Gold and silver mining stocks aren’t keeping pace with metals – Richard Mills

2023.06.10

Ask anyone what is the best commodity to invest in, 9 of 10 times you get “gold” as the response. And with the current macroenvironment, that makes a lot of sense, as bullion is often seen as the ideal safe haven asset during uncertain times.

Gold’s performance since the start of the year also backs up that notion: Since the start of the year, gold’s price has risen by 8%, the best YTD return of all mainstream metal commodities. Several times, it came within cents of reaching a new record price of $2,069.40 per ounce set in 2020.

“The story is all about gold,” Will Rhind, founder and CEO of GraniteShares, recently said on ETF Edge, a CNBC segment covering various topics on modern investing. ”[It’s] the only major metal to remain firmly in the green for this year.”

There’s no shortage of belief within the industry that gold could soon hit another all-time peak given the confluence of mid- and long-term driving forces.

Gold’s Main Drivers

UBS recently listed three main reasons investors should be buying gold right now: 1) robust central bank purchases; 2) broad weakness in the dollar; and 3) US recession risks. For the first one, AOTH has already examined in detail. It can’t just all be a coincidence that central banks have been buying gold for 13 consecutive years after two decades of being net sellers.

Data compiled by the World Gold Council shows that the pace at which central banks are buying gold is also accelerating. In 2022, the net purchases totaled 1,078 metric tons, which was the most ever on record dating back to 1950.

According to UBS analysts, this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation around the globe. In fact, the US decision to freeze Russian foreign exchange reserves in the aftermath of the war in Ukraine may have led to a long-term impact on the behavior of central banks, the bank said.

The geopolitical tension also ties into the second reason because it weakens the US dollar, as many emerging economies would look to diversify away from the USD from their reserve holdings and use gold as an alternative. Russia, as a prime example, can use gold to replace the USD and circumvent Western sanctions when it comes to international trade.

Within the US, the direction of a weakening dollar is also very clear, with the Federal Reserve having signaled a pause in its current tightening cycle after a series of interest rate hikes over the past 14 months. As the Fed begins to cut rates, this would weigh on both US Treasury yields and the greenback.

“Gold has historically performed well when the US dollar softens due to their strong negative correlation, and we see another round of dollar weakness over the next 6–12 months,” UBS analysts said.

CMC Markets recently predicted that a Fed pivot will trigger a sell-off in the US dollar and tank bond yields, sending gold prices up to between $2,500 and $2,600 per ounce.

Lastly, there’s the recession theme, which has been in the background for well over a year. The general consensus among experts is that the Fed’s constant rate hikes will eventually lead the economy into a severe recession, and the recent banking turmoil only helped to cement that belief.

In its latest analysis, UBS said it sees gold hitting $2,100/oz by year-end and $2,200/oz by March 2024. The bank has also maintained its most-preferred rating on gold alongside a positive stance on broad commodities.

Gold Equities Underperforming

This brings us to our conundrum: Despite a bullish outlook and healthy gains, gold-related equities, in particular the small-cap mining stocks, have not been as reflective of bullion’s strong performance.

Take the VanEck Junior Gold Miners ETF (GDX) for example. As the most widely followed measure of gold stock prices, GDX has recorded a decent YTD gain of 6%, which is just slightly lower than the 8% actual metal’s returns. It also trails that of SPDR Gold Shares gold ETF (GLD), which, being the largest fund of its kind, is possibly the most accurate representation of gold’s valuation.

An analysis by Adam Hamilton of Zeal Intelligence comparing the performance of GDX versus GLD between 2020-2022 reveals that the former has significantly lagged behind. Even at the gold-stock upleg’s latest high-water mark of mid-April, a share of GDX was only worth 18.9% of a GLD share.

A closer look at data going back 30 years indicates that there’s indeed a chasm that exists between gold prices and the valuation of gold mining stocks, MINING.COM recently wrote. Forming the basis of the article was a chartbook published by Merk Investments, which is an investment advisor and manager of ASA Gold and Precious Metals, another precious metals fund listed in New York.

To reach this conclusion, the author specifically uses two long-term charts to show the disconnect between the value of gold companies and bullion price, and also the US stock market (as seen below).

As seen in the first chart, the current ratio between the metal and gold stocks, as represented by the NYSE Arca Gold Mining Index, is not that far off historic lows struck in 2015. This shows that gold stocks have certainly been underperforming gold for more than a decade.

If the price of gold stays stable at today’s levels, gold stocks would have to collectively more than double to bring it in line with the historical average since the early 1990s, the charts show. Of course, balance could also be restored if gold prices were to be halved, but because of all the reasons listed at the start of this article we can’t realistically see any scenario of that happening.

At the same time, despite robustness in the gold market, gold equities have also been deeply discounted when compared to the broader market in the form of the S&P 500, as shown in the second chart.

These charts pretty much tell us that gold stocks have underwhelmed relative to prevailing gold price levels, as well as the overall market. Such dissonance can be attributed to a variety of market forces, or it can be simply down to investors’ attitudes. Below are five reasons why AOTH believes have gold stocks overshadowed over the years:

- Bear Market Syndrome

The value of gold mining companies is primarily tied to gold prices (i.e. the higher the price, the larger their profit). Yet the recent trends don’t reflect that.

This is because gold mining stocks are still stocks after all, which meant many investors still viewed them as an equity investment, an asset class that is much riskier, as opposed to a commodity investment.

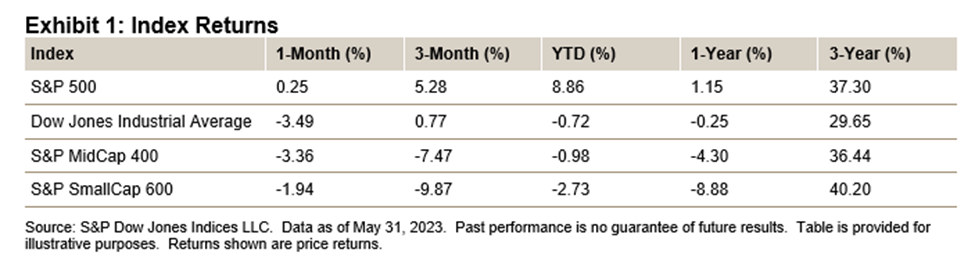

Since bullion tends to maintain its value through economic turmoil, there would be more capital flowing into physical gold investments when people expect a market downturn, which would somewhat help us explain the gold stock performance. Remember, Wall Street is coming off its worst year since 2008, with the S&P finishing last calendar year down 20%!

Therefore, any rational investor would have avoided going long on stocks, which unfortunately do not preclude gold mining stocks.

Moreover, as capital becomes limited, more of the investment would have gone towards safer bets. It’s worth noting that the US dollar index recorded double-digit gains in 2022, which would have made the greenback attractive.

Importantly, analysts remain cautious over whether to announce the next bull market. Morgan Stanley recently warned that the stock market is “far from being out of the woods,” despite a sizable pullback in recent weeks.

Those at Goldman Sachs previously predicted that the bear market will last through 2023 as the effect of rising interest rates has yet to fully kick in.

According to Goldman’s strategists, the recent gains aren’t sustainable, because stocks don’t typically recover from troughs until the rate of deterioration in economic and earnings growth slows down. “The near-term path for equity markets is likely to be volatile and down,” they said.

On the other hand, investors are more likely to buy stocks when they’re upbeat. But for gold miners, their profitability (and by extension, their equity value) depends on how “hot” the gold market is, and so we essentially have a paradox.

- ‘Getting No Respect’

Theoretically still, gold companies should benefit either way, but obviously, that hasn’t happened.

This can be explained by the fact that gold equities represent a tiny section of the global stock market; in other words, investors have loads of options like tech stocks, which have a far bigger investor base and, more importantly, buzz.

And with the rising popularity of Artificial Intelligence, people are likely to be heavily “invested” in AI-related stocks going forward.

To industry experts, gold miners are just being overlooked by the market. “It’s kind of like the Rodney Dangerfield phase, where everybody’s saying, ‘I get no respect’,” Jason Neal, a veteran mining investment banker, told the Financial Post last year.

As illustrated above, even with the S&P 500 rebounding this year, the US mid-cap and small-cap stocks are still lumbering in the negative, which makes sense as these stocks tend to be risky.

This kind of investment attitude would also prevail in Canada, where many of the gold miners are listed. A more accurate reflection of the market is the S&P/TSX Global Mining Index, which is down 5.8% over the past year, and flat year-to-date.

In short, gold mining stocks do not get enough attention regardless of which way the overall market is headed.

- Risk of Gold Juniors

Then there’s the degree of risk when it comes to investing in gold miners, which represent a “niche” market. Those bullish on gold tend to prefer funds that mimic the metal’s price like GLD, rather than say, the VanEck fund, which tracks a basket of gold mining stocks.

And even when the GDX hit its high point in February 2020, its value was propped up by the gold streaming and royalty companies, which many executives say created an increasingly attractive investment alternative to mining companies during the past 15 years.

Gold streaming companies finance projects by providing cash to gold miners upfront in exchange for a portion of the gold produced, or a cut of the profits from a mine. As such, they can hold stakes in many more gold mines than a mining company, which creates insulation against the social and environmental challenges of actually operating a mine.

In essence, such companies allow investors to bypass the risks associated with a single gold explorer or a project, in the same way as the physically backed gold ETFs.

On the other end of the risk spectrum, the market for gold miners, in particular the juniors, is almost purely speculative. Finding gold, especially high-grade deposits, has become increasingly difficult. Not all exploration will lead to discovery, and when it does, it would take years to be developed into a mine — that’s just assuming everything goes well (i.e. permitting).

Moreover, those within the mining industry have mostly been focused on growing their value through acquisitions rather than exploring and developing their own assets.

At last year’s Mineral Exploration Roundup in Vancouver, Ian Telfer, a gold industry veteran who formerly chaired Goldcorp Inc., advised companies to avoid “grassroots exploration,” because the chance of striking a motherlode is too small.

Commenting on why miners’ shares have trailed the commodity, he said: “Because of the lack of returns, the financial markets don’t have time for it. There’s no compelling reason to own gold (mining) shares.”

- Timing Matters

Speaking of time, making risky investments often require a great deal of patience. People prefer to wait for an adequate return on their hard-earned money after all. They’re also a matter of timing, because stocks, for example, move in recurring cycles, sometimes presenting good entry points for investors.

These principles certainly apply to mining stocks, perhaps even more vigorously than other sectors. As mentioned, mining projects can take an excruciatingly long time to move along, and during the early stages, progress often comes in the form of exploration results, which only a small fraction of the investor base with industry knowledge could understand.

Compare that with a tech company or luxury brand, every time a product is released, the average investor would get the signal that it might be time to buy more shares. But when a miner announces what’s considered a “bonanza” gold grade from drilling, some may not fully understand its meaning.

Even if the drilling results turn into an exciting new discovery for the industry, it doesn’t mean it’s all smooth sailing from thereon. After that, the project owner is faced with different challenges. In fact, seasoned mining investors don’t always hold a company’s shares from start to finish, because the risks vary depending on what stage a project is in; again, timing is crucial here.

This idea is perfectly illustrated in what the junior exploration sector commonly refers to as the Lassonde Curve, named after the legendary Canadian resource investor Pierre Lassonde himself. The Lassonde Curve (as seen below) outlines the change in the market values of a mining company from exploration all the way through production.

As you can see, a miner’s stock initially gains value during the discovery/exploration stage, as drill results continue to be rolled out and generate excitement.

However, at some point, the speculative retail investors would be tempted to take their profits as the discovery hype dies down, and the mineral deposit must be subject to further studies (i.e. PEA, PFS, FS) to determine whether it can actually be economically developed.

Then the company goes through a long waiting period during which it must demonstrate the mine’s profitability to investors, as well as funding, which creates a whole new set of risks. Only when it manages to secure the funding to carry out the mine plan, investors who have held the stock can breathe a sigh of relief. The development phase is also when institutional investors tend to arrive on the scene, having deemed the mine a worthy investment.

But for the general public, it’s much more difficult to know the ins and outs of the mining industry, let alone have a grasp of the timing of their investment decision.

- Superior Alternatives

Even for those who recognize the value of holding gold-related stocks in a volatile market, the existence of better alternatives might overrule investors’ thinking.

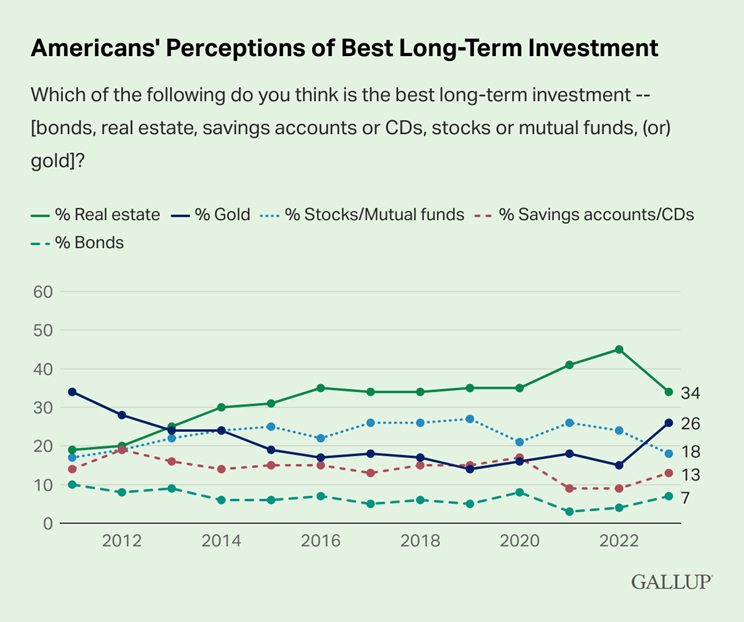

The latest Gallup Poll Social Series monitoring public opinion on economy and finance shows that Americans continue to view real estate as the No.1 long-term investment choice, which has been the case for the past decade (survey results are shown below).

For a number of years, the second-best option has been stocks/mutual funds, but as we all know, the US stock indices are coming off a terrible year in 2022, which made more investors lose faith than previous years.

As a result of the lowered confidence in stocks, the percentage of respondents selecting gold shot up 11% in the 2023 survey, propelling gold to second place this year. Nevertheless, this is still 8% lower than real estate despite falling housing prices and sky-high mortgage rates.

As Gallup states in its report, gold tends to be the beneficiary when confidence levels in both real estate and stocks are down, which have both happened in the months leading up to the survey. Inflation worries plus recession risk also likely played a role in more people choosing gold this time.

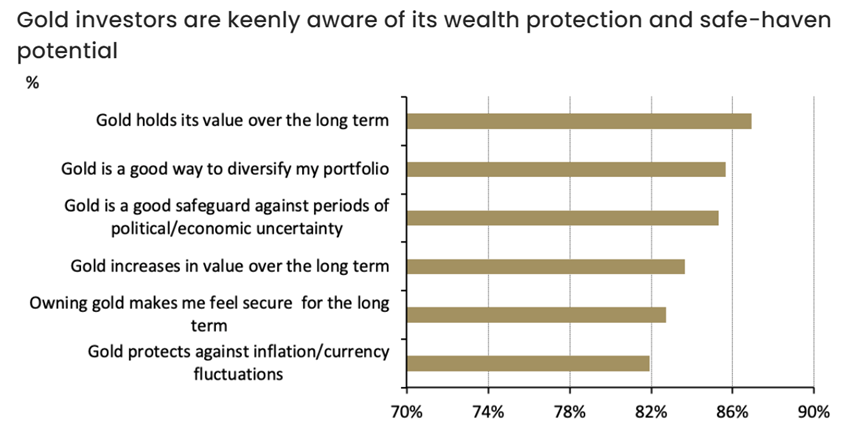

A separate survey by the World Gold Council confirms that a majority of US investors do recognize gold’s long-term value proposition and safe haven attributes, but these are not tempting enough to make it a top priority.

The main takeaway here is that despite everything going its way, gold is still not seen as the best choice, as real estate trumps everything else for its risk-reward profile over the long run.

Additionally, many financial advisors simply don’t view gold as a good long-term investment.

Ivory Johnson, founder of Delancey Wealth Management, said in a recent CNBC interview that gold “more of a short-term holding — a hedge for investors when gross domestic product and inflation are both decelerating”

Johnson, who has been recommending more gold to clients over the past year or so, admitted that “it’s not something you just put in the portfolio and keep it there.” If GDP starts to rebound, he’d generally recommend dumping gold and instead buying growth stocks.

Conclusion

It’s important to note that last year’s gold demand surged by 18% to 4,741 tonnes, almost on par with 2011 – a time of exceptional investment demand, according to WGC data. Meanwhile, total supply only increased 2% to 4,755 tonnes, mainly due to mine production rising to a four-year high.

For silver, the market has already sunk into a prolonged supply shortage that could take years to recover from. Latest data from the Silver Institute reveals that annual silver demand also surged by 18% to a record high 1.24 billion ounces against a stagnant supply in 2022. This resulted in a second straight year of undersupply at 237.7 million ounces, which the Silver Institute says is “possibly the most significant deficit on record.”

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

In 2023, we are most likely going to see a repeat of last year, according to the Institute, which expects the market deficit to remain high at 142.1 million ounces on the back of solid demand.

As concerns of undersupply linger on, the precious metals market will be well-positioned to maintain its bullish trend from the start of 2023.

Within the past several years, large gold companies have shifted from greenfield (early stage) to brownfield (historic producer) exploration.

Whereas in the 1980s, junior gold companies discovered 10-30% of new mines, after 2000 they have accounted for up to 75%, according to a McKinsey report.

A junior resource company’s place in the food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over. Discoveries won’t be made if juniors aren’t out in the bush looking at rocks.

But junior mining financing has pretty much dried up.

Recognize that, like all other metals, gold reserves and production estimates are always optimistic; they almost never match the original figures.

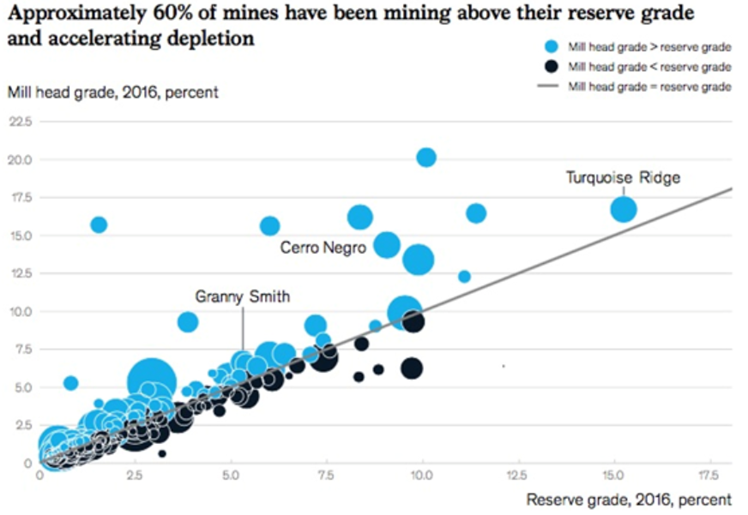

Only a third of a mine’s reserves make it to the mill and the average life of mine (LOM) has dropped from 19 to 12 years. The rapidly depleting reserves and grades, exacerbated by high grading, will accelerate a fall in gold production – a change of direction from many years of annual increases – perhaps as early as this year, certainly something that is going to happen very near term.

Notice the blue circles that represent mill head grades at gold mines in 2016 that were higher than reserve grades. The black circles are mines where mill head grades were less than the reserve grades. The head grade is the average gold grade that will be fed into the mill. Two takeaways from the graph – first, there were many more blue circles than black, showing more mines high grading than not. Second, some mines were sending ore through the mill at grades way richer than reserves – up to 20 grams per tonne higher.

We know from a combination of McKinsey’s and Dundee Capital Markets’ data, that it’s been going on since at least 2005.

But there’s more to it than just a gold company fattening up its margins and robbing Peter, representing the long-term life of mine, to pay Paul, the next couple of business quarters. High grading provides the fuel for mergers and acquisitions. The way it works is this: Major gold companies are running out of ore, as they churn through reserves that were discovered 15 – 20 years ago. It costs too much, takes too long, and is too risky exploring greenfield projects, so they let juniors do that. They could expand their mines, or explore in and around others they acquire, but that too requires heavy expenditures.

Instead a gold major high grades its reserves, which boosts its earnings, and fills its coffers in order to be able to afford an acquisition. If the deal is approved, the company not only gets new reserves – solving the problem of depletion – it also gains the opportunity to high grade the new reserves, at the cost of many hundreds of thousands, or millions, of ounces, plus lower grades.

Also, lumping the new reserves into their existing ones disguises the fact they’ve been high grading, which wouldn’t go over well with shareholders.

Gold miners use shareholder money to high-grade reserves to achieve maximum revenues from gold sales. Costs remain low because much less earth is moved to get the best ore. Its treasury bulked up by high grading, the company is then in a position to buy a company and its reserves, thereby replacing those lost to high grading. Rinse and repeat.

Throw in safe-haven demand from a more volatile, dangerous world, the specter of future financial crises, currency wars and the already-happening de-dollarization, plus resource nationalism and the loss of mining expertise to retirements.

Adding it all up points to a looming scarcity of gold, a trend that can only be managed, not reversed.

Gold is, in this author’s opinion, an extremely undervalued financial instrument.

But historically, and perhaps especially so today, the greatest leverage to rising precious metals prices has been owning the shares of junior resource companies focused on acquiring, discovering and developing precious metals deposits.

Importantly, juniors are a cost-effective answer to the problem of gold reserves depletion. Because gold reserves are being used up faster than they are being replenished, it behooves the industry to come up with a strategy for reversing this trend – one that doesn’t involve high-grading and M&A. Rather than adding to the pot of global reserves, the latter “pours reserves from one pot to another,” asserts Stephen Letwin, the President and CEO of IAMGOLD Corp.

In Letwin’s report ‘Growth in a Time of Reckoning’ he states that while there are multiple ways the industry can boost its reserves, exploration is the only way to create long-term value for the industry. The cost of the status quo is to rapidly deplete global gold reserves, leaving millions of tonnes of low-grade ore that cannot be mined until much higher prices.

Here’s Letwin:

“Only through strategies that increase the global pot of mineable reserves can we reverse the trend in reserve replacement. Acquisitions play a role, but unless for the purpose of developing an asset that otherwise might not happen, they accomplish little but a change in ownership.”

In sum, the combination of high grading, which lowers both reserves and grades, a drastic reduction in new discoveries due to a lack of exploration spending, and decreased mine lives, means the industry will be extremely challenged to maintain current production levels.

Do you want to own the cheapest gold and silver you can find to reap the maximum coming rewards? If you do, buy it while it’s still in the ground.

The fact is junior resource companies – the owners of the world’s future precious metal mines – are on sale.

Juniors, not majors, own the world’s future mines and juniors are the ones most adept at finding these mines. They already own, and endeavor to find more of, what the world’s larger mining companies need, to replace reserves and grow their asset bases.

Gold’s bull market is not over and here at Ahead of the Herd our edge is two-fold. First, it’s being right about the future for precious metals. Second, it’s having an excellent selection of well-managed juniors with plenty of metal in the ground to gain the desired leverage to rising gold and silver prices.

In the 1970s, every ounce of gold that got depleted was replaced by 2.6 ounces of new gold. Today, for every ounce of reserve depletion, only half an ounce is discovered. High grading has reportedly diminished the lifespan of existing mines. According to Scotiabank, the average mine life of the miners it covers has fallen from 19 years to 12 – the shortest in 30 years.

Precious metals-focused junior companies are again going to have their turn under the investment spotlight and should be on every investor’s radar screen.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.