Graphite One: America’s climate plan comes down to building domestic critical mineral supply

2021.03.27

Five years ago, 196 countries came together and signed the Paris Agreement with the common goal of keeping the average global temperature within 2°C of pre-industrial levels. But thus far, this commitment has yet to be matched by sufficient action — and, by extension — adequate results.

Europe is coming off its hottest year on record, much of the US West is facing the driest spring in years, and China, notorious for being a major polluter, is experiencing the worst sandstorm in over a decade. There’s a global climate crisis happening at a pace faster than we’ve ever feared.

The current decade is a make-or-break moment in terms of our planet. To confront the challenges ahead, world leaders have drawn up improved climate plans, including the structural changes and investments necessary to transition into a green global economy.

US Climate Plan

In the US, climate change has long been described as one of the key efforts under the Biden administration’s long-term economic program.

Shortly after taking office, the administration laid the groundwork of its climate focus by setting policies aimed to reduce greenhouse gas emissions. This includes dramatically increasing the number of electric cars driving on American roads, which are currently the single largest source of carbon emissions.

To set an example, the administration said in January it will replace the federal government’s fleet of 650,000 vehicles “with clean electric vehicles made right here in America made by American workers,” sending a signal to the rest of the world that the US wants to “rejoin” the global fight against climate change.

The Biden administration also wants to build more charging stations to power these vehicles.

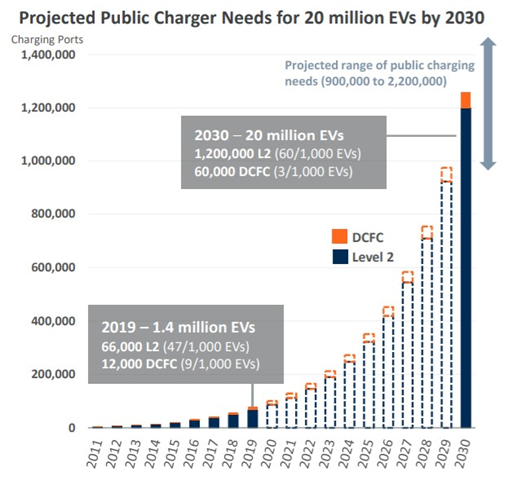

Even with 1.8 million battery-powered cars on US roads, there are only about 100,000 charging plugs for them at around 41,000 public station locations.

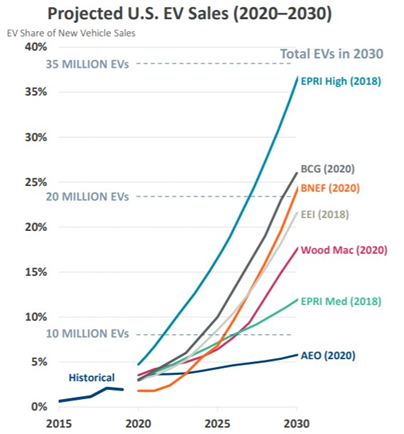

Given this disparity, which is one of the main hurdles for consumers considering a clean car, President Joe Biden has pledged to build 500,000 new plugs over the next decade. The Brattle Group, an economics consulting firm, projects that the number of EVs in the US may balloon to 35 million by 2030, requiring more than 2 million public chargers.

President Biden is also pushing for his country to take more aggressive climate action. According to Bloomberg sources, he is expected to announce a 2030 pollution reduction goal next month that will align with the most ambitious target under the Paris Agreement: keeping average global temperatures from rising more than 1.5°C from pre-industrial levels.

Details also revealed that his administration is eyeing some $400 billion for its so-called green spending. Measures to improve the financial industry’s environmental impact disclosure are also being worked on by US regulators, and by June, a green finance framework is expected to take shape.

Push for Battery Metals

The common denominator to each climate action plan is electric vehicles; that’s easy to identify. But whether economies can acquire sufficient raw materials to reach “full electrification” is another story — it’s a problem that has yet to be solved.

For years, the US has been heavily reliant on foreign supply of minerals required for key areas such as national defense, electronics and medical equipment, and its EV sector is no different.

Since the days of Donald Trump’s presidency, the US has been planning to reverse its dependence on foreign rivals especially China, which currently has the largest EV market and dominates the battery supply chain.

Under an executive order issued by Trump, a report was published by the Interior Department in 2018, highlighting 35 minerals that are critical to the US national and economic security, 14 of which are 100% dependent on imports.

The current President, too, is more than aware of America’s vulnerabilities. In late February, the Biden administration announced it would conduct a government review of US supply chains to seek to end the country’s reliance on China and other adversaries for crucial goods.

This would be a natural step to take should the US wish to achieve its ambitious climate goals, and many, including those on Wall Street, are predicting that a change in US administration would finally set off a battery boom. About 30% of an electric car’s cost goes towards its battery, which requires metals such as lithium and cobalt — both on the US critical minerals list.

Already, we’ve seen the Biden administration breathe new life into the global lithium industry. The lithium price index compiled by Benchmark Mineral Intelligence jumped 32% this year through February, after plunging 59% during a two-year period between 2018-2020.

Morningstar analyst Seth Goldstein said the election of Biden is “a very favorable signal to investors” as it boosted confidence that the switch to clean energy will accelerate, which along with existing favorable subsidies and regulations in Europe and China bodes well for raw materials needed for that energy transition.

Focus on Graphite

Another mineral required to build EV batteries is graphite, which is the second-largest battery component by weight, about 10-15 times more than the lithium content in an EV battery. As such, it is indispensable to the global shift towards clean energy.

Under Trump’s executive order (September 2020), graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

At present, the mineral is sourced from just a few places around the globe. China currently is the world’s biggest producer, with 700,000 tonnes of mined graphite recorded in 2019, representing more than 60% of the world’s total that year.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US, however, does not produce any natural graphite and therefore must solely rely on imports to satisfy domestic demand.

The executive order also highlighted the vulnerability of America’s graphite supply chain: “The US is 100% reliant on imports for graphite, which is used to make advanced batteries for cellphones, laptops, and hybrid and electric cars.”

The level of foreign dependence has also increased over recent years. The US imported about 40,000 tonnes of graphite material during 2018, followed by 58,000 tonnes in 2019. With the climate targets by the current administration, we can imagine imports to rise exponentially unless a domestic graphite source is developed.

High-Priority Project

According to the US Geological Survey, despite having no known production of graphite domestically, the US boasts an abundance of graphite deposits in the far and remote areas of Alaska.

In a 2017 critical minerals report, the USGS specifically named the Kigluaik Mountains on the Seward Peninsula as the home to at least one deposit that has both the size and grade to meet the growing EV battery needs.

Earlier this year, one of these deposits was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The deposit, known as Graphite Creek, is considered the largest known graphite resource on the continent, spanning 18 km of the Kigluaik Mountains.

The project is being advanced by Vancouver-based junior Graphite One Inc. (TSXV: GPH) (OTCQB: GPHOF), which aims to become the first vertically integrated domestic producer to serve the EV battery market.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg, for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A preliminary economic assessment (PEA) for the project envisions a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

Once in full production, Graphite One’s proposed advanced graphite product manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn these graphite concentrates into 41,850 tonnes of EV-battery grade coated spherical graphite (CSG) and 13,500 tonnes of purified graphite powders per year.

However, these production figures are based on resource estimates prior to the 2019 update, leaving room for potentially higher production.

Nevertheless, graphite material produced from Graphite Creek could be more than sufficient to supply the entire nation’s demand given recent years’ import totals.

“Designating the Graphite Creek project as a High-Priority Infrastructure Project will send a strong signal that the US intends to end the days of our 100% import-dependency for this increasingly critical mineral,” said Alaska Governor Mike Dunleavy, who began the nomination process of the project back in 2019.

‘Built in America’

While there are still ways to go before achieving 100% import-dependency on graphite, it seems the US government wants to do everything it can to make that happen sooner rather than later.

The HPIP designation for the Graphite Creek project comes right before the new executive order issued by the Biden administration earlier, which states:

“In addition to being a US government-listed critical mineral, graphite is an essential material for both the renewable and EV battery sectors, and for advanced semiconductor manufacturing.”

Commenting on the new executive order, Simon Moores, a renewable energy analyst from UK’s Benchmark Minerals Intelligence, said: “What we expect from the Biden Administration is to simply make one of their policies to make gigafactories across the whole country at scale.” To realize that, there must be at least one domestic source of graphite.

As new Secretary of Energy Jennifer Granholm stated in her nomination hearing earlier: “We can buy electric car batteries from Asia, or we can make them in America.” The message is strong and simple.

With aggressive but perhaps necessary climate goals in mind, a global EV battery boom is on its way, and along the way, we may finally see the US join the list of graphite producers.

Graphite One Inc.

TSX.V:GPH, OTCQB:GPHOF

Cdn$01.27, 2021.03.25

Shares Outstanding 43,109,143m

Market cap Cdn$55.1m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer or not, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur because of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSX.V:GPH, OTCQB:GPHOF). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.