Gold and silver prices are pushing higher. Here’s why – Richard Mills

2025.02.07

During Donald Trump’s first term as president, gold rose from $1,209 to $1,839. Factors included trade wars, geopolitical tensions and the covid-19 pandemic. Trump’s protectionism and MAGA rhetoric incited BRICS like China, Russia and India to move away from the US dollar as the global reserve currency, and increase their gold reserves, pushing gold higher.

Under President Biden, gold prices continued their upward climb, reaching $2,450 on May 20, 2024. While Biden made efforts to mend relationships with allies, he presided over sanctions against Russia for invading Ukraine. The US and its allies also froze $300 billion of sovereign Russian assets, prompting many developing countries to buy gold to prevent the same thing from happening to them.

Which US president does gold prefer? — Richard Mills

Central bank gold buying accelerated under Biden and this, along with physical gold purchases in Asia, has been the main driver behind the gold price, despite a high dollar and elevated US Treasury yields. Both resulted from the Federal Reserve hiking interest rates to reduce inflation.

The Fed announced its first interest rate cut since the pandemic on Sept. 18, 2024. Since then, the federal funds rate has dropped 100 basis points, as have bond yields.

From a five-year high of 4.92% on Oct. 22, 2023, the benchmark US 10-year Treasury yield now sits at 4.24%.

Gold and silver have both benefited from looser monetary policy.

So far this year, spot gold has risen 32% and spot silver has gained 11%.

Gold

Hits new record high

But gold has received an added boost from President-elect Trump’s threatened trade war, and it has continued to climb as the implementation date for 25% tariffs on Canada and Mexico, Feb. 1, came and went.

On Jan. 30 spot gold hit a new record of $2,798.50 during the trading session, while gold futures went even further to $2,846.20 per ounce. Factors included impending tariffs and fresh economic data that weakened the dollar. The US dollar and gold typically move in opposite directions.

Gold bullishness continued on Jan. 31, with bullion topping $2,800 for the first time. Spot gold added 0.5% to $2,809.16 an ounce as of 10:54 am in New York.

Bloomberg reported The precious metal, on track for its fifth consecutive weekly gain, has benefited from haven demand as Trump’s tariff threats spur fears of trade wars that could sap economic growth. There are also worries that his pledges to cut taxes and overhaul immigration may erode US finances and reignite inflation.

After Trump relented on tariffs on Canada and Mexico, giving each a one-month reprieve due to their actions to stem the flow of illegal drugs and migrants from crossing the US border, gold jumped again following the imposition of 10% tariffs on China on Tuesday, Feb. 4.

This time it was safe-haven demand providing the catalyst for bullion, which traded near the all-time high of $2,830 reached on Monday the 3rd. The Financial Post reported that Beijing hit back immediately with a range of levies on US products, noting There’s plenty of uneasiness about what lies ahead, burnishing gold’s appeal as a store of value in a hard-to-predict environment. Whether the dollar keeps rising will be important, as a strengthening US currency makes bullion more expensive for many buyers.

Among the biggest questions are how resilient the US and Chinese economies would be to a trade war, as well as the ripple-on effects for monetary policy if tariffs reignite inflation.

State Street Global Advisors’ George Milling-Stanley told Kitco News it is not surprising that renewed investment demand is driving gold prices back to all-time highs, as investors seek protection against inflation and market volatility. SSGA thinks gold could push past $3,000 an ounce in the not-too-distant future.

Tariffs and gold prices

Some have speculated that the threat of tariffs from the United States could lead to shortages of deliverable gold and silver on the COMEX, a New York-based marketplace for trading contracts for metals like gold, silver, copper, and aluminum.

Fearing potential tariffs on gold by the Trump administration, traders are moving billions worth of gold (and surprisingly, silver), from the Bank of England to New York. Delivery times from the BoE have risen from a few days to 4-8 weeks, causing a gold shortage in London.

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

An example is JP Morgan Chase & Co, which will deliver gold bullion valued at over $4 billion this month against futures contracts in New York. Bloomberg said the delivery notices totaling 3 million ounces were the second-largest ever in bourse data going back to 1994.

Tariff fears have caused the prices of COMEX gold futures to rip past spot prices in London. Similar pricing dynamics have emerged in the silver futures market, with the disparity so large that traders, hoping to cash in on the arbitrage opportunity, have started flying silver into the country. Bloomberg states:

The precious metal is usually too cheap and bulky to justify the cost of airfreight, and one industry veteran says it’s the first time they’ve seen it happen.

As reported by Natural News, gold futures prices are trading at a premium to spot prices, incentivizing shipments and driving COMEX inventories to a 16-month high. The website references a story first reported on by the Financial Times of London, revealing that traders have stockpiled an $82 billion gold reserve in New York since November’s U.S. election. This massive movement of gold has left the BoE struggling to meet demand, raising questions about the central bank’s ability to fulfill its obligations and sparking fears of a potential default.

Further, If the BoE is unable to meet delivery demands, the “paper” gold market—where investors trade gold contracts without taking physical possession—could face a catastrophic collapse.

Sprott Money explains how the situation could lead to the breakdown of the London/ NY Gold Pool — something that happened in 1968 when the rush to exchange dollars for gold broke the London Gold Pool.

The upshot? Now might be a good time to buy physical gold, because if the pool breaks, gold is going up:

Well, quite obviously, you should definitely get your hands on some physical gold while you can. The breaking of the London Gold Pool saw the gold price rise from $35 to $800 over the course of the decade that followed. What price follows the breakup of the current NY/London Gold Pool is unknowable. However, it’s unlikely to be $2820. That much is certain.

Central bank buying

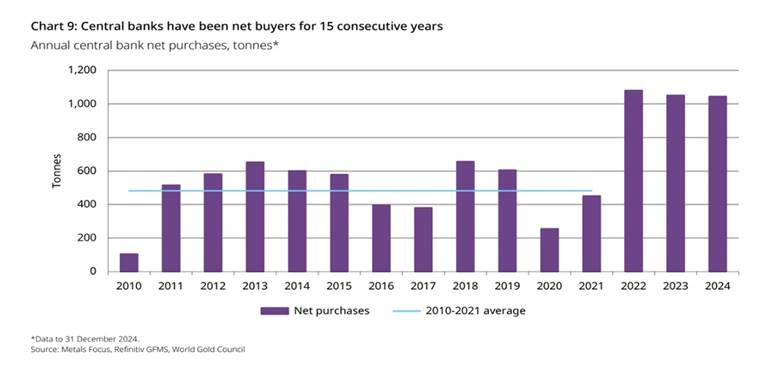

As mentioned at the top, central bank buying was one of the main factors for gold’s substantial 27% gain in 2024 — the most since 2010.

Central banks bought more than 1,000 tons of gold for the third year in a row, with the National Bank of Poland the largest buyer adding 90 tons to its reserves.

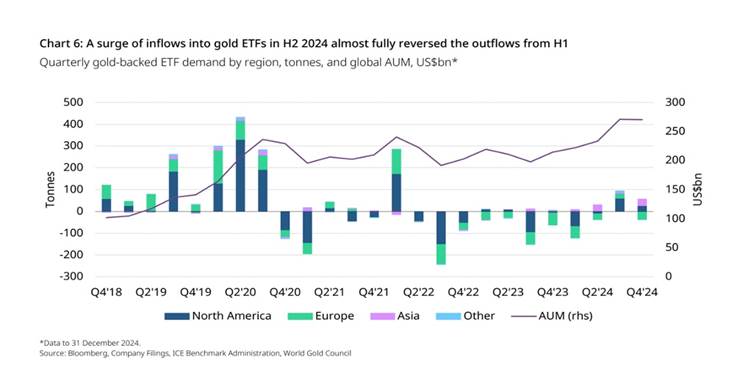

Last year’s investment demand for gold rose 25% to a four-year high of 1,180 tons, mainly because outflows from physically-backed gold exchange-traded funds (ETFs) dried up for the first time in four years…

Investment demand for bars rose 10%, while coin buying fell 31%.

According to the World Gold Council’s latest report, global gold demand including over-the-counter (OTC) trading rose by 1% to a record 4,984.5 tonnes in 2024. Excluding OTC trading, total gold demand hit 4,553.7 tons, the highest since 2022.

Gold buying accelerated after Trump won the election in November. According to WGC, via Reuters, purchases by central banks accelerated by 54% year on year in the fourth quarter to 333 tons.

Quoting data from the London Bullion Market Association, the average gold price in 2024 rose to $2,386 an ounce, 23% higher than the average price in 2023. The average gold price in the fourth quarter climbed to a record-high $2,663 an ounce.

The upward price trend looks set to continue. Kitco News talked to Joseph Cavatoni, market strategist at the World Gold Council, who said, “The growing government debt burdens and the dramatically changing geopolitical landscape suggest that central banks will continue to buy gold.”

Cavatoni noted that geopolitical uncertainty owing to the unpredictable Trump administration could lay the groundwork for further central bank demand, and he cautiously said CBs could repeat their 1,000-ton-plus net buying in 2025.

Cavatoni said that, overall, the broader trend is that given all the uncertainty in the marketplace, demand for gold will remain high through 2025, even at elevated gold prices.

Russians back up the truck

Usually China and India make headlines for being the nations that consume the most physical gold — including gold bars and coins for investment, and gold jewelry for special occasions like weddings.

With all that is going on in Russia, it appears that Russians are embracing bullion in a big way. Bloomberg reported on Wednesday that Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output.

Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins and jewelry in 2024, the fifth biggest figure among all nations, according to World Gold Council data published Wednesday. That’s an increase of 6% on the previous year and more than 60% since President Vladimir Putin ordered his troops into Ukraine almost three years ago.

The news is even more compelling in that Russia’s central bank, despite being one of the largest gold buyers, hasn’t resumed purchases at significant volumes. According to Bloomberg,

Retail gold demand shifted upward after the Kremlin’s invasion of Ukraine as Russians started to find alternative ways of securing their savings instead of traditional investments in dollars or euros. Western sanctions last year intensified cross-border payment difficulties and led to some foreign currency shortages, while the ruble also fell to historic lows.

To spur gold sales, Russia canceled value-added tax on retail purchases of the metal right after the invasion following more than a decade of discussing such a move.

Gold supply crunch

Turning from gold demand to gold supply, it appears that AOTH’s predictions of peak gold are bang on.

The concept of peak gold should be familiar to most readers. Like peak oil, it refers to the point when gold production is no longer growing, as it has been, by 1.8% a year, for over 100 years. It reaches a peak, then declines.

At The Northern Miner’s International Metals Symposium in London on Dec. 2, a presenter from CRU Consulting said global gold production will peak at 3,250 tonnes, or 105 million ounces, next year, before entering a period of prolonged decline.

From 2025 onward, according to gold and base metals analyst Oliver Blagden, reserves will deplete, ore grades will decline and aging mines will close. Even if all planned projects come online, production could drop by up to 17% by 2030, Blagden noted.

China and Russia both face challenges in maintaining output levels, while in West Africa there has been a rise in resource nationalism, particularly Mali and Burkina Faso which have nationalized operations thus deterring foreign investment.

North America, while politically stable, remains the highest-cost region for gold mining.

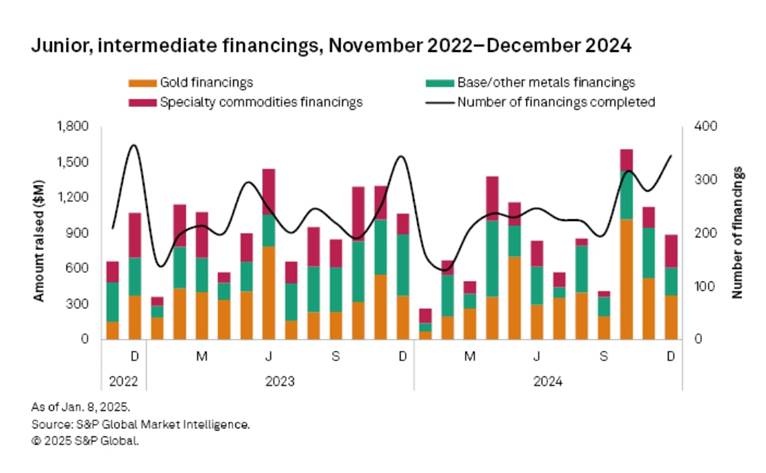

None of this is new to Ahead of the Herd. Regarding our wheelhouse, the junior mining sector, the Northern Miner quotes Blagden saying that, despite the industry being on strong financial footing, with 97% of gold producers operating at positive margins and average all-in-sustaining cost margins at 47%, there is not enough investment in exploration. He said high-grade, well-located projects are harder to find, and he called for miners to act decisively during this period of high profitability. “Without new projects, mines will close, production will fall, and profits will shrink,” he said.

According to S&P Global, funds raised by junior and intermediate mining companies fell in December to $890 million. Despite a 2% increase in transactions, fewer high-value gold and other metals financings weighed down the monthly totals, resulting in year-to-date financings dropping 12% to $10.27 billion, the lowest since 2019.

Some central banks are diversifying to currencies other than the US dollar following Russia’s invasion of Ukraine. When the United States punished Russia by freezing half of its $640 billion in gold and FX reserves, other countries thought “the same thing could happen to them”. Among the countries on a path to “de-dollarization” are Russia, China, India, Turkey and Saudi Arabia.

While the BRICS block of countries consisting of Brazil, Russia, India, China and South Africa has rejected the idea of forming a common currency to challenge the US dollar, they have also made significant strides in reducing dependence on the dollar by establishing a cross-border payment system and expanding the use of local currencies in trade, reports Natural News.

An October 2024 report by Ernst & Young India projected that coordinated BRICS policies could gradually diminish the dollar’s dominance in global trade and foreign exchange reserves. However for now, the US dollar remains the world’s primary reserve currency.

Trump has said that any country that tries to abandon the US dollar “should say hello to tariffs and goodbye to America!” he wrote on his Truth Social platform.

Remember, anything that puts downward pressure on the US dollar is good for precious metals.

US government needs to find $28 trillion

Schiff Gold notes that gold rocketed to an all-time last year because central banks and foreign governments reduced their dollar holdings.

But the greater risk to the US federal government is the maturation of US government bonds, aka Treasuries:

According to Federal Reserve data, there will be roughly $28 trillion worth of US government bonds maturing over the next four years, i.e. now through the end of 2028.

That’s more than 75% of the government’s $36+ trillion national debt.

This is an absolutely staggering figure, averaging $7 trillion per year for the next four years.

And remember, we’re just talking about the existing debt that is set to mature. It doesn’t even include new debt that has to be issued over the next four years, which could easily be another $7-10 trillion.

This is an enormous problem for the Treasury Department, because they clearly don’t have $28 trillion to repay those bondholders.

Usually when a government bond matures, the investor simply rolls the proceeds into a new bond. This is referred to as the debt “rolling over”. The problem for the US government is that most of the bonds that are maturing over the next four years were issued when interest rates were much lower. If they were previously issued at 3%, for example, now the government has to refinance that debt at say 5%, meaning an extra 2% in interest charges per year.

That’s almost $600 billion in additional interest EACH YEAR on top of the $1.1 trillion interest bill that they’re currently paying.

The question is not only how will the government find the $28 trillion — likely they will print it, which is hugely inflationary — but who is going to buy the new bonds? Enter the de-dollarization trend.

The Treasury Department relies on foreign individuals and governments to buy US Treasuries, which helps fund the national debt. Traditionally, countries are forced to buy US government bonds because the dollar is the world’s reserve currency. Most commodity transactions are conducted in dollars. But over the past several years, a number of countries have started to trade in currencies other than the dollar.

Schiff Gold then poses the question: If you’re a foreign central bank and you have $100 billion of US government bonds that are about to mature, what are you going to do?

Are you going to reinvest that entire $100 billion back into a country that might already be threatening you with economic penalties?

Or do you quietly let the treasuries mature, take the money, and find someplace else to invest that $100 billion?

A lot of foreign governments and central banks are going to be giving serious consideration to option two.

But they are going to have to invest that money in an asset that, like US dollars, is widely accepted, and has universal value and marketability around the world.

Gold is one of those assets. And that’s why central banks have been buying so much of it for the past couple of years.

I think there’s an obvious case to be made, given the prospects of tariffs and further trade wars, or even just the threats thereof, they are going to keep buying gold and send the price even higher.

Silver

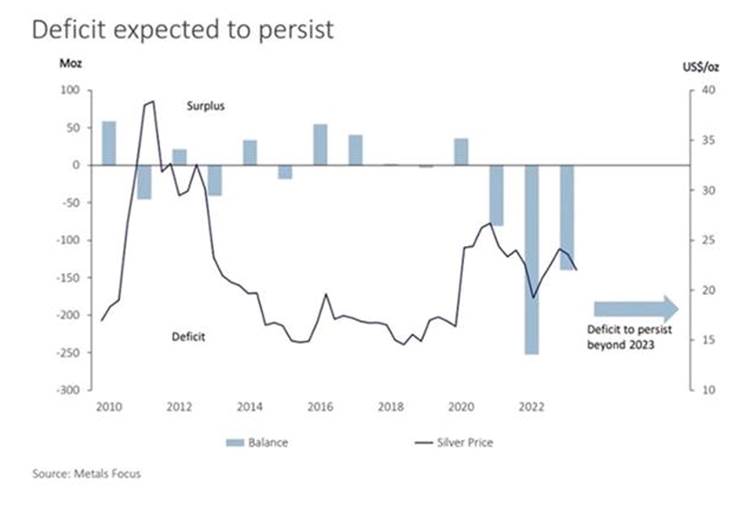

Spot silver narrowly beat spot gold in 2024, with an annual gain of 27% to gold’s 24%. Silver has benefited mostly due to physical buying in India and China. Silver ETFs have also been a factor.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

A report by Oxford Economics commissioned by the Silver Institute found that demand for industrial applications, jewelry production and silverware fabrication is forecast to increase by 42% between 2023 and 2033.

The Silver Institute expected demand to grow by 2% in 2024, led by an anticipated 20% gain in the solar PV market.

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second-largest in more than 20 years.

In fact it’s the fourth year in a row that the silver market would be in a structural supply deficit.

As for what’s in store for silver in 2025, UBS financial markets strategist Julian Wee says that silver could enjoy a spillover effect from gold, which he expects will reach $2,900 around September 2025.

He suggested stronger industrial demand could propel silver higher, especially if China lowers interest rates, sparking a recovery in global manufacturing. The People’s Bank of China lowered its benchmark lending rates by 25 basis points in October.

Wee said on the supply side, mining output should remain constrained in 2025. “We thus expect prices to reach USD$36-38/oz in 2025, and advise investors to stay long the metal or use it for yield pickup opportunities,” he said via Kitco.

In fact there is evidence to suggest that silver could be on the verge of its biggest breakout in history, with projections of $50 an ounce by mid-year.

Silver’s growing importance

The Jerusalem Post reports that governments and central banks are taking an increasing interest in silver for both its monetary and industrial purposes. For example, some central banks are considering adding silver to their portfolios, while several countries are stockpiling silver supplies for high-tech and defense applications. Silver’s use in solar power has made it a strategic metal.

Gold-silver ratio

The gold-silver ratio shows how many ounces of silver equal one ounce of gold. The ratio is a good indication of whether silver is under- or over-valued. To find it, simply divide the price of gold by the price of silver.

As of this writing, the gold-silver ratio sits at 88.5. Historically, when the ratio is this high, silver tends to outperform gold in the following months. The historical average for the gold-to-silver ratio has typically ranged between 50 and 70, meaning silver is significantly undervalued relative to gold at current levels.

In an interview on CapitalCosm, precious metals analyst Peter Krauth argues that the Federal Reserve’s policy of keeping interest rates near zero for an extended period has contributed to the current inflationary pressures and that recent rate hikes may not be enough to control it.

He cited instances where silver prices tripled within a few years and mentioned silver companies that witnessed gains of 16 times and 17 times their share price within a two to three-year period.

The author of ‘The Great Silver Bull’ thinks a new bull market in silver will be driven by inflation, rising interest rates and the impact of the Trump tariffs. He sees the current economic climate as similar to the 1970s when silver prices skyrocketed amid high inflation.

Consumer prices rose 2.6% in December from a year earlier, up from 2.4% in November and the third straight monthly increase. AP notes the Jan. 31 figures arrived two days after the Federal Reserve paused interest rate cuts in part because inflation has been stuck at about 2.5%, above their 2% target, for the past six months.

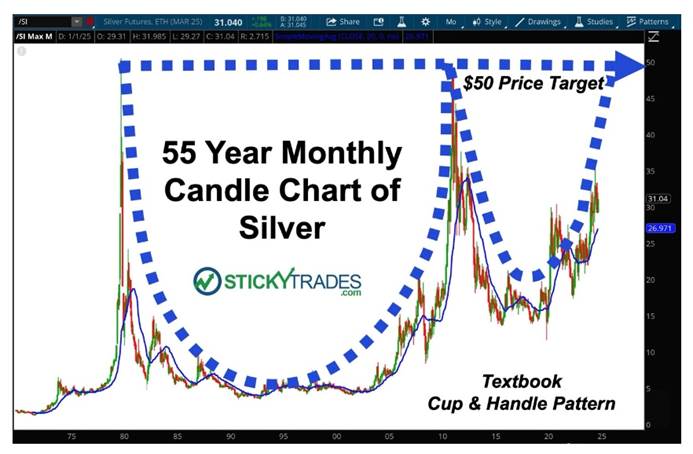

Cup and handle

Another reason to think silver is on the verge of a breakout is that the silver price has formed a textbook cup and handle formation. A cup and handle is a technical indicator that suggests a price increase.

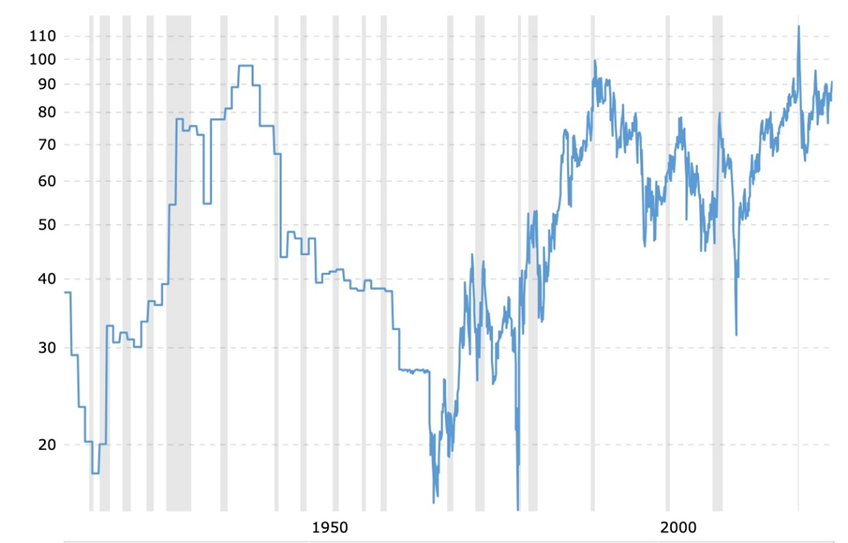

A 50-year-old silver price chart shows a cup and handle pattern with highs around $50 per ounce in 1980 and 2011.

A 44-year cup and handle pattern in silver has been called one of the largest ever seen.

A contributor to Zero Hedge offers a similar chart, with the cup and handle pattern spanning 55 years and the handle projecting a $50 price target.

Conclusion

Silver and gold are both projected to move higher under the new Trump administration — echoing our finding back in July that Trump would be better for precious metals than Biden.

Trump has threatened, and in the case of China, practised, trade protectionism and he is promising tax cuts. He would fire Fed Chair Jerome Powell and replace him with someone more accommodating to monetary stimulus, which would be good for the stock markets but terrible for inflation.

High debt levels weigh on the US dollar and are gold-supportive. However, Trump’s tariff raises could be inflationary and lead to a fresh round of interest rate hikes to hold inflation in check. Yields and the dollar would both move higher.

Gold has done well, even amid high inflation and the Fed’s rate increases. The danger of Trump is that his inflationary policies will cause the Federal Reserve to go back to hiking rates rather than cutting them. That could be disastrous for gold prices.

For now, gold is catching a bid due to its safe-haven appeal. In a world filled with uncertainty, buying gold now is thought to offer future stability and an inflation-proof store of value.

Gold appears to be running to $3,000 and if that happens silver could be taken along for the ride. A 44-year cup and handle pattern in silver has been called one of the largest ever seen. That, combined with an 88 gold/silver ratio indicating silver is way undervalued, and silver’s increasing importance among countries and their central banks, could easily lift it past $50 for the first time since 2011.

Buckle up and stay tuned to AOTH by visiting the site, new articles are posted everyday, or sign up for our free weekly newsletter. A bull market in precious metals is starting and there will be plenty of news to come.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

4 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#gold #silver #PreciousMetals #BullMarket

In an interview today on Fox Trump confirmed that indeed Canada becoming the 51st state is a real thing and he also said that Canada’s efforts to stop tariffs are not enough. Tariffs are coming, it looks like we’re in a fight.

The Globe and Mail reports in its Wednesday edition that with increasing gold bullion prices, earnings per share expectations for miners have risen by 60 per cent and 80 per cent for 2025 and 2026 since April, 2024. The Globe’s guest columnist Bhawana Chhabra writes that stock prices, however, have only increased by 25 per cent, matching the pace of gains in gold itself over the same period. With a forward price-to-earnings ratio of 12 times earnings and annualized earnings growth for the next three years forecast at 38 per cent, the PEG ratio (forward P/E to earnings growth) works out to be just 0.3 times. A PEG ratio of less than one is considered cheap, between one and two is considered reasonable and more than two is regarded as expensive. This all implies that precious metals miners are available at bargain basement prices. Compare this to the MSCI USA Index, which has a PEG ratio of 1.9 times, the MSCI Canada Index at 2.2 or the MSCI World Index at 2.5. This makes gold miners one of the most underappreciated opportunities for equity investors. To little fanfare, these stocks rank in the top five of all subindustries in the S&P 500 Index and the S&P/TSX Composite when it comes to expected earnings growth. https://www.stockwatch.com/News/Item/Z-C!ABX-3651031/C/ABX

History does not exactly repeat, but it sure enough rhymes – Rick

The language of failed peacemaking follows a familiar pattern.

History is full of ironies, and the latest flurry of peace initiatives comes just before the Munich Security Conference, a meeting held a few hundred yards away from the site of the most notorious failed peacemaking attempt in modern history. It was there, in 1938, that Adolf Hitler managed to convince Britain and France that Czechoslovakia, not Nazi Germany, was the cause of conflict on the continent.

After a month of crisis diplomacy, the British, French, and Italian leaders met Hitler at the Führerbau (“the Führer’s building”) in Munich and imposed a political settlement on Czechoslovakia, stripping it of the so-called Sudetenland, a western region with a substantial German-speaking minority that had been radicalized by Nazi propaganda.

Although peace agreements are often driven by a revulsion to the horrors of war, they also often set the stage for new conflicts. In a September 27, 1938 radio address to the British people, Prime Minister Neville Chamberlain reflected on, “How horrible, fantastic, incredible it is that we should be digging trenches and trying on gas-masks here because of a quarrel in a faraway country between people of whom we know nothing.” Within a year, Britons were putting on gas masks and building defenses.

Meanwhile, in France, the argument for peace (appeasement) in 1938 and 1939 was distilled in the question: “Mourir pour Dantzig?” (“To die for Gdansk?”). But those who believed they had kept themselves safe through clever diplomacy were soon dying for France.

The language of failed peacemaking follows a familiar pattern. First, we are told that the big boys will handle it by sidelining bothersome smaller countries with their complicated histories. As Trump said of his conversation with Putin, “We both reflected on the Great History of our Nations.” The big European powers exhibited the same arrogance in 1938.

Second, we are told that simple logic will suffice. Or as Trump put it, “President Putin even used my very strong Campaign motto of, ‘COMMON SENSE.’” It was also common sense that the Sudeten question, not Hitler’s desire to unite Europe under Nazi rule, was at the heart of the 1938 crisis.

Third, the peace mongers invoke the threat of civilizational collapse. Russia has consistently threatened nuclear war, and similar fears of escalation shaped British decision-making in the late 1930s. “The real triumph,” Chamberlain told the House of Commons on October 3, 1938, “is that … representatives of four great Powers can find it possible to agree on a way of carrying out a difficult and delicate operation by discussion instead of by force of arms, and thereby they have averted a catastrophe which would have ended civilisation as we have known it.”

With the benefit of hindsight, the real triumph would have been to freeze the conflict until a real solution could be worked out. That might take decades, as in postwar Germany, or even longer, as on the Korean Peninsula since the 1953 armistice. There may be a gradual thaw, as occurred in relations between East and West Germany, or there may not be. Either way, West Germany and South Korea both remained secure after the fighting stopped because they were protected by the West’s Cold War deterrence framework.

Likewise, effective deterrence is the key to ensuring that the conflict in Ukraine remains truly frozen, and that Russia does not just use the freeze to build up its military capacity until it can apply irresistible force. During the Cold War, such deterrence was achieved with the threat of mutual assured destruction. The same mechanism could offer a way out now.

https://www.project-syndicate.org/commentary/trump-russia-appeasement-in-ukraine-france-britain-still-have-options-by-harold-james-2025-02