Golden consequences

2019.08.05

The long-anticipated US Federal Reserve decision last Wednesday to notch interest rates downward was, like most of these over-hyped meetings, anti-climactic.

Since the central bank in June hinted that a rate cut was in the offing, North American stock markets have trended up, but they took a hit on Wednesday following the Fed’s decision to only lower rates by a quarter-percentage point.

The market was clearly wanting the Fed to go further in the direction of monetary easing, hoping that weak global growth and the ongoing trade war with China would prompt the bank to announce several cuts right through to the end of 2020.

Instead, Fed Chair Jerome Powell indicated the cut was a one-off, referring to the first lowering of the federal funds rate in 10 years as a “mid-cycle adjustment”.

In US trading the S&P 500, the Dow and the Nasdaq all finished lower on Wednesday, while in Canada, eight of the 11 major sectors of the TSX were down, led by materials which shed 2.6%.

Gold and copper futures both slipped, by a respective $4.00 an ounce and 1.25 cents a pound, to end the day at $1,437.80/oz and $2.67/lb.

The precious metal appeared to experiencing another bad day when trading began on Thursday, but a surprise decision (is there any other kind?) by US President Trump had bullion erasing earlier losses and heading north by day’s end.

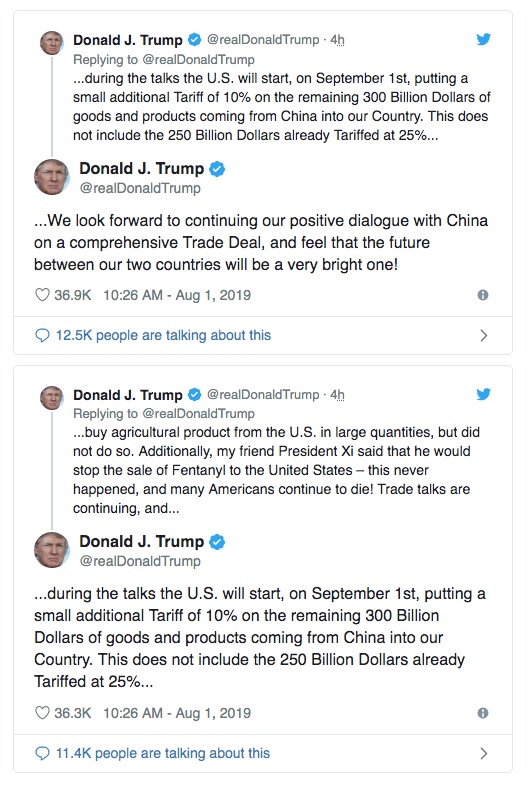

Trump tweeted that come September, his government will slap a 10% tariff on the remaining $300 billion of Chinese goods not yet subject to US duties. That’s on top of the $250 billion of products from China already subject to a 25% tariff.

Spot gold was well into negative territory, sinking as low as $1,400 in early trading, before veering up sharply on Trump’s tweets; it finished the day at $1,437.90 in New York, a $24.50 gain on Wednesday’s close.

The gold party continued on Friday, with December futures raging to a six-year high of $1,457.50.

It doesn’t shock us that the Federal Reserve would disappoint the market and pump the brakes on what has been an exciting summer gold run. As the institution that sets interest rates and controls the money supply, the Fed is supposed to be independent of policymakers, despite Trump’s entreaties to influence the decisions of its board of governors. Powell took the opportunity to make that point at the Fed’s July 31 meeting.

Stock markets didn’t like the Fed’s decision, nor did gold traders. But the worst effect was in the bond markets. The yield on the benchmark 10-year U.S Treasury note dropped to its lowest since Trump was elected in November 2016 – 1.89%.

Besides the rate “nick” (versus a cut), the other negative event for gold came via the World Gold Council. In its second-quarter report, London-based WGC said Aug. 1 that while central bank gold buying hit a 19-year record high in the first half, including 224 tonnes purchased in the second quarter, most of the buying was by emerging-market central banks.

Developed-country central banks didn’t appear in the gold buying picture at all, in fact European central banks scrapped a 20-year-old agreement that limits their gold sales – opening the door to offloading bullion en masse – although the European Central Bank says there are no plans to sell large amounts of it.

A deeper analysis of the Q2 report shows an interesting trend in the gold market right now, as two camps with different goals face one another: developed-country central banks, versus developing, or emerging-market banks.

In this article we’ll discuss the two CB gold camps, more neatly termed gold buyers vs gold holders.

We’ll also point out that the timing of Trump’s decision to levy around round of tariffs on the day after the Fed rate cut is no coincidence…

Central bank gold buying

Central banks see Treasury yields slumping and real yields low or negative, so they are backing up the truck for gold. They don’t see this changing anytime soon.

According to the World Council, central banks are continuing a buying spree that started in 2018, when a total of 651 tonnes of gold was accumulated, 74% more than 2017 and the highest amount since the end of the gold standard in 1971.

So far in 2019, central banks have squirreled away 374.1t in bank vaults, the biggest half-year increase since WGC started keeping records, 19 years ago.

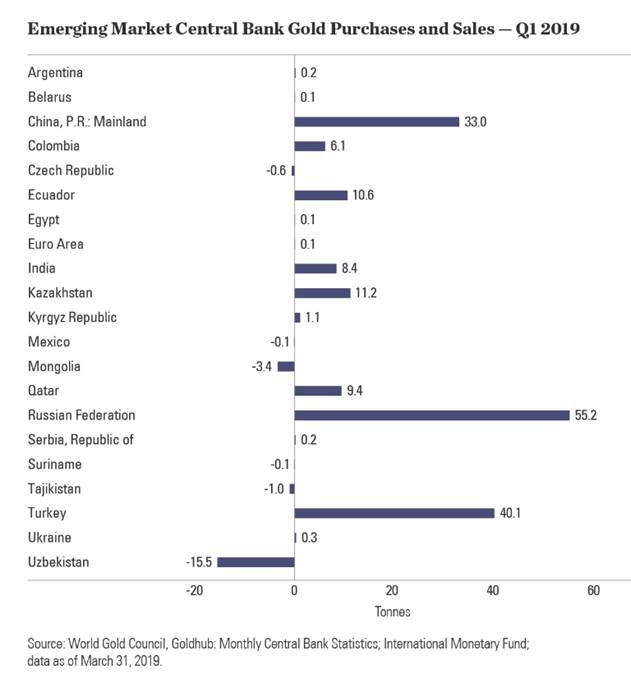

Poland was the largest Q2 buyer, boosting its reserves of the shiny metal by 100 tonnes, the most any central bank has bought in one quarter since India’s 200t purchase from the IMF in 2009. Second-place Russia increased its gold pile by 38.7t. On a half-year basis China, always among the top buyers, came in at 74 tonnes, followed by Turkey, which increased its haul by 60.6t. Kazakhstan bought 24.9 more tonnes over the half, while India, Ecuador, Colombia and the Kyrgyz Republic each added more than one tonne.

Another notable stat: buying over the first half far out-paced selling, with gross sales amounting to just 7.2t, or 2% of gross purchases. Only four central banks sold more than a tonne of their gold – Uzbekistan, Germany, Tajikistan and Mongolia.

Total gold demand in H1 jumped to a three-year high of 2,181.7t, largely due to the record-breaking central bank purchases. The first half featured a June gold rally, when the precious metal burst through the $1,400/oz mark for the first time since 2013, mostly on the anticipation of lower interest rates.

Buyers and holders

Appearing less prominent in the report but importantly, in our opinion, is this statement: In a continuation of recent trends, buying was spread across a diverse range of – largely emerging market – countries.

As proof, consider that in the first quarter, emerging-market central banks represented about 93% of the 145.5 tonnes purchased. While the World Gold Council is correct, in that the total was spread among 20 countries, three stand out – Russia, China and Turkey – as the top buyers.

Emerging-market gold buying is very different from gold being purchased by developed-country central banks and bears further investigation.

Emerging-market buyers

SPDR Blog takes the idea and runs with it, creating a conceptual model via which we can further break down central bank gold buying in 2019:

The first camp is the economic titans of North America and Western Europe that were financial powerhouses during the heyday of the gold standard from 1870–1970. Historically, these countries accumulated gold to back their currencies. But despite that no longer being the case, these developed countries continue to hold large volumes of gold, which collectively amounts to 70% of today’s reserves. Interestingly, data confirms that they have all but stopped any sales (except for coinage purposes), following a period of net selling during the 1990s and early 2000s. This highlights the relevance that gold has played in managing their monetary policy, despite their currencies not being backed by gold any longer.

The second camp is the rest of the world, primarily emerging markets—some large, like Russia or China, and others far smaller, like Colombia or Thailand. These smaller and developing nations have historically lacked the financial strength to accumulate large gold reserves, and by the time they started to develop further, the US dollar had established itself as the global reserve currency. As a consequence, these countries do not have large legacy gold reserves – notably under 1-2% – with many holding a high percentage of US dollar-backed securities, like US Treasuries, which are backed by the full faith and credit of the US government.

Recall from the World Gold Council report, emerging-market countries represented 93% of the 145.5 tonnes of gold purchased in the first quarter of 2019.

In the second quarter, there was more emerging market buying, mostly by Poland, Russia, China and Turkey.

The latest WGC numbers show that the top gold buyers in the second quarter were all emerging-market economies: Poland, Russia, China, Turkey, Kazakhstan and the Kyrgyz Republic.

Russia has been trying every means available to diversify away from the US dollar – such as selling US Treasuries and signing energy deals with China whereby the transactions are in yuan or rubles, not USD.

China has increased its monthly gold purchases by nearly 50%, to 15 tonnes a month, according to Kitco; its Belt and Road Initiative envisions wide-spread use of the yuan, in cross-border trade transactions.

Russia is actively seeking to reduce its dependence on the greenback in an effort to skirt US sanctions for interfering in the US 2016 election and invading Crimea. The Kremlin stopped buying foreign currency in September 2018 to prevent the ruble from crashing due to sanctions. Instead the Russian Central Bank turned to gold, buying a record 274.3 tonnes in 2018, while selling a whack of US Treasuries – halving the US dollar’s share of Russia’s foreign reserves from 43.7% to 20%. Last year Russia sold off 84% of its US debt holdings, leaving just $14.9 billion in its US reserve account.

Turkey needs gold to protect itself against a sluggish economy. Gold-buying is one way to support the lira versus purchasing US Treasuries, which are expensive. A couple of years ago Turkey’s President Erdogan called on citizens to buy gold, and they have: “Those who keep dollar or Euro currency under their mattresses should come and turn them into Liras or gold.”

There are 3 reasons emerging markets Central Banks would favor buying gold over U.S. Treasuries:

- U.S. dollar weakness

- Downward revisions to global growth forecasts

- Central banks increasing dovishness is creating demand for risk-averse asset classes

Developed-country holders

Nobody is selling much gold. As mentioned, in Q2 only four central banks sold more than a tonne of bullion. Twenty-two European central banks that are signatories to the Central Bank Gold Agreement – including Germany, France and Italy, three of the world’s largest gold holders – have only sold between 3.01 and 4.20 tonnes in the last five years of the agreement.

In place since 1999, the Central Bank Gold Agreement put a cap on annual gold sales by the member nations. It was very recently scrapped – freeing up the signatories to sell as much gold as they like.

We know that developed-country banks have refrained from bold gold buying or selling, as when UK Chancellor Gordon Brown sold half of Britain’s gold reserves between 1999 and 2002, the bottom of the gold market – considered one of the worst financial decisions of all time.

Their stasis is understandable. The Trump administration’s low-dollar policy has put these central banks in a very tough spot. To understand why, read about The Triffin Dilemma

1 + 1 = 2

We know that U.S. President Trump wants a massively lower dollar and will do anything to get it. Why? Trump thinks a low dollar is the way to bring jobs back to the US after so many were exported abroad to take advantage of lower labor costs. He wants to rebuild the US manufacturing sector, primarily through cheaper exports. He’s particularly targeted China for competitively devaluing its currency to dump cheap exports into the US, such as steel and aluminum. All Chinese imports into the US are now subject to tariffs of between 10 and 25%.

The problem for the United States is that throughout the past several years, the dollar has remained high in relation to other currencies, and that has created a large trade deficit – $825 billion for 2018.

Was it a coincidence that Trump ordered 10% tariffs on $300 billion worth of Chinese imports, the day after the US Federal Reserve didn’t give him what he wanted, a 50-point rate cut? We think not!

The unconventional president has shown that he’s not above attacking Fed President Jerome Powell, for being too quick to raise interest rates. Now it appears that Trump has used the Fed’s rationale for cutting interest rates a quarter-point, to escalate the trade war with China.

Usually the central bank’s board of governor’s makes its interest rate decisions based on how the labor market is doing. After Wednesday’s meeting, however, Powell said the rate was lowered due to “the implications of global developments for the economic outlook.” Pressed further, Powell said he was talking about the trade war with China and the risk of the conflict worsening.

This was despite trade talks appearing to be back on track. After the recent G20 meeting, Trump reportedly backed down on imposing 25% tariffs on China, because he was worried about their effects on the US economy, which he needs to be strong in the run-up to the 2020 election.

Then came the Fed’s quarter-point cut, which we stated at the top, went over like a lead balloon with the markets. Trump’s attempt to influence the Fed to cut rates more than a quarter-point had failed. Could Trump have latched onto Powell’s words, in inventing a reason for the Fed to cut more?

We think so, and so does veteran Bloomberg markets reporter John Authers, writing in an op-ed:

When the Fed’s reaction function is led by measures of inflation and employment, neither of which the president can control (even if policies can affect them), then there is little Trump can do to force the central bank’s hand. But when the Fed is driven by “global developments” over trade, then he can very directly engineer a cut in rates by threatening new tariffs on key trading partners…

My best guess to explain the sudden escalation from Trump is that he was presented with a new and very appealing reason to raise tariffs – that this was the way he could force the Fed to cut rates. Now we will find out the consequences.

Well, the consequences of more Trump tariffs weren’t long in coming.

On Monday China, for the first time in more then a decade, decided to set the yuan’s value below the key level of seven to the U.S. dollar.

China also ordered its state-owned firms to stop importing U.S. Agricultural products.

|

|

|

Us Ten Year Treasury Yield 1.82%

President Trump has found his way to lower the dollar and fix the trade deficit.

Trump will force the Fed to keep cutting rates all the way up to the election in the fall of 2020, using trade wars ie. China and the EU, as the reason to do it.

At Ahead of the Herd we think real interest rates will fall deep into negative territory, the U.S. dollar falls off it’s podium of exorbitant privilege and stock market participants suffer horrendous losses.

Got precious metals, and some quality junior resource stocks, on your radar screen?

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.