Goldshore continues to identify +1 g/t gold at Moss Lake, suggesting open-pit viability

2022.09.10

For the past year and a half, Goldshore Resources (TSXV:GSHR) (OTC:GSHRF) (FRA:8X00) has been advancing its flagship Moss Lake Project, through detailed field work including a massive 100,000-meter drill program.

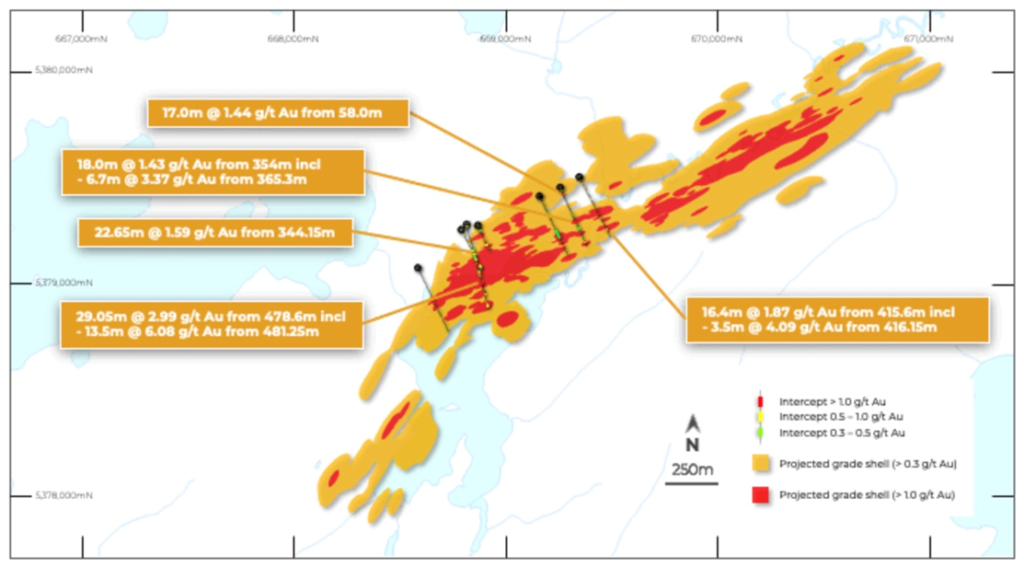

This week, Goldshore posted the results of eight holes that have confirmed high-grade gold in the Main Zone, within a large volume of well-mineralized diorite, an intrusive igneous rock. The best intercepts include:

- 29.05m @ 2.99 g/t Au from 478.6m depth in MMD-22-045, including 13.5m @ 6.08 g/t Au from 481.25m;

- 16.4m @ 1.87 g/t Au from 415.6m depth in MMD-22-033, including 6.65m @ 4.09 g/t Au from 416.15m;

- 5.85m @ 3.47 g/t Au from 110m depth in MMD-22-034;

- 17.0m @ 1.44 g/t Au from 58m depth in MMD-22-039, including 14.45m @ 1.63 g/t Au from 58.55m;

- 18.0m @ 1.43 g/t Au from 354m depth, including 6.7m @ 3.37 g/t Au from 365.3m; and

- 22.65m @ 1.59 g/t Au from 344.15m depth in MMD-22-040.

The better intercepts are all centered around 12 very high-grade gold zones that represent the axis of the shear network, including:

- 1.0m @ 22.0 g/t Au from 418m in hole MMD-22-033;

- 1.0m @ 17.7 g/t Au from 349m in MMD-22-040; and

- 0.75m @ 88.6 g/t Au from 481.25m in MMD-22-045

“We continue to intersect wide zones of +1 g/t Au mineralization that underpin our belief that the Moss Lake Deposit has potential to develop an initial high-grade phase 1 open pit within the larger low-grade open pit operation,” President and CEO Brett Richards said in the Sept. 9 news release.“ It can be seen that the projected grade shell of +1.0 g/t Au is significant at this early stage, and we will look to expand upon these exploration results, as we continue with our program.”

Moss Lake Project

Located 100 km west of Thunder Bay, the Moss Lake property has seen extensive historical exploration dating back to the late 1800’s.

Prospecting resulted in the discovery of multiple high-grade gold occurrences and the North Coldstream copper-gold-silver deposit, from which 2.7 million tonnes was mined up to 1950, at grades of 1.89% Cu, 0.56 g/t Au and 5.59 g/t Ag.

Gold exploration intensified during the 1970s with Falconbridge and exploration of the Snodgrass Lake prospect. The original Moss Lake showing was stripped and washed by the Tandem/Storimin joint venture in 1985.

Between 1986 and 1990, extensive drilling and 1,000m of underground development work were completed by several groups, along with the first resource estimates and metallurgical work.

During the 1990s, Moss Lake Gold Mines continued exploration with several modest drill campaigns and further geochemical/ geophysical surface programs, along with an updated resource estimate in 2010.

A PEA was completed by Moss Lake Gold Mines in 2013, ownership was amalgamated by Wesdome Gold Mines in 2014, and the Coldstream and Hamlin properties were later added in 2016. More exploration and drill programs in 2016 and 2017 confirmed extensions of mineralization along strike.

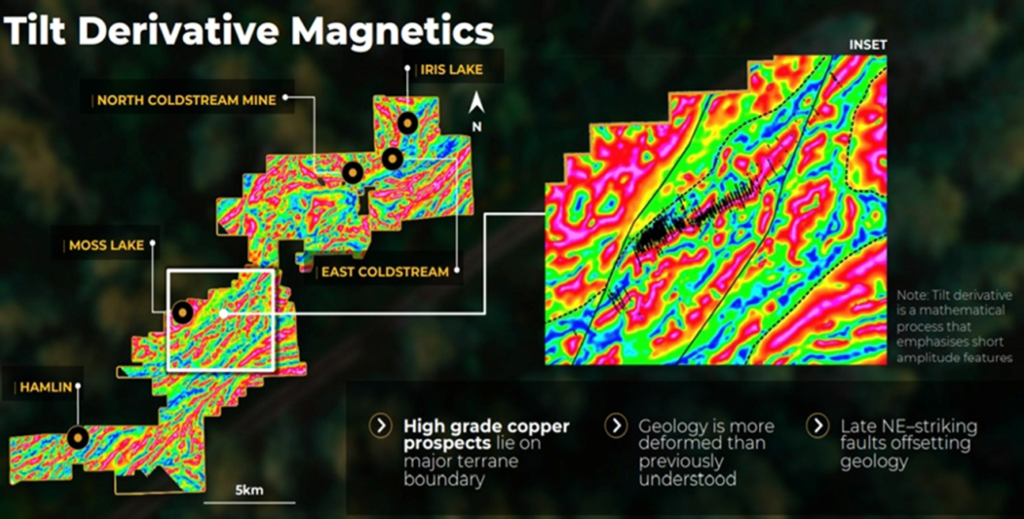

The Moss Lake Project now consists of 282 mining claims for a total area of 14,292 hectares, hosting a number of gold and base metal-rich deposits, all of which occur over a mineralized trend exceeding 20 km.

The property is in an excellent jurisdiction with a number of major gold deposits nearby (see below), including Detour Lake (Kirkland Lake Gold) with 15.7Moz proven and probable at 0.82 g/t Au, New Gold’s Rainy River with 2.6Moz P&P at 1.06 g/t Au, and Cote’s (IAMGOLD & Sumitomo) 7.3Moz P&P at 1.0 g/t Au.

In comparison, Moss Lake’s historical (2013) resource estimate is 1.47Moz measured and indicated at 1.08 g/t Au, and 2.51Moz inferred at 0.98 g/t Au, for a combined 3.98Moz. This estimate covers the Moss Lake and East Coldstream deposits, both of which have expansion potential as confirmed by previous drilling.

In an interview with AOTH last year, Goldshore CEO Brett Richards said: “We have a very large land package in a very good jurisdiction. We have 4Moz of historical resources and we’ve already identified a number of targets along strike and a 20 km known mineralized trend. We have been gifted a very good starting point.”

Richards also noted that the Moss Lake Project, despite having a number of companies’ fingerprints on it, is massively under-explored with limited drilling to date.

“The historical drilling goes down to 250m but this deposit (historically) is 2 km long and about three-quarters of a km wide, and we see significant expansion potential in every direction,” he added.

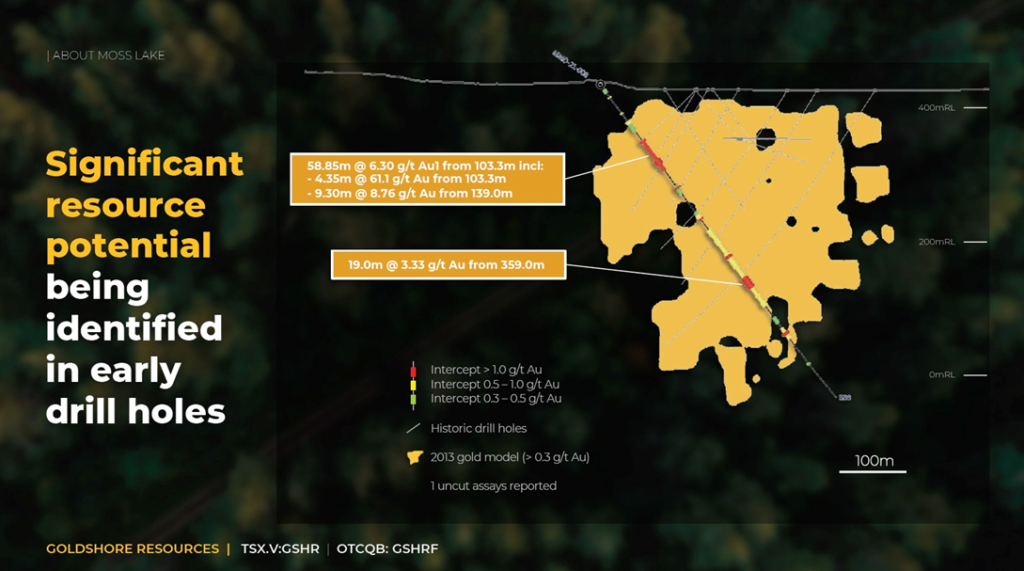

The 20-km mineralized trend contains multiple zones and targets ready for follow-up, with infill and expansion drilling considered necessary. From the schematic below, Goldshore believes there is significant exploration potential below and lateral to the indicated resource in yellow and the inferred portion in green.

2021-22 exploration

Analysis of a VTEM geophysical survey shows the Moss Lake deposit is wide open at strike, with a significant fault system running for quite a distance.

This was confirmed when the first set of assays were received last October, with widespread mineralization reported from the first three holes of the program.

Among the highlights, hole MMD-21-001 intersected 550m, which corresponds to an estimated true thickness of 422m and a 52% increase over the historical resource model.

Mineralization was also intersected between 100-500m below the 2013 historical resource model in MMD-21-002, representing a +100% increase to the known vertical extent of the gold zones in this area.

Additionally, there were several higher-grade zones identified. Two of the best intercepts included: 57m at 120 g/t Au from 4.0m; and 36m at 1.15 g/t Au from 182m.

These results helped to validate Goldshore’s belief that the Moss Lake deposit is very much underexplored and misunderstood, given the wide lateral extension indicated. The company’s exploration model suggests that there exists “significant exploration potential below and lateral to the current resource.”

Then in December, more assays were released, this time for two additional holes drilled to validate the gold mineralization at Moss Lake. The latest results were highlighted by a number of higher-grade zones within large, low-grade envelopes.

The best intercept was 117.12m at 1.16 g/t Au from 1.1m in hole MMD-21-004. Deeper down, the hole cut 17m at 2.40 g/t Au from 57m and 26.2m at 1.63 g/t from 92m. The hole also returned 23.45m at 1.54 g/t from 302.85m.

The other hole, MMD-21-005, featured an 8.5m intercept at 2.53 g/t Au from 42.5m and 16.5m at 1.26 g/t from 139.5m.

The two main takeaways from the Dec. 8 news release were the significant volume additions and the expanding drill capacity.

According to Goldshore, mineralization continues to be intersected laterally and at depth, significantly expanding the width and depth of mineralization compared to the 2013 grade model. MMD-21-004, for instance, has extended the width and depth of mineralization, relative to the 2013 model, by 38% and 56%, respectively.

“The fact that we are continuing to intersect gold mineralization outside of the volume modeled in 2013 also affirms our belief that the deposit is wider and larger than previously interpreted,” CEO Brett Richards said at the time.

In early March of 2022, Goldshore received further confirmation of high-grade gold at Moss Lake, with assay results from hole MMD-21-008. The drill cut a 58.5m intercept grading 6.3 g/t Au, including 4.35m @ 61.1 g/t Au and 9.30m @8.75 g/t Au. Another 19-meter interval deeper down-hole graded 3.33 g/t Au. Four drill rigs were on site.

A week later, Goldshore published the final results of the helicopter-borne VTEM survey, revealing 29 undrilled high-priority targets, and expanding the strike length from 2.5 to 11 km. The results included 11 new chargeability targets with a Moss Lake gold deposit signature; six folded magnetic targets with an East Coldstream gold deposit signature; and 12 magnetic conductors suggesting additional copper prospects.

After Goldshore closed a CAD$10 million private placement, the company revealed more details of the feeder system identified in its March 2, 2022 news. Drilling expanded the Main Zone and provided better definition of the high-grade corridors. Highlighted intercepts included 13m @ 1.25 g/t Au, 29.75m @ 1.03 g/t Au, and 13m @ 1.02 g/t Au. An additional parallel zone returned 16.0m @ 5.31 g/t Au, including a higher-grade 5.2m @ 15.8 g/t Au. Visible gold was also discovered in quartz-pyrite veins at 478.1m. This northern structure is interpreted to be the same parallel structure intersected over 100 meters further to the east, identified in a Jan. 28 news release.

The news in early June concerned hole MD-022-025, which identified high-grade gold mineralization 200m below the previously modeled low-grade Southwest Zone, implying significant potential in this area. The best intercept was 23.0m @ 2.57 g/t from 514m. Hole MMD-22-022 extended the strike length of the southern parallel zone by 600m, within a broad low-grade envelope at the end of the hole. Gold mineralization was also added to the eastern and western extents of the Main Zone. The best intercepts in hole MMD-22-024 added 200m to the depth of the deposit, returning 23.7m @ 1.11 g/t Au.

In mid-June Goldshore announced that drilling has started at Coldstream, located in the northeastern part of the Moss Lake land package, shown on the mineralized zones map, above. Two rigs of seven were mobilized to this area, to evaluate gold mineralization at East Coldstream and copper-gold-cobalt mineralization at North Coldstream.

Also in June, the total width of the Main Zone was expanded from 300-350m, to between 600 and 650 meters. Hole QD-22-019 at the QES Zone upgraded the mineralization within the modeled volume and confirmed the parallel zone of mineralization to the north, with best intercepts of 65m @ 1.04 g/t Au, including 13m @ 2.14 g/t Au.

Fast forward to June 29, when the results of four shallow holes drilled during the winter program were published. The holes confirmed high-grade gold mineralization within shears hosted by altered diorite, with a highlighted intercept of 78.35m @ 1.17 g/t Au.

In July, three holes drilled to evaluate gaps in the Main Zone confirmed high-grade gold mineralization within shears, hosted by low-grade mineralized altered diorite. Highlighted intercepts included 13.30m @ 1.49 g/t Au, 21.20m @ 1.66 g/t Au, and 3.5m @ 10.7 g/t Au.

In August, four holes drilled to evaluate the eastern extension of the Southwest Zone confirmed gold mineralization within shears in altered diorite, with a highlighted intercept of 2.65 g/t Au over 14.6m.

This was followed by the publication of assay results from previously unsampled historical drill core taken from the Moss Lake Project. The sampling program increased the width and grade of the mineralization, and identified a new southern parallel zone. The expanded intercepts include 104.2m @ 1.04 g/t Au and 56.1m @ 0.42 g/t Au. The results from the new southern parallel zone include 35.7 g/t Au over 0.9m, 0.35 g/t Au over 78.45m, and 0.49 g/t Au over 69.1m.

Results of the 100,000-meter drill program will serve as a basis for an update of the historical resource in the 2013 PEA. Goldshore is also preparing to begin all necessary pre-feasibility study (PFS) work to support further development of the project.

Conclusion

In 2022, the company’s objective is to advance its understanding of Moss Lake, ultimately towards a “Tier One” status in terms of both resource size and project potential.

Drilling so far has demonstrated that the property indeed contains a significant volume of +1 g/t Au mineralization that underpins a meaningful, economic gold deposit.

Starting out with 4Moz of historical resource, on the largest land package assembled in northwestern Ontario for a mining company, Goldshore is in an enviable position to succeed.

In fact, the Moss Lake Project could easily help the company attain a higher value than most projects that have been targeted by the majors in the area, given the project’s economics were last updated in 2013.

“We’re talking about a massive resource, we’re talking about a Detour Lake-sized project in both capex, production profile and size of resource, that is what we’re aiming for,” says Richards.

Goldshore Resources Inc.

TSXV: GSHR, OTC: GSHRF, FRA:8X00

Cdn$0.20, 2022.08.09

Shares Outstanding 143.8m

Market cap Cdn$28.4m

GSHR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security. Richard does not own shares of Goldshore Resources Inc. (TSX.V: GSHR) GSHR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.