Graphite One gets drilling underway at Graphite Creek ahead of PFS later this year

2021.07.29

All cashed up from a recent financing that will see the company raise up to C$12 million, Graphite One Inc. (TSXV: GPH) (OTCQX: GPHOF) has initiated its 2021 drilling program at Graphite Creek property located near Nome, Alaska.

The drilling is part of the company’s previously announced 2021 field program to gather more data for an upcoming pre-feasibility study on Graphite Creek, on track for completion by the end of the year.

2021 Drill Program

The ongoing drill program is planned for 3,000 meters of HQ core infill drilling, with the goal of expanding the Graphite One project’s measured and indicated resources of graphitic carbon.

The new resource estimate will be used for a feasibility study (FS) that will follow the completion of the project’s pre-feasibility study (PFS).

“The 2021 field program is a very important and exciting milestone for our stakeholders as it is advancing the project towards the feasibility study while providing economic benefit to the local businesses,” Graphite One’s CEO Anthony Huston stated in the July 20 press release.

Previous drilling has identified long intercepts of high-grade graphite at surface at the Graphite Creek property.

According to Huston, the 2021 drilling will continue to provide Graphite One with invaluable data to progress the project towards a production decision.

The company is simultaneously working to complete the project’s PFS and generating additional data for the FS that is set to follow.

In addition to the infill drilling being conducted with a core rig, a sonic rig is active to collect geotechnical engineering data for continued development of the open-pit mine design, and to advance the understanding of ground conditions at the project’s proposed infrastructure sites.

Both the core rig and sonic rig will be active through the summer field season, Graphite One said.

In parallel to the drilling program, site visits and field work by the engineering team and environmental specialists is also underway, producing access route surveys and generating additional environmental baseline data.

Ultimately, results from the 2021 drilling program are expected to provide additional information to continue advancing the design and engineering for the Graphite Creek project, the flotation process facility, the secondary treatment plant for producing coated spherical graphite and other graphite products, and all associated infrastructure.

About Graphite Creek Project

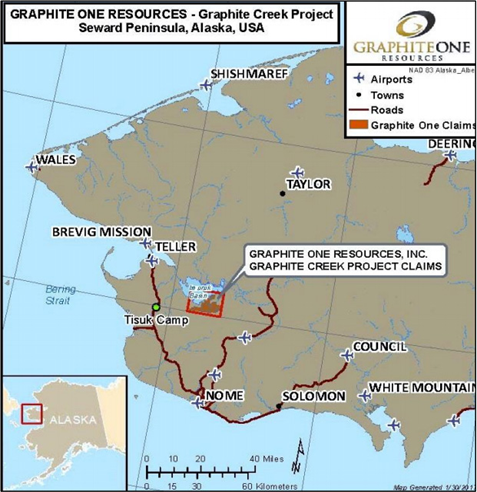

The Graphite Creek property is located on the Seward Peninsula in western Alaska, along the north flank of the Kigluaik Mountains about 55 km north of the city of Nome (see map below).

The land package consists of 176 mining claims covering 9,583 hectares, of which 56 are Alaska state mining claims overlapping and surrounding 24 pre-existing federal mining claims originally acquired by Graphite One (see figure below).

The remaining 120 are state mining claims staked by the company, some of which will be used for locating infrastructure.

Graphite showings at the property were first discovered after the 1898 Cape Nome gold rush and have been reported under several names including the Uncle Sam, Tweet and Kigluaik graphite deposits. These deposits were intermittently mined from 1907 to 1920, with some 580 tonnes of hand-sorted graphite mined from talus and adits that penetrated high-grade graphitic zones.

However, the graphite showings were never drill tested prior to Graphite One’s exploration program in 2012, when a geophysical survey identified an electro-magnetic conductor on the Kigluaik Mountain front, coincident with graphite occurrences, that is more than 18 km in strike length.

Drill results from that year served as the basis of the project’s maiden resource estimate (2013), which has since been updated several times. Only 4.8 km of the area has been drilled and used for resource calculation to date.

The most recent resource estimate (March 2019) for Graphite Creek shows 10.95 million tonnes of measured and indicated resources at a grade of 7.8% Cg, for 850,000 tonnes of contained graphite.

Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

These figures make Graphite Creek the highest-grade large flake graphite deposit currently found in North America.

Graphite as Critical Mineral

A graphite deposit of such size and grade could prove to be vital for America’s future supply chain of battery metals in the middle of a global shift towards clean energy.

In 2018, the Department of the Interior released a list of 35 critical metals that it deems to be critical to the US economy and national security, among which is graphite. The mineral is the second-largest EV battery component by weight, about 10 to 15 times more than the lithium content.

Graphite was later highlighted as one of four minerals considered by former US President Donald Trump to be essential to “national security, foreign policy and economy.”

A big reason for that was the nation’s dependency on foreign supply of natural graphite. In fact, despite its abundance of resources, the US has no domestic production of the mineral and is fully reliant on imports.

“The US is 100% reliant on imports for graphite, which is used to make advanced batteries for cellphones, laptops, and hybrid and electric cars,” the September 2020 executive order specifically stated.

The near monopolistic nature of the global graphite market exacerbates this issue. China, its biggest rival, is currently the world’s top graphite producer with over 70% of the global output.

In addition, nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs.

However, as we have seen with rare earths, a market that China manipulated in its favor following a territorial dispute with Japan in 2010, and more recently, with restricted shipments of personal protective equipment from China during the pandemic, being overly reliant on foreign suppliers is dangerous.

As one of the main drivers of the “electrification” movement, the US inevitably needs to tap into its own graphite resources, otherwise its imports will continue to escalate.

From 2018 to 2019, US imports of graphite material rose from 40,000 tonnes to 58,000 tonnes, a 45% increase, and that was even before the “Decade of Renewable Energy” of the 2020s.

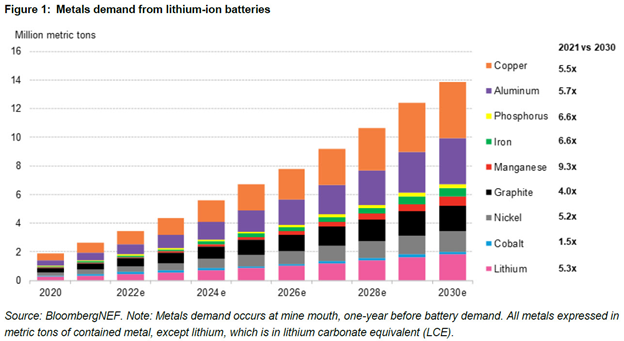

In its H1 Battery Metals Outlook report, BloombergNEF estimates that global demand for graphite used in lithium-ion batteries is set to quadruple by 2030 (see figure above).

That would also mean the global mined supply of graphite must at least double by that point to keep pace with demand, based on 1.1 million tonnes of production registered in each of the past two years.

A recent White House report on critical supply chains goes even further, stating that the global graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

Like with lithium, the future energy movement has set off a global race to secure more graphite, an essential ingredient in electric vehicle batteries and energy storage systems. The US, with a grand total of zero graphite mines, is already playing catch-up.

Largest Graphite Source in US

This brings us back to Graphite One and its deposit in western Alaska, which as of today is the largest known source of natural graphite in the US.

Leveraging the high-grade mineralization at Graphite Creek, the company has set its sights on becoming the first vertically integrated domestic producer to serve the EV battery market.

Tests carried out on the property found that at least 75% of its flake graphite could be converted into spherical graphite, the form used in EV batteries.

In early 2021, Graphite Creek was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC), a signal of intent by the US government to address the country’s supply concerns.

While the project remains at least a couple of years away from starting its permitting process, the earlier signs are promising as to how much battery-grade graphite material it could churn out.

The project’s preliminary economic assessment envisions a long-life operation (40 years) with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% Cg) per year.

As part of Graphite One’s proposed supply chain strategy, the concentrates would be shipped to an advanced manufacturing facility, to be located in the Pacific Northwest, for the production of battery-grade graphite material.

From there, about 41,850 tonnes of coated spherical graphite (CSG) and 13,500 tonnes of purified graphite powders are expected to be produced annually once the mine reaches full production in the sixth year.

However, these estimates were based on drilling only less than 20% of the deposit, so there is further production upside to be had over this 18 km stretch of the Kigluaik Mountain range.

Conclusion

The company’s first priority, though, remains to be the upcoming PFS, followed by more drilling and engineering and environmental studies to gain a better understanding of the deposit.

According to chief operating officer Stan Foo, Graphite One’s roadmap is about 4-5 years away from becoming a reality. Nevertheless, he is “encouraged by the interest people have in the project and the support provided by local businesses.”

This year alone, the graphite developer has already announced three financings for a total sum of C$22 million, a significant amount relative to the funds raised by other junior miners.

For shrewd investors, there’s no such thing as making a move “too early” when a clear path for growth has been lined up.

Graphite One Inc.

TSXV:GPH, OTCQB:GPHOF

Cdn$01.05, 2021.07.27

Shares Outstanding 65.2m

Market cap Cdn$68.5m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security. Richard owns shares of Graphite one. GPH is a paid advertiser on his site aheadoftheherd.com

Richard owns shares of Graphite One (TSX.V:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.