Gold Fields’ Osisko Mining acquisition heats up Windfall area play, Quebec – Richard Mills

2024.08.14

Gold Fields Limited (NYSE:GFI) is one of the world’s largest gold miners with a current market value of USD$14.5 billion.

Founded in 1887 by Cecil John Rhodes, Gold Fields sold all but one of its South African assets a decade ago to focus on newer, more profitable deposits in Ghana, Australia and South America.

The following is sourced from Gold Fields’ project webpages:

Gold Fields’ mining assets in Australia include a 100% interest in the St. Ives, Agnew and Granny Smith mines and a 50-50 interest in the Gruyere JV project with Gold Road Resources, located in the Yilgarn area of Western Australia.

In South Africa, Gold Fields’ remaining mine, South Deep, is building up to 380,000 oz per annum, which it is expected to reach in the latter part of 2026.

However, gold production decreased by 2% to 322,000 ounces in 2023 from 328,000 oz in 2022, due to cost inflation and a slower ramp-up towards 12 tonnes annual output in 2027, the company states.

Gold Fields’ operations in Western Ghana comprise the Tarkwa and Damang gold mines.

Its presence in the Americas consists of the Cerro Corona mine in Peru and the Salares Norte mine in Chile.

Recently Gold Fields has been looking to expand its portfolio into Canada, as it seeks to replace output from aging assets in Ghana and Peru. Two years ago, GFI tried and failed to acquire Yamana Gold. The Canadian mid-tier producer was later bought by Pan American Silver (TSX:PAAS) for $4.8 billion.

In its second attempt to enter Canadian mining, Gold Fields has just acquired Osisko Mining (TSX:OSK) for $1.6 billion US, or $2.1 billion CAD.

The all-cash deal makes Gold Fields the sole owner of the Windfall project in Quebec, which it has been developing in a 50-50 joint venture with Osisko.

“We are pleased to consolidate the remaining 50% interest of the advanced-stage Windfall Project and its highly prospective exploration camp,” Gold Fields’ Chief Executive Mike Fraser said in the Aug. 12 news release. “Over the past two years, beginning with our initial due diligence in 2022 and throughout our joint ownership of the project since May 2023, we have developed a strong understanding of Windfall and its potential, and view it as the next long-life cornerstone asset in our portfolio.”

John Burzynski, Osisko’s chairman and CEO, said the transaction represented an early payout for Osisko investors and reflected Windfall’s potential.

“In the span of nine years, we’ve transformed Windfall into one of the largest and highest-grade gold development projects globally, and this transaction is a testament to the extraordinary entrepreneurial effort of the Osisko Mining team,” Burzynski said.

The Canadian mining industry continues to see active deal-making. In the first quarter of this year there were 101 M&A deals worth a total $543.7m, according to GlobalData’s Deals Database.

Windfall project

The Windfall property consists of 286 claims covering 12,523 hectares. Located within the famous Abitibi Greenstone Belt straddling Ontario and Quebec, Windfall is 700 km north-northwest of Montreal, 200 km northeast of Val-d’Or and 115 km east of Lebel-sur-Quévillon.

Gold Fields reportedly plans to bring it into production by the end of 2026 or early 2027, eventually reaching about 300,000 ounces per year.

According to the company, Windfall is among the largest gold deposits in Canada, and a top 10 gold deposit globally by head grade.

Based on Osisko Mining’s December 2022 feasibility study, Windfall is expected to produce about 300kt a year at an all-in sustaining cost of US$758/oz. This positions Windfall to become one of the lowest-cost mines in Gold Fields’ portfolio, with a current projected mine life of 10 years.

Development of Windfall is well-advanced. Before the May 2023 Windfall JV transaction, Osisko Mining had invested more than CAD$800m on the project. Since then, Gold Fields and Osisko Mining have each spent a further $158m, bringing the total investment to date to more than CAD$1 billion, or USD$720m.

As a result, Windfall today includes over 2 million meters of drilling, a submitted EIA permitting application in process, studies, significant underground development and major surface infrastructure.

Underground infrastructure includes 14 km of underground development to 671m of vertical depth into ore, four main ventilation raises and 57 drill bays, amongst others. Concurrently, extensive surface civil works have been undertaken, including a lined waste pad, three lined water treatment ponds, a water treatment facility currently under construction, offices and a temporary 300-person camp.

The project currently has more than 150 full-time employees as well as a contractor workforce.

Environmental permitting for construction of the project is underway, with final approval expected in 2025. The project is powered by hydro-electricity from Hydro Québec. The power line is owned and operated by the Waswanipi Cree First Nation.

In October of last year, drill results were published highlighting an 8.0-meter intersection of 413 g/t Au, and 623 g/t Au over 3.0 meters.

The drill campaign primarily targeted infill areas; over 95,000 meters were drilled using eight rigs.

According to Osisko, the intercepts were all located within the mineral resource blocks as described in Osisko’s feasibility study.

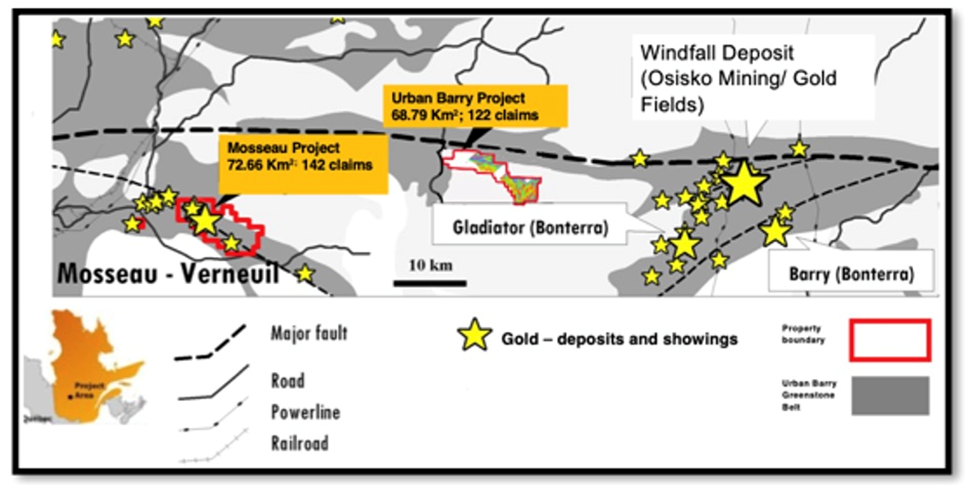

Nearby projects

Gold Fields has high hopes of extending Windfall’s life through conversion of resources to higher-certainty categories, together with significant regional exploration potential in the highly prospective Urban Barry and Quévillon district exploration camps.

The near-mine exploration upside is further enhanced by Osisko Mining’s joint venture with Bonterra Resources (TSXV:BTR), which secures a 70% interest over an additional 225 km2 of prospective exploration ground adjacent to the Windfall deposit.

Urban Barry

The Urban Barry property is in the Urban Township of the James Bay region of Quebec in the Abitibi Greenstone Belt, which hosts the Windfall gold deposit that holds nearly 4 million oz of gold (indicated and inferred resources). The Urban Barry property encompasses approximately 6,900 hectares and directly adjoins Osisko’s Windfall, with the Langlois base metal-silver-gold mine located about 30 km to the northwest.

From November 2019 to March 2020, EGR Exploration (TSXV:EGR) flew an airborne drone magnetic geophysical survey over the property. The results confirmed the northwest extension of rock units and fault structures hosting the nearby Windfall gold deposit.

On Dec. 19, 2023, EGR entered into an option agreement with Harvest Gold (TSXV:HVG).

The agreement involves the option and sale of 122 claims within the 6,879-hecatre property. EGR will receive $90,000 in cash and 1.7 million Harvest Gold shares, plus a 2% net smelter returns (NSR) royalty.

Harvest Gold is also required to spend a minimum of $300,000 on exploration in the first two years.

EGR will receive another million shares upon Harvest Gold announcing a resource estimate of 1 million ounces in the inferred category.

“This is an accretive transaction for our shareholders. We now are shareholders in Harvest Gold, a Quebec-focused gold exploration company that will move the Urban Barry property forward,” EGR’s CEO Daniel Rodriguez stated in the Dec. 19 news release.

“This mining district is heating up with recent transactions, led by the 50/50 JV of Osisko’s Windfall property with Gold Fields Limited and infrastructure announcements with Hydro-Quebec,” he added. “Harvest Gold, whose management team is motivated, experienced, and very strong technically, is more than capable of making a new discovery in the Abitibi region. We look forward to their success with both their Quebec acquisitions.” (the second acquisition being the Mosseau gold project — see map below.)

Rodriguez said this week that Gold Fields buying Osisko should be good for the nearly 2 million Harvest Gold shares that EGR owns. “It’s a nice little piece of M&A,” he told me over the phone.

Harvest Gold says the Urban Barry property straddles the southern margin of the under-explored Urban Barry Greenstone Belt. It is bolted onto the Windfall property which includes the Windfall deposit about 43 km to the east. Urban Barry has a strike length of approximately 19 kilometers.

Rick Mark, President and CEO of Harvest Gold stated: “One of the many things that attracted us to Urban Barry was the confidence Gold Fields had in this greenstone belt, as indicated in Osisko’s May 2, 2023 announcement that said their partner Gold Fields will sole fund expenditures for regional exploration up to a maximum of C$75 million. This mining-centric region in Quebec is gaining renewed attention worldwide.”

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does not own shares of EGR Exploration (TSXV:EGR), Harvest Gold (TSXV:HVG), Bonterra Resources (TSXV:BTR), Pan American Silver (TSX:PAAS) or Gold Fields Limited (NYSE:GFI). EGR Explorationis a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of EGR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

$EGR $HVG $BTR $PAAS $GFI #Gold