“Gold, Geopolitics, Market Moves and Junior Resource Companies #2 — a Bob Moriarty Exclusive Interview

2025.04.13

Rick Mills, Editor and Publisher, Ahead of the Herd:

Hi Bob, good to be talking again so soon. First off I want to give us a pat on the back. We talked on the 8th, published on the 9th and it was the very next day that started to prove us right in so many of the different things we discussed.

First was China offloading its US dollar foreign reserves and there’s absolutely no doubt that’s happening, and there’s strong suspicions that they were probably responsible for “Blink Wednesday” aka “Donald Ducks” which was Trump and his 90 days of delaying the tariffs.

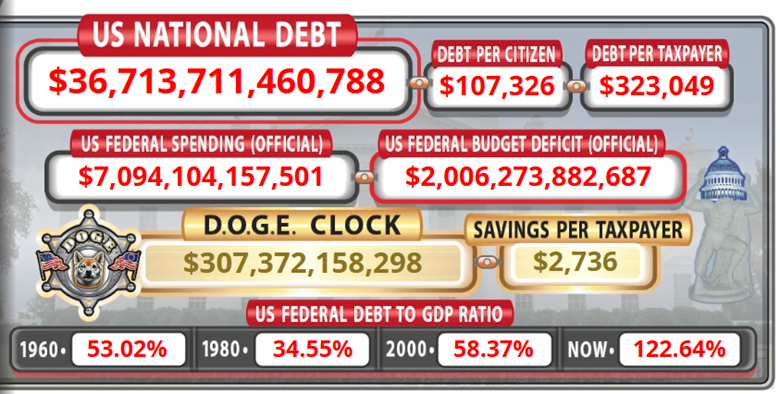

The bond market is an absolute mess, there’s people now talking about US treasuries and dollar no longer safe havens. The bonds have whipsawed investors, they’ve eroded appetite for US assets, there’s been whispers about blowups in hedge fund trades, an exodus of foreign investors and large organized bond vigilante actions.

We talked about rolling over $7T of US debt and we saw it is a potential disaster waiting to happen. With all the drama in the bond market it’s increasingly looking like we might be right on that.

And we were right on food inflation. There’s an extremely interesting report by Wolf Richter over on his WolfStreet.com; “worst food inflation since ’22, worst housing inflation in months, but plunging prices for lodging, rental cars and air fares are interesting and what happened was the consumer price index, the month to month inflation accelerated further for housing, food, medical care services and motor vehicle maintenance repair.

They’re showing the worst increases in months and in the case of food for years, but inflation went down because those price increases were overpowered by plunging gasoline prices and by plunging prices in the travel sector, I mean you’re looking at annualized year to year drops of 28% and 48%, and that’s what brought the inflation rate down.”

Now all the talking heads are saying Trump managed to get the inflation rate down but the picture Wolf painted in his reporting is a horrible picture of an economy in trouble. It is literally one of the worst pictures you could paint, and it’s all been covered up by the fact inflation went down, and it went down because nobody’s traveling, nobody’s buying gas, gas prices have plummeted, so you’ve really got something going on that that very few people are recognizing.

We also talked about the farmers and how hard they are going to get hit. The farmers in the US are planting their soy crop and believe me they’re worried because, as we said was going to happen, China came out yesterday and they made a massive early purchase of Brazilian soybeans. China is also making deals for more Spanish pork.

None of this bodes well for agricultural exports because soybeans are the biggest agricultural export from the US and China the largest buyer.

(U.S. top 3 exports in the agricultural sector: Soybeans: $27.37 billion. Corn: $18.72 billion. Beef: $10.58 billion. Largest 3 Importers of U.S. Agricultural Products China: $28,750,288,000. Canada: $25,414,534,000. Mexico: $18,962,080,000.).

And then the other thing that we did, when we talked about gold it took off again, made another all-time record, smashed through that, today it’s soaring again but one of the things that was impressive was our little “baby out with the bathwater” talk, and if you look at the charts of the stocks we talked about — Harvest Gold, Sitka, Silver47, Trifecta and Banyan, we pretty much nailed the bottom.

The volume was terrific, they’re all up nicely except for one. So Bob we deserve that pat on the back. If we’re not careful people might start to think that maybe two old guys might know a thing or two.

Bob Moriarty, Founder, 321gold:

Nah they’ll never go that far.

RM: You don’t think we’re in any danger of getting recognized as occasionally getting things right?

BM: We haven’t even started, okay. I went into the marine corps in 1964, got into flight training, got my wings, was in fighters. I went to Vietnam in 1968, and I looked around and I realized we were not paying for the war.

The war was expensive and the US government wasn’t paying for it, there was a 10% income tax surcharge and that was it. Now the interesting thing is gold was $35 an ounce, nobody was talking about the dollar declining and I looked around and said I’d kind of like to own some gold so literally, I got into gold in 1968 in a very small way but absolutely called it correctly.

Do you realize how much gold has gone up in the last three days?

RM: Gold’s gone up a few hundred bucks, look at how much the dollar’s gone down against other currencies so yeah gold has been performing spectacularly as it should when there’s so much chaos.

BM: Yeah, here’s the deal, it’s a giant warning, okay? Gold goes up more than $250 in three days and I think I made the comment that you don’t want to live in a world with $5,000 gold and everybody disagrees with me because they want gold to go up, but for gold to go up the world must blow up. One of the things we must cover, are you familiar with the basis trade in Treasuries?

RM: Please explain for some of our readers that might not know.

BM: Okay, hedge funds will trade in things that are not high gain but are exceptionally low risk, so they’ll trade 5-year or 10-year or 30-year against each other, or they’ll trade different months and that is a giant trade.

They borrow money in Japanese yen and then they invest in this low-risk hedge. Well the basis trade is blowing up and the Federal Reserve is going to have to step in, probably this weekend. The world’s financial system is literally on the point of exploding.

RM: Yes I agree, your overseas investors are pulling back from US assets, they’re going to Europe for stability. Compared to the US German yields are unchanged while the US 10-year debt surged more than 40 points, that’s probably the biggest underperformance of Treasuries compared to German bunds since ’89, I mean you just can’t have this stuff continuing and expect things to function, they’re going to start breaking down.

You said something in our last talk that the US was going to be in a war with Iran in in a matter of weeks. We see in the news this morning that Iran is setting conditions for the talk with the US, and it does seem on the surface like they are going to sit down and give the talks a good faith effort but I’m just not really feeling it from either side.

I’m going to do a little wargaming.

Let’s say that the talks between US and Iran break down and the US and Israel start bombing Iran’s nuclear facilities.

The Middle East is going to boil over big time, Iran’s proxies are going to get really fired up, Hezbollah still has well over 100,000 missiles. Houthis, being the kind of people with no quit and zero back up, are going fire everything they’ve got at the US navy.

We’ll see a reconstituted well armed and better organized Hamas. Iran has a dozen other proxy groups in the middle east and a network of operators and sympathizers globally. They are all going to commit acts of aggression and terrorism, the Imans are going to issue fatwas on jihad, the Middle East is going to burn and it’s going to spread.

Israel’s totally under siege; the constant bombardment is intense. Israel and Turkey have been facing off in Syria, they start trading military body blows.

Russia now is emboldened, and they start a new offensive in Ukraine. There is now Chinese and North Korean nationals fighting in the Russian army and Russia is not using criminals anymore, they’re not using mercenaries.

Instead, they bring up their A divisions, their front-line troops with the most modern equipment and they’re literally pounding the undersupplied Ukrainians and rapidly pushing them back.

China does not have to invade Taiwan, instead China blockades Taiwan cutting off US$2.5 trillion worth of trade through the South China Sea and all the specialized chips coming out of Taiwan. Taiwan can only survive six months, they don’t have any energy of their own and they don’t grow enough food, so they’ve got at most six months before they have to surrender,

China’s been practising live fire blockade maneuvers, and they have purged their officer corps. You would do that in front of a war effort, you get rid of a lot of the stodgy old guard and bring up the next rung of command, these will be your war fighters, the firebrands, younger and more energetic.

Now you’ve got 3 theaters of war, the Middle East, you’ve got Taiwan, and you’ve got Ukraine. My question to you Bob is if you were the chief of staff and Trump wanted a war plan what would you bring to him, what would you tell him that you, as chief of the army and the navy, how much could the US handle out of all of this?

BM: Okay I’m going to go off topic slightly, but it will tell you what’s really going on. Now does Trump want the Nobel Peace Prize?

RM: He was so jealous of Obama.

BM: Well, the strange thing is, do you remember how many days Obama had been in office before he was picked for the Nobel Peace Prize? 17. Okay Obama was sworn into president for 17 days and they selected him for the Nobel Peace Prize. So, what was the message that the Nobel committee was trying to send?

RM: Well to me that message is if you get it after just 17 days it’s worth SFA.

BM: Well that’s absolutely true but Bush had started so much shit in the world and the Nobel committee said you know this guy’s been in office for 17 days and hasn’t started a war, so we need to give him a Peace Prize.

RM: He’s been in office 17 days and hasn’t yet started a war, so he gets the Nobel Peace Prize? Perfect, would you get 2 if you went a whole month?

BM: Yeah exactly. So, Trump is aware of this, the guy is an egomaniac and when he says he wants the Nobel Peace Prize he truly wants it. Now the issue is can you practice genocide and get the Nobel Peace Prize at the same time? There are two things that he could do, and he would get the Nobel Peace Prize. Would you like to know what they are?

RM: Absolutely.

BM: Okay, he calls up Bibi Netanyahu and says we just canceled your Platinum American Express card. We’re not paying for anymore of this stupid war, pull your troops out, the war’s over and Bibi Netanyahu would do exactly that because he has no other choice.

I mean this is not a war of Israel against Hamas, it’s not a war of Israel against Hezbollah, it’s not a war of Israel versus Houthis, it’s a war of the United States against Hezbollah, it’s a war of the United States against the Houthis, it’s a war of the United States against Hamas. Trump could end the war within one day.

Okay now that’s half of the Nobel Peace Prize what’s the other half? He calls up Zelensky and says okay the war’s over, we’re giving you 24 hours to pack and fly out of Kiev, go anywhere you want to, war’s over, I just ended the war.

The amazing thing is nobody thinks about this, all the shit going on in the Middle East is because of the United States and all the shit going on between the Ukraine and Russia is because of the United States and all Trump has to do to end it is pull the plug.

RM: He hasn’t done it yet and he could’ve done it at anytime up to now and he hasn’t, so my thinking on that is he doesn’t want to do it, he doesn’t want it to stop. Why?

BM: Well he is owned by Israel and I can prove that. You remember the trial in New York City where he was accused of stating that his income and his assets were a lot higher than reality. Remember that civil case?

RM: Yes, what he was charged with, I think was 34 counts of fraud.

BM: Okay here’s the deal and here’s where it gets really something. The judge ordered if he wanted to appeal the case, he had to pay fines in full up front. Now bear in mind the whole case was about Donald Trump’s finances; the judge knew to a penny exactly how much money Donald Trump had okay?

And Donald Trump did not have $450 million that he could pay the court so he could appeal the case. Now the case is probably the obscenest example of lawfare that I’ve ever heard, it makes canceling the Romanian election look like chump change.

I like a lot of things Trump does, I don’t like however the legal system in New York, it’s totally perverted, so the judge orders Trump to pay the money up front so where did Trump get the money?

RM: I think Russia.

BM: He didn’t get it from Russia, he got it from a Jewish billionaire, Benjamin Netanyahu owns Trump, owns him. Okay you were talking about Iran being unreasonable with their demands.

RM: I said they had a lot of conditions, places the US could not go with their demands.

BM: The essence of the American demands is Iran totally gives up all defensive capability. They would literally have to let the American army come in and destroy their defensive capability.

The chances of Iran agreeing to that is zero. There’s no way in hell they’re going do that, so what Trump appears to be doing from the narrative in the West is he’s setting up a scenario where he’s going to force Iran into saying no, and then he’ll attack.

And there’s some little, tiny subtleties. There are six B2 bombers and their support aircraft on Diego Garcia. Diego is a relatively small base so if you want a parking spot you must reserve it months in advance.

The United States has only reserved parking spots for these six B2 bombers until May 1st. So whatever the United States does it has to do it between now and the end of April.

RM: So let’s revisit my question. If you were the general in charge of the Joint Chiefs of Staff, what would you tell President Trump about your armed forces capabilities?

BM: Well, the answer to that is how many battles has the United States won in Ukraine in three years and the answer is zero. What is the chance of the United States and NATO succeeding against Russia and the answer is zero.

Let’s go back to the attacks by Israel and the US on Iran. In this situation I’m going to claim seniority, I was a fighter pilot when I was 20 years old. At the time the F-4 was probably the best fighter in the entire world. I was the youngest fighter pilot in the world. I went to Vietnam, I flew 125 missions in the F-4, most of which about 95% of which were air to ground meaning they weren’t fighter missions, but I was flying the F-4.

Then I flew another 700 missions in the bird dogs and actually controlled air strikes, naval gunfire and artillery so if you put together 10 experts on war and aviation, I would know more than all 10 combined.

There are some subtleties that I’m aware of that very few other people are aware of. When Israel/ US attacked Iran the second time they used a wave of aircraft including Israeli F-35s and American F-35s. The most advanced stealth fighters in the world were fixing to swarm into Iran and they got like 200 kilometers away from Iran’s border and all of a sudden, they were being painted, seen, on radar. And these guys said, ‘uh oh, we thought they couldn’t see us,’ but they could clearly be seen.

The very best thing that Donald Trump can do, and the US military could do, is to tell Trump to surrender. If the United States attacks Iran, it’s going to look like the Marianas Turkey Shoot. It was the last big carrier battle of the war and we shot down four or five hundred Japanese aircraft.

RM: The Battle of the Philippine Sea aka the Great Marianas Turkey Shoot.

Who is shooting the ‘turkey’s’ this time?

BM: Iran.

RM: Well, the US navy doesn’t want to get anywhere near the China Sea, they shouldn’t want to be within 500 kilometers of it because there’ll be missile wave after missile wave, and they’ll simply run out of defence capability and be destroyed.

With Ukraine we’ve already seen how Trump treated Zelensky, NATO and most EU members. NATO, Ukraine and the EU are on their own.

Now we want to go into as to why it’s such a foolish idea to get into a trade war with China.

You’ve been to war, when a military fights the amount of munitions and armaments that they go through must be off the charts; every day of constant fighting they are burning through their stockpiles. Each unit is supplied with a certain amount, you’ve got prepositioned equipment spread across the globe, you’ve got stockpiles in the US.

How long would it take the US military to use up all its stockpiles of smart missiles and smart bombs and the chips you need to run your war machine?

BM: Yeah, here’s what’s crazy, the United States is making the same mistake Israel’s making. In their arrogance they believe they can do anything. Now in a strictly conventional war which is what you’re talking about, in two to three months the United States would be out everything, we’d literally have emptied the warehouses.

RM: Would it change their war plans, tamp down the arrogance or simply fire up the lies and denials if I told them they would never be re-supplied?

If I told them by cutting off the US from rare earth elements, REE’s, China has literally kneecapped your military. When your existing stockpiles run out, they are not going to get refilled.

BM: They wouldn’t listen, but you just nailed it right on the head. There’s the flaw okay, and this is why it’s so dangerous for the United States to be on the path that it’s on.

The United States is acting so arrogant it guarantees they’re going lose. I can’t even imagine wanting to take China on, but Trump’s entire Cabinet is saying why don’t we go after China? What Trump is trying to do, he’s trying to maintain the United States’ control over the world’s economy and what he did is he just blew up the world’s economy.

RM: The bottom line is the US military cannot afford, for the safety of the country, to get into a fight right now. If they go to war with Iran, China or Russia, basically anyone but Panama or Greenland, they’d burn through all their stockpiles of chips and REE’s and parts. The US would be in a very precarious position.

BM: You’re absolutely correct, the United States would be defenseless.

Everybody’s been running around saying Russia wants to attack the EU. Russia doesn’t want to attack the EU; for what, what do they get from that?

Yes, this is a war, but it’s a war between the debt-based system of the West and the resource-based system of the East and nobody in the West wants to admit it, we lost.

RM: I look at this and I see the US is wearing blinders, literally being too focused on China and being manipulated into fighting a war they can’t possibly win because China has them by the short hairs on rare earths.

If you didn’t have the rare earths you couldn’t have stealth technology. If you didn’t have rare earths your engine turbine blades would overheat and melt, you couldn’t have your computers running everything without the chips and REEs. Your missiles would not be precision anymore, they would not be stand-off or loiter munitions. They would not be laser or infrared guided. That’s just a little bit of what REE’s are used for in just one weapons platform, the F-35.

Rare earths use is spread throughout a modern military and used in every piece of high-tech equipment. If you can’t resupply FROM CHINA you are not going to be fighting a modern war.

BM: Every piece of electronics has rare earths in it. China supplies almost 100% of what the US needs concerning REE’s and the things made from them. What Donald Trump has done is so foolish.

RM: Bonds are talking to us; the bond market’s a lot smarter than the stock market and the bonds are telling us everything we need to know about an underlying problem.

BM: It’s not just who’s smartest it’s also eight times bigger than the stock market.

RM: People are starting to realize that we are facing potential global financial Armageddon if the bond market keeps melting down and if a President loses his temper because of an imagined slight what are we all going to be left with?

BM: You’re absolutely correct, the 10-year note today is over 4.5% and the 30-year yield is just short of 5%. It’s catastrophic okay, I said last time that gold was a thermometer for the world financial system and it’s saying that there’s a good chance of war, but the price of gold going up more than $250 in three days is catastrophic.

RM: Yes, you said that, and both you and I have been saying for a very long time we don’t want to live in a world of $5,000 an ounce gold because we understand the conditions that would cause gold to get there. Looks like we’re well on our way buddy.

BM: Well I’m going to say something that’s very important for you to understand. In 1929 the average investor had access to information. Today how much more information is available to the average investor?

RM: You know what I would say is there’s more info, but it lacks quality, most of it is just pure unadulterated bullshit. There’s a saying that 85% of statistics are made up on the spot. There’s more information available out there but it’s overload and most of it’s wrong. So in 1929 I think you were better off because you could at least trust the bit you were getting.

BM: They got their information from radio and from a newspaper twice a day. We’ve got 1,000 times more information and you’re absolutely correct about there’s a lot of bad information, but the strange thing is there’s a lot of good information. Two or three years from now we’re going to look back and say we need to look at the first interview that we did, it was amazingly accurate, and it was frank.

RM: This one I think is going to play out in a way that we’re predicting but we don’t really want, I mean I look at a lot of stuff every day and I’ve never seen anything like this. I’ve been investing 24 years; I started in the junior resource market and with AOTH about the same time you and your wife started 321Gold.

We’ve come all the way to here, we went from a tech bull market to a commodities bull market centric on China. We’ve seen so much change in the last plus two decades, meltdown after meltdown, come back after comeback. I think you could call us battle-hardened veterans of bull and bear markets and everything in between, just cast your mind back and remember all the drama and chaos, and the good times, over those years.

We had to learn something from all of that, so it’s not surprising to me that when we talk to each other we get a lot of stuff right.

BM: Well it scares me because the rate of change is faster today than I’ve ever even read about much less been exposed to. Quinton Hennigh is my best friend, we talk about investments all the time, we’ve always got something that we’re working on and in one day gold goes up more than $100, that’s remarkable, gold doesn’t move like that, it’s not suppose to move 3% in a day yet it’s moved 8% in three days, that’s amazing and scary.

RM: It is both amazing and scary.

Today we’re talking about two gold stocks. You wanted to talk about New Found Gold (TSXV:NFG), they came out with a resource estimate, it sold off, what have you got to say about New Found Gold Bob?

BM: That’s a really good question because I like that story. Can you accept that when a QP [Qualified Person] does a resource there’s a lot of magic to it? Because you can have two different QPs and come up totally different numbers. It used to be that mining companies would shop for the QP they wanted and in the last 25 years there’s been a lot of examples of 43-101s that you can look at and know it was totally rubbish.

RM: You can influence your resource estimate as to how conservative it is or isn’t.

BM: And some practical issues creep in, say you have a high-grade intercept of 75 grams over 3 meters, if you use 75g at 3 meters in your calculations you are guaranteed to be inaccurate because you’ve taken the drill core, you’ve cut it in half and you’ve sampled a 3m intercept, now the problem is when you cut the core one side’s got more gold than the other side so they cap the numbers.

Okay instead of calling it 75 grams over 3 meters they’ll cap it, call it 8 grams or 10 grams over 3 meters. The beauty of that is when you have a lot of nuggety high-grade gold and you tend to cap it, when you actually go into production you always have higher grade than the resource indicates.

But again, every QP has a certain bias and the guys running the company know this so say we want an exceptionally conservative 43-101. Instead of calling it 10 grams he/she might call it 5 grams.

Now I believe the management of New Found Gold over capped it and did it deliberately for the resource to come up to exactly 2 million ounces. All you have to do is look at the hundreds of intercepts that were high grade, and you’d say hey wait a minute there is no way that they’ve only got 2 million ounces of gold.

They have to have more gold than that. And in fact I think the 43- 101 was exceptionally conservative. I think it was deliberately conservative. I think it offers a wonderful opportunity for investors to go and pick up a good company cheap and I’ll tell you one better.

If you back to when New Found Gold bought the project from Labrador Gold they paid Labrador Gold I think 5.2 million shares, and Labrador Gold has been dumping those shares on the market for a couple of months now. So you’ve got this excessive supply of shares, and you’ve got an exceptionally conservative 43-101.

Had Labrador Gold not dumped those 5 million shares on the market I think the price of New Found Gold would be considerably higher. Like probably two or three times higher and what it is right now, so what has happened is the effects of management of New Found Gold and the effects of management of Labrador Gold have artificially forced the price of New Found Gold down.

New Found Gold is a deposit like Fosterville and Fosterville took Kirkland Lake from a $3 billion company to an $18 billion company and New Found Gold has the same potential to do that.

RM: I’m going to talk Storm Exploration (TSXV:STRM).

When you’re buying a company with good management, an excellent project with gold already on it, and you’re buying one for pennies a share, Cdn$0.03, sporting a micro market cap of Cdn$2m. When they’re trading below the value of a shell and you’re financing a company that is going to do a drill program in short order meaning this summer. When it has a decent chance of success, they’re not looking at something that’s totally greenfield, there’s been exploration and there’s some decent grade and intercepts. To me, all that describes STRM.

So I’m looking at Storm Exploration, they’ve got gold in a banded iron formation (BIF) in the Miminiska-Fort Hope Greenstone Belt. They’ve got two confirmed high-grade gold zones separated by 14 kilometers. On the east end is Frond, on the west end is Miminiska, in the center there is a gold showing, they’re going in there drilling this summer.

Bruce Counts is the CEO, John Williamson’s on board with it, so between the two of them that’s a quality adviser and management who are both very experienced with gold in BIF’s. I like the project, 14 kilometers long with a potentially mineralized zone gold, good share count, strongly held and again you’re buying it for $0.03 with a $2m MC.

BM: How much lower can it go? It costs you $1,000,000 a year to keep the doors open. We’re going to have a situation, and I follow sentiment, the average investor has no clue as to how much opportunity there is in resource stocks, take gold stocks right now.

When you’ve got almost $3,300 gold dirt pretty much becomes economic, okay? And nobody’s pricing that into the market. The price of gold resource stocks now relative to the price of gold is the lowest it’s been in 45 years and that’s not going last for very long.

RM: No it isn’t, and that’s why I’m getting on this theme about trying to get people to pay attention to what we’re talking about. Where’s the value in junior resource companies?

When I look at a stock like Storm, I look at the market cap, does it have room to grow 3, 4 or 5 times on one successful drill program?

I think the most money in the market to be made today is to be picking up these penny juniors that are financing to do a drill program. To me that’s your value, and it’s where I want to play. One good hit with a tiny, microscopic market cap company, and what’s going to happen?

BM: Okay, well let’s work it out mathematically. If the market cap of Storm is $2,000,000 how low can it go?

RM: I don’t think it will go any lower.

BM: Well in theory it could go to zero. If they have a good hit what could it go up to?

RM: If you’ve got a $2 million market cap and you think the stock should be sporting a $8-10 million market cap after financing a successful drill campaign in the current gold friendly environment, I don’t think that’s unreasonable.

Let’s end here, thank you Bob.

BM: Let’s talk again soon.

Richard (Rick) Mills

aheadoftheherd.com

Bob Moriarty

321Gold.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

2 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#NewFoundGold $NFG #StormExploration $STRM

Stagflation Nation

Slowing economic growth, rising unemployment plus rising inflation might mean stagflation for the US economy.

The Phillips Curve says inflation and unemployment are inversely related. Yeah…no. Stagflation upset that wheelbarrow.

According to Investopedia the definition of stagflation is; An economic condition characterized by slowing economic growth, high unemployment, and rising prices (during stagflation, inflation continues to rise despite the economy stagnating or even contracting) simultaneously.

“A few blocks from the White House, the International Monetary Fund is set to lower its outlook for economic growth in new projections released on Tuesday. The following day, purchasing manager indexes from Japan to Europe to the US will offer the first coordinated glimpse of manufacturing and services activity since Trump’s global tariffs — now partly on hold — were unleashed on April 2.

Business surveys from major economies are also on the calendar. The combined picture is set to offer finance ministers and central bankers assembled in Washington a chance to make initial damage assessments on Trump’s attempt to rewire the global trade system.”

At the Economic Club in Chicago Federal Reserve Chair Jerome Powell, last Wednesday, cautioned that the central bank could face a “challenging scenario” of managing both accelerating inflation and a slowing economy brought on by the impact of President Trump’s tariffs.

Slowing growth means rising unemployment.

In September of 2024 the US Chamber of Commerce suggested that economic growth and the labor market were robust enough to prevent stagflation in the near term. Elevated oil price shocks (Similar to the 70s’), geopolitical risks, and extraordinary economic uncertainties were their concerns going forward.

So what causes stagflation? Well according to RBC it’s a combination of several factors; supply shocks, government policy errors, a rising cost of inputs, geopolitical tensions and monetary policy.

Cash and bonds are a bad place to be because their yields are often below the level of inflation in an inflationary environment, inflation destroys the value of fixed income assets and your currency. Stocks don’t fare much better during high-inflation periods.

Companies struggle with rising input costs, weaker demand, and higher borrowing costs. Also, an unstable currency makes planning all that harder.

The World Gold Council said that starting in 1971 stagflation has been the most frequent economic malady having occurred in 68 of the 201 quarters (until January of 2023) and having lasted eight consecutive quarters twice.

Now you might think the WGC cherry picked their start/ end dates but gold, silver and related equities do well during stagflation. Fact.