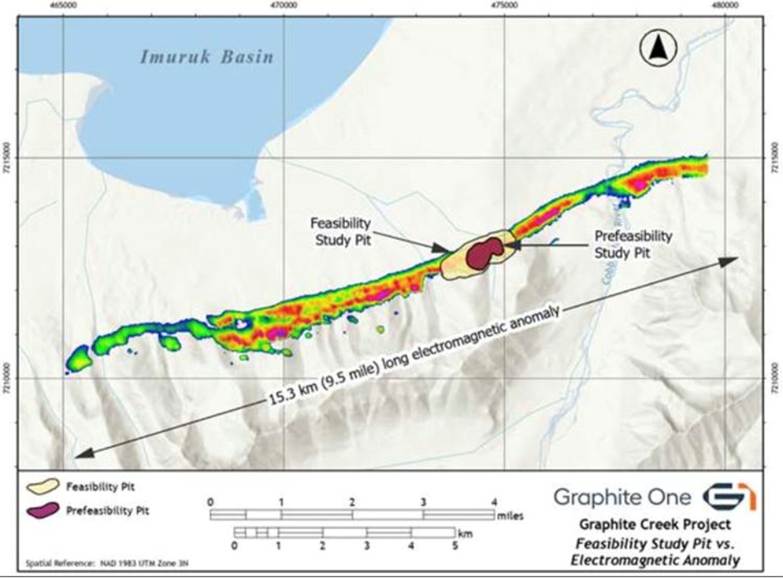

The graphite zone is exposed on the surface and strikes east/northeast along the north face of the Kigluaik Mountains. The FS pit and Mineral Reserve and resources footprint represents just 1.9 km of the 15.3-km-long electromagnetic anomaly (Figure 1).

Achieving US security of supply

The US could soon have security of supply for a critical mineral that they are currently 100% reliant on China for.

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

China accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

China has imposed restrictions on Chinese graphite exports. Exporters must apply for permits to ship synthetic and natural flake graphite.

Up to now, the US has had no security of supply for graphite. The country has reached a point where much more graphite needs to be discovered and mined in the US.

Graphite One could take a leading role in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek project in Alaska and shipping it to its planned graphite product manufacturing plant in Voltage Valley, Ohio.

Consider: In 2024, the US imported 60,000 tonnes of natural graphite, of which 87.7% was flake and high purity.

As Huston is quoted saying above, the soon-to-be-released Feasibility Study anticipates tripling the production rate envisioned in the PFS, which would be 155,439 tonnes, meaning Graphite One could have the capacity to not only meet the US’s annual graphite needs, but have extra to stockpile, in the neighborhood of 100,000 tonnes each year. This additional graphite could be put to domestic usage or built up to accommodate future demand growth.

All of this is based on the results of just 1.9 km of the 15.3-km-long geophysical anomaly. The resource remains open down dip and along strike to the east and west. Graphite Creek is now triple the size when the US Geological Survey reported three years ago that it was the largest flake graphite deposit in the US. And it could get even bigger with further exploration. We are talking about a potential life of mine (LOM) that provides all the graphite the US needs spanning across generations.

Conclusion

G1’s Feasibility Study is coming out during an interesting time in the graphite market. China has imposed fresh restrictions on graphite exports. Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is at the forefront of this trend.

President Trump wants to expand production of critical minerals and rare earths in America. On March 20th he set out the boldest measures the mining industry has seen in decades, with an executive order that aims to speed up permitting, prioritize land-use for mining and provide financial support.

The company has significant financial backing from the Department of Defense, a letter of interest from the Export-Import Bank of the United States to provide up to $325 million of debt financing, and political support from the highest levels of government, including the White House, Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation.

The project isn’t near a salmon fishery and it has the backing of local communities. Nome, Alaska has a long history of resource extraction.

Two Department of Defense grants have been awarded to Graphite One, one for $37.5 million — paying 75% of the cost of the Feasibility Study.

The company plans to invest $435 million to build a graphite product manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh. The plant will use synthetic graphite until natural graphite anode active material becomes available from Graphite Creek.

Politicians like Lisa Murkowski realize the benefits of mining and processing graphite domestically. Unlike current suppliers like China, which can turn off exports at the slightest provocation, and Mozambique, where civil unrest has interrupted graphite production. A 2022 report documents the rise of insurgent group al-Shabaab, which has claimed allegiance to Islamic State.

The Graphite Creek mine is in the US; therefore, it faces no tariff or other trade impediments.

Anthony Huston and his team at G1 should be congratulated for single-handedly eliminating US dependence on graphite imports. This is a major accomplishment that cannot be overstated.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2025.04.15 share price: Cdn$0.94

Shares Outstanding: 146.2m

Market cap: Cdn$137.4m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Graphite One Inc. (TSXV:GPH) GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

Graphite One Completes Bankable Feasibility Study

Graphite One Advances its United States Graphite Supply Chain Solution with Completion of a Bankable Feasibility Study

Feasibility Study Results Pre-Tax: US$6.4B NPV (8%) 30% IRR

7.3 Year Payback on Integrated Project

With Defense Production Act Title III Funding, the Feasibility Study was completed 15 months ahead of schedule

Graphite One Enters Permitting Phase as Presidential Critical Mineral Executive Order calls for “Immediate Measures to Increase American Mineral Production” and “Unleashing Alaska’s Extraordinary Resource Potential”

https://www.graphiteoneinc.com/graphite-one-advances-its-united-states-graphite-supply-chain-solution-with-completion-of-a-bankable-feasibility-study/

$GPH #SecurityofSupply #graphite #FeasabilityStudy #index