Golden Triangle’s Red Line

2018.11.09

Geology

“Geologists are scrambling to understand what created the phenomenal concentrations of gold at the Valley of the Kings discovery of Pretium. Recent drill results include 0.5 meters that carried 41,582 grams per tonne gold (1.6 feet at 1,213 ounces per ton of gold). Another hole hit 2,393 g/t gold 1,605 g/t silver over 10.7 meters (70 ounces gold and 47 ounces of silver per ton over 35 feet). Numerous intersections have exceeded 1,000 g/t, grades rarely seen in gold deposits.

The broad picture, in simplest terms, is that most of British Columbia is made up of blocks of crustal material (terranes) that have been accreted to the coast over a period of hundreds of millions of years. Those terranes include a wide variety of rock types, including metal-rich material derived from the depths of the crust.

Most metal deposits are derived from hydrothermal systems. That is, superheated water, circulating kilometers deep in the crust, gathers metal atoms and then deposits them in particular zones, creating concentrations of metals. Typically, such a system would remain active for hundreds of thousands of years to as much as perhaps a couple of million years. For reasons not yet well understood, the hydrothermal processes in the Golden Triangle were active for much longer, in some areas for perhaps 10 million years. Few areas on the planet have seen such long-lived geological conditions.

That long period of stable mineralizing systems played an important role in creating the high concentrations of metals at Eskay Creek and Valley of the Kings. It is also the reason for the very large and well mineralized systems at Red Chris, KSM, Galore and other porphyry deposits in the region.”Kitco.com, British Columbia’s Golden Triangle

About 150 million years ago during the Jurassic geological period, an uplift of Jurassic and older rocks cut across central British Columbia and resulted in the separation of the Bowser and Nechako basins. Rocks exposed along the “Skeena Arch” represent a magmatic arc, where over a long period of time, magma rose up from deep in the earth to produce a wide range of mineral deposits including porphyries, precious metal veins, and coal. The Skeena Arch has some of the mostly richly endowed mineral terrain in BC and has been a destination for prospectors and mining companies for the past 125 years.

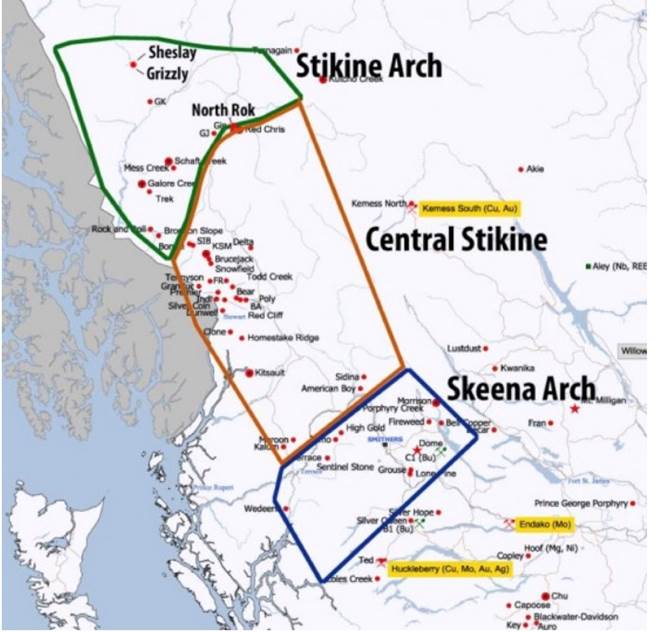

The map below shows the Golden Triangle where a lot of historical exploration and mining has taken place in the last century and a quarter, and where over the past couple of years juniors have rushed in to stake claims as mineral exploration conditions and the gold market have improved.

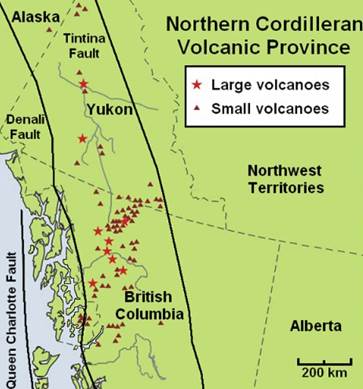

Note the three arches bounding the Golden Triangle in the second map: the Skeena Arch, Central Stikine and Stikine Arch. The Stikine Arch is one of four terranes – or distinct geological structures with different histories – along with Cache Creek, Yukon-Tanana and Cassiar, which form the bedrock of the Northern Cordilleran Volcanic Province, a wide belt of volcanoes that extends all the way from Stewart, BC in the south, through the Alaska Panhandle north to eastern Alaska. According to a presentation by Geoscience BC, “World class gold-rich deposits are associated with the Late Triassic, and Early Jurassic intrusive suites in NW Stikinia.” The non-profit research group also states that bulk tonnage copper/ gold/ silver porphyries (igneous rock consisting of large-grained crystals such as feldspar or quartz) in the Stikinia, and bonanza-grade gold and silver epithermal veins are associated with the early Jurassic period, such as the KSM (Seabridge), Snowfield and Brucejack (Pretium) deposits.

This article will trace the history of the Golden Triangle, explain why the area has become hot again after many years of neglect, and present a few junior resource company successes from the Triangle last year. Lastly, we’ll roll out a watchlist of juniors that are on our radar as potentially hitting the next big discovery hole.

This article will trace the history of the Golden Triangle, explain why the area has become hot again after many years of neglect, and present a few junior resource company successes from the Triangle last year. Lastly, we’ll roll out a watchlist of juniors that are on our radar as potentially hitting the next big discovery hole.

A brief history

Just inland from the Alaska Panhandle, the Golden Triangle has been the site of three gold rushes and some of Canada’s greatest mines, including Premier, Snip and Eskay Creek. Other significant and well known deposits located within the Triangle include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, and Red Chris.

Alexander Choquette kicked off the Stikine Gold Rush in 1861 after finding gold at the confluence of the Stikine and Anuk Rivers.

Premier Gold Mine, which started operations at Premier in 1918, returned 200% on the stock market between 1921 and 1923. The Snip Gold Mine produced a million ounces in the 1990s at an eye-popping average grade of 27.5 grams per tonne (g/t), and Eskay Creek was Canada’s highest grade gold mine and the world’s fifth largest silver producer, with production well over 3 million ounces of gold and 160 million ounces of silver, before it closed in 2008.

Porphyry copper-gold deposit Galore Creek, now owned by Novagold and Teck Resources, has 9 billion pounds of copper, 8 million gold ounces and 136 million ounces of silver. Another porphyry, Shaft Creek, a JV between Copper Fox Metals and Teck, contains 5 billion pounds of copper, 5.8 million ounces of gold, 363.5 million pounds of molybdenum and 51.7 million ounces of silver. (2013 feasibility study)

But after decades of productive mining and some big discoveries, the Golden Triangle went dormant. Isolated from major infrastructure, the area was expensive to conduct sampling, surveys and drill programs, and due to its harsh winter climate, was only accessible for half a year. Not much news came out of the Golden Triangle during the 1990s and 2000s. When gold prices weakened, to about $400 an ounce, several mines shut down, unable to make a decent margin against fixed costs.

What changed?

Despite over 130 million ounces of gold, 800 million ounces of silver and 40 billion pounds of copper having been found in the area, the tip of the surface has only been scratched. The BC Geological Survey database has identified over 900 mineral occurrences, 67 of which have documented mineral resources.

Lately there has been a resurgence of interest in the Golden Triangle, with something of a staking rush going on there as juniors position themselves for the next discovery hole. So what changed? The excitement is being driven by five factors.

1. New deposits

In 2009 exploration drilling at the Valley of the Kings deposit – the site of a former gold mine – hit a bonanza hole of four mineralized gold bands, with the highest grading 16,949 grams per tonne, leading to a 33,000-meter drill program in 2010. New company Pretium, led by Bob Quartermain, former president of Silver Standard Resources, proceeded to develop the Brucejack project, with a PEA completed the same year. More drilling and a 10,000-tonne bulk sample revealed that unlike porphyry-style deposits in the area, the Valley of the Kings contained high-grade stockwork-style (a complex system of veins) gold. At 8.1 million ounces graded 16.1 grams per tonne, Pretium had some of the richest ore in the world. After a feasibility study in 2013 and permits and financing in 2015, mine construction started in 2016, with the first gold pour last July.

Also critical to the revival of the Triangle was Seabridge’s KSM project. Considered the largest gold project in the world, with reserves of 38.8 million ounces of gold, 10.2 billion pounds of copper and 183 million ounces of silver, KSM was green-lighted by the Canadian federal government in 2014. The discovery of the Deep Kerr and Iron Cap Zones are expected to increase the resource estimate; mining would be done via the underground block cave method.

Then there’s Red Chris. Run by Imperial Metals, this $700 million gold and copper mine entered production in 2015 and is expected to go until 2043. In 2017 Red Chris produced 74.6 million pounds of copper, 33,416 oz gold and 133,157 oz silver.

2. New infrastructure

New road and power infrastructure built by the BC government includes the paving of the Stewart-Cassiar Highway north from Smithers; port facilities for export of concentrate opened at the town of Stewart; and most importantly, a $700 million high voltage transmission line to bring power to mining properties previously unaccessible to the grid and reliant on diesel-powered portable generators.

3. Declining snow cover

The retreat of glaciers in the upper elevations of the Golden Triangle have revealed rocks never before seen – fuelling the curiosity of exploration geologists. In 2015 British Columbia experienced one of the most dramatic melts of glacial cover, with up to 10 centimeters of ice lost per day in summer that is not being replaced during the winter. Glacier researchers predict much of Western Canada’s 25,000 square kilometers of ice fields won’t last the century. The photo below compares the Bear Glacier northeast of Stewart in 1978 and 2013.

4. New geological theory

While the geology of the Golden Triangle has been well known for decades, it took a new twist to get geologists back into the field. Jeff Kyba, a former geo with the BC government, theorized that geologic contact between Triassic age Stuhini rocks and Jurassic age Hazelton rocks is the key marker for copper-gold mineralization. That means most of the Golden Triangle’s deposits are found within 2 kilometers of this contact zone, which Kyba and his team dubbed “The Red Line”. His theory, published in a BC government paper, was significant because it was the first time anyone had tied the area’s discoveries together with a structural explanation.

Red Line in above picture is the Stuhini-Hazelton group stratigraphic contact

By: Lesley Stokes May 6, 2015 Northern Miner – Volume 101 Number 13 May 11 – 17, 2015 VANCOUVER — Geologists Jeff Kyba and Joanne Nelson from the B.C. Geological Survey may have unlocked the secret to world-class porphyry- and intrusion-related gold-copper deposits in northwestern B.C. They’ve discovered that most of the major deposits in the region occur within 2 km of a regional stratigraphic contact, and according to Kyba, there are lithological and structural clues to narrow that window even more. “The contact represents a period in earth’s history when a lot of deposits in B.C. were forming,” Kyba says during an interview with The Northern Miner. “But no one really knows what controlled their emplacement and where best to look. We’re trying to answer that question, and so far the results are exciting.” Northwest B.C. contains the remnants of a much larger, ancient volcanic arc — similar to the present-day Philippines — called the Stikine terrane. Between 220 and 175 million years ago, subduction and volcanism along the arc promoted the emplacement of worldclass deposits such as KSM, Brucejack, Eskay Creek, Schaft Creek and Red Chris — to name a few. But during the Cretaceous period, starting 144 million years ago, the metal-rich arc was compressed to nearly half its length as the margin of western North America collided with other terranes. The deformation was so intense that it obliterated most structural clues related to the main mineralizing event, making it difficult for explorers to locate the deposits. “The rocks here are much older than those in the Philippines or Indonesia, so they’ve been banged up quite a bit,” he says. “But just because the geology is more complex, doesn’t mean the deposits aren’t there.”

“Over the past five years, the northwest Stikine has built its momentum towards becoming the world’s next big mineral province,” he says. “People are recognizing that these deposits have high-grade roots and big extensions they never thought were there.” Kyba and Nelson started their investigations at the KSM and Brucejack copper-gold camp, where Pretium geologists were finding evidence for an old tectonic event that influenced mineralization. What they found was a unique package of basal conglomerates and turbidites along the Stuhini-Hazelton group stratigraphic contact. “To a geologist, these rocks indicate a hiatus in ancient volcanism and an increase in earthquake activity,” he explains. “The land was uplifted along faults, and near its edges, the rocks were eroded and deposited into the basin below.” Kyba believes this tectonism provided the framework for metal-rich fluids and intrusions to migrate along when volcanism resumed during Hazelton time…Kyba mentions he has an “open-door” policy on the data he uses, and offers explorers a geological map that highlights the prospective contact as a thick, red line.“If you’re near that red line, and there’s a clastic sequence coupled with large-scale faults, then you might be in the neighbourhood of B.C.’s next big deposit,” he says. “And knowing that is a big game changer for explorers in the region, because it’ll get them closer to making a discovery.”

5. Higher gold price

As mentioned low gold prices shut down several operating mines in the Golden Triangle during the 1990s and early 2000s, and also squelched exploration. Since then a tripling of gold prices has injected gold fever back into the area, and combined with a new geological theory and the above factors, breathed new life into the possibility of discoverers hitting the next Valley of the Kings or KSM.

2017 successes

Along with the opening of the Brucejack mine, the Golden Triangle saw a few notable success stories in 2017. The most obvious was Garibaldi Resources (TSXV:GGI). In 2016 Garibaldi’s summer exploration program confirmed E&L to be the first magmatic nickel-copper-rich massive sulfide system in the Eskay mining camp. In the summer of 2017 Garibaldi intersected two long intervals of nickel-copper sulfide mineralization in its first hole, impressing investors who saw the prospect of a major base metal mine. The stock rocketed from $0.15 in July 2017 to $2.00 in October. But the run didn’t stop there. By the end of October the shares had risen to $4, briefly hitting a high of $5.27. The same month Garibaldi did a $2.5-million private placement with Eric Sprott, who bought 2.87 million shares in equal amounts at $0.82 and $0.92 – giving Sprott, a resource investing billionaire, 10% of the company.

Garibaldi Resources now trades at $2.88, which is great for a junior still in the discovery phase, but there are far cheaper companies out there with lots of upside potential.

Other notable junior hits in the Triangle in 2017:

- Colorado Resources (TSXV:CXO) assayed 4,770 grams per tonne gold over half a meter at its KSP project.

- GT Gold (TSXV:GTT) made a gold-silver discovery at its Saddle prospect: a high-grade epithermal gold-silver vein system; and a copper-gold-silver mineralized porphyritic intrusive it believes to be “the engine” for the system. Intercepts in multiple holes included 13.03 g/t Au over 10.67m.

What makes an area play?

Area plays, where one company makes a discovery then dozens of other companies rush in to stake all around them, are one of the very foundations of our junior markets. Some noteworthy Canadian area plays are Hemlo in 1982, Eskay Creek in 1990, the Lac de Gras diamond area play in 1992, Voisey’s Bay (nickel-copper) in 1995 and the Yukon’s White Gold rush in 2010.

All the elements needed to kick off a new area play are in the Golden Triangle are here right now:

- Spectacular new discoveries (and follow up discoveries by others) that are world class in grade and size.

- A discovery with a new geological twist or surprise.

- A jurisdiction with safe and reasonable tenure that’s amenable to mineral exploration and development.

John Kaiser of Kaiser Research puts some more meat on the bones of these three criteria by noting that area plays often get fuelled during bear markets, when a new discovery awakes investors from their slumber and gets some excitement going again. In the case of the Triangle, the commissioning of Red Chris, the first new BC mine in decades, took place during the gold price doldrums in 2014; when Brucejack started in 2017, gold was around $1200. But if the Valley of the Kings is considered to be the “new discovery” that kicked off the area play, then the development of the mine for sure mostly happened during the bear market of 2012 to 2016, when gold started to turn upward. Juniors began moving into the area in 2016, after the price hit a five-year low of $1050 and all indications were that the Valley of the Kings would indeed become a mine.

Kaiser notes that area plays do well in a bear market because they rekindle faith in the “rags to riches story”. “Anybody with a land position in the relevant region can and, in the eyes of speculators, will duplicate the flagship discovery. It is this sense of equal opportunity that coaxes money into the market,” writes Kaiser. We can see this in the two positions renowned investor Eric Sprott took in two relatively unknown juniors last year. Without his help, it’s unlikely they would have had such impressive runs.

How does an area play take shape? The first stage is a staking rush, as companies, many of them complete unknowns, gather what they deem to be geologically prospective ground. This could be the company with the initial discovery expanding its land position, as Dia Met did at Lac de Gras, and Robert Friedland’s Diamond Fields did at Voisey’s Bay. As soon as the discovery is announced, outsiders start piling in, either expanding existing land positions or taking new ones, always within close proximity to the discovery.

In the second wave, companies who have figured out the broader implications of the discovery expand their positions further.

Kaiser notes that area play typically last two to three years before running out of steam. He says the market is usually cautious about area plays in their first year (the size and economics of the discovery are still uncertain, and investors are skeptical of the “me too” companies). The time to make money is in the second year, according to Kaiser, when the discovery junior will get financing, conduct a major exploration campaign, and those juniors who identify drill-ready targets manage to attract speculators.

“From the perspective of a speculator this is the most lucrative phase because the identities of all the participants and their projects are known, prices have usually fallen after the initial staking frenzy, and it is fairly easy to plot the exploration story lines,” writes Kaiser, adding that an element of drama always helps an area play along.

“For an area play to evolve into a Great Canadian Area Play, the scale of the discovery must boggle the minds of speculators and silence the professional cynics.”

The ones to watch

Given that Pretium has started mining and Garibaldi Resources has had its run, I would argue that the Golden Triangle has entered a new phase. At this point, investors are aware of the play, but they are eager for another discovery like Garibaldi’s to keep driving interest forward into the summer drilling season. Who could that discovery hole come from? Here are a few possibilities.

Skeena Resources

Skeena Resources (TSX.V:SKE) is developing the past-producing Snip and Eskay Creek mines, both acquired from Barrick Gold. (Barrick optioned Eskay Creek in December, under an agreement for Skeena to spend $3.5 million before 2020) Results from the 2017 drill program were announced on Dec. 12. Highlights from the 72-hole, 9,000-meter program included 341 g/t Au over 1.5 meters. The company is moving toward a maiden resource at Snip. In April an underground drill program there commenced. This week Skeena announced it is selling its Porter Idaho silver property to concentrate on Snip and Eskay Creek.

Aben Resources

When Aben Resources (TSX.V:ABN, ABNAF:OTC) acquired the Forrest Kerr set of properties they came with a significant amount of exploration – 120 holes and about 20,000 soil samples. The most promising intersection was in the Boundary Zone hole which returned 33.4 g/t gold over 11 meters including 326 g/t gold over 0.45 meters. A nine-hole drill campaign that started last summer showed continuous mineralization in the first three holes of the North Boundary Zone.

Highlights included 21.5 g/ t gold, 28.5 g/t silver and 3.1% copper over 6 meters; 2.91 g/t gold, 5.2 g/t silver and 0.6% copper over 14 meters. The North Boundary Zone mineralization remains open in multiple directions with numerous soil geochemical anomalies and geophysical targets yet to be drill-tested. Aben anticipates doubling the 2017 drill program at Forrest Kerr this year, as the company chases more high-grade mineralization found in the new North Boundary zone in a southerly direction up to possibly 12 kilometers.

The dotted red line in the above picture shows Kyba and Nelson’s Red Line, theStuhini-Hazelton group stratigraphic contact as it relates to Aben’s Forest Kerr project.

Jim Pettit CEO and President of Aben talks 2018 plans for Golden Triangle

IDM Mining

In 2014 Seabridge Gold optioned its Red Mountain project to IDM Mining (TSX.V:IDM) in exchange for a series of cash and share payments and $7.5 million in exploration expenses, plus 10% of annual production. Last year the company completed a feasibility study and the proposed mine is currently under review for environmental assessment; it expects a decision by the third quarter. Glacial retreat uncovered a new discovery in 2016 called Lost Valley, comprised of high-grade veins. Mineral reserves as of June 2017 stand at 473,000 ounces graded 7.53 g/t Au, and 1.373 million ounces of silver graded 21.86 g/t Ag. IDM is currently doing engineering and metallurgical test work.

Dolly Varden Silver

The Dolly Varden project is the site of four historically active mines that produced 20 million silver ounces. Four new targets are mentioned in Dolly Varden Silver’s (TSX.V:DV) 2017 exploration recap: Torbrit North, Torbrit East, Moose-Lamb and Beginner’s Luck, all of which have drill results. Drilling last year was also done on the Dolly Varden and Torbrit deposits, both of which have past-producing mines. A 2015 technical report shows an NI 43-101-compliant total resource for the Dolly Varden project of 31.7 million ounces of silver and 10.7 million ounces inferred. The 2018 drill program of 25,000 meters will include 60 to 75 holes and will focus on three of the new targets and areas around the Dolly Varden and Torbrit deposits.

GT Gold

As mentioned GT Gold (TSX.V:GIT) made a gold-silver discovery at its Saddle prospect last summer. The discovery was on its flagship Tattoga property. Final assays from the 2017 drill season were posted on Jan. 15. The highlights from six core holes were 23.78 g/t Au and 65.87 g/t Ag over 4.02 meters from 150.23 meters, and 31.79 g/t Au and 1,141.10 g/t Ag over 3.01 meters from 41.17 meters. GT Gold’s 18,000-meter drill program will focus on expanding the 2017 gold-silver and copper-gold-silver discoveries at Saddle.

Jaxon Mining

Jaxon Mining (TSX.V:JAX) is advancing its Hazelton and More Creek projects (consolidating the Wishbone and Foremore properties) in the Golden Triangle. At Hazelton, soil anomalies and surface showings up to 3,397 g/t Ag, 12.7 g/t Au, and 22.29% Zn have been found on this advanced exploration project. In 1987 Cominco staked parts of the Foremore property after the discovery of a 162 g/t Au quartz boulder and several massive sulphide boulder fields. Millions were spent by Cominco and Roca Minerals, which completed an NI 43-101 report. This report detailed an outcropping of vein gold from the southern end of the Wishbone property containing 3,240.9 g/t Au and 82,514 g/t Ag. Historical exploration at Wishbone saw channel samples in a single vein averaging 7.8 g/t Au over an average vein width of 2.4 meters and a strike length of 78 meters. Assays up to 6.7 kg/t Ag and 8.2% Cu were found in mineralized boulders and outcrops consisting of disseminated massive sulfides in quartz carbonate vein material. 2018 exploration plans for Hazelton and More Creek include:

- Extension drilling at Max target on high-grade silver and zinc

- Detailed mapping/sampling at new porphyry discovery at Hazelton

- Ground geophysics on five targets at More Creek

Surge Copper

Surge Copper’s (TSX.V:SURG) Ootsa property is an advanced stage copper-gold exploration project containing the East Seel, West Seel and Ox porphyry deposits. It is located adjacent to the Huckleberry open-pit copper mine operated by Imperial Metals. Surge Copper completed a PEA in 2016 showing the potential for a 12-year mine that would produce 324 million pounds of copper, 185,000 ounces of gold, 15.8 million pounds molybdenum and 3 million ounces of silver.

A resource estimate done the same year shows 1.1 billion pounds of copper and over a million ounces of gold, in the measured and indicated categories.

Exploration drilling in 2018 will focus on several copper-gold porphyry targets surrounding the East and West Seel deposits. The goal is “to create increased flexibility in future project development and help establish the viability of Ootsa as a stand-alone operation,” the company states.

Conclusion

As spring weather continues to warm the Golden Triangle region of northwest BC, breakup and continued glacial retreat will likely reveal some interesting surprises for junior companies gearing up to explore new and existing targets. Over the past couple of years we have seen the Golden Triangle emerge as an area play as the initial playmakers, Pretium Mining and last year, Garibaldi Resources, showed results that impressed investors and poured much-needed money back into the junior exploration space. At Ahead of the Herd we expect last year’s momentum in the Triangle to continue as the drills start turning in the next couple of months. I’ve got British Columbia’s Golden Triangle area play, what is going to be Canada’s hottest play, and it’s soon to be red lined juniors, what with their pedal to the metal exploration and development plans, on my radar screen. Do you?

As spring weather continues to warm the Golden Triangle region of northwest BC, breakup and continued glacial retreat will likely reveal some interesting surprises for junior companies gearing up to explore new and existing targets. Over the past couple of years we have seen the Golden Triangle emerge as an area play as the initial playmakers, Pretium Mining and last year, Garibaldi Resources, showed results that impressed investors and poured much-needed money back into the junior exploration space. At Ahead of the Herd we expect last year’s momentum in the Triangle to continue as the drills start turning in the next couple of months. I’ve got British Columbia’s Golden Triangle area play, what is going to be Canada’s hottest play, and it’s soon to be red lined juniors, what with their pedal to the metal exploration and development plans, on my radar screen. Do you?

If not, perhaps you should.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Aben Resources (Aben Resources Ltd. (ABN:TSX.V, ABNAF:OTC). Richard might purchase shares in other companies mentioned in this report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.