Graphite One bolsters management team, has resources updated ahead of feasibility work – Richard Mills

2023.04.06

To say the global energy transition will be metal-intensive would be quite an understatement.

BloombergNEF estimates that getting to net zero could require almost $10 trillion worth of metals between now and 2050.

By then, the world’s renewable energy capacity must be tripled under the International Energy Agency’s Stated Policies Scenario (STEPS), and can even grow sixfold under the Sustainable Development Scenario (SDS).

However, a concerted effort to reach the goals of the Paris Agreement (climate stabilization at “well below 2°C global temperature rise”, as in the SDS) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net-zero globally by 2050, would require six times more mineral inputs in 2040 than today, the IEA says.

In climate-driven scenarios, mineral demand for use in EVs and battery storage is a major force, growing at least thirty times to 2040, the Agency adds.

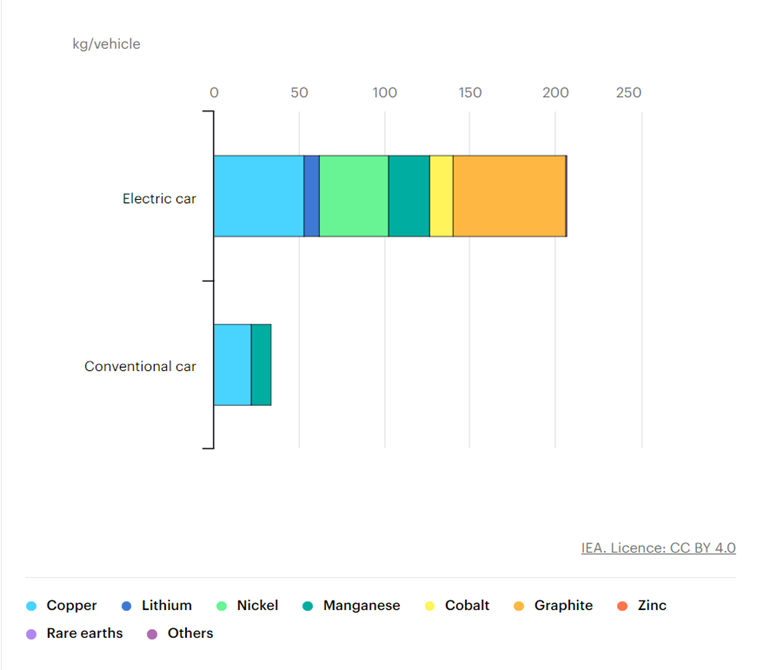

By IEA calculations, a typical electric car requires six times the mineral inputs of a conventional car, while an onshore wind plant requires nine times more mineral resources than a gas-fired plant. Since 2010, the average amount of minerals needed for a new unit of power generation capacity has increased by 50% as the share of renewables in new investment has risen.

Forecasts now show large relative increases in demand of up to nearly 500% for certain minerals key to the green energy transition.

According to the IEA, to meet the goals of the Paris Agreement, sectors contributing this transition will be responsible for over 45% of total copper demand, 61% of nickel demand, 69% of cobalt demand, and a staggering 92% of lithium demand by 2040.

Graphite – The Essential EV Material

Another mineral that is key to the vehicle electrification and decarbonization efforts is graphite, which could see demand surge by over 40 times under the SDS scenario by 2040, IEA estimates.

Graphite is the only material in the world that conducts electricity other than metals, and the only material that can be used as anode material in EV batteries. It is also the largest component in batteries by weight, constituting 45% or more of the cell, which may come as a surprise given the presence of metals in battery chemistries. In fact, there is nearly four times more graphite feedstock consumed in each battery cell than lithium and nine times more than cobalt.

For these reasons, graphite firmly sits amongst the list of 23 critical minerals that the US Geological Survey has deemed critical to the national economy and national security. The European Union, too, has included natural graphite in its critical raw materials list.

Like metals, natural graphite is sourced from mineral deposits and then processed into battery-grade products for the EV industry. However, the anode material can also be synthetic graphite, which is produced from petroleum feedstocks and therefore has a much larger carbon footprint.

A study by Northwestern University found that mining natural graphite would result in between 62% and 89% lower greenhouse gas emissions. Synthetic graphite is also much more expensive to produce due to the extensive amount of energy required.

Lack of US Graphite Source

As of now, the United States uses mostly synthetic graphite since it does not mine natural graphite. But for a country with grand ambitions with regard to climate goals and vehicle electrification, that doesn’t seem very sustainable. Eventually, it would need to find sources of natural graphite.

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It is thought that battery demand could gobble up well over 1.6 million tonnes of natural flake graphite per year (out of 2022 mine supply of 1.3 million tonnes).

But one more thing to note — the mining industry still needs to supply other graphite end-users. Right now, the automotive and steel industries remain the largest consumers of graphite, with demand across both rising at 5% per annum.

Benchmark Mineral Intelligence has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. At this rate, the US would most certainly be left in the dust as it continues to play catch-up in the EV race.

For starters, natural graphite material is very difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

China is by far the biggest producer with 65% of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Madagascar, Brazil and South Korea. The US, as mentioned, mines absolutely zero tonnes, and therefore must rely solely on imports for natural graphite.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity, 22% amorphous, and 1% lump and chip graphite. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that China, its main competition, controls all graphite processing, the US is not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should it wish to stay in contention for EV dominance, let alone meet its climate goals, and it will only worsen as demand for battery minerals grows.

China’s domination of the graphite space means that developing a US-based supply chain from scratch will not be easy, though still a necessary avenue to explore.

Graphite One to be the One?

There is one company that almost certainly will have a role to play in this endeavor. Graphite One (GPH, OTCQX:GPHOF) is advancing the Graphite Creek property, situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The US Geological Survey has also cited Graphite Creek as the country’s largest known graphite deposit, and recently extended that status to “among the largest in the world.” (see map below)

The part of the USGS report about Graphite Creek’s size is consistent with the company’s 2022 drilling that indicated the deposit remains open to the west, east and downdip.

Conducted between June and September, the program included 1,940 meters of drilling for resource definition. The program also increased field camp capacity, completed key environmental baseline studies, and ran 210 meters of geotechnical drilling for the mill site and tailings area.

Results of drilling were released by Graphite One earlier this year, confirming that “significant graphite grade” continues 4 kilometers from the pit boundary defined in the 2022 prefeasibility study (PFS). One step-out hole, drilled 2 km west of previous resource drilling, showed significant intervals above mill cut-off grade, with selected intervals totalling 8.2 m of 4.18% graphite.

Based on these results, the company then put out an updated resource estimate for Graphite Creek, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite over the 2022 PFS.

Video – Graphite One shows potential of Graphite Creek Deposit with update Resources Estimate

The deposit now has 37.6 million tonnes of M+I resources grading 5.14% Cg (graphitic carbon), for 1.93 million tonnes of contained natural graphite. It also has 243.7 million tonnes of inferred resources at 5.07% Cg, for 12.3 million tonnes of natural graphite.

“We’ve been very consistent about the potential we see in Graphite Creek,” said Anthony Huston, president and CEO of Graphite One in the March 13 news release. He then went on to say that:

“The recognition by USGS, coupled with this increase in our measured and indicated resources and the fact that we have explored only 26% of our graphite anomaly, underscores that Graphite Creek is truly a generational resource.

“These strong results from our 2022 program will assist in developing our 2023 drilling plan, and the continued expansion of our Graphite Creek resource will support our plan to quadruple the annual production from our PFS study,” added Mike Schaffner, SVP Mining.

According to Graphite One, the upcoming 2023 drill program will continue to delineate the scope and size of this massive, but vastly underexplored resource.

Strengthened Management Team

To support the development of this “generational critical minerals resource,” Graphite One this week bolstered its operations team with the appointment of a new VP Operations to oversee site operations, exploration activities and feasibility studies for the Graphite Creek project.

Kevin Torpy is a mining engineer that comes with an impressive resume spanning 26 years in developing, building, and operating mines, primarily in remote northern locations. Prior to joining the company, he was VP Operations at Ambler Metals, another major Arctic exploration project in Alaska.

Torpy’s other Alaska experience includes the Kensington mine (Coeur Mining), where he was technical services superintendent through construction, and the Pogo mine (Northern Star Resources), where he was an operations Engineer during the advanced exploration and construction phases.

His experiences outside of Alaska include VP Operations at Titan Mining Corp., where he oversaw the restructuring and operational turnaround of the Empire State mine in northern New York state.

He also held several positions of increasing responsibility including general manager at Pretium Resources’ Brucejack mine in British Columbia during the advanced exploration, construction, and startup phases of the project.

“Kevin has brought mines through permitting, construction and into production – a skill set that’s going to make our team even stronger,” Huston commented in a news release on April 3.

Concurrent with Torpy’s appointment, Graphite One also promoted Andrew Tan to the position of VP, Advanced Graphite Materials. Tan joined the company in April 2021 as director of graphite products manufacturing, and has been instrumental in planning its advanced graphite materials manufacturing facility.

Domestic production

Graphite One aims to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The company in April, 2022 announced an MOU with Sunrise New Energy Material Company., a China-based lithium-ion battery anode producer.

The intent is to develop an agreement to share expertise and technology for the design, construction and operation of Graphite One’s proposed US-based graphite material manufacturing facility in Washington State.

Last year Sunrise started preparing anode materials for sample purposes from Graphite Creek concentrate, and in December 2022, Graphite One announced that concentrate is being used to prepare sample battery anode materials for two major electric vehicle (EV) manufacturers, while an artificial graphite anode sample is being prepared for a third EV company. Results are expected this quarter.

This is a crucial milestone for Graphite One in proving, a/ that its graphite end product is of sufficient quality to be battery-grade; and b/ that Graphite One is able to tailor its graphite processing to meet the specific graphite anode needs of its potential future clients.

Now we don’t want to speculate on who those companies are, but the fact that Graphite One describes them as “major EV manufacturers”, narrows the list down to a handful of American car companies; for now we’ll have to use our imagination to guess who they are.

Graphite One than made two more announcements, the first regarding the testing of graphite from Graphite Creek; and the second, the testing of Graphite Creek material “as a potentially critical mineral-rich carbonaceous feedstock.”

In the first news release, G1 states that the company, through a subsidiary, has entered into a Material Transfer Agreement with Pacific Northwest National Laboratory (PNNL), managed and operated in Richland, Washington by Battelle for the U.S. Department of Energy.

Under the MTA, PNNL will test anode active and other materials to verify conformity to electric vehicle battery specifications. The first materials to be tested will be the anode-active materials now being produced as samples by Sunrise, using Graphite Creek graphite. These samples will be sent to American electric vehicle manufacturers for evaluation as a possible source of battery materials.

“We are delighted to work with one of the U.S. Government’s premier national labs,” said Anthony Huston, President and CEO of Graphite One, in the Jan. 20 news release. “Given PNNL’s experience in developing renewable energy solutions, and the importance of graphite to the major renewable energy applications as well as the energy storage systems required for the national grid, Graphite One sees this as a major step in our supply chain strategy.”

The second news release details Graphite One’s arrangement with Sandia National Laboratories in Albuquerque, New Mexico. The company’s subsidiary Graphite One (Alaska) has provided material from the Graphite Creek deposit to Sandia, as part of Sandia’s green extraction processing work.

National Technology and Engineering Solutions of Sandia, a subsidiary of Honeywell International, Inc., operates Sandia National Laboratories as a contractor for the U.S. Department of Energy’s National Nuclear Security Administration (NNSA).

In 2021, Sandia’s patent-pending process was awarded a prestigious R&D 100 Award, “GOLD Special Recognition in Green Technology for Environmentally Benign Extraction of Critical Metals Using Supercritical CO2-Based Solvent”. Sandia’s method uses supercritical CO2 in combination with a food-grade additive to extract rare earths and other critical minerals. Sandia will test Graphite Creek material as a potentially critical mineral-rich carbonaceous feedstock.

“We are pleased that Sandia will apply its path-breaking process to Graphite Creek material,” CEO Huston said in the Jan. 25 news release. “We are excited about the potential for value-added applications which identify flake graphite from Graphite Creek as a unique resource, and Sandia’s process will provide us important data on that potential with implications for how we unlock the value of G1’s additional critical minerals.”

These latest updates place Graphite One in a stronger position to continue its work in Alaska, where it holds the country’s largest confirmed graphite resource.

Following on last year’s success, the company is about to ramp up drilling in 2023-2024 with a total of 20,000 meters planned. The results would help to determine the possibility of increasing the designed production capacity for the upcoming Graphite Creek feasibility study.

If all goes according to plan, the FS would move Graphite One’s deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance.

The project already has the backing of the highest levels of government in Alaska, and is expected to qualify for tax incentives under the US Inflation Reduction Act.

In a world where battery minerals like graphite are becoming increasingly in-demand and hard to come by for most countries, the development of such a project should warrant more attention.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.47, 2023.04.04

Shares Outstanding: 109.8m

Market cap: Cdn$161.4m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.