Gold Upleg Still Running

By Adam Hamilton

Gold has carved an impressive upleg over this past half-year, powering dramatically higher. But in April that mostly stalled out, leaving the yellow metal drifting sideways. That high consolidation has frustrated plenty of traders, leaving them worried this upleg is failing. But odds are gold is simply regrouping ahead of its next surge to new heights. The majority of major gold uplegs’ typical buying firepower has yet to be spent.

Even if this upleg did give up its ghost here, gold could walk off the field proud. From late September to mid-April, gold blasted up 25.7% in just 6.5 months! This upleg is already gold’s biggest since mid-2020, besting 13.5% and 18.9% ones in 2021 and 2022. Both of those were artificially truncated by extreme Fed hawkishness, which unleashed massive gold-futures selling. 2023’s specimen has easily surpassed those.

Yet gold uplegs can grow much bigger still. In 2020, gold enjoyed two separate monster uplegs peaking at mighty 42.7% and 40.0% gains! Today’s definitely has the potential to give those a run for their money. To achieve that rarefied 40%+ status again, this upleg would have to ultimately drive gold up near $2,275. And based on historical precedent, the yellow metal looks to have plenty of gas left in the tank to achieve that.

Major gold uplegs are fueled by three distinct telescoping stages of buying. The first two push gold prices high enough for long enough to ignite the larger subsequent stages. While today’s gold upleg has largely exhausted first-stage buying, plenty of second-stage buying remains. And the all-important huge third-stage capital inflows have barely even started. So this gold upleg is almost certainly still running, yet to climax.

Gold uplegs’ three stages are respectively fueled initially by speculators buying to cover gold-futures shorts, later these same traders buying gold-futures longs, and finally investors returning with their vast pools of capital. All these traders are chasing gold’s upside momentum, piling in at different times to ride these uplegs. Their buying accelerates gold’s rallying, attracting in more traders forming virtuous circles.

With investors still mostly missing in action, gold’s entire upleg to date has been fueled by big spec gold-futures buying. Due to the extreme leverage inherent in futures trading, these guys punch way above their weights in bullying around the gold price. This week each 100-ounce contract controls $198,870 worth of gold. But speculators are only required to keep $8,300 cash per contract in their accounts to trade!

That yields maximum leverage to gold of 24.0x, dwarfing the decades-old legal limit in the stock markets of 2x. At 24x, every dollar deployed in gold-futures has 24x the price impact on gold as a dollar invested outright! But this is exceedingly risky, as a mere 4.2% gold move against futures bets will wipe out 100% of capital risked. That forces gold-futures speculators to operate on myopic ultra-short-term timeframes.

These guys can’t afford to care where gold is going in coming months, they have to focus on mere hours or days on the outside. The gold-futures speculators are intensely fixated on one primary trading cue, the fortunes of the US dollar. Those in turn are incredibly sensitive to any economic data or news that could alter the Fed’s upcoming monetary-policy decisions. So gold’s trading action depends on those same dynamics.

Examples are legion. Back in early February gold plunged 2.4% in a day, entering a sharp pullback on a record-seasonal-adjustment-driven colossal upside surprise in monthly US jobs. That was seen as Fed-hawkish, arguing for more rate hikes. So the benchmark US Dollar Index soared 1.2% on that wild eight-standard-deviation beat, unleashing withering gold-futures selling. Fed-dovish data or news sparks the opposite.

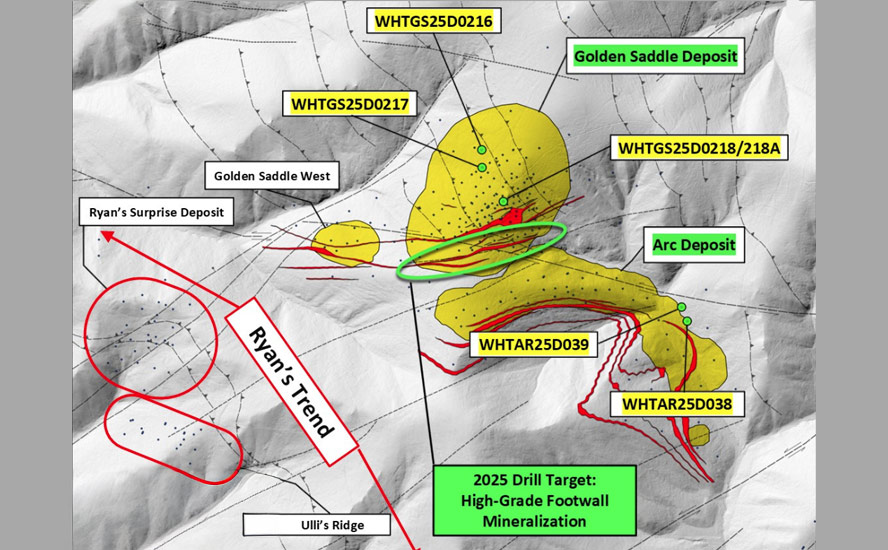

This chart superimposes gold and its key technicals over speculators’ total gold-futures long and short contracts disclosed in the weekly Commitments of Traders reports. Total spec buying and selling during gold uplegs and corrections is noted, revealing leveraged gold-futures trading continuing to dominate gold’s short-term price action. Gold’s upleg is still running because specs still have room to keep buying longs.

Last year gold was bludgeoned a brutal 20.9% lower in just 6.6 months on heavy gold-futures selling. The US dollar was shooting parabolic, skyrocketing to extreme multi-decade highs on the Fed’s most-extreme tightening cycle ever. It wasn’t just the headline-making monster rate hikes starting off zero, but the Fed also began selling bonds to shrink the bloated US money supply. All that proved extraordinarily hawkish.

The main reason gold technically plunged into bear territory was specs dumped 165.5k gold-futures long contracts while short selling another 66.0k. Together that colossal 231.5k contracts of selling added up to the equivalent of 720 metric tons of gold! That was way too much too fast for markets to digest without greatly distorting gold pricing. For comparison total global gold investment demand in all of 2022 ran 1,107t.

That anomalous pummeling left gold extremely oversold, literally trading at stock-panic-grade lows. At $1,623 in late September, gold hadn’t been lower since briefly in the dark heart of March 2020’s brutal pandemic-lockdown stock panic! But in an essay right before that, I showed why “that anomalous gold-futures selling has exhausted itself, reaching excessively-bearish levels that will fuel huge mean-reversion buying.”

That fantastic contrarian buying opportunity was revealed in real-time by specs’ gold-futures positioning. Their total longs collapsed to an extreme 3.4-year low of 247.5k contracts, while their total shorts soared to an even-more-extreme 3.8-year high of 185.3k! When speculators’ collective gold-futures bets get so darned lopsided they forge secular extremes, big reversals are imminent. Extremes are inherently unsustainable.

Since specs’ gold-futures trading dominates short-term gold price action, I analyze the latest CoT data in every issue of our subscription newsletters. In order to quickly provide perspective on this complex data, I recast total spec longs and shorts relative to their past-year trading ranges. In late September 2022, spec longs had collapsed to 0% up into their 52-week range while spec shorts soared 100% up into their own!

That 0% longs and 100% shorts is the most-bullish-possible near-term setup for gold. That implies both these hyper-leveraged traders’ probable long dumping and short selling have been exhausted. As their capital firepower is finite, that only leaves room to buy. And that always starts with short covering, that stage-one gold-upleg fuel. Short-covering buying is legally required to close out those downside bets.

But speculators short gold futures into major secular gold lows also want to cover to realize their fat profits. That buying quickly catapults gold sharply higher, becoming self-feeding. The more traders buy to cover, the faster gold surges. The sharper gold’s mean-reversion V-bounce rally, the more specs are forced to cover or face catastrophic losses. This normal stage-one dynamic played out perfectly early in this upleg.

Gold blasted higher in early October, then plunged back down to retest its recent deep lows on more Fed-hawkish data and news. That proved successful, so gold rocketed up again in early November. As I explained in an early-November essay just before gold’s decisive surge, the Fed’s ability to shock the US dollar and gold was ending. With “little room for more hawkish surprises” left, these competing currencies had to reverse.

Note in this chart that both these initial surges igniting today’s gold upleg were almost totally fueled by short-covering buying. The red spec-gold-futures-shorts line fell sharply both times, while the green longs line barely moved. Unlike short-side traders who have to buy to cover when gold rallies or risk ruin, long-side traders are in no hurry to buy. After they’ve sold they are out and safe, and only return at their leisure.

That stage-two spec long buying only ignites after stage-one short covering propels gold high enough for long enough to attract back those traders. That really started accelerating in January, as evident by the green total-spec-longs line surging driving gold sharply higher. That gold-futures long buying is way more important for gold uplegs than the preceding short covering, as spec longs really outnumber spec shorts.

That too is readily apparent in this chart, with the green line always being much higher than the red one. Over the past year into this week, total spec longs have outnumbered total spec shorts by an average of 2.2x across all 52 CoT weeks. That makes stage-two long buying proportionally 2.2x more important than stage-one short covering. Gold’s initial upleg surge proved powerful, soaring 20.2% into early February.

That formally returned gold into bull-market-dom, and that run was almost exclusively fueled by big gold-futures buying. Specs bought to cover 59.7k short contracts during that span, while adding another 45.3k longs. Together that added up to gold-equivalent buying of 327t, or about 4/9ths of the huge gold-futures selling in mid-2022’s anomalous plummeting. But this gold upleg was far from over even after that run.

Remember that expressed in terms of their past-year trading ranges, 0% longs and 100% shorts is the most-bullish near-term setup for gold. So the opposite 100% longs and 0% shorts is the most bearish, implying speculators have largely exhausted their likely gold-futures buying. At the end of January before gold plunged in February’s sharp pullback, spec longs and shorts were only 32% and 31% up into their ranges.

Thus nearly 1/3rd of this gold upleg’s probable stage-one short covering remained, along with fully 2/3rds of its much-larger stage-two long buying! So gold’s subsequent selloff driven by a confluence of several rare factors I explained at the time had to merely be a sharp-yet-healthy mid-upleg pullback. Gold plunged 7.2% over the next few weeks on 46.3k contracts of spec long selling and a modest 4.9k of new shorting.

That really battered herd sentiment, leaving traders increasingly bearish on gold. But that was a big mistake, as spec gold-futures selling was actually reloading their capital firepower for more strong buying. At worst in late February, total spec longs fell all the way back to 4% up into their past-year range for a near-total reset! A week later in early March, total spec shorts surged all the way to 52% up into their own range.

Indeed gold soon rocketed higher again as specs flooded back into gold futures, on Fed-dovish news including that major US bank failure in mid-March. If extreme Fed rate hikes were starting to incite bank runs, how could the Fed keep hiking? As gold’s newfound upside momentum fed on itself with buying begetting more buying, it surged another 12.6% in just 1.6 months into mid-April. Thank the gold-futures speculators.

During this latest sharp mean-reversion rebound, they added 55.1k long contracts while covering another 32.1k short ones. Stage-two long buying was increasingly taking the baton from stage-one short covering, just like normal. That added up to big gold-equivalent buying of 271t. Gold has mostly consolidated high since, grinding sideways to work off overboughtness and greed. But this upleg still has room to run.

As of the latest-reported CoT week when this essay was published, total spec shorts are only 4% up into their 52-week trading range. So likely stage-one short-covering buying is exhausted. But spec longs are still just 57% up into their own past-year range, implying fully 3/7ths of probable stage-two long buying is still coming! That remains quite bullish for gold despite its massive gains since late September’s deep low.

While I segmented gold’s current upleg in this chart to illustrate the driving gold-futures trading, it is really a single upleg with a sharp pullback. Gold’s total gains over 6.5 months into mid-April have ballooned to that impressive 25.7%. All together that was fueled by 86.9k contracts of short covering and 54.2k of long buying. That adds up to 141.4k or 439t in gold-equivalent terms, which is certainly big. But it’s likely not finished.

Again when gold plummeted 20.9% in the middle of last year on that parabolic US-dollar moonshot, specs dumped 231.5k contracts or 720t. So far roughly 6/10ths of that extreme selling has been unwound. That leaves fully 4/10ths to fuel the rest of this mean reversion! And it should grow even bigger than that since these often overshoot to opposite extremes before running their courses. So gold’s upleg is still running.

Perhaps most bullish of all, gold-futures buying only fuels the first two stages of major gold uplegs. Far-larger investment buying drives the third. And so far that has been virtually nonexistent! Gold apparently hasn’t yet rallied high enough for long enough to ignite stage three. The best high-resolution proxy for global gold investment demand is the combined bullion holdings of the mighty American GLD and IAU gold ETFs.

I last analyzed these in depth in a late-February essay on gold investors still missing in action if you need to get up to speed. But for now, it is stunning to realize that during gold’s 25.7% upleg so far GLD+IAU holdings actually slumped 3.6% or 51.1t! Even at best within that span, they only grew a trivial 3.1% or 41.1t from mid-March to mid-April! So for all intents and purposes, investment buying hasn’t even started yet.

Odds are that all-important stage-three buying is still coming, that investors will increasingly flock back and take the baton from the gold-futures guys before their buying capital firepower is spent. If investors indeed increasingly return after gold powers high enough for long enough to excite them into chasing its mounting gains, this mighty gold upleg is far from over. Up 26% without investors, 40% may be way too conservative!

The biggest beneficiaries of gold continuing to power higher on balance will be the gold miners’ stocks. Their leading GDX benchmark has already blasted up 63.9% at best paralleling gold’s upleg, amplifying its gains by 2.5x. And the smaller fundamentally-superior mid-tier and junior gold miners we have long specialized in at Zeal are faring much better. Our newsletter trading books are full of big unrealized gains.

We were aggressively buying when gold was bottoming from late September to early November, leaving our subscribers flush with soaring portfolios. Our trades during this gold-stock upleg are up as much as 111.1% this week! And as long as gold’s driving upleg keeps running higher on balance, the gold stocks will continue amplifying its gains. There’s no other sector with such big frequent swings to multiply traders’ wealth.

The bottom line is gold’s upleg is still running. Most of the normal buying capital firepower that drives major gold uplegs has yet to be spent. While the stage-one gold-futures short-covering buying is mostly exhausted, a large fraction of the probable bigger stage-two gold-futures long buying remains. And the ultimate stage-three investment buying dwarfing the first two stages has apparently barely even started yet!

So gold’s recent high consolidation should soon give way to more rallying, catapulting it to new all-time nominal record highs. Those along with strong upside momentum should really catch the attention of investors. If they increasingly return to chase gold’s gains, this upleg can still grow a heck of a lot bigger. The gold stocks will continue leveraging their metal’s advance, earning fortunes for smart contrarian traders.

Adam Hamilton, CPA

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.