Golden Goose to acquire Gran Esperanza Project in Argentina – Richard Mills

2026.01.31

Golden Goose Resources (CSE:GGR) is adding to its land package in Argentina by signing a deal to acquire the Gran Esperanza Project.

The company has entered into a Definitive Agreement with Valcheta Exploraciones S.A.S. to acquire up to a 100% interest in the epithermal gold-silver property located in Rio Negro Province, Argentina.

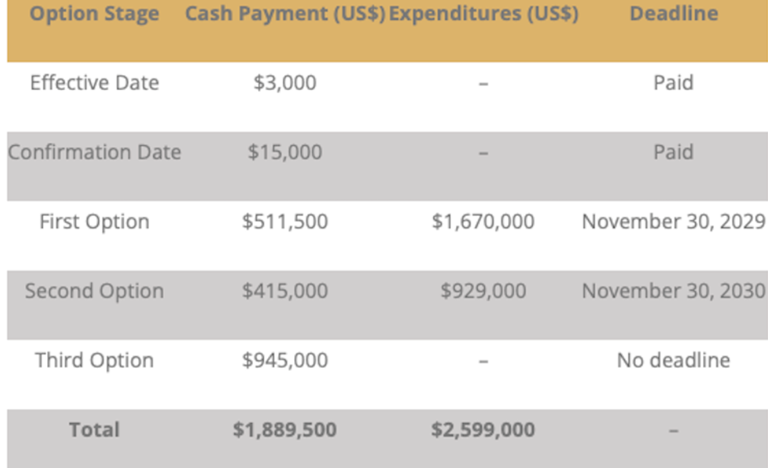

Under the option agreement, Golden Goose would acquire 100% of Gran Esperanza through a series of cash payments and exploration expenditures totaling USD$4.448 million.

The project is subject to a 1% net smelter return royalty, of which Golden Goose has the right to purchase 0.5% for $1 million.

“Signing the Definitive Agreement for Gran Esperanza represents an important milestone and transformative step for Golden Goose,” said CEO Dustin Nanos in the Jan. 29 news release. “The Project stands out due to its favorable structural and geological setting, confirmation of numerous surface-exposed vein networks, excellent historical reported grades, and outstanding site access. During a site visit in December, our team visited confirmed gold-mineralized veins on the property. Despite being preliminary, these results and observed vein density are very encouraging. The information collected to date positions Gran Esperanza as a compelling, drill-ready exploration project with the potential to rapidly deliver high-impact results. We look forward to advancing the project through systematic surface exploration programs on the property.”

Site visit

Before executing the Definitive Agreement, Golden Goose completed a comprehensive technical and legal due diligence process, including a detailed review of historical data, surface geology, sampling records, land tenure, permitting status, and third-party technical reports.

During a site visit in December, the company collected four rock-chip samples from exposed veins. Three chip samples returned gold values above 2 g/t Au, including one sample grading 14.34 g/t Au, providing confirmation of the high-grade potential in the mineralized system.

Project highlights

Among the project highlights are about 44,400 hectares of year-round accessible terrain in the Los Menucos District, North Patagonian Massif, a region known for its high-grade precious metal potential.

The property is surrounded by major operators including Southern Copper (NYSE:SCCO), and located near Patagonia Gold’s (TSXV:PGDC) Calcatreu Project currently under development.

There are 10 km of historically mapped, low-sulfidation epithermal gold vein exposures, with veins widths averaging about 1.5 meters, and strike lengths ranging from 50 to 2,500m.

Thirty trenches have been excavated exposing 2,937m of epithermal veins; 690 channel samples were collected, with reported grades up to 2m at 24 g/t Au, demonstrating high-grade potential from surface.

In total there are 1,674 rock samples, including grab, chip, channels and float. The veins are characterized by drusy quartz, banding, crustiform and carbonate replacement. The rock chip samples feature grades up to 24.4 g/t Au.

Gran Esperanza contains several drill-ready targets in what Golden Goose says is an extremely attractive precious metal district.

The project also benefits from excellent infrastructure – situated approximately 2 kilometers from a paved highway, with gentle topography and numerous secondary roads across the property.

Other properties

In addition to Gran Esperanza, Golden Goose continues to work its optioned La Esperanza property in Argentina, which features 10 kilometers of surface gold veins in Rio Negro Province, which recently approved its first gold mine.

Golden Goose has also successfully acquired one of the best strategic land positions in Quebec.

Golden Goose has the right to acquire 100% of the Goldfire property, a large property in the Urban Barry Greenstone Belt within the world-class Abitibi Greenstone Belt.

To the east of Goldfire is the 4.1-million-ounce Windfall mine owned by Gold Fields (NYSE:GFI). To the west of its claims is a 510,000-ounce gold resource also owned by Gold Fields.

According to the company, the geology is the same as what’s at Windfall.

Under the Spotlight – Dustin Nanos, CEO, Golden Goose Resources

Golden Goose Resources is building value — Richard Mills

Golden Goose Resources

CSE:GGR

2026.01.30 Share Price: Cdn$0.26

Shares Outstanding: 50.7m

Market Cap: Cdn$16.4m

GGR website

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.