Gold and silver in ‘26 – Richard Mills

2026-01-07

The Bloomberg Commodity Index (BCOM) is made up of exchange-traded futures on 22 commodities and is widely mimicked by ETFs and fund managers. On Nov. 28, 2025, the weighting for gold was at 19.4% and silver at 7.1%. On Jan. 8 the BCOM is set to change its 2026 target weight to 4.9% weighed to gold and 3.9% to silver.

This is happening on both precious metals because of the large price movements since the end of November. A very large rebalancing trade is going to start this week and continue over five business days. A lot of index funds mirror the BCOM and will have to rebalance starting the 8th.

But the bull market in gold and silver will continue.

The other thing making the news recently is the anticipated crash from a selloff in the PM markets where so many are comparing this period to the late ’70’s. I’ve done it to the early 1970’s, stagflation, but the difference is what happened in the later part of that decade. Former Fed Chair Paul Volcker jacked interest rates, yields spiked, the US dollar strengthened and the bull in PMs was over.

That is not happening this time, yields are 1%-bound starting in May; Trump wants a 1% Fed policy rate. So, absolutely yes to lower US interest rates. Trump takes control of the Federal Reserve in May, and it’s guaranteed to result in at least a half-point cut.

The Fed does not control long-term yields, just short-term. So, and it’s already happening, long yields go up, bond vigilantes will step in here as well, then the US Treasury really steps up, (they have been quietly buying) and starts buying the US debt rollover, and buying new US debt by printing money to buy short-term debt.

(There is a group of powerful investors that not only watch US Treasury yields closely, but they take an active part in influencing the bond market, especially if they don’t like the economic policies of the administration. Bond vigilantes are investors who sell government bonds in response to fiscal policies they view as inflationary or irresponsible, driving up borrowing costs for the government. — Investopedia definition)

The Fed is lowering rates in the face of rising inflation to goose the US consumer, which is 70% of US economy. This is the best thing the government could do if it wanted inflation to really soar, and let’s remember the US consumer already has record credit card, student loan and mortgage debt. And the US is shedding jobs.

US consumer debt hit a record high of approximately $18.6 trillion in late 2025, driven primarily by mortgages, but we’re also seeing significant increases in credit card and student loan balances, though student loan delinquencies are rising, indicating potential stress, especially for younger borrowers. The largest portions of this debt are mortgages (around $13 trillion) and auto/student loans, with credit card debt also at a peak of over $1.2 trillion.

Consumers have been the main engine of the U.S. economy. A healthy job market and solid, rising wages have largely fueled this spending. Looking back over the past two decades, average wages in the US have outpaced inflation more than 70% of the time. This has been particularly concentrated among high-income households, who are less affected by inflation and higher interest rates due to their rising net worths from assets like stocks and real estate.

However, it is important to note that, for a period between April 2021 and late 2022, the situation reversed as a surge in inflation (due to supply chain issues and other global events) meant that prices rose much faster than wages, eroding purchasing power. The current period marks a recovery from that time. At AOTH we believe the current period marks a recovery from that time.

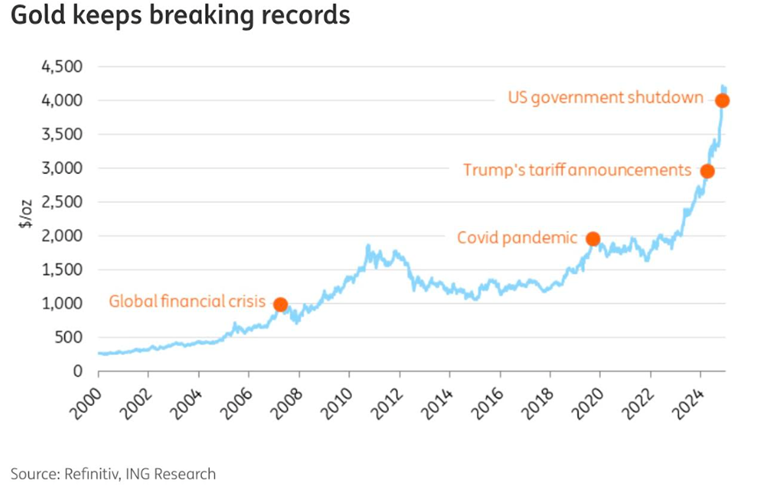

In 2025 gold rocketed higher due to a combination of factors, including safe haven demand arising from numerous geopolitical hot spots — Gaza, Ukraine, and recently, Venezuela — a lower US dollar which is always good for metals prices; central bank buying; robust gold-backed ETF inflows; a cooling US labor market; and the prospect of the Fed lowering interest rates further this year.

There are also structural supply constraints on gold, silver and copper. AOTH research has found that for all three metals, for the past several years, supply can’t meet demand without recycling.

The silver market continues its longest streak of supply deficits in recent years, with the 2025 World Silver survey noting 2025 was the fifth straight year of supply not meeting demand. Mine production has fallen to 813 million ounces, unable to keep pace with surging demand mostly from industrial (but also monetary) applications.

While the many estimates vary, their sources suggest there are roughly four to seven times more ounces of gold available above ground than investable silver. The total amount of above-ground fine silver bullion for investment is estimated to be around 3 to 3.5 billion ounces, much lower than gold’s supply of approximately 7.6 billion ounces.

While most of the world’s mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated that 60% of silver is utilized in industrial applications, leaving only 40% for investing. Of the 60% used for industrial applications almost 80% ends up in landfills.

From Kitco comes this interesting tidbit, “Despite gold’s ascent to successive all-time highs in 2025 and new all-time highs being made today, American institutional and retail investors have maintained remarkably tepid exposure to the precious metal, presenting what Goldman Sachs analysts characterize as a significant structural opportunity for continued price appreciation.”

From Jan. 1, China will require exporters of silver, tungsten and antimony to obtain licenses from the Ministry of Commerce. This is expected to further tighten the market for silver, since China is the world’s second-highest silver producer behind Mexico.

In November 2025 silver was among 10 minerals the US Department of Defense added to the US Geological Survey’s 2025 List of Critical Minerals.

For the first time, silver was recognized as having growing importance to US economic and national security. This inclusion signals enhanced government focus on securing domestic supply chains through enhanced permitting, subsidies and strategic stockpiling initiatives.

Not 1979

2025 was the best year for gold since 1979, leading some commentators to draw parallels between that period in history and the present day. There are certainly geopolitical similarities. 1979 was when the Soviet Union invaded Afghanistan, and the year the Iranian Revolution spiked oil prices. In 2026, we have continued simmering hot spots in Ukraine and the Middle East, and the evolving crisis in Venezuela — all of which are boosting demand for gold.

2026 and 1979 also show a weak US dollar. As in the late 1970s, the dollar has weakened, making gold more attractive to holders of other currencies. The Street notes the first half of 2025 was the buck’s worst H1 performance since 1973. It ended 2025 about 10% lower.

But what happened in 1979 is extremely unlikely to happen in 2026.

Between 1979 and 1982, the Fed under Chairman Paul Volcker tackled the problem of high inflation by lifting interest rates to a historic high of 20%, causing a recession in the process.

Higher interest rates made US Treasuries attractive, which boosted demand for dollars. The dollar rose and gold prices tanked.

Today, despite similar economic conditions to 1979, the Fed is poised to do the opposite: cut interest rates and keep the dollar low.

The Street notes that, while inflation is nowhere near what it was in the late 1970s, about 8%, in 2025 it was “sticky”, meaning above the Fed’s 2% target. Normally this would result in the Fed hiking rates, but instead it has lowered them due to concerns over a soft labor market.

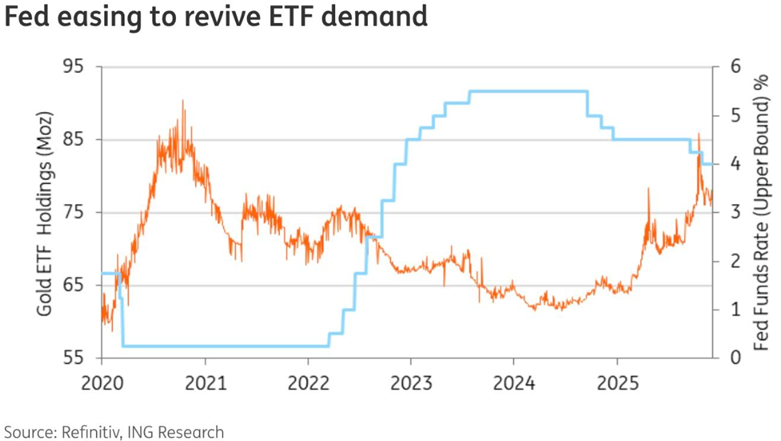

The Fed has cut short-term rates three times since September and they now range between 3.5 and 3.75%, the lowest since 2022. According to Fed fund futures, the market expects at least two quarter-point rate cuts next year.

As I mentioned at the top, Fed Chair Jerome Powell’s term expires in March and President Trump is widely expected to appoint a chair who agrees with his low-interest-rate stance. Trump has said he wants a 1% Fed rate policy, so the US is zero bound again.

Powell recently stated there is nothing to suggest concern about inflation in the long-term, so why are rates going up? As the two charts below show, the 10-year yield has risen from 3.99% on Nov. 26, 2025, to the current 4.16%, a gain of 0.17%, while the 30-year yield has gained 0.22% over the same period.

The Street observes that Expectations that the central bank’s independence may become compromised in May have already led to market distortions. Long-term interest rates have stayed higher than expected, even after the Fed began cutting rates in September.

Another point of view says long-term rates currently embed a premium due to uncertainty over Powell’s successor.

Even perceived interference by the government in Fed policymaking could lead to higher long-term borrowing costs, BBVA Research says. This would defeat the Trump administration’s efforts to lower them…

According to analysts at the CPM Group, “reduced faith in the U.S. central bank’s independence already is and would continue to be very supportive of gold and silver investment demand.

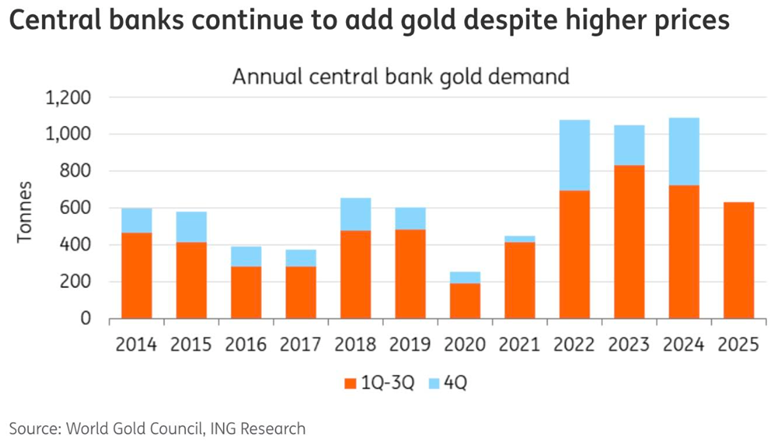

Central bank buying

Central bank buying continues to be a significant gold demand driver, and increasingly, silver demand driver.

As trust in the dollar, the leading reserve currency, is tested by inflation, sanctions, and shifting alliances, many countries are turning to gold as a store of value.

In the third quarter of 2025, central banks globally bought an estimated 200 tonnes, 28% higher than the second quarter and 6% above the five-year quarterly average.

According to ING, up to Dec. 8, year-to-date purchases totaled 254 tonnes, with Poland the stand-out buyer at 531 tonnes, or 26% of total reserves.

China bought gold for the 13th month in a row, in November adding 0.93 tonnes or 30,000 ounces, bringing its total gold holdings to 2,305 tonnes or 74.1Moz.

Among the countries considering buying more gold are South Korea, which hasn’t bought bullion since 2013, Madagascar and Serbia.

ING notes the pace of central bank gold buying doubled following the freezing of Russia’s foreign exchange reserves by the G7 and the European Union after Russia’s 2022 invasion of Ukraine.

In 2024, central banks bought a combined 1,045 tonnes, with Poland, India and Turkey the largest buyers, states the World Gold Council.

The combined official gold reserves of BRICS member states now exceed 6,000 tonnes, with Russia leading at 2,336 tonnes, followed by China with 2,298 tonnes and India with 880 tonnes. Brazil added 16 tonnes in September 2025—its first purchase since 2021—bringing its total reserves to 145.1 tonnes.

The dual strategy of high internal gold production alongside the accumulation of strategic reserves positions BRICS as both a key supplier and a major influence in the physical gold market.

Between 2020 and 2024, central banks of BRICS member states purchased more than 50% of the global gold supply, systematically reducing their reliance on dollar-denominated assets.

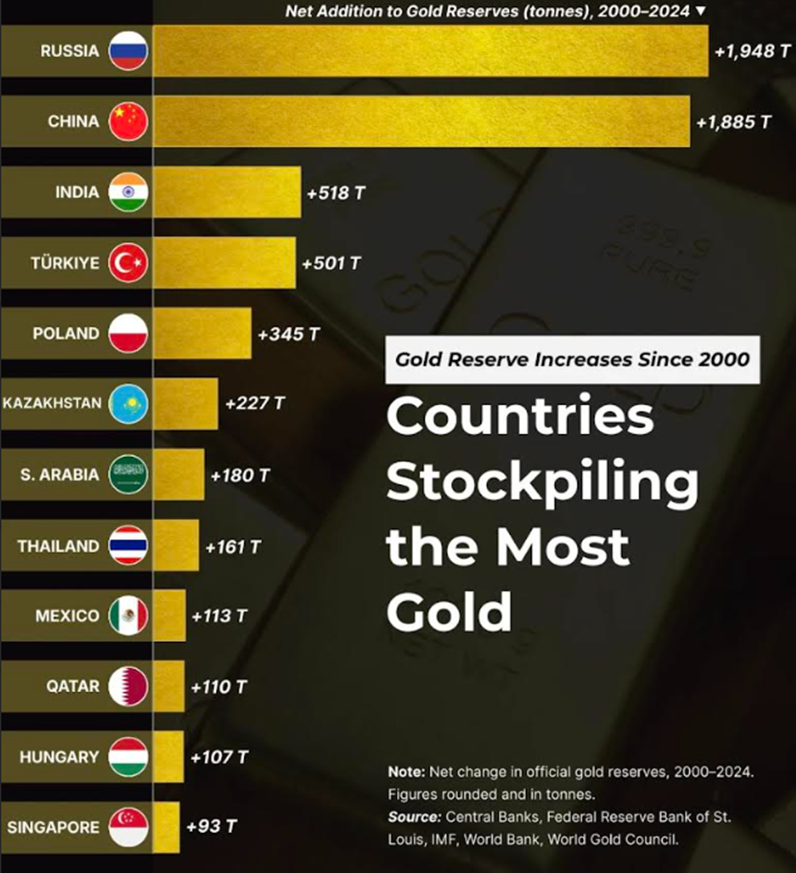

A recent infographic by Visual Capitalist shows that Russia and China have stockpiled the most gold since 2000, more than triple the next highest country, India.

The chart, which visualizes the net additions to official gold reserves from 2000 to 2024, reveals that Russia narrowly edged out China with a 1,984-tonne increase compared to China’s 1,885 tonnes.

Why are Russia and China hoarding gold? According to Visual Capitalist,

The dramatic increase in gold holdings by Russia and China is part of a broader effort to reduce reliance on the U.S. dollar. After facing Western sanctions, Russia has accelerated its de-dollarization strategy, favoring gold to protect reserves from seizure or devaluation.

China’s motives are also strategic. Amid trade tensions with the U.S. and a growing desire to internationalize the yuan, Beijing has been quietly amassing gold, often through discreet central bank purchases and reported transfers from domestic mines.

Russia and China have also engaged in bilateral gold trade deals that bypass the US financial system, moves that align with a broader trend where central banks now hold more gold than US Treasuries.

BRICS member India has boosted its reserves by 518 tonnes in response to currency volatility and inflation concerns, Turkey added 501 tonnes amid economic turbulence and lira devaluation, and Poland and Kazakhstan each amassed hundreds of tonnes as part of strategies to diversify their reserves, Visual Capitalist states.

Gulf states like Qatar and Saudi Arabia are also increasing gold holdings.

The IMF doesn’t recognize silver as an official reserve asset, but that isn’t stopping central banks from purchasing the monetary/ industrial metal

Three central banks — Russia, India and Saudi Arabia — have reportedly entered the silver market.

India’s foray into central bank silver buying is due to its remonetisation of silver. As of April 2026, silver will officially be allowed to serve as collateral for bank and non-bank loans under new Reserve Bank of India regulations. The move, one source says, effectively establishes a 10 to 1 silver-to-gold ratio in collateral lending, marking the first time a major economy has formally recognized silver’s role alongside gold in modern banking.

The country reportedly bought 6,000 tonnes of silver in 2025, which accounts for 25% of annual silver supply. At today’s spot silver price of $78.84 an ounce, that works out to USD$16,686,012,960.

Investment interest increasing

Gold and silver’s monstrous gains in 2025 have, unsurprisingly, been noticed by retail and institutional investors.

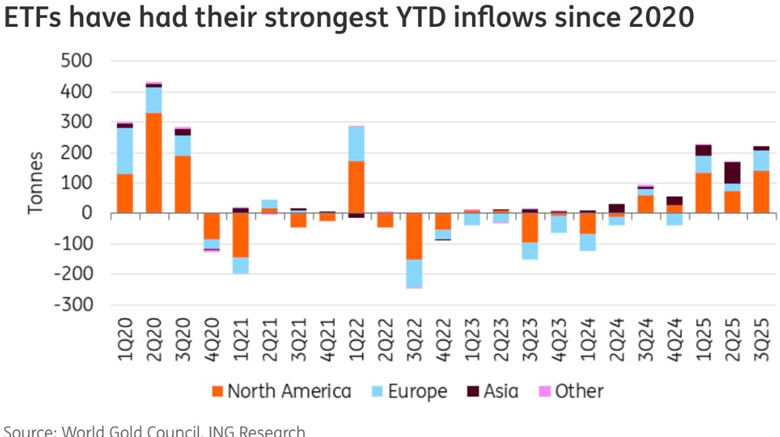

The ING piece states that Q3 2025 marked a record-high for gold-backed exchange-traded-fund (ETF) inflows, with gold ETF investors adding 222 tonnes, coming close to the November 2020 all-time high.

In India, the largest consumer of silver, the price rocketed 180% year on year during Diwali, India’s harvest festival, as consumers pivoted from too-expensive gold to cheaper silver.

According to trade data cited by Indian business media, India’s silver imports were expected to reach 5,500–6,000 tonnes in 2025, extending an already elevated trend from 2024.

Much of this demand was investment-oriented, with retail participation through silver ETFs remaining strong even after Diwali.

Based on data from the Silver Institute and market tracking groups, global investment demand for silver via ETFs and funds surged dramatically in 2025. By mid-year, 95 million ounces of silver had flowed into ETFs globally, already surpassing total inflows for all of 2024. (Equiti.com)

Silver’s new industrial uses

Silver has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

Solar

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.”

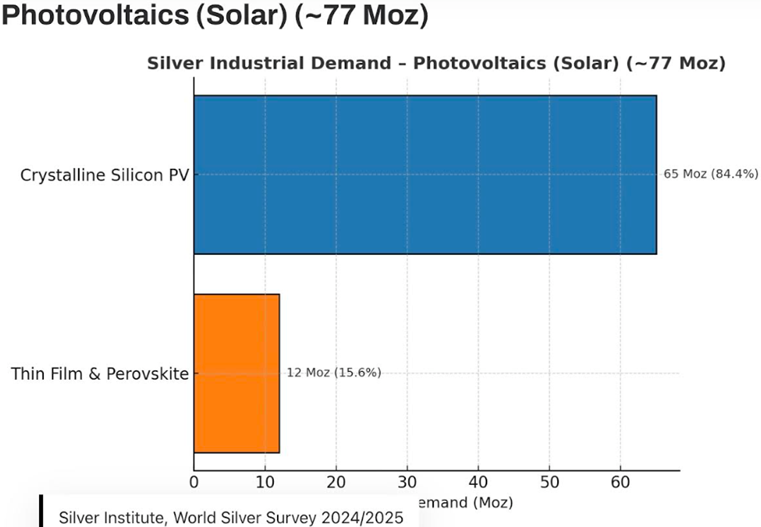

Roughly 14% of industrial silver demand now flows into photovoltaics (PV), a figure that has tripled in less than a decade.

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need.

For every gigawatt of solar energy produced, 700,000 ounces of silver are consumed, according to the Silver Academy. With global solar capacity additions projected to hit 467 GW in 2024—a 460% surge since 2015 — silver demand for photovoltaics alone could exceed 232 million ounces in 2025.

New solar panels to use more silver, driving demand higher — Richar Mills

Electronics

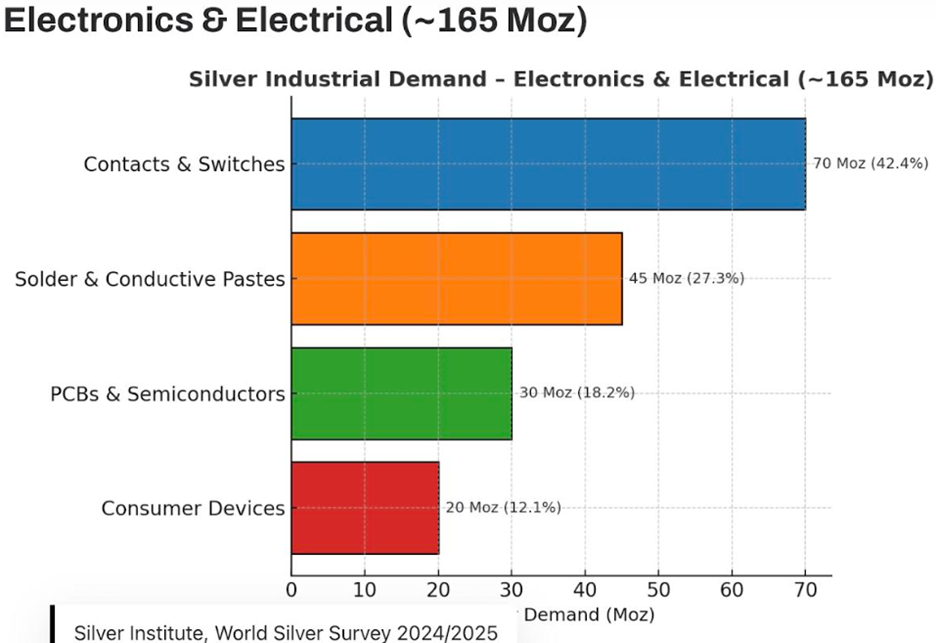

Electronics accounts for roughly 30% of industrial consumption, more than any other category. The metal’s unmatched conductivity and resistance to corrosion make it indispensable in applications ranging from power grids to smartphones. (Guardian Gold, Silver Institute, World Silver Survey 2024/2025; Silver Institute industry overview)

The largest slice, nearly 70Moz annually, goes into electrical contacts and switches. The second major slice, around 45 Moz, is consumed in high end solders and conductive pastes.

Around 30Moz flows into printed circuit boards and semiconductors. Finally, about 20Moz goes into consumer electronics — smartphones, tablets, laptops, wearables. Each device contains just milligrams of silver, but when billions are produced annually, the numbers add up, states Guardian Gold.

5G

5G technology is set to become another big new driver of silver demand. Among the 5G components requiring silver, are semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Institute expects silver demanded by 5G to more than double, from its 2022 ~7.5 million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030.

According to Shanghai Metal Market, 5G infrastructure deployment using silver in connection components was expected to reach 13 million base stations globally by 2025.

Automotive

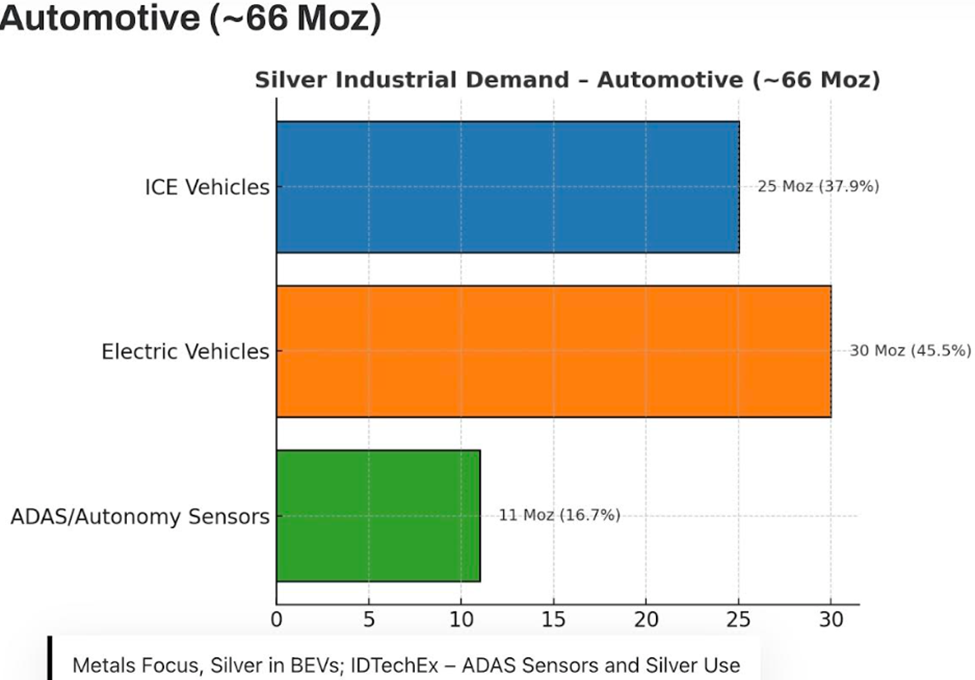

Another major industrial demand driver for silver is the automotive industry. Silver is found in many car components throughout vehicles’ electronic systems.

A Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles — between 20 and 50 grams depending on the model. Charging points and charging stations are also expected to demand a lot more silver. It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

Solid-state batteries

Citizen Watch Report (CWR) says solid state batteries are not only the future of electric vehicles, but could change energy storage due to their superior safety, energy density and longevity compared to lithium-ion batteries.

For instance, Samsung’s solid-state silver-carbon batteries promise a 600-mile range, 9-minute charging and a 20-year lifespan.

Silver-zinc batteries offer higher energy density and safer operation, making them ideal for medical devices and aerospace.

Solid-state batteries replace the liquid or gel electrolyte with a solid one, requiring silver for their construction. Each battery cell uses about 5 grams of silver, with a standard 100kWh battery pack potentially needing up to 1 kg of silver.

According to CWR, “estimates suggest that if just 20% of global car production adopts this technology, the annual demand for silver could skyrocket to 16,000 metric tons. This figure is significant when considered against the backdrop of current global silver production, which hovers around 25,000 metric tons annually, highlighting a potential silver squeeze in the market.”

Robotics

The robotics market, growing at 23% annually, could also strain silver supplies. The Silver Academy says “A typical $130,000 robot displacing 1.3 workers delivers a 65% IRR with a 1.5-year payback. These machines rely on silver for wiring and sensors, with AI-enhanced models driving demand further.”

AI

Data centers are growing rapidly in size and number, leading to a significant increase in their consumption of energy, water and minerals. This expansion is largely driven by the increasing demand for Artificial Intelligence (AI), cloud computing and digital services.

The physical infrastructure of data centers requires significant land and raw materials, including copper and silver, and rare earth elements for manufacturing chips. Server boards that connect the electrical components of a server and other intricate circuitry require minerals that efficiently conduct electricity and are resistant to corrosion — especially copper but also silver, gold, tin, tantalum, platinum and palladium.

Data centers are inherently energy-intensive, and their power consumption is projected to double globally by 2030, reaching around 945-980 terawatt-hours (TWh) annually. In some countries like the US, they could account for up to 12% of total electricity consumption by 2030, straining existing power grids. (AI Overview).

Data centers: gluttons for power water and minerals Part II — Richard Mills

Tech companies are plowing billions of dollars into data centers in pursuit of revolutionary advances in artificial intelligence.

According to Data Center Knowledge, despite the limitations of solar power, in terms of its intermittency, technology giants are racing to secure solar capacity. It reports the following:

Microsoft has added more than 860 MW of new solar capacity in 2024 alone, with projects spanning Illinois, Texas, Michigan, and Missouri, bringing its clean energy portfolio to more than 34 GW.

Meta has similarly scaled its solar footprint in Texas, developing three major projects totaling over 900 MW. Amazon leads all US companies in solar development, with 13.6 GW of solar capacity in progress – more than the total installed capacity of most states. This includes over 20 projects in Texas.

Google is taking a hybrid approach, combining solar energy and battery storage. The company operates 312 MW of battery capacity and has entered a $20 billion partnership with Intersect Power to develop co-located clean energy and data center facilities.

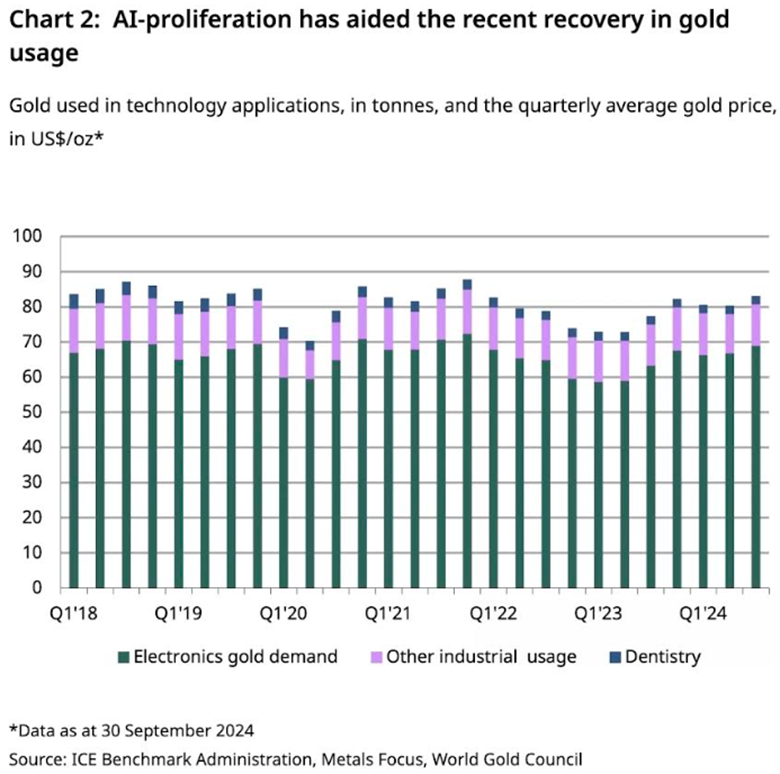

Gold’s new industrial uses

Gold is obviously seen as less of an industrial metal than silver, but new uses are coming to the fore. In particular, gold is finding applications in AI-related technology.

Before we go there, it should be noted that gold plays a crucial role in electronic devices; like silver it is an excellent conductor of electricity, it does not corrode, and its physical and chemical properties allow it to be manipulated into extraordinarily thin wires and reliable coatings. These properties make it an indispensable component of the computer chips found in almost all electronic equipment. (The World Gold Council)

WGC notes that gold is an essential component in the manufacturing of AI-enabled devices. AI systems rely heavily on advanced hardware, including processors, memory chips and sensors, all of which utilize gold. Gold’s superior conductivity ensures that data can be processed and transmitted at high speed with minimal energy loss. Furthermore, gold’s resistance to corrosion ensures component longevity and durability – critical for continuous and intensive AI applications.

Beyond AI, gold is used in medical devices such as implants, and gold nanoparticles are used in the medical diagnostics field; in aerospace, where gold is used in the production of critical components for satellites and spacecraft; and in clean technologies, where gold is an excellent chemical catalyst and a promising candidate material in the production of clean hydrogen and carbon dioxide transformation.

Geopolitics

A substantial amount of physical gold and silver buying as well as the purchase of precious metal stocks has come from safe-haven demand resulting from numerous areas of geopolitical tension.

Russia has been pounding Ukraine’s energy infrastructure in recent weeks, leaving thousands across the country without power or heating amid freezing temperatures. Strikes on Kiev on Dec. 27 left more than 40% of residential buildings without heating, stated CNN.

An overnight Russian air attack killed at least two people in Ukraine’s capital.

Five days ago Russia said a Ukrainian drone strike in a Russian-occupied village in the Kherson region killed 24 and wounded at least 50.

And despite some good news Tuesday, in the form of a statement signed by Canada and Ukraine’s other allies to help secure Ukraine from further Russian invasions if there is a peace deal — the proposed security agreement would see a multinational force sent to aid Ukraine after a ceasefire takes hold — the Ukraine security conference in Paris was overshadowed by President Trump’s recent capture and prosecution of the Venezuelan president and his wife, and threats to annex Greenland.

“We do need Greenland, absolutely. We need it for defense,” Trump told The Atlantic in an interview, describing the island as reportedly “surrounded by Russian and Chinese ships.”

One of Trump’s senior advisors, Stephen Miller, refused to rule out the use of military force to take control of the self-ruling Danish territory, which has mineral and strategic significance.

Major European allies warned the United States on Tuesday that they would “not stop defending” the values of sovereignty and territorial integrity should the US invade the Arctic island.

Denmark’s Prime Minister Mette Frederiksen said if Trump invades Greenland it will spell the end of NATO, which operates under the assumption that an attack on one NATO member is an attack on all.

“But I will also make it clear that if the U.S. chooses to attack another NATO country militarily, then everything stops, including NATO and thus the security that has been established since the end of the Second World War,” Frederiksen added.

The dramatic seizure of the Maduros is the most assertive action to achieve regime change since the 2003 invasion of Iraq. While ostensibly done to indict President Maduro on narco-terrorism charges, the Venezuelan government for months has said that Trump and the US are seeking to take Venezuela’s oil. The South American country is said to have the world’s largest proven crude oil reserves of approximately 303 billion barrels, according to the US Energy Information Association.

Last Saturday CBC News reported Trump saying he will allow “very large United States oil companies” into Venezuela, who will spend the necessary billions to “fix the badly broken infrastructure and start making money for the country.”

There have been questions about the legality of the US operation, which was done without congressional approval.

Trump later told reporters on Air Force One that military action could soon be coming to Colombia and Mexico, adding that Cuba may fall on its own.

While China and other foreign governments have criticized the US removal of Maduro, there are now questions being asked whether the Trump administration’s action could make it easier for President Xi Jinping to make a move on Taiwan, CNBC reported on Monday.

The world is definitely becoming more dangerous with Trump as the commander-in-chief, despite promising voters that his “America First” doctrine would avoid foreign entanglements.

Meanwhile in Iran, protests have started in at least 17 of its 31 provinces, “presenting the largest challenge to the country’s clerical establishment since 2022, a BBC Verify and BBC Persian analysis has found.”

Iranians are angry following a sharp devaluation of the currency.

In the war-riddled part of Africa containing the Democratic Republic of Congo and Rwanda, DW reported “Violent fighting erupted on Saturday between pro-Kinshasa forces and M23 rebels near Uvira, a key border city connecting the DRC to Burundi, according to local sources.

“Kinshasa says Rwanda-backed M23 rebels have killed 1,500 civilians despite a US-brokered ceasefire, as fresh clashes erupt near Uvira and tensions spill into Burundi.”

Finally, continuing conflict between Thailand and Cambodia resulted in a Thai soldier being wounded in a mortar attack in a disputed border region, Aljazeera reported, despite a ceasefire agreed to in late December.

Fighting last month killing dozens and displaced about one million on both sides.

US debt woes

A crisis is unfolding in the bond market that equity investors may not be aware of. Long-term government bond yields are rising across major economies as governments struggle to contain mounting debt burdens.

Japan’s 30-year bond yield currently sits at 3.4% compared to 2.2% a year ago.

Japan has long faced a mountainous debt problem. A 260% debt-to-GDP ratio is by far the highest among all major economies. (Reuters)

What happens in Japan reverberates beyond, given that Japan is the largest holder of US Treasuries at about USD$1.2 trillion. If Japan were to sell Treasuries en masse, it could impact the ability of the United States to finance its ever-expanding spending, that is increasing under the Trump administration.

Last May, a $16-billion auction of 20-year bonds saw weak demand, forcing yields higher. In fact, the Federal Reserve had to step in to buy up nearly $2.2 billion of the $16 billion bond issue. Last Wednesday’s bond purchase came after the Fed bought up more than $40 billion in Treasuries.

The 30-year Treasury breached 5%, reflecting concerns over rising deficits and long-term borrowing capacity.

As a result, Moody’s downgraded its US debt rating from the top-level Aaa to Aa1. As investor confidence in US debt declines, borrowing costs could rise (higher yields are needed to attract investors to what are now considered riskier assets), increasing the interest burden on the US government. As yields go up, the US government must spend more of its revenues just to keep up with interest payments.

Asia Times recently reported the US reached a dubious milestone: trillion-dollar interest payments on runaway US government debt.

According to the nonpartisan Committee for a Responsible Budget, this is the “new norm” as the US national debt approaches $39 trillion.

As the Trump administration auctions off more Treasury bonds to pay for this increasing shortfall, the question is who will buy them? Or in Asia Times’ words, “why would officials in Tokyo and Beijing, in their right minds, increase their exposure to the US economy at such a precarious moment?”

Similar concerns were expressed by a panel of economic luminaries quoted by Bloomberg, who said “the long-run risk posed by mounting federal debt represented a paramount problem facing the US economy.”

The Congressional Budget Office confirms the Asia Times’ federal deficit figure, stating that this year it will reach $1.9 trillion, bringing total debt to about 100% of gross domestic product. That’s seen rising to about 118% of GDP in the next decade.

Dollar destruction

If the government can’t find enough foreign buyers to sop up its debt, the Fed will have to step in and buy Treasuries, much the same as it did during the quantitative easing that accompanied the financial crisis and the covid-19 pandemic. This, of course, is highly inflationary.

Inflation not only raises consumer and producer prices, it devalues the currency, i.e., the US dollar.

In a recent article we discussed the BRICS move away from the dollar through the formation of a gold-backed currency, the Unit.

BRICS launch gold-backed currency — Richard Mills

The BRICS countries are moving away from the US dollar as the currency that settles international transactions, and gold is an integral part of the new settlement mechanism.

On Oct. 31, 2025, researchers launched a pilot to test a gold-anchored settlement “Unit” inside the 10-member BRICS+ bloc of countries, which includes Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates.

This was followed by a Unit prototype launched on Dec. 8.

The Unit is a “digital trade currency” pilot created for settlement between BRICS economies. The initiative came from IRIAS, the International Research Institute for Advanced Systems.

Importantly, the Unit does not replace national currencies. Rather, it aims to act as a neutral settlement tool that reduces reliance on the US dollar in trade between BRICS economies.

According to CCN:

The BRICS Unit is a gold-anchored digital trade currency designed for cross-border settlement.

Its launch coincides with record public anxiety about dollar debasement, as shown in Google Trends data shared by Bloomberg.

The prototype uses a 40% gold and 60% BRICS-currency basket that adjusts daily.

The pilot signals a structural move toward de-dollarization and strengthens long-term global demand for gold.

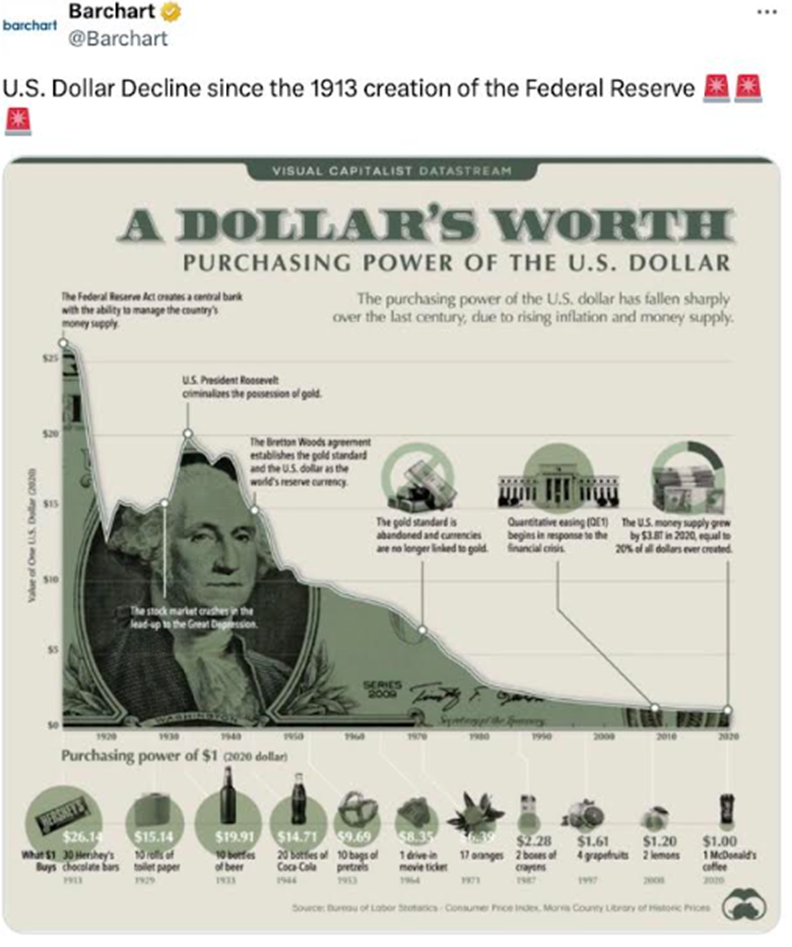

The tweet below shows how far the dollar has been devalued since the Fed was created in 1913. That year, one US dollar bought 30 Hershey’s chocolate bars.

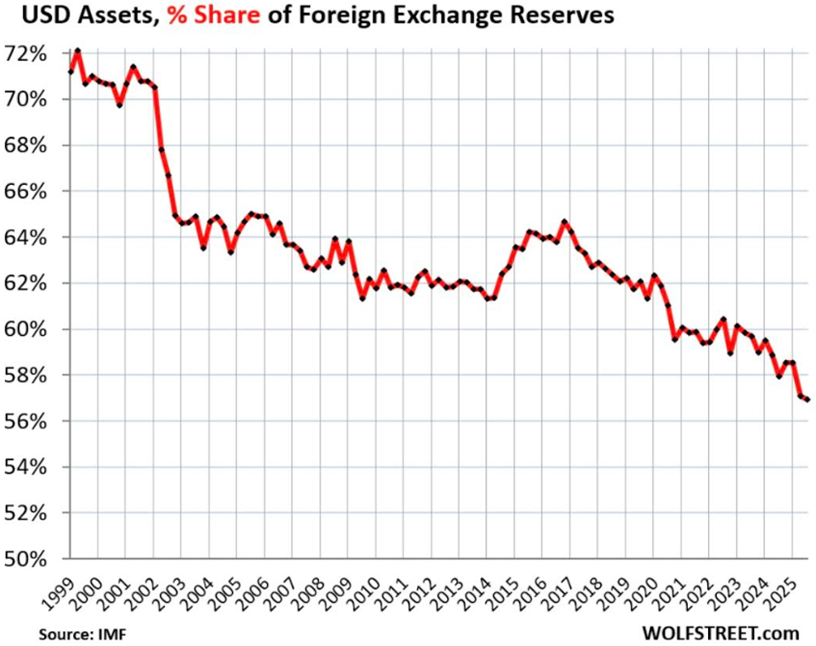

Another means of evaluating the strength of the dollar is to see what percentage of central banks exchange reserves are in dollars.

Wolf Street recently reported that in Q3 2025, the share of USD-denominated assets held by other central banks than the US dropped to 56.9% of total foreign exchange reserves — the lowest since 1994.

Remember, central banks now own more gold than US Treasuries.

The data came via the IMF’s Currency Composition of Official Foreign Exchange Reserves.

But Wolf Street makes an important point.

It’s not that central banks are dumping dollars; rather, they are still adding to their dollar holdings, it’s just that they are adding more of other currencies, and gold.

“Particularly”, says Wolf Richter, “a gaggle of smaller currencies whose combined share has surged, while central banks’ holdings of USD-denominated assets haven’t changed much for a decade, and so the percentage share of those USD assets continued to decline.”

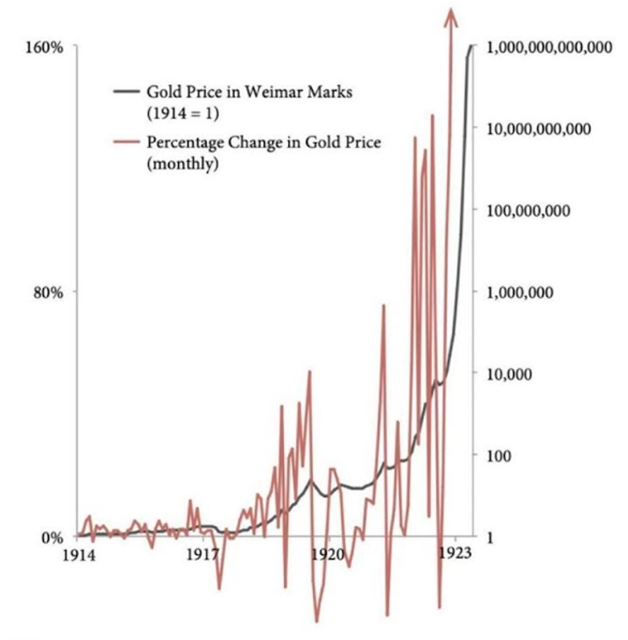

Commentators mostly talk about the dollar, interest rates, and bond yields in the context of gold, but Tavi Costa, former partner at Crescat Capital, recently chose to comment on silver — although the chart he posts shows how the price of gold spiked during the hyperinflationary years of Germany’s Weimar Republic.

While not suggesting that the two time periods, now and Weimar Germany, are similar, he does see a resemblance from a price-performance standpoint. While US inflation was “sticky” throughout 2025, never falling below 2.3%, silver gained 147%.

Costa suggests that among all the reasons for silver rising, a depreciating currency is paramount:

“There have been no major discoveries, no meaningful supply response, while demand continues to rise structurally, all while a monetary crisis quietly builds. This is the kind of price behavior typically observed in emerging markets when confidence in the currency is eroding.”

Conclusion

Given all that has been discussed in this article, it should be clear that I believe the bull market for gold and silver is not over.

Among the demand drivers for both are geopolitical hot spots like Venezuela, central bank purchases, increased investor interest, inflation, lower interest rates, a continuing low dollar, and new industrial uses for gold and silver, particularly around electrification and AI.

With a lack of new discoveries and ore grades falling, the supply of gold and silver is failing to meet the demand, without recycling.

As for how long the momentum could last, Kitco cites one commentator, veteran precious metals executive Robert Gottlieb, who argues there is a structural shift going on that is not temporary: “This is people waking up to hard assets as a necessity.”

That brings up a frequently asked question: In a precious metals bull market, is it better to own physical gold/silver, or PM mining stocks?

I’ve always maintained that mining stocks, particularly juniors, offer the best leverage to rising commodity prices, and apparently, I’m not alone.

Another Kitco article cites Chris Mancini, co-portfolio manager of the Gabelli Gold Fund (GOLDX), who says that “the conditions that have driven gold prices to record highs above $4,400 an ounce remain firmly in place, supporting higher prices and robust earnings.

“He said he expects U.S. interest rates to trend lower this year, regardless of who leads the Federal Reserve, while economic momentum softens. At the same time, central bank demand—particularly from China—remains a structural feature of the market.

“That backdrop, he says, is now translating directly into margin expansion for producers.”

But it’s not only the producers who have gained and are set to do even better in 2026.

Respected precious metals analyst Adam Hamilton observed that, after slumping badly a year ago, 2025 was the year that PM mining stocks finally caught up with soaring gold and silver prices. Hamilton references the huge gains in gold miner and junior gold miner ETFs GDX and GDXJ, and notes that silver bested even Nvidia in 2025.

After years of being starved of capital, funding finally returned to junior mining in 2025, meaning a lot of companies executed drilling and exploration programs whose results are still trickling in.

Major miners still occasionally make discoveries, but usually it’s in partnership with juniors. Juniors almost always find the early-stage, high-potential targets that will become the next mines.

The mining industry is on the hunt — Richard Mills

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.